ICSI FAQS ON UNIQUE DOCUMENT IDENTIFICATION NUMBER (UDIN)

(Guidelines are approved by the Council in its 261st (Special) Meeting held on 27th June, 2019 and amended by the Council in its 263rd Meeting held on 23rd September, 2019, 269th (Adjourned) Meeting held on 13th July, 2020, 278th Meeting held on 26th July, 2021 and further amended by the Council in its 279th (Special) Meeting held on 31st August, 2021)

Q.1 What is Unique Document Identification Number (UDIN)?

Ans. UDIN is a 17 digit system generated number which is used to verify the authenticity of documents attested / certified by a Company Secretary in Practice.

Q.2 What is the purpose of UDIN?

Ans. The UDIN Guidelines have been issued by the Institute of Company Secretaries of India (“ICSI”) in order to-

- Enable the stakeholders to verify the authenticity of various documents certified by Company Secretaries in Practice;

- Prevent counterfeiting of various attestations / certifications;

- Provide ease of maintaining the Register of Attestation /Certification services rendered by practicing members;

- Ensure compliance of the Guidelines issued by the Institute r.t ceilings on the number of the various certification / attestation services that may be rendered by the practitioners;

- Auto-prefill details of Certification / Attestation services rendered by practicing members in of the form for renewal of Certificate of

Q.3 What is the significance of 17 digits in UDIN?

Ans. The structure of the UDIN Number is like AXXXXXXAYYYYYYYYY

|

A |

XXXXXX | A | YYYYYYYYY |

| Running series of UDINs generated | |||

| ACS/FCS | Financial Year Equivalent | ||

Wherein:-

A/F refers to ACS of FCS status of Member

XXXXXX is the Membership Number of the professional

A is the Financial Year (A equivalent to 2019-20, B equivalent to2020-21, C equivalent to 2021-22 and so on)

YYYYYYYYY is the system generated unique number

Hence, 1+6+1+9=17 digits

Q.4 Is there any fee for generation of UDIN?

Ans. No. There is no fee for generation of UDIN. Any member of ICSI holding a valid CoP may generate any number of UDINs by logging into the system.

Q.5 How is UDIN Secure?

Ans. The UDIN can be generated only at the UDIN Portal maintained by ICSI by a member holding a valid CoP after logging in using his credentials. The UDIN is shared only through electronic means on the email id registered with the Institute.

Q.6 When to generate UDIN?

Ans. UDIN shall be generated at the time of signing of Reports, Returns, Certificates and Other Documents or can be generated seven days in advance of the date of such signing as above.

Illustration: A Certificate is signed on September 25, 2019. In such case, ideally the UDIN should be generated on September 25, 2019 but in exceptional cases, the UDIN may be generated 7 days in advance, i.e., any time during September 18, 2019 to September 25, 2019. Thereby, providing a window of advance seven days for UDIN generation.

Q.7 What are the requirements to generate UDIN?

Ans. The Practicing Company Secretary shall go to the designated website (https://stimulate.icsi.edu/udin), and create a login id and password by entering the Membership Number, CoP No., Phone No., Email Id and PAN.

- The login id would be verified through a computer

- The UDIN shall be a system generated random alphanumeric

- No document is required to be uploaded for generating the

8. When UDIN has been made mandatory?

Ans. Quoting UDIN on certifications, w.r.t the professional services has been made mandatory w.e.f 1st October, 2019

Further, the Council of the Institute in its 279th (special) meeting held on August 31, 2021 amended the UDIN Guidelines and provided that quoting of UDIN on the Reports, Returns, Certificates & Other documents, w.r.t the professional services as prescribed under Para 3(b) has been made mandatory w.e.f 1st October, 2021.

Q.9 Is it mandatory to mention UDIN?

Ans. Yes, it is mandatory to mention UDIN in the Reports, Returns, Certificates and Other documents along with the Certificate of Practice number.

In case of e Form-MGT 7 as mentioned in paragraph 3 (b) (xiv) of the ICSI UDIN Guidelines, 2019 or in case of any other e-Form(s), the UDIN shall be mentioned by way of attachment in the optional attachment, unless any specific field for the same is provided by the law.

Q.10 What all services are covered for mandatory generation of UDIN?

Ans. Presently UDIN shall be generated for the following services rendered by PCS:

i. Certification of Annual Return in Form MGT-8 under Section 92(2) of the Companies Act, 2013 and Rule 11(2) of the Companies (Management and Administration) Rules, 2014.

ii. Issuance of Secretarial Audit Report in terms of Section 204 of the Companies Act, 2013 read with Rule 9 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014.

iii. Issuance of Secretarial Audit Report to material unlisted subsidiaries of listed entities (whose equity shares are listed) Regulation 24A of SEBI (LODR) Regulations, 2015.

iv. Issuance of Annual Secretarial Compliance Report to Listed entities (whose equity shares are listed) under SEBI Circular No. CIR/CFD/ CMD1/27/2019 dated 8th February, 2019.

v. Certification under Regulation 34(3) read with Clause 10(i) of Part C of Schedule V of the SEBI (Listing Obligations & Disclosure Requirements) Regulations, 2015 that none of the directors on the board of the company have been debarred or disqualified from being appointed or continuing as directors of companies by the Board/ Ministry of Corporate Affairs or any such statutory authority.

