Circular No. 33/2016-Customs dated 22nd July, 2016

1. AEO-LO Certificate– This certificate may be granted to categories of economic operators other than importers and exporters, namely Logistics Providers, Custodians or Terminal Operators, Customs Brokers and Warehouse

For the purpose of this certificate:

(i.) the economic operator should fulfill the criteria mentioned at para 3.1 below; and

(ii.) all other requirements as stipulated in paragraphs 3.2, 3.3, 3.4 and 3.5 below shall be considered to have been met if the claims made in this regard in information and documents submitted by the applicant have been physically verified by the AEO Programme Team by visiting the concerned places/premises of the applicant, on the dates decided by mutual consent by the team and the applicant, and found to be true to the satisfaction of the AEO Programme Manager.

2. Benefits for AEO-LO:

| Entity | Facilities to be provided |

| Logistic Service Providers | (a) Waiver of bank Guarantee in case of trans-shipment of goods under Goods imported (Condition of Trans-shipment) Regulations, 1995.

(b) Facility of Execution of running bond. (c) Exemption from permission on case to case basis in case of transit of goods. In case of international transshipped cargo (Foreign to Foreign), for the pre-sorted containers wherein Cargo does not require segregation, ramp to ramp or tail to tail transfer of cargo can be effected without Customs escorts. |

3. Application for an AEO certificate:

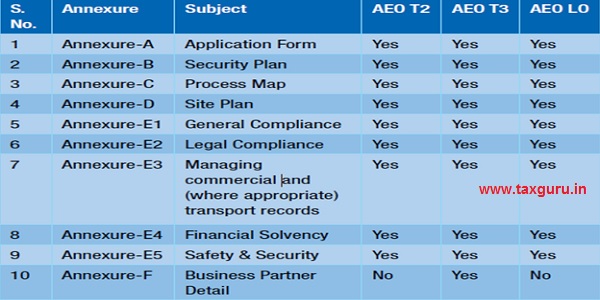

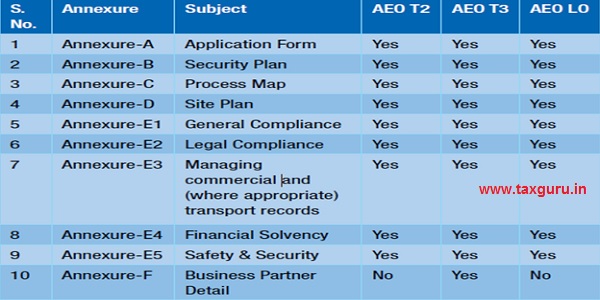

AEO-LO, should submit the application in the proforma specified in Table below. The application form as specified in the Circular No. 33/2016-Customs contains Ten annexures. However, an applicant is required to fill-in and submit only those annexures which may be applicable to it, as mentioned below:

In case the applicant is already holder of any one of the four AEO certificates, he should clearly highlight in its application all the changes in respect of any information and/or documents submitted earlier, with a view to expeditious processing of the application by the AEO Programme Team.

The applicant shall nominate a readily accessible central point of contact person within the administration of the applicant, in order to make available to the AEO Programme Manager or to any officer authorised by the AEO Programme Manager all the information necessary for proving compliance with the requirements for issuing the AEO certificate.

The application should be sent to the “AEO Programme Manager, Directorate General of Performance Management, Customs & Central Excise, ‘D’ Block, I.P. Bhawan, I.P. Estate, New Delhi – 110002.”

The Additional Director General, Directorate General of Performance Management, Customs & Central Excise, ‘D’ Block, I.P. Bhawan, I.P. Estate, New Delhi – 110002 will be the AEO Programme Manager and AEO Programme Team will comprise officers from the Directorate General of Performance Management and its regional offices.

4. Who can apply for AEO-LO certificate?

Anyone involved in the international supply chain that undertakes Customs related activity in India can apply for AEO status irrespective of size of the business. These may include exporters, importers, logistic providers (e.g. carriers, airlines, freight forwarders, etc.), Custodians or Terminal Operators, Customs House Agents and Warehouse Owners. Others who may qualify include port operators, authorized couriers, stevedores. The list is not exhaustive.

Businesses that are not involved in Customs related work / activities will not be entitled to apply. This means that in general, banks, insurance companies, consultants and the like categories of businesses will not be eligible for AEO status.

Application for AEO status will only cover the legal entity of the applicant and will not automatically apply to a group of companies……………………………………..

There is no provision to grant AEO status to specific site, division or branch of legal entity of the applicant. The application must cover all the activities and locations of the legal entity involved in the international supply chain and the prescribed criteria will be applied across all those activities and locations.

In order to apply for AEO status the applicant must be established in India. For this purpose, the applicant should provide evidence which may include:

(i) A certificate of registration issued by the Registrar of

(ii) Details of places/locations where goods are being handled, e.g. loading, unloading, storage etc., in the course of supply to/from international supply

(iii) Proof that the business has its own accounts

The applicant should have business activities for at least three financial years preceding the date of application. However in exceptional cases, on the basis of physical verification of internal controls of a newly established business entity, the AEO Programme Manager may consider It for consideration………

Keeping the small and medium scale enterprises in mind it has been decided the AEO programme is made open to all Importers/Exporters whose threshold of import or export declarations is 25 documents i.e. either Bills of Entry or Shipping Bills during the last financial year. The other economic operators should have handled at least 25 documents i.e. Bills of Entry or Shipping bills during the last financial year.

5. Legal-Compliance:

There should be no show cause notice issued to them during last three financial years involving fraud, forgery, outright smuggling, clandestine removal of excisable goods or cases where Service Tax has been collected from customers but not deposited to the Government.

There should be no case wherein prosecution has been launched or is being contemplated against the applicant or its senior management ……………………………… ..

If the ratio of disputed duty demanded or drawback demanded or sought to be denied, in all the show cause notices issued under the Customs Act, 1962 (other than those mentioned ABOVE) during the last three financial years, to the total duty paid and drawback claimed during the said period is more than ten percent, a review would be taken of the nature of cases and decision would be taken on issue or continuance of AEO status by AEO Programme Manager.

Explanation: for the paras above, the cases where the show cause notices have been dropped or decided in favour of the applicant by the adjudicating or appellate authorities will not be considered.

An applicant will also need to demonstrate that he has:

i. procedures in place to identify and disclose any irregularities or errors to the Customs authorities or, where appropriate, other regulatory

ii. taken appropriate remedial action when irregularities or errors are

6.Financial solvency … … … … … … … … … … … … … … … … … … .

An applicant must be financially solvent during the three financial years preceding the date of application. The applicant should not be listed currently as insolvent, or in liquidation or bankruptcy. Further, the applicant should not have defaulted in payment of due Customs duties during the past three years. The applicants must submit an undertaking regarding its solvency and a Solvency Certificate issued by the Statutory Auditor of the applicant.

As per Circular No. 3/2018- Customs dt.17.01.2018

“An applicant must be financially solvent during the three financial years preceding the date of application. The applicant should not be listed currently as insolvent, or in liquidation or bankruptcy. Further, the applicant should not have defaulted in payment of due Customs duties during the past three years”

The applicants applying for LO must submit a Solvency Certificate from the Statutory Auditor of the applicant.

7. Validity of AEO Certificate:

5 years for AEO-LO

Renewal of AEO certificate

| AEO status | Time limit for submission of application for renewal before lapse of validity |

| AEO-T1 | 30 days |

| AEO-T2 | 60 days |

| AEO-T3 | 90 days |

| AEO-LO | 90 days |

A. FAQ on AEO scheme1

Q.1 Who is an authorised economic operator (AEO)?

Ans. An AEO is a business entity involved in international movement of goods requiring compliance with provisions of the national Customs law and is approved by or on behalf of national administration in compliance with World Customs Organization (WCO) or equivalent supply chain security standards

Q.2 What is the AEO programme?

Ans. Thus, the aim of AEO programme is to secure the international supply chain by granting recognition to reliable operators and encouraging best practices at all levels in the international supply chain. Through this programme, the Customs shares its responsibility with the businesses, while at the same time rewarding them with a number of additional benefits.

Q.3 What is the structure of Indian AEO programme?

Ans. There is a three-tier programme for importers and exporters i.e. AEO-T1, AEO-T2 and AEO-T3 in the increasing degree of benefits accorded and compliance requirements. Furthermore, there is single Tier AEO Programme for Logistics Providers, Custodians or Terminal Operators, Customs Brokers and Warehouse Operators who are granted AEO-LO certificate.

Q.4 What is the validity period of AEO status?

Ans. The validity of AEO certificate is three years for AEO-T1 and AEO-T2, and five years for AEO-T3 and AEOLO.

Q.5 Whether AEO certificate is valid at all Customs stations across India?

Ans. . Yes, it is valid at all Customs stations in India. In other words, an AEO status holder shall get the AEO benefits at all Customs ports/ airports/ Land Customs stations.

0.6 What are the benefits of AEO status?

Ans. There are a host of benefits for all three categories of AEOs- T1, T2, T3 and LOs. These are listed in paras 1.5.1 to 1.5.4 for AEO T1, T2, T3 and LO respectively of Circular No. 33/2016-Customs dated 22nd July, 2016. Some of the major benefits are listed below:

a) Recognition worldwide as safe, secure and compliant business partners in international trade and get trade facilitation by a foreign Customs administration with whom India enters into a Mutual Recognition Agreement/ Arrangement;

b) Facility of Direct Port Delivery (DPD) of their import Containers and/ or Direct Port Entry (DPE) of their Export Containers;

c) Waiver of full or part of the Bank Guarantee requirements, Waiver of Merchant overtime fees;

d) Deferred payment of duties;

e) Waiver from transactional PCA. Instead Onsite PCA has been provided, the selection of the same shall be based on risk assessment of AEOs;

f) Waiver of solvency certification for Customs Brokers;

g) A lower risk score in risk analysis systems when profiling;

h) Faster disbursal of drawback amount through process eased out vide Circular 18/2017 Customs dated 05.2017;

i) Fast tracking of refunds and adjudications;

j) Self-certified copies of FTA / PTA origin related or any other certificates required for clearance would be accepted;

K) Recognition by Partner Government Agencies and other Stakeholders as part of AEO

Q 7. Whether all AEO operators are entitled for DPD /DPE facility?

Ans. . Yes, all AEO T1/T2/T3 status holders are entitled for DPD/ DPE facility. However, they have to apply for the Direct Port Delivery permission to the concerned Chief Commissioner and also register themselves with the port authority for DPD facility.

Q.8 Whether the amount of Bank Guarantee in case of T1, T2 and T3 is reduced to 50%, 25% and Nil respectively in all cases of dispute between Customs and AEO status holder?

Ans. No. The CBIC Circular No. 38/2016 dt. 22.08.2016 list out the situations where amount of BG is reduced to 50%, 25% and Nil. Further it is not applicable for cases where competent authority orders furnishing of bank guarantee for provisional release of seized goods.

Q.9 What is deferred payment of duty scheme?

Ans. It is a mechanism for delinking duty payment from Customs clearance. It is based on the principle ‘Clear First-Pay later’. Deferred Payment of Import Duty Rules, 2016 vide notification no 134/2016-Customs (NT) and 135/2016-Customs (NT) both dated 02nd Nov 2016 have been notified and the same have come into effect from 16.11.2016. The AEO-T2 and AEO-T3 certified importers can avail the benefit of these Rules.

Q.10 How can an AEO avail the facility of deferred payment of duty?

Ans. As per Rule 4 of the Deferred Payment of Import Duty Rules, 2016 an eligible importer who intends to avail the benefit of deferred payment has to intimate his intent to the jurisdictional Principal Commissioner of Customs or the Commissioner of Customs and get registered on the ICEGATE site www.icegate.gov.in.

Q.11 What are the due dates for payment in respect of deferred payment of duty?

Ans. As per Notification No. 134/2016 Cus (NT) dated 02.11.2016 as amended by Notification No. 28/2017 –Cus(NT) dated 31.03.2017,the Deferred Payment of Import Duty time lines are as below:

| Date of return of BE for payment of Duty | Date of deferred payment of duty |

| Date of return of BE for payment of Duty B/E from 1-15th day of any month | 16th of the Month |

| B/E from 16th-last day of month except

March |

1st day of the

following month |

| B/E from 16-31 March | 31st March |

The duty under deferred payment scheme has to be paid electronically

Q.12 Whether facilitation benefits will be available to Indian AEOs in foreign countries?

Ans. Yes, the facilitation benefits will be available in countries with whom India has signed Mutual Recognition Agreement (MRA). Indian Customs has signed Mutual Recognition Agreement (MRA) with South Korea, Taiwan and Hong Kong Customs to enable trade to get benefits on reciprocal basis.

Q.13 What exactly is a mutual recognition agreement/ arrangement (MRA)?

Ans. Mutual Recognition Arrangements/ Agreements (MRA) are bilateral understandings between two Customs Administrations which allow one business partnership program to recognize the AEO validations of the other country’s program and extend reciprocal benefits to each other’s AEO. The benefits are generally in nature of enhanced system-based facilitation & reduced interdiction, lower risk score for Indian exporter’s consignments at foreign port.

Q.14 Whether benefit of AEO LO status granted to a Customs Broker will also be given to its clients i.e. importers or exporters?

Ans. No. The AEO LO status will only be valid and applicable for the applicant and not for his importers or exporters. They need to apply separately for AEO status.

PROCESS OF FILING OF AEO APPLICATION

Q.15 Where should applications for AEO be submitted?

Ans. The application should be sent to the office of the jurisdictional Chief Commissioner of Customs with copy to AEO Programme Manager, Directorate of International Customs or in case of any doubt, to the AEO Programme Manager, Directorate of International Customs, 10th Floor, Tower II, Jeevan Bharti Building, Connaught Place, New Delhi – 110001. The jurisdictional Chief Commissioner of Customs is the one from where the Importer/Exporter/Logistic operator is doing majority of business in international supply chain. An on-line website (Domain name: aeoindia.gov.in) has been created for filing and processing of AEO-T1 application. The applicant can login to the website and file the AEO- T1 application. A separate FAQ about online filing of application is attached as Annexure-A.

Q.16 Which jurisdictional Chief Commissioner offices are designated for processing of AEO applications?

Ans. As of now, the following Chief Commissioner of Customs offices have been designated for processing of AEO application:

a) Delhi

b) Mumbai Zone-I

c) Mumbai Zone-II

d) Mumbai Zone-III

e) Ahmedabad

f) Vishakhapatnam

g) Bhubaneswar

h) Bangalore

i) Chennai

j) Hyderabad

k) Kolkata

l) Tiruchirappalli

m) Patna

n) Pune,

o) Nagpur

p) Bhopal

Q.17 Who is responsible for processing AEO application and taking decision on grant of AEO status?

Ans. The AEO Cell under the jurisdictional Chief Commissioner of Customs, headed by nodal officer of the rank of Additional /Joint Commissioner is responsible for processing AEO applications as per provisions contained in Circular No. 33/2016-Customs as amended by Circular Nos. 03/2018-Customs, 26/2018 and 51/2018 -Customs. The nodal officer of the jurisdictional Chief Commissioner forwards the processed application of AEO-T2/T3 and AEO-LO with recommendation to programme manager of Indian AEO Programme having office at Delhi for taking final decision on AEO accreditation.

The process of AEO-T1 accreditation has been further simplified and decentralised by Circular No. 26/2018 dt. 10.08.2018. Officers in the Rank of Principal Commissioner/ Commissioner have been appointed as the Zonal AEO Programme Manager in each Zone headed by Principal Chief Commissioner or Chief Commissioner of Customs and are responsible for final acceptance or rejection of the AEO application. Thus, the AEO-T1 application is processed by AEO Cell and eligibility thereto is decided at Zonal level only. The decision is conveyed to Directorate of International Customs for generation of AEO Certificate. Such approved applications are sent online by the zones to DIC Delhi for generation of digitally signed certificate.

Q.18 Whether an economic operator whose application is once rejected under the current scheme, can apply again for AEO status?

Ans. Yes, the application can be filed again if grounds on which the application was rejected are no longer valid and the applicant is otherwise eligible for AEO status.

Q.19 What are the requirements for filing AEO T1/ T2/T3/LO application?

Ans. . An applicant for AEO-T1 status is to file application online (Domain name: aeoindia.gov.in) in prescribed proforma alongwith a Declaration as indicated in Annexure A- 1, Annexure A-2 to CBEC Circular No. 26/2018 dt. 10.08.2018. After introduction of web- based module for filing online application vide Circular 51/2018 dt. 07.12.2018, it is mandatory to file online application only. An applicant for grant of any of the remaining three AEO statuses, namely AEO-T2, AEO-T3 and AEO-LO, should submit the application in the proforma specified in Table below. The application form as specified in the Circular No. 33/2016- Customs contains Ten annexures. However, an applicant is required to fill-in and submit only those annexures which may be applicable to it, as mentioned below:

Q.20 Can an existing AEO status holder file application for higher AEO status? If yes, what is the time limit for filing such application?

Ans. An existing AEO certificate holder can apply for higher AEO status. There is no time limit for filing higher status application except in case of AEO-T3. In case of AEO-T3, either the entity should have had AEO-T2 status continuously for two years or when all its business partners in international supply chain have acquired either AEO-T2 or AEO-LO status.

Q.21 Can a consultant be appointed as the contact person or the authorised person for filing application?

Ans. No. The applicant has to nominate the contact person/ authorized representative from company’s own administration only (Para 2.3 of Circular No. 33/2016-Customs).

ELIGIBILITY/ REQUIREMENTS TO BECOME AEO:

Q.22 Who can apply for AEO status?

Ans. Any business entity that is part of the international supply chain; involved in the cross- border movement of goods and required to fulfill obligations under the Customs law in India, only can apply for AEO status. These may include exporters, importers, logistic providers (e.g. carriers, airlines, freight forwarders, etc.), Custodians or Terminal Operators, Customs House Agents and Warehouse Owners, Port operators, authorized couriers, Stevedores etc. The list is not exhaustive.

Q.23 What is the eligibility criteria for a business entity to apply for Indian AEO status?

Ans. The eligibility conditions and criteria for granting AEO Status has been listed in the Section 3 of the AEO Circular No. 33/2016 –Customs dated 22nd July, 2016 as amended by Circular No. 3/2018-Customs dated 17th January, 2018. An entity should fulfil the following criteria:

a) Established in India;

b) Business should be involved in Customs related activity;

c) Should have dealt with minimum 25 Customs documents (either Bill of Entry or Shipping Bill) in the last fiscal year;

d) Should have been in business activity for last 3 Financial

Q.24 Whether a branch of a legal nentity can apply for a separate AEO Status?

Ans. No. There is no provision to grant AEO status to specific site, division or branch

Q.25 Whether a newly established company can apply for AEO Status?

Ans. As per the Indian AEO requirements, the applicant should have business activities for at least three financial years preceding the financial year of date of application. However, in exceptional cases, on the basis of physical verification of internal controls of a newly established business entity, the AEO Programme Manager can consider it for certification.

Q.26 What are the legal requirements for applying for AEO status? What are the documents to be submitted?

Ans. The Legal requirement for applying for AEO status, as prescribed in para 3.2 and annexure E.2, to Circular No. 33/2016-Customs dated 22.7.2016.

Q.27 What are the documents to be submitted as proof of having business activity for the last three financial year preceding the date of application?

Ans. The documents /evidence include Certificate of Incorporation, Import- Export Code (IEC), balance sheets for three-years etc.