Page Contents

- 1. Introduction and Background

- 2. Legislative Framework – Reference of CA Certificates in RERA Act and KA Rules

- 3. Various CA (Chartered Accountant) Certificates under RERD Act & KA Rules

- 4. Formats of Chartered Accountant (CA) Certificate

- 5. Responsibility of the promoters

- 6. Documentation and verification of records for issuance of certificate related to cost of the project and percentage of completion

- 7. Abbreviation / Definitions

- 8. Best Practices –

- 9. Reference Materials

1. Introduction and Background

The Government of India had enacted the Real Estate (Regulation and Development) Act, 2016 on 26/3/2016. The Government of Karnataka had notified Karnataka Real Estate (Regulation and Development) Rules-2017 in the State Gazette on 11/7/2017.

With reference to RERD Act and KA RERA Rules, the last date for registration of ongoing Real Estate project was 31st July 2017.

Many Promoters/ Builders/ CA’s are currently having questions/ queries on what’s next! having filed application online for registration and approved by authorities. Many Promoters / builders, CA’s are calling us and enquiring the next step, process and action required to comply with provisions of RERD Act 2016 / State Rules in relation to procedure, precautions to be followed in Issuance, maintenance and submission of CA Certificates.

In order to educate, guide the Promoters / Builders and to CA’s (Chartered Accountants) on matters which may arise in the course of their professional work and on which they may desire assistance in resolving issues which may pose difficulties. Our Consultants have prepared this smallbook on CA Certificates under –RERD Act 2016.

2. Legislative Framework – Reference of CA Certificates in RERA Act and KA Rules

Certificate by a Chartered Accountant is to be issued with set of objects and intentions with an intent to express the professional opinion or state the facts based on the information, explanation, documents received from the promoter.

Proviso to Sec 4(2)(l)(D) of RERD Act having reference and requirement of CA Certificate – which is reproduced below –

2nd Proviso – Provided further that the amounts from the separate account shall be withdrawn by the promoter after it is certified by an engineer, an architect and a chartered accountant in practice that the withdrawal is in proportion to the percentage of completion of the project:

3rd Proviso – Provided also that the promoter shall get his accounts audited within six months after the end of every financial year by a chartered accountant in practice, and shall produce a statement of accounts duly certified and signed by such chartered accountant and it shall be verified during the audit that the amounts collected for a particular project have been utilised for the project and the withdrawal has been in compliance with the proportion to the percentage of completion of the project

Karnataka RERD Rule 4(2) (c) having reference and requirement of CA Certificate – which is reproduced below –

Status of the project (extent of development carried out till date and the extent of development pending) including the original time period disclosed to the allottee for completion of the project at the time of sale including the delay and the time period within which he undertakes to complete the pending project, which shall be commensurate with the extent of development already completed, and this information shall be certified by an engineer, an architect and a chartered accountant in practice

3. Various CA (Chartered Accountant) Certificates under RERD Act & KA Rules

| Sl No | Certificate for | Act / Rule Ref | Certifying |

| 1 | Ongoing Project – 1st time | Karnataka RERD Rule- Rule 4(2)(c ) | Extent of development carried out, pending – money collected from allottees, spent for project and balance with promoter |

| 2 | On every withdrawal from project Bank Account | RERD Act –

2nd proviso to sec 4(2)(l)(D) |

Withdrawal of money from project bank account is in proportion to the % of completion of the project |

| 3 | Annual Audit under RERD Act | RERD Act –

3rd proviso to sec 4(2)(l)(D) |

1. Amounts collected from Allottees for a particular project have been utilised for the same project and

2. the withdrawal has been in compliance with the proportion to the % of completion of the project |

In case of ongoing project – the following shall be certified with reference to Karnataka RERD Rule 4(2) (c)

1. Status of the project

a. extent of development carried out till date and

b. the extent of development pending

2. original time period disclosed to the allottee for completion of the project at the time of sale

a. the delay and

b. the time period within which he undertakes to complete the pending project,

3. shall be commensurate with the extent of development already completed, and this information shall be certified by an engineer, an architect and a chartered accountant in practice

4. Formats of Chartered Accountant (CA) Certificate

a. Certificate for Ongoing Project

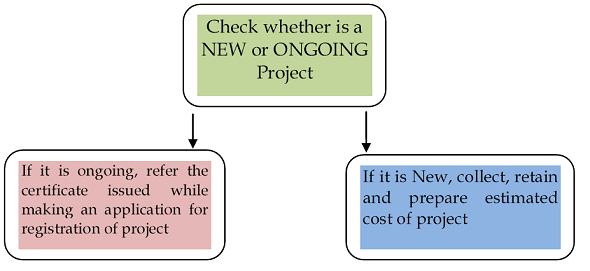

For ongoing project – Chartered Accountant certificate shall be obtained by the promoter while making an application for registration of ongoing real estate project under sec 3 to RERD Act.

Objective of this certificate is to certify –

1. Status of the project

a. Extent of development carried out till date and

b. The extent of development pending

2. Original time period disclosed to the allottee for completion of the project at the time of sale

a. The delay if any

b. The time period within which he undertakes to complete the pending project i. shall be commensurate with the extent of development already completed,

In our opinion, as a Chartered Accountant, the financial values as per books of accounts related to the project shall be certified. Chartered Accountant can insist the promoter for Architect and Engineer Certificate for the present status / development of the project.

1. Architect certifies the % of the construction work completed. He may certify based on site visit (onsite physical progress) and using their expert in their field.

2. Engineer certifies the value of material, labour involved in arriving at such % of the construction work completed. He may certify based on site visit (onsite material, labour and overhead usage) and using their expert in their field.

Estimated Cost of the project (Land plus construction) would be certified by based on the information, documents, explanation given by the promoter. A Chartered Accountant should verify the details provided by the promoter relating to Estimated Cost of the project.

As the word states Estimated Cost of the project, hence it is only an estimate. Actual cost may differ considering the various factors throughout the project period.

A Chartered Accountant shall certify Actual cost incurred towards the project based on books of accounts maintained by the promoter. Such information shall be verified and satisfied before issuance of

certificate. As a best practice, a Management Representation Letter (MRL) may also be obtained suitably disclaiming that the certificate is issued basis the best estimates given by the Management of the Promoter.

Sec 2(v) of the RERD Act defines estimated cost of the real estate project means the total cost involved in developing the real estate project and includes land cost, taxes, cess, development and other charges.

Importance and outcome of this certificate – based on this certificate, promoter decides the quantum of money collected from Allottees

1. to be retained or deposit back into designated RERA project bank account and

2. deposit 70% or 100 % further money realization into designated RERA project bank

Note –

1. Ongoing certificate is different than certificates issued for withdrawal of money

2. Ongoing certificate consider and allow promoter retaining the full money spent on the land and development

Note – In case of new project (other than ongoing project) this certificate is not required for the reason that promoter may not have liability to any Allottee in the real estate project (i.e., advance money has not been collected from Allottees)

b. CA Certificate on every withdrawal

Chartered Accountant certificate shall be obtained by the promoter on (every) withdrawal of sums deposited in separate bank accounts sec 4(2)(l)(D) of RERD Act and Karnataka RERD Rules – Rule 5

Objective of this certificate is to certify –

1. Status of the project

a. Extent of development carried out till date and

b. The extent of money spent on project till date

c. % of completion work based on initial estimated cost / escalated cost

2. Monies have been collected from Allottees towards project

a. Total Money collected from Allottees

b. Of collected 70 %, whether deposited into separate bank account

3. Quantum of money Eligible to withdraw from separate bank account

In our opinion, as a Chartered Accountant, the financial values as per books of accounts related to the project shall be certified to arrive at % of completion. Chartered Accountant can insist the promoter for Architect and Engineer Certificate for the present status / development of the project.

- Architect certifies the % of the construction work completed. He may certify based on site visit and using their expert knowledge in their field.

- Engineer certifies the value of material, labour involved in arriving at such % of the construction work completed. He may certify based on site visit and using their expert knowledge in their field.

Chartered Accountant shall certify Actual cost incurred towards the project based on books of accounts maintained by the promoter. Such information shall be verified and satisfied before issuance of certificate.

- In case of new project, a Chartered Accountant should collect the details of project, estimated cost on real estate project and retain the workings etc for the reference to issue periodical certificate for withdrawal of money from separate project bank account.

- In case of ongoing project, a Chartered Accountant should consider the CA certificate issued during registration of real estate project under Rule 4(2)(c ) Karnataka RERD rule. If the certificate was issued by different CA, then copy of such certificate shall be obtained, satisfied before issuance of this certificate. (nevertheless, CA should collect, retain workings of estimated cost of real estate project for his/her reference before issuance)

Rule 5 of Karnataka Real Estate (Regulation and Development) Rules 2017 deals with the aspect of withdrawal from 70 percent account. While the Rules define the cost of land (to mean higher of acquisition cost or guidance value) and construction cost (to mean costs incurred by the promoter towards onsite and offsite expenditure for development of real estate project), no guidance is available with respect to the question whether the quantum of withdrawal would be determined by applying the percentage of completion so determined with the balance in the 70 percent (project designated) account or by applying the percentage of completion with the total estimated cost of the project.

However, regulators in few states such as Madhya Pradesh have prescribed a method which suggests an approach to apply the percentage of completion (as determined by the proportion of land and construction cost incurred to the total estimated cost of the project) with the balance available in the 70 percent separate/ designated account. However, in case where the milestone agreed with customers based on onsite physical progress does not coincide (or significantly varies) with the percentage of completion as determined above, resorting to this approach may not enable the developer to withdraw the amount incurred on the project as the costs incurred may be higher than the money received as progress payments.

Also, based on the intent of Section 4(2)(l)(D) of RERA, it appears that the reason for creating the rule that 70 percent of the receipts from customers will be pooled into a separate bank account is to ensure that the same is used only for project cost purposes. The certification mechanism (project architect/engineer/CA) also aims at safeguarding this aspect that the withdrawals will be allowed only for meeting the project costs. Therefore, if based on the certifications provided, if the project costs incurred till date based on the certified project completion justifies a higher withdrawal from the pooling a/c, then that should be allowed since it is in line with the intent of the 70 percent account mechanism.

However, the absence of any guidance from the regulators in Karnataka, the possibility of a divergent view (i.e., multiplying percentage of completion to 70 percent of project receipts and receivables and not to total estimated cost of the project) cannot be ruled out. A Chartered Accountant should bring this to the notice of the Promoter and adequately document this before issuance of the certificate.

Objective of RERA Audit Certificate by a CA

1. Amounts collected from Allottees for a particular project have been utilised for the same project and

2. the withdrawal has been in compliance with the proportion to the % of completion of the project

Note –

1. Different states may prescribe different format of certificate. Currently, the regulators in few states (MH, AP) have prescribed format.

2. This certificate shall be issued by a CA holding COP

3. CA to collect project financial information from the promoter.

4. Collect estimated cost of project, escalation if any and details there on

5. CA to collect and consider all professional certificates issued from time to time for withdrawal of project.

6. This certificate shall be submitted to authorities and is a public document. It could be made available for viewing at the portal of the regulators in the respective states. The comments in this note are purely a matter of interpretation and not binding on any regulatory authorities. Therefore, there can be no assurance that the regulatory authorities will not take a position contrary to our comments or views.

5. Responsibility of the promoters

1. Promoter to maintain the complete financial and other information relating to project

2. Provide such information to professionals to obtain certificates from time to time

3. Submit or utilize those certificate to withdraw money from project bank account

4. Reconcile the receivables, received, utilized and balance money in bank account periodically

5. Follow best practices

6. The cost of the project as per RERA has to be reconciled as per books for Audit and compliance under other statutes like GST, Income Tax, ROC etc

7. Maintain and update books of accounts from time to time

1. Accounting records – updated books of accounts

2. Copy of application filed for registration of project under RERD Act

3. Details of calculations considered to arrive at estimated cost of project.

4. All project related documents like land documents, sanctions, clearances, NOC’s

5. Amount incurred towards acquisition of land or TDR etc

6. All bank statements of RERA project account and other bank accounts

7. Statement of customers, list of agreement of sales entered, advances received, balance receivables etc

8. Money collected from allottees, 70 % deposit made to RERA project bank account

9. All government fees challahs for all clearances etc

10. All development expenses bills, vouchers, invoices for both onsite and offsite expenditures

11. Advance paid for supply of materials or services vouchers, references etc.,

12. Certificates from Engineer, Architect and CA for withdrawal of money based on % of completion of construction

13. Project Loan or other loan statement

14. Interest calculation / attribution towards the project

15. Indirect taxes / GST paid from time to time

7. Abbreviation / Definitions

| Sec Ref | Header | Definition / Explanation |

| Sec 2(h) of RERD Act | Architect | Architect means a person registered as an architect under the provisions of the Architects Act, 1972 |

| Sec 2(s) of RERD Act | Development | Development with its grammatical variations and cognate expressions, means carrying out the development of immovable property, engineering or other operations in, on, over or under the land or the making of any material change in any immovable property or land and includes redevelopment; |

| Sec 2(t) of RERD Act | development works | Development works means the external development works and internal development works on immovable property |

| Sec 2(u) of RERD Act | Engineer | Engineer means a person who possesses a bachelor’s degree or equivalent from an institution recognised by the All India Council of Technical Education or any University or any institution recognised under a law or is registered as an engineer under any law for the time being in force |

| Sec 2(v) of RERD Act | estimated cost of real estate project | estimated cost of real estate project means the total cost involved in developing the real estate project and includes the land cost, taxes, cess, development and other charges |

| Rule – 5 of KA RERD Rule | land cost means | i. the costs incurred by the promoter for acquisition of ownership and title of the land parcels for the real estate project as an outright purchase lease etc., or the Guidance Value in accordance with section 45-B of the Karnataka Stamp Act 1957 relevant on the date of registration of the real estate project whichever is higher

ii. amount paid for acquisition/ purchase of TDR etc iii. amount paid to the competent Authority for project approval, No objection certificates, stamps duty, transfer charges, registration charges, conversion charges, change, taxes, statuary payments to state and central Government |

| Rule – 5 of KA RERD Rule | Cost of Construction” means | The cost of construction shall include all such costs, incurred by the promoter towards

i. on-site and ii. off-site expenditure for the development of the real estate project including payment of Taxes, Fees, charges, premiums, interests etc., to any competent Authority, or statutory Authority of the Central or State Government, including interest, paid or payable to any Financial Institutions including scheduled banks or non – banking financial companies etc |

| on-site expenditure | All expenditure incurred by promoter at site for development of project | |

| off-site expenditure | All expenditure incurred by promoter other than site expenditure for the project, includes marketing, admin, interest on borrowing costs, professional fees, advances for material supplied, R & D costs, insurance costs etc | |

| Costs, not to be considered as estimated cost of project |

Income Tax, taxes on profits, |

8. Best Practices –

1. The Promoter may have appointed external professionals to obtain certificates from time to time, consult the same professional who had issued the earlier certificate.

2. All the CA certificates has to be in conformity with assurance standards issued by the ICAI.

3. All the certificates to be backed up with adequate documentation by way of Management Representation letter and the basis of preparing such certificates. In case the regulators suggest a format at a later date or issue any clarification in this regard, the above-suggested template may suitably be aligned.

9. Reference Materials

- RERD Act 2016

- KA RERD Rules

- MH RERD Rules

- Gujarat RERD Rules

Download Above in Book Format with Format of CA Certificates

The comments in this note are purely a matter of interpretation and not binding on any regulatory authorities. Therefore, there can be no assurance that the regulatory authorities will not take a position contrary to our comments or views. The views are exclusively for educational purpose and any correction you feel necessary please write to consult@reraconsultants.in or vinay@vnv.ca

Dear Sir,

I wanted to know about the calculation of the amount to be withdrawn from Karnataka RERA account, As per RERA act and rules, it should be as per % completion basis. But I am not able to understand how exactly the same should be calculated as per Karnataka RERA Rules/Act.

I would request you to help me with a small illustration of calculating the same.

I would be glad if you would guide me with the same.

Thanking You in Advance.

WHAT IS THE EXACT PERIOD TO BE COVERED IN 1ST ANNUAL REPORT IN MAHARERA FORM 5 A ND IN CLAUE 3 OF SAID FORM 5

We have some queries wrt RERA Form 5 as under as there is no clarification available to us on same:-

QUERY REGARDING RERA FORM 5 (ANNUAL REPORT BY STATUTORY AUDITOR)

1 In Subject of Form 5 period is mentioned.

What is the period to be coverd for 1 st Annual Report on statement of Accounts in Form 5 ? Is it for period from 01/07/2017 TO 31/03/2018 OR from Date of Rera Registration of project to 31/03/2018? or any other date ?

2 Clause 3 of Form 5 speaks of Amount Collected and amount Withdrawn as under

ii. Amount collected during the year for this project is Rs. ___________________ and amounts collected till date is Rs. _______________________

iii. Amount withdrawn during the year for this project is Rs. _________________ and amount withdrawn till date is Rs. _____________________

What is the period to be covered for Amount collected during the year for this project and Amount withdrawn during the year for this project ?Is it for period from 01/07/2017 TO 31/03/2018 OR from Date of Rera Registration of project to 31/03/2018? or any other date ?

What is the period to be covered for Amount collected and Amount withdrawn till date ?Is it for period from 01/07/2017 TO 31/03/2018 OR from Date of Rera Registration of project o 31/03/2018? or Is it for period from 01/07/2017 TO 31/122018 OR from Date of Rera Registration of project to 31/12/2018 as CA will be issuing certificate in 1st week of January 2019?or is it for period from inception of project to 31/03/2018? or is it for period from inception of project to 31/12/2018 as CA will be issuing certificate in 1st week of January 2019? or any other date ?

It will be great help if we get proper reply to ou above queries wrt Form 5

IMPROMPTU

At the outset, it ought not to be over sighted , or impudently slighted, that the set of rules, etc., as framed by each one of the states, apart from Karnataka, are , in comparison, mutually at variance, in material respects. Notwithstanding that the central legislation and the model rules thereunder are envisaged to be strictly followed by all the federal states of the UOI.

Incidentally, besides the rest, the writer’s own Tail End Note (of ‘disclaimer’) calls for a careful but anxious consideration.

The implication / underlying message is seen to be more than obvious , and self-evident. As such, it might defeat the very objective of the requirement, intended to principally serve the larger interests of the investing public, should each and every certifying CA,- regardless of , apart from eminence, exposure and experience in field practice, in different states, -be allowed, to proceed and certify based on individual’s own understanding / whims and fancies. Instead, ideally, rather prudently, viewing, in order to bring about / ensure some sort of ,- if not absolute,- uniformity in the matter, the ICAI and the other regulatory (apex) bodies (in control of related professionals, not barring, the ICSI ), if not already done, need to frame and come out with appropriate clear-cut guidelines to be acted acted upon.

May you care and refer the earlier posts on this very topic; lastly @ https://taxguru.in/corporate-law/difficulty-issue-ca-certificate-rera.html