vi. Certification under Regulation 40(9) of SEBI (Listing Obligations & Disclosure Requirements) Regulations, 2015 certifying that all certificates have been issued within thirty days of the date of lodgement for transfer, sub- division, consolidation, renewal, exchange or endorsement of calls/allotment monies.

vii. Conduct of Internal Audit of Operations of the Depository Participants registered with National Securities Depository Limited (NSDL) and Central Depository Services Limited (CDSL) under the Bye Laws issued by NSDL and CDSL.

vii. Conduct of Internal Audit of Operations of the Depository Participants registered with National Securities Depository Limited (NSDL) and Central Depository Services Limited (CDSL) under the Bye Laws issued by NSDL and CDSL.

viii. Certification under Regulation 76 of SEBI (Depositories and Participants) Regulations, 2018 for Reconciliation of Share Capital Audit.

ix. Acting as Compliance Auditor under third party certification/ Audit Scheme (Amendment), 2016 in the State of Haryana.

x. Diligence reporting for Banks in case of multiple banking/consortium lending arrangements in terms of the circular issued by RBI.

xi. Conduct of Internal Audit of the stock brokers/ sub brokers under SEBI Circular no. MIRSD/ DPSIII/ Cir-26/ 08 dated 22nd August 2008 and MRD/ DMS/Cir-29/2008 dated, 21st October 2008.

xii. Issuance of Certificate in case of the Indian company accepting the investment from a foreign investor, thereby confirming compliance of Companies Act, 2013 and other matters (As per Para 9 (1) (B) (i) of Schedule 1 to Notification No. FEMA 20/2000-RB dated 3rd May, 2000).

xiii. Compliance Certificate regarding compliance of conditions of Corporate Governance as prescribed under Regulation 34(3), Schedule V, Part E of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015.

xiv. Signing of Annual Return in Form MGT-7 through digital signature certificates (DSC) under Section 92(1) of the Companies Act, 2013 and Rule 11(1) of the Companies (Management and Administration) Rules, 2014.

xv. Due Diligence Report under Regulation 10 (3) of the SEBI (Delisting of Equity Shares) Regulations, 2021.

xvi. Certificate relating to shares held by inactive shareholders under Regulation 21(a) (iii) of the SEBI (Delisting of Equity Shares) Regulations, 2021

xvii. Compliance Certificate under Regulation 10(b), 13, 26, 27, 36 of SEBI (Share Based Employee Benefits and Sweat Equity) Regulations, 2021

xviii. Scrutiniser’s report pursuant to Section 108 of the Companies Act, 2013 read with Rule 20(4)(ix) and Rule 20(4)(xii) of Companies (Management and Administration) Rules, 2014

xix. All other Reports, Returns and Certificates which are prescribed to be certified or issued under any applicable law or rules or regulations made thereunder.

Provided further that the PCS may generate the UDIN for any other document which are not listed above and not mandatory as per these guidelines.

Q.11 Whether it is mandatory to generate UDIN for all e-forms?

Ans. No, it is not mandatory to generate UDIN for all e-forms. However, the generation of UDIN under the guidelines is mandatory for e- form MGT-7 only and for other e-forms, it remains optional.

Q.12 When are the amendments made by the Council in its 279th (Special) meeting held on 31st August, 2021 become effective?

Ans. The amendments made by the Council in its 279th (Special) meeting held on 31st August, 2021 are effective w.e.f. October 1, 2021.

However, on the basis of clarification issued by the Institute on October 6, 2021 UDIN can be generated under amended Guidelines w.e.f. October 7, 2021.

Q.13 Para 3(b)(xix) of the UDIN Guidelines provides generation of UDIN for “All other Reports, Returns and Certificates which are prescribed to be certified or issued under any applicable law or rules or regulations made thereunder”, What all are the services where mandatory generation of UDIN is not required?

Ans. Given below is the indicative list of services for which it is not mandatory to generate the UDIN:

> Search Report issued for the internal use of the client.

> Valuation Report issued in the capacity of Registered Valuer

> Documents/Report issued in the capacity of Insolvency Professional

> Legal Opinion/ Fairness Opinion

> Diligence Report issued to the Company during the restructuring process

> Peer Review Report & Quality Review Report signed by the PCS

> Certificate of completion of apprenticeship training/Quarterly reports of the trainees

> Any Salary Certificate, good standing certificate, experience certificate issued to the employees by the PCS in the capacity as employer.

> Any Certification/ Report/ Return, submitted to any authority or regulators in the capacity as employer, promoter, director, designated partner, partner or proprietor of the firm which are not prescribed to be certified or issued as Practicing Company Secretary under any applicable law or rules or regulations made thereunder.

Q.14 Who can verify UDIN and how?

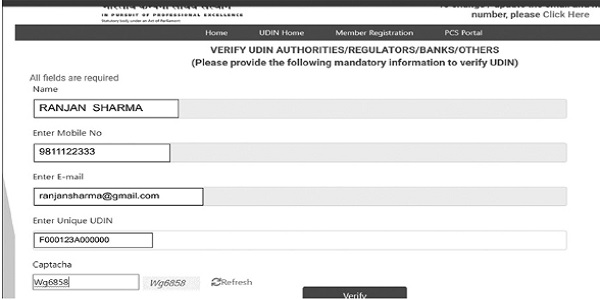

Ans. The Authorities / Regulators / Banks / Others can verify the UDIN indicated on certificate through the UDIN Web Portal https://stimulate.icsi.edu/udin/Home/UDINVerification by providing few details like Verifier Name, Verifier Mