Understand the key discussions on Ind AS-1 regarding the presentation of financial statements, including objectives, scope, definitions, and structural elements.

Ind AS 1 – Presentation of Financial Statements

1 Objective : (PARA-1)

- This Standard prescribes the basis for presentation of general purpose financial statements;

- to ensure comparability both with the entity’s financial statements of previous periods and with the financial statements of other entities;

- It sets out overall requirements for the presentation of financial statements, guidelines for their structure and minimum requirements for their content.

2 Scope : (PARA-2 to 6)

- An entity shall apply Ind AS-1 in preparing and presenting general purpose financial statements in accordance with Indian Accounting Standards (Ind ASs).

- Other Ind ASs set out the recognition, measurement and disclosure requirements for specific transactions and other events.

- Ind AS-1 does not apply to the structure and content of condensed interim financial statements prepared in accordance with Ind AS 34, Interim Financial Reporting. However, paragraphs 15–35 apply to such financial statements ( General features for financial statements).

- Ind AS-1 applies equally to all entities, including those that present consolidated financial statements and those that present separate financial statements.

- Uses terminology that is suitable for profit-oriented entities, including public sector business entities. entities with not-for-profit activities may need to amend the descriptions used for particular line items in the financial statements and for the financial statements themselves.

- Similarly, entities whose share capital is not equity may need to adapt the financial statement presentation of members’ interests.

3 Important Definitions : (PARA- 7 to 8A)

- General purpose financial statements

(Referred to as ‘financial statements’) are those intended to meet the needs of users who are not in a position to require an entity to prepare reports tailored to their particular information needs.

- Material

Omissions or misstatements of items are material if they could, individually or collectively, influence the economic decisions that users make on the basis of the financial statements. Materiality depends on the size and nature of the omission or misstatement judged in the surrounding circumstances. The size or nature of the item, or a combination of both, could be the determining factor.

Assessing whether an omission or misstatement could influence economic decisions of users, and so be material, requires consideration of the characteristics of those users. The Framework for the Preparation and Presentation of Financial Statements issued by the Institute of Chartered Accountants of India states in paragraph 25 that ‘users are assumed to have a reasonable knowledge of business and economic activities and accounting and a willingness to study the information with reasonable diligence.’ Therefore, the assessment needs to take into account how users with such attributes could reasonably be expected to be influenced in making economic decisions.

4 Complete Set of Financial Statement : (PARA- 10 to 14)

| A complete set of financial statements comprises |

| A balance sheet as at the end of the period |

| A statement of profit and loss for the period |

| Statement of changes in equity for the period |

| a statement of cash flows for the period |

| Notes- Accounting Policy & explanatory Information |

| comparative information in respect of the preceding period |

| A balance sheet as at the beginning of the preceding period: |

- when an entity applies an accounting policy retrospectively

- makes a retrospective restatement of items in its financial statements

- when it reclassifies items in its financial statements in accordance with paragraphs 40A–40D

- Single Statement of Profit and Loss shall be presented in two section, with Profit and Loss followed by other Comprehensive Income.

- Shall present with equal prominence all of the financial statements in a complete set of financial statements.

- Other reports, statements and financial reviews such as Environmental Reports, Value Added Statement, review of entities’ source of funding and targeted ratio of liability to equity, the main factors and influences determining financial performance, the entity’s resources not recognized in the balance sheet in accordance with Ind ASs, are reports and statements presented outside financial statements and outside the scope of Ind AS.

5 General Features of Financial Statements : (PARA- 15 to 46)

General features

- Presentation of True and Fair View and compliance with Ind Ass

- Going concern

- Accrual basis of accounting

- Materiality and aggregation

- Offsetting

- Frequency of reporting

- Comparative information

- Consistency of presentation.

5A Presentation of True and Fair View and compliance with Ind ASs : (PARA- 15 to 24)

- Shall present a true and fair view of the financial position, financial performance and cash flows of an entity.

- The application of Ind ASs, with additional disclosure when necessary, is presumed to result in financial statements that present a true and fair view. (Additional disclosure where compliance with Ind AS is insufficient for Users’ understanding of the impact of particular transactions, other events and conditions on the entity’s financial position and financial performance.)

- Explicit and unreserved “statement of compliance”* with Ind ASs in the notes.

- An entity shall not describe financial statements as complying with Ind ASs unless they comply with all the requirements of Ind ASs.

- Presentation of a true and fair view also requires an entity to select and apply accounting policies in accordance with Ind AS 8.

- Present Information including accounting policies in such a manner which provides relevant, reliable, comparable and understandable information to the users.

- Entity cannot rectify the an inappropriate accounting policy by giving a disclosure of the accounting policy used or by notes or explanatory material.

- Departure From compliance with Ind AS (discussed separately in next slide…)

- When an entity has departed from a requirement of an Ind AS in a prior period, and that departure affects the amounts recognized in the financial statements for the current period, it shall make the disclosures as discussed in the next slide (paragraph 20(c) and (d))

- Example: when an entity departed in a prior period from a requirement in an Ind AS for the measurement of assets or liabilities and that departure affects the measurement of changes in assets and liabilities recognized in the current period’s financial statements.

5B Going Concern : (PARA- 25 to 25)

- Management shall make an assessment of an entity’s ability to continue as a going concern.

- An entity shall prepare financial statements on a going concern basis unless management either intends to liquidate the entity or to cease trading, or has no realistic alternative but to do so.

- In assessing whether the going concern assumption is appropriate, management takes into account all available information about the future, which is at least, but is not limited to, twelve months from the end of the reporting period.

- When management is aware, in making its assessment, of material uncertainties related to events or conditions that may cast significant doubt upon the entity’s ability to continue as a going concern, the entity shall disclose those uncertainties.

- When an entity does not prepare financial statements on a going concern basis, it shall disclose that fact, together with the basis on which it prepared the financial statements and the reason why the entity is not regarded as a going concern.

- When an entity has a history of profitable operations and ready access to financial resources, the entity may reach a conclusion that the going concern basis of accounting is appropriate without detailed analysis.

- In other cases, management may need to consider a wide range of factors relating to current and expected profitability, debt repayment schedules and potential sources of replacement financing before it can satisfy itself that the going concern basis is appropriate.

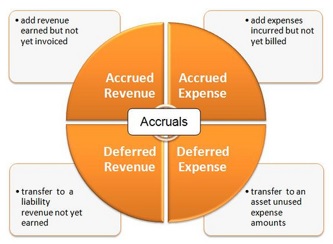

5C Accrual Basis of Accounting : (PARA- 27 to 28)

- An entity shall prepare its financial statements, except for cash flow information, using the accrual basis of accounting.

- When the accrual basis of accounting is used, an entity recognizes items as assets, liabilities, equity, income and expenses (the elements of financial statements) when they satisfy the definitions and recognition criteria for those elements in the Framework.

5D Materialiry and Agregation : (PARA- 29 to 31)

- An entity shall present separately each material class of similar items.

- An entity shall present separately items of a dissimilar nature or function unless they are immaterial except when required by law. (See foot Note*)

- An entity need not provide a specific disclosure required by an Ind AS if the information is not material except when required by law.

*Financial statements result from processing large numbers of transactions or other events that are aggregated into classes according to their nature or function. The final stage in the process of aggregation and classification is the presentation of condensed and classified data, which form line items in the financial statements. If a line item is not individually material, it is aggregated with other items either in those statements or in the notes. An item that is not sufficiently material to warrant separate presentation in those statements may warrant separate presentation in the notes.

5E Offsetting: (PARA- 32 to 35)

- Assets, Liabilities, income and expenditure sell not be offset unless required or permitted by an Ind AS.

- For example. Revenue recognised is after offsetting trade discounts and volume rebates. Same is allowed by India.

- Measuring assets net of valuation announces, for example, Obsolescence Allowances on inventories and doubtful debts. Allowances on receivables is not offsetting.

- an entity presents on a net basis gains and losses arising from a group of similar transactions, for example, foreign exchange gains and losses or gains and losses arising on financial instruments held for trading. However, an entity presents such gains and losses separately if they are material.

- An entity presents the results of the transactions, when this presentation reflects the substance of the transaction or other event, by netting any income with related expenses arising on the same transaction. For example:

- an entity presents gains and losses on the disposal of non-current assets, including investments and operating assets, by deducting from the amount of consideration on disposal the carrying amount of the asset and related selling expenses; and

- an entity may net expenditure related to a provision that is recognized in accordance with Ind AS 37, Provisions, Contingent Liabilities and Contingent Assets, and reimbursed under a contractual arrangement with a third party (for example, a supplier’s warranty agreement) against the related reimbursement.

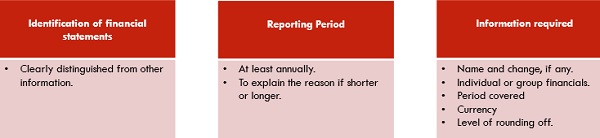

5F Frequency of Reporting: (PARA- 36 to 37)

- An entity shall present a complete set of financial statements (including comparative information) at least annually.

- When an entity changes the end of its reporting period and presents financial statements for a period longer or shorter than one year, an entity shall disclose, in addition to the period covered by the financial statements:

- The reason for using a longer or shorter period, and

- The fact that amounts presented in the financial statements are not entirely comparable.

5G Comparative Information: (PARA- 38 to 44)

- Comparative information includes narrative and descriptive information.

- If an entity changes the presentation or classification of items in its financial statement, it shall reclassify comparative amounts unless reclassification is impracticable.

When an entity reclassified comparative amounts, it shall disclose:

- The nature of the reclassification;

- The amount of each item or class of items that is reclassified; and

- The reason for reclassification.

When it is impracticable to reclassify comparative amounts, entity shall disclose:

- The reason for not classifying the amount; and

- The nature of the adjustments that would have been made if the amounts had been reclassified.

5H Consistency of Presentation : (PARA- 45 to 46)

An entity shall retain the presentation and classification of items in the financial statements from one period to the next unless:

- It is apparent, following a significant change in the nature of the entity’s operations or a review of its financial statements, that another presentation or classification would be more appropriate having regard to the criteria for the selection and application of accounting policies in Ind AS 8; or

- An Ind AS requires a change in presentation.

For example, a significant acquisition or disposal, or a review of the presentation of the financial statements, might suggest that the financial statements need to be presented differently. An entity changes the presentation of its financial statements only if the changed presentation provides information that is reliable and more relevant to users of the financial statements and the revised structure is likely to continue, so that comparability is not impaired. When making such changes in presentation, an entity reclassifies its comparative information in accordance with paragraphs 41 and 42.

6 Structure and Content : (PARA- 47 to 138)

General features

- Identification of financial statements, Reporting period and Information required

- Balance Sheet

- Current and Non Current Distinction/classification

- Long Term Loans Classification (Carve Out)

- Statement of Profit and Loss

- Other Comprehensive Income

- SOCIE

- Statement of Cashflows

- Notes and Other Disclosures

Balance Sheet

Minimum Line items on face of balance sheet:

- Property, plant and equipment

- Investment property

- Intangible assets

- Financial assets

- Trade, and other receivables

- Cash and cash equivalents

- Biological assets

- inventories

- Investments accounted for using the equity method.

- Non current assets and liabilities classified as HFS

- Trade and other payables

- Provisions

- Financial liabilities

- Liabilities and assets for current tax

- Deferred tax asset and Liabilities

- Non controlling interest within equity

- Issued capital and reserves attributable to equity holders of the parent

- Additional Line item, headings and subtotals in the BS shall be presented If required for better understanding of the entity’s position.

Current and Non Current Distinction/classification

Current Assets:

- Expects to release the asset or intense to sale or consume it in its normal operating cycle, or,

- Holds the asset primarily for t trading purpose, or,

- Expects to realise the asset within 12 months after the reporting.

- The asset is cash or cash equivalent as defined in Ind AS 7 unless the asset is restricted from being exchanged or used to settle a liability for at least 12 months after reporting

Asset which is not current, is non current asset.

Current Liability:

- Settled in normal course of operating cycle, or,

- Due to be settled within 12 months of the balance sheet date, or,

- Held primarily for trading purpose, or,

- No unconditional right to defer settlement for at least 12 months.

Liability which is not current, is non current Liability.

- Deferred Tax Assets (Liability) shall always be Long Term.

Long Term Loans Classification (Carve Out)

Long term loan is classified as current where there is a breach of a material provision of a long term arrangement on or before the end of the reporting period resulting in to loan becoming payable.

However, If the lender agreed after the reporting period and before the approval of the financial statements for issue, not to demand payment as a consequence of the breach or provided a grace period of more than 12 months to rectify the beach, Loan shall continue to be classified as Long Term.

Case Study:

Relays Roosters, Inc. (RRI) Has a December 31st year end. As of June. 30th, 2019. RRI obtains a $1,00,000 loan from a bank for a new chicken coop facility. The lawn is due in 12 months. In December 2019, RRI spends too much of its cash on its holiday party and incurs debt covenant violation as of December 31st, 2019. Azure result of the violation, the loan becomes due within 30 days. At this time RRI ask the bank to waive the violation. RRI tells the bank it will recoup some of its cash by selling its party residuals. On 5th January 2020 the bank agrees to waive the violation. RRI issues its financial on 25th January 2020.

Statement of Profit & Loss

- Comprises of Profit and Loss, and comprehensive income for the Period being the total of profit or loss and OCI (As discussed earlier)

- Classification of Expenses shall be based on the Nature Only. (IFRS also allowed function based classification)

Minimum Line Items on the face of P & L :

- Revenue

- Finance Cost

- Impairment Losses

- Share of Profit or Loss of Associate and JV accounted for by Equity Method

- Tax Expenses

- Sum of profit or loss from discontinued operations and gain or loss on disposal of discontinued operations assets

- Gain or Loss arising on from derecognition of financial assets measured at amortised cost.

- No Extraordinary Items on the face of P & L.

Statement of Profit & Loss

- Comprises of Profit and Loss, and comprehensive income for the Period being the total of profit or loss and OCI (As discussed earlier)

- Classification of Expenses shall be based on the Nature Only. (IFRS also allowed function based classification)

Minimum Line Items on the face of P & L :

- Revenue

- Finance Cost

- Impairment Losses

- Share of Profit or Loss of Associate and JV accounted for by Equity Method

- Tax Expenses

- Sum of profit or loss from discontinued operations and gain or loss on disposal of discontinued operations assets

- Gain or Loss arising on from derecognition of financial assets measured at amortised cost.

- No Extraordinary Items on the face of P & L.

Other Comprehensive Income (OCI)

Items that will not be re-classified to P & L:

- Changes in Revaluation Surplus (Ind AS 16 and Ind AS 38)

- Actuarial Gain or Loss on Remeasurements on defined benefit plans (Ind AS 19)

- Gain or Loss on Investment in Equity Instruments accounted at FVTOCI (Ind AS 109)

- Fair Value changes for own credit risk of financial liabilities accounted at FVTOCI (Ind AS 109)

- Share of OCI in Associates and Joint Ventures to the extent not to be classified into P & L (Ind AS 28)

Items that will be re-classified to P & L:

- Exchange difference in translating the financial statements of foreign operation (Ind AS 21)

- Gain or losses on Financial Assets measured at FVTOCI (Ind AS 109)

- Effective portion of gain or loss on hedging instruments in cash flow hadge and the gains and losses on hedging instruments that has investments in equity instrument measured at FVTOCI (Ind AS 109)

- Changes in the Value of forward elements of the forward contacts when separating the forward element and spot element of a forward contract and designating as the hedging instrument only the changes in the spot element, and changes in value of foreign currency basis spread of a financial instrument when excluding it from the designation of that financial instrument as the hedging instrument (Ind AS 109)

Structure and Content- SOCIE

- SOCIE is the separate component of Financial Statements.

- On the face, for each component of Equity a reconciliation b/w carrying amount at beginning and at the period end shall be given as under:

> Profit or Loss for the period

> Other Comprehensive Income

> Effect of retrospective application or restatement

- Also In Statement or in Notes the following shall be given:

> Capital transections with owners

> Movements in accumulated profit

> Movements in capital and reserves

Cash and Cash Equivalent shall be presented in accordance with Ind AS 7.

Structure and Content- Notes

- To present information about the basis of preparation of the financial statements and the specific accounting policies.

- To disclose the information required by Ind ASs that is not presented else where in the financial statements.

- To provide the information that is not presented else where in the financial statements but is relevant to the understanding of any of them.

- To give a statement of compliance with Ind ASs.

- To give summery of significant accounting policies.

- Supporting information for items presented in FS, in the order in which each statement and each line item is presented

- Other disclosures including contingent liabilities and unrecognised contractual commitments, and other non financial disclosures.