Journey of Companies act, 2013

√ Companies act, 2013 (1.4.2014)

√ Companies Amendment act, 2015 (w.e.f.4-4-2015)

√ Companies Amendment act, 2017 (w.e.f.5-1-2018)

√ Companies amendment ordinance 2018 (w.e.f.5-11-2018)

√ Companies amendment Second ordinance 2019 (15-1-2019)

√ Companies amendment ordinance 2019 (26-03-2019)

√ Companies amendment act, 2019 ( 1-8-2019)

√ Companies amendment act, 2020 (26-09-2020)

√ Many notifications, rules and circulars

Items for discussion

1. Reasons for frequent amendments to Companies act, 2013

2. Over view of Companies amendment act, 2020

3. New definition of small company and its privileges

4. Liberalized provisions for payment of Remuneration to Managerial Personnel

5. Amendments to CSR provisions

6. Revised Schedule III & Revised CARO FY 2021-22 onwards

7. Other Key amendments to Companies act, 2013

8. Changes in Audit report format F.Y. 2021-22

9. Regulatory developments in adjudication and compounding of offences

10. Consequences of filing defective documents with MCA

11. Possible areas requires attention

12. Enable working with MCAv3

13. New changes proposed to be amended

14. Amendments to LLP Act, 2008

15. Certain amendments to Nidhi and producer companies ( not covered for discussion)

16. Key Take aways

1. Reasons for several amendments

- Ease of doing business;

- Less government more governance;

- Achieve 5 trillion economy;

- No Exit to Easy Exit of Corporates( CIRP, Liquidation moved to IBC);

- Invite Global investments;

- Self governance and Transparency;

- Empower shareholders to approve all major decisions;

- Compliances to meet changing needs – Covid 19;

- FS to become more useful to stakeholders (Lenders);

- Have proper checks and balances;

- More responsibility on CA/CS/CMA and Directors;

Overview of Companies(Amendment) Act,2020

- De-clogging 46 penal provisions in the following manner w.e.f. 21.12.20

- Re-categorising of 23 offences out of 66 compoundable offences to an in-house adjudication framework wherein penalty will be levied by an adjudication officer

- Omitting 7 compoundable offences

- Limiting 11 compoundable offences to fine only (by removing imprisonment part)

- Recommending 5 offences to be dealt with in an alternative framework

Highlights of Companies(Amendment) Act,2020

- Decriminalization of the Companies Act

> It removes the imprisonment for various offenses, substitutes fine by penalty and reduces amount payable as penalty across the board.

- Reduction in Penalties

- Exclusion from listed companies

- Exemptions from filing resolutions

> Banking companies and registered NBFC and HFC are exempt from filing resolutions passed to grant loans or to provide guarantees or security for a loan.

- Changes in CSR provisions

- Specified unlisted entities to prepare and file periodical financial statements

- Provision for remuneration to Independent Director in case of inadequacy of profits

- Reduction in time line for rights issue even less than 15 days

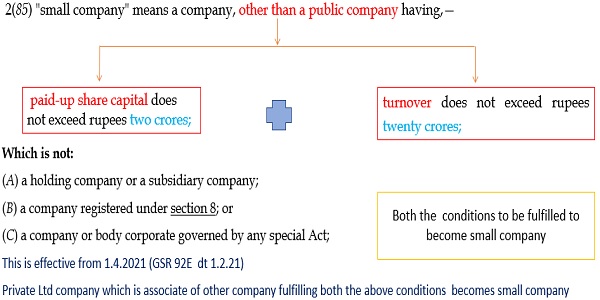

Small company definition and its impact

Small Company definition and its impact (Ctd…)

1.ABC Pvt Ltd which is not subsidiary its

Small Company definition and its impact (Ctd…)

1. More Companies covered under the ambit of the definition

2. No cash flow statement

3. No CARO Report

4. Two Board Meetings in a year

5. Abridged version of Board’s Report

6. MGT-7A instead of MGT-7 Lesser filing fees

7. Lesser penalties for One Person Companies or small companies (446B)

8. Section 233 – Merger or Amalgamation benefits under fast track.

9. No certification of e-Forms

Definition of “Listed Company” Section 2(52)

- Listed company” means a company which has any of its securities listed on any recognized stock exchange;

- The following clause is inserted:

Provided that such class of companies, which have listed or intend to list such class of securities, as may be prescribed in consultation with the Securities and Exchange Board, shall not be considered as listed companies.

Filing of periodical FS by certain unlisted entities

- New section 129A has been introduced;

- Specified classes of unlisted companies to prepare and file their periodical financial results at a regular frequency

- FS to be filed with the Registrar within a period of thirty days of completion of the relevant period

- This provision is aimed at improving corporate governance.

Corporate Social Responsibility (Section-135)

- Constitution of CSR committee is not mandatory if the CSR spent is less than Rs. 50 Lakh;

- The functions of such Committee in such cases, be discharged by the Board;

- If the company spends an amount in excess of the requirements, such company may set off such excess amount for succeeding financial years;

- Companies spending more than Rs. 10 crore for CSR purpose shall undertake impact assessment;

- Certain activities are defined as not eligible for CSR purpose ;

- CSR details to be reported as per revised schedule III.

Unspent CSR expenditure

Other CSR amendments

- CSR implementing agency shall register by submitting form CSR 1.

- Details to be reported as per revised schedule III.

- Board shall satisfy itself that the funds so disbursed have been utilized for the purposes.

- CSR report to be signed by CFO or other person in charge for functional requirements.

- File CSR-2 before due date i.e. 31st May, 2022 (31.3.2022).

- CSR-2 annexure to be part of AOC 4 from financial year 2022-23 onwards.

Corporate Social Responsibility Section-135(7)

- If a company contravenes the provisions:

|

Previous |

Amended | Impact | |

| Company | •Rs. 50,000 to Rs. 25 Lakh | •twice the amount required to be transferred to the Fund or the Unspent CSR Account, as the case may be, or

•Rs. 1 Cr, whichever is less, |

Change in penalty based on the Unspent amount of CSR |

| Officer in default | •Imprisonment up to 3 Years or

•Rs. 50,000 to Rs. 5 Lakh or •Both |

•one-tenth of the amount required to be transferred to such Fund or the Unspent CSR Account, as the case may be, or

•Rs. 2 Lakh whichever is less.” |

Other Key amendments

- Audit trial mandatory w.e.f 1st April 2023: (1.4.2022)

Accounting software for maintaining its books of account shall have feature of recording audit trail of each and every transaction.

Form CSR 2 to be filed before 31.5.2022 (31.3.2022)

- Changes in Board’s Report: Amendment in the Companies (Accounts) Rules, 2014:

In rule 8, in sub-rule (5), after clause (x), the following clauses shall be inserted namely:-

“(xi) the details of application made or any proceeding pending under the IBC and its status.

(xii) the details of difference between amount of the valuation done at the time of one time settlement and the valuation done while taking loan from the Banks or Financial Institutions along with the reasons thereof.”

Other Key amendments

- Offer period in rights issues shall be minimum seven days instead of (Fifteen days).

- CA, CS, CMA, Lawyer is exempted from taking proficiency test for appointing as an Independent director.

- Board /Committee meetings through VC mode.

- AGM/EGM can be conducted through V.C upto 30th June 2022. (MCA cir 21/21)

- Gap between two meetings can be 180 days instead of 120 days u/s 173 (upto 30.9.2021).

- Board/Committee can discuss any business items in V.C. Meetings subject to section 179.

Other Key amendments

- Not necessary to attach form MGT 9 to board report, if it is uploaded on website and link to provided.

- Rule 4 of the Companies (Meetings of Board and its Powers) Rules, 2021 OMITTED w.e.f 30th June, 2021

Earlier : Matters not to be dealt with in a meeting through video conferencing or other audio visual means.

The following matters shall not be dealt with in any meeting held through video conferencing or other audio visual means:-

(i) the approval of the annual financial statements;

(ii) the approval of the Board’s report;

(iii) the approval of the prospectus;

(iv) the ACM for consideration of financial statement to be approved by the board;

(v) the approval of amalgamation, merger, demerger, acquisition and takeover;

- Now Board/Committee can discuss any matters through V.C – Physical meeting is not mandatory

Changes in Audit report fy 21-22 (GSR 206E) w.e.f. 1.4.21

- Whether the management has represented that, to the best of it’s knowledge and belief, other than as disclosed in the notes to the accounts;

> no funds have been advanced or loaned or invested (either from borrowed funds or share premium or any other sources or kind of funds) by the company to or in any other person(s) or entity(ies), including foreign entities (“Intermediaries”), with the understanding, whether recorded in writing or otherwise, that the Intermediary shall, whether, directly or indirectly lend or invest in other persons or entities identified in any manner whatsoever by or on behalf of the company (“Ultimate Beneficiaries”) or provide any guarantee, security or the like on behalf of the Ultimate Beneficiaries;

> no funds have been received by the company from any person(s) or entity(ies), including foreign entities (“Funding Parties”), with the understanding, whether recorded in writing or otherwise, that the company shall, whether, directly or indirectly, lend or invest in other persons or entities identified in any manner whatsoever by or on behalf of the Funding Party (“Ultimate Beneficiaries”) or provide any guarantee, security or the like on behalf of the Ultimate Beneficiaries; and

Based on such audit procedures that the auditor has considered reasonable and appropriate in the circumstances, nothing has come to their notice that has caused them to believe that the representations under sub-clause (i) and (ii) contain any material mis-statement.

- Whether the dividend declared or paid during the year by the company is in compliance with Sec 123.

ABC Ltd cannot give loan to PQR Ltd with an understanding that PQR to given loan to XYZ Ltd.

POR Ltd. cannot take from ABC Ltd for giving loan to XYZ Ltd.

Statutory auditors of both the Companies to report such instances

Adjudication and compounding of offences

- RD will compound instead of NCLT if fine amount is less than Rs. 25 lakhs

- Appeal can be filed before RD within 60 days against the order of ROC

- No appeal against compounding order

- Lesser penalties for small companies

- Double the penalties if same offence is committed within 3 years (sec 454A)

- No compounding of offence within 3 years if same offence is committed.

- If the compounding orders are not complied it amounts to contempt of court.

- Where any offence is compounded before the institution of any prosecution, no prosecution shall be instituted in relation to such offence.

Certain penalties

- If the auditor does not comply with the provisions, he is liable for a penalty:

|

Previously |

Amended | Impact |

| •Rs. 50,000 or

•an amount equal to the remuneration of the auditor, whichever is less and •in case of continuing failure, Rs. 500 for each day, •subject to a maximum of Rs. 5 Lakh |

•Rs. 50,000 or

•an amount equal to the remuneration of the auditor, whichever is less and •in case of continuing failure, Rs. 500 for each day, •subject to a maximum of Rs. 2 Lakh |

Reduced penalty from Rs. 5 Lakh to Rs. 2 Lakh |

- If a director of the company contravenes the provisions of this Section 184:

|

Previously |

Amended | Impact |

| •imprisonment up to 1 Year or

•fine up to Rs. 1 Lakh or •with both |

•Rs. 1 Lakh | Imprisonment removed |

Penalty v/s Fine

Issues for discussion

- ABC Pvt Ltd violated Section 203 and offence was compounded by NCLT. Mr. X Managing Director paid Rs. 1 lakh as compounding fee in February, 2022

Mr. X re-appt is due on 30.4.2022. Can he be eligible for re-appt?

> Yes,

Compounding fees is not fine for conviction of an offence.

Recent Adjudication orders

|

|

Penalty on company |

Penalty on Directors/KMP |

||||||||

S. No |

ROC |

Sections |

One Time |

Conti-nuing |

Total |

One Time |

Conti-nuing |

No. of KMP |

Total Penalty |

Total |

1 |

Maharashtra |

173 |

– |

– |

– |

1.00 |

– |

2 |

1.00 |

1.00 |

2 |

Delhi |

92&137 |

0.20 |

0.72 |

0.92 |

0.20 |

0.72 |

1 |

0.92 |

1.84 |

3 |

Gujrat |

197 |

0.10 |

– |

0.10 |

0.50 |

– |

1 |

0.50 |

0.60 |

4 |

Gujrat |

92&137 |

– |

– |

– |

0.30 |

0.57 |

2 |

0.87 |

0.87 |

5 |

Maharashtra |

173 |

– |

– |

– |

5.00 |

– |

2 |

5.00 |

5.00 |

6 |

Bangalore |

88 |

3.00 |

– |

3.00 |

0.50 |

– |

1 |

0.50 |

3.50 |

7 |

Odisha |

92&137 |

1.00 |

14.61 |

15.61 |

9.00 |

7.82 |

3 |

16.82 |

32.44 |

8 |

Maharashtra |

177 |

5.00 |

– |

5.00 |

13.00 |

– |

13 |

13.00 |

18.00 |

9 |

Gujrat |

82 |

5.00 |

– |

5.00 |

1.50 |

– |

3 |

1.50 |

6.50 |

11 |

Gujrat |

203 |

5.00 |

– |

5.00 |

1.00 |

2.98 |

2 |

3.98 |

8.98 |

12 |

Bangalore |

12 |

1.00 |

– |

1.00 |

2.00 |

– |

2 |

2.00 |

3.00 |

13 |

Bangalore |

117 |

0.50 |

5.73 |

6.23 |

0.25 |

5.73 |

1 |

5.98 |

12.21 |

14 |

Bangalore |

117 |

1.00 |

0.30 |

1.30 |

2.00 |

1.18 |

4 |

3.18 |

4.48 |

15 |

Bangalore |

117 |

0.50 |

0.02 |

0.52 |

0.75 |

0.07 |

3 |

0.82 |

1.34 |

16 |

Bangalore |

117 |

1.00 |

8.54 |

9.54 |

1.50 |

13.50 |

3 |

15.00 |

24.54 |

17 |

Bangalore |

88 |

3.00 |

– |

3.00 |

0.50 |

– |

1 |

0.50 |

3.50 |

18 |

Maharashtra |

135 |

0.10 |

2.00 |

2.10 |

1.30 |

4.69 |

13 |

5.99 |

8.09 |

19 |

Bangalore |

64 |

– |

4.46 |

4.46 |

– |

11.58 |

4 |

11.58 |

16.04 |

20 |

Bangalore |

42 |

– |

0.13 |

0.13 |

– |

0.65 |

5 |

0.65 |

0.78 |

21 |

Delhi |

12 |

1.00 |

– |

1.00 |

2.00 |

– |

2 |

2.00 |

3.00 |

22 |

Maha-rashtra |

12 |

1.00 |

– |

1.00 |

2.00 |

– |

3 |

2.00 |

3.00 |

23 |

Maharashtra |

42 |

2.00 |

– |

2.00 |

3.00 |

– |

3 |

3.00 |

5.00 |

24 |

Gujrat |

12 |

– |

0.50 |

0.50 |

– |

1.50 |

3 |

1.50 |

2.00 |

25 |

Delhi |

42 |

– |

0.19 |

0.19 |

– |

0.38 |

2 |

0.38 |

0.57 |

26 |

Gujrat |

12 |

– |

1.00 |

1.00 |

– |

4.00 |

4 |

4.00 |

5.00 |

27 |

Delhi |

118 |

1.00 |

– |

1.00 |

0.60 |

– |

3 |

0.60 |

1.60 |

28 |

Delhi |

56 |

0.50 |

– |

0.50 |

1.50 |

– |

3 |

1.50 |

2.00 |

29 |

Gujrat |

42 |

100.00 |

– |

100.00 |

100.00 |

– |

5 |

100.00 |

200.00 |

30 |

Tamil Nadu |

203 |

5.00 |

– |

5.00 |

1.44 |

– |

1 |

1.44 |

6.44 |

31 |

Chandigarh |

149 |

0.50 |

0.66 |

1.16 |

0.50 |

0.66 |

1 |

1.16 |

2.32 |

Present position of Adjudication

- ROC’s are authorized to adjudicate offences u/s 454 w.e.f 24/03/2015;

- MCA scrutinizes the documents filed with MCA under STP mode;

- Show cause notices are sending for adjudication if there are any deviations;

- Recent adjudication orders:

√ Non filing of Form 20A commencement of business

√ Non filing of INC- 22 declaration of registered office

√ Non appointment of auditor within 30 days and non-filing form ADT 1

√ Letter heads not containing CIN

√ Non filing of INC-22 shifting of registered office

√ Director signing without DIN

- Reviewing of Annual reports/return focusing on following :

√ Audit qualifications

√ Not having significant accounting policies

√ UDIN not mentioned in FS

√ Without proper supporting documents

√ Inconsistency in reporting

√ Deviation disclosed in board’s report

√ CSR report and other supporting documents not attached properly

Possible areas requires attention

> Meeting notices (minimum no of days)

> Updation of minutes – interested director

> Timely filing of forms

> Disclosure of interest – form MBP 1

> Minimum no of meetings

> Obtaining approvals – Board and shareholders

> Related party transactions

> Annual return and Annual accounts filed with ROC

Expectation from auditor

Additional filing fees

Additional fee shall be applicable for delay in filing of forms other than for increase in Nominal Share capital or forms under section 92/137 of the Act.

|

Sl. No. |

Period of delays | Additional fees as a multiple of normal fees | Higher additional fees as a multiple of normal fees (in certain cases) |

| (a) | Upto 15 days(sections 139 and 157) | One time of normal fees | – |

| (b) | More than 15days and upto 30days | 2 times of normal filing fees | 3 times of normal filing fees |

| (c) | More than 30 days and upto 60 days | 4 times of normal filing fees | 6 times of normal filing fees |

| (d) | More than 60 days and upto 90 days | 6 times of normal filing fees | 9 times of normal filing fees |

| (e) | More than 90 days and upto 180 days | 10 times of normal filing fees | 15 times of normal filing fees |

| (e) | More than 180 days | 12 times of normal filing fees | 18 times of normal filing fees |

Higher additional fees is payable for INC 22 & PAS 3 for delay happens in repeatedly within 365 days

Whenever Higher additional fee is payable, additional fees shall not be charged.

I.”For Forms under section 92 or 137”:-

(i) In case the period within which a document required to be submitted under section 92 or \137 of the Act expires after 3o/o6/2018, the additional fee mentioned in Table shall be payable –

| S.l no | Period of delays | Company | Officer in default |

| 01 | Delay beyond period provided under Section 92(4) of the Act | Rs. 10,000 +

100/-per day S.t. max Rs. 2 lakh |

Rs. 10,000 +

100/-per day S.t. max Rs. 50k

|

| 02 | Delay beyond period provided under Section 137 of the Act |

No adjudication, if the Company files FS/AR within 30 days of notice paying Rs. 100 per day as penalty

Enable working with MCAv3

- In line with digital transformation, MCA V3 is going to be operational soon.

- Web inter face for efiling

- Data integrates with each filing and integrates with other dept like GST portal CBDT

- E-adjudication, on-line hearings

- Dash board for accessing the data such as notices etc.,

- Data analytics

New Changes under consideration

- Company law Committee submitted its report to MCA proposing some changes:

1. Issue of fractional shares, RSU and SAR’s;

2. Easing the requirement of raising capital in distressed companies;

3. Self certification/ declaration instead of affidavit;

4. Prohibiting companies from recording trusts on their register of members;

5. Allowing companies to hold AGM/EGM in virtual, physical or hybrid modes;

6. Creating an electronic platform for maintenance of statutory registers;

7. Strengthening the NFRA;

8. Reviewing and strengthening the audit framework and introducing mechanisms to ensure the independence of auditors;

9. Standardizing the manner for auditors to provide qualifications;

10. Recognizing and providing an enabling framework for the constitution of Risk Management Committees;

New Changes under consideration

1. Clarifying the tenure of independent directors;

2. Revising provisions relating to the disqualification and vacation of the office of directors;

3. Clarifying the procedure for the resignation of key managerial personnel;

4. Strengthening the provisions relating to mergers and amalgamations;

5. Provisions for restoration of struck off companies by the RD;

6. Prohibiting the conversion of co-operative societies into a company;

7. Modernizing enforcement and adjudication activities through electronic mode;

8. Removing ambiguities from present provisions under the Companies Act, 2013 through changes of drafting & consequential nature.

LLP Amendments

- LLP Amendment Act, 2021 – notified

- Vide notification dated 11.02.2022, sections 1 to 29 of the Limited Liability Partnership (Amendment) Act, 2021 have been notified to take effect from 01.04.2022.

Coverage

- Key amendments:

‘Small limited liability partnership’ is introduced

The filing fees and penalty amount will be lesser for small LLPs as notified by MCA vide LLP (Amendment) Rules, 2022

LLP Amendments

34A. The CG in consultation with the NFRA may:

(a) prescribe the accounting standards; and

(b) prescribe the auditing standards on recommendation of ICAI

Offences

- Adjudication, Compounding is done inline with CA 2013

- Offences punishable with

- No powers to NCLT for compounding.

- No compounding if similar offence committed within 3 years

- Non-compliance of compounding order will attract twice the amount in addition to compounding fee.

Coverage

LLP Amendments

- LLP (Amendment) Rules, 2022– notified

Fee for filing, registering, or recording notice of appointment, cessation, change in name, address, designation of a partner or designated partner, intimation of Designated Partner Identification Number and consent to become a partner or designated partner in LLP Form No. 4:

For Small LLPs Rs. 50

For Other than Small LLPs Rs. 150

[In the existing provision, only Rs. 50 was provided for filing Form No. 4. Vide this notification fees for small LLPs and other than small LLPs is provided separately. In a way, burden of other than small LLPs is increased by Rs. 100.]

LLP Amendments

- LLP (Amendment) Rules, 2022– notified

- Fee for any application other than application for conversion of a firm or a private company or an unlisted public company into LLP shall be as under:

|

Sl. No. |

Application | Small LLPs (in rupees) | Other than Small LLPs (in rupees) |

| (a) | For reservation of name under section 16 of the Act | Rs. 200 | Rs. 200 |

| (b) | For direction to change the name under section 17 of the Act | Rs. 5000 | Rs. 5000 |

| (c) | For striking off name of defunct Limited Liability Partnership under rule 37 | Rs. 500 | Rs. 1000 |

- LLP (Amendment) Rules, 2022– notified

(2) Fee for an application under rule 18 (3):

|

(a) |

Application for reservation of name under Rule 18(3) | Rs. 10000 |

| (b) | Application for renewal of name under Rule 18(3) | Rs. 5000 |

[In the existing provision, only Rs. 500 was provided for filing of application for striking off name of defunct LLP under rule 37. Vide this notification fees for small LLPs and other than small LLPs is provided separately. In a way, burden of other than small LLPs is increased by Rs. 500.]

- LLP (Amendment) Rules, 2022– notified

Following Table of additional fee shall be applicable for delay in filing of forms.

|

Sl. No. |

Period of delays | Small LLPs | Other than Small LLPs |

| (a) | Upto 15 days | One time | One time |

| (b) | More than 15 days and upto 30 days | 2 times of normal filing fees | 4 times of normal filing fees |

| (c) | More than 30 days and upto 60 days | 4 times of normal filing fees | 8 times of normal filing fees |

| (d) | More than 60 days and upto 90 days | 6 times of normal filing fees | 12 times of normal filing fees |

| (e) | More than 90 days and upto 180 days | 10 times of normal filing fees | 20 times of normal filing fees |

| (f) | More than 180 days and upto 360 days | 15 times of normal filing fees | 30 times of normal filing fees |

| (g) | Beyond 360 days | 25 times of normal filing fees for forms other than Form 8 and Form 11. For 8 and Form 11, 15 times normal filing fees plus Rs. 10 per day for every day delay beyond 360 days | 50 times of normal filing fees for forms other than Form 8 and Form 11. For 8 and Form 11, 30 times normal filing fees plus Rs. 20 per day for every day delay beyond 360 days |

16. Key take Aways

- Companies amendment act , 2020 has decriminalized offences.

- Special privileges for small companies.

- Filing of periodical accounts by certain unlisted companies.

- No restrictions on payment of remuneration to Managerial persons including NED and independent director.

- CSR committee is not required if the CSR spent is less than 50 lakhs and unspent CSR to be transferred.

- Changes to schedule III and CARO 2020 effective from the FY 2021-22.

- Audit trial to be mandatory effective from 1st April 2023.

- Companies amendment act , 2020 has decriminalized offences.

- Special privileges for small companies.

- Filing of periodical accounts by certain unlisted companies.

- No restrictions on payment of remuneration to Managerial persons including NED and independent director.

- CSR committee is not required if the CSR spent is less than 50 lakhs and unspent CSR to be transferred.

- Changes to schedule III and CARO 2020 effective from the FY 2021-22.

- Audit trial to be mandatory effective from 1st April 2023.

Nice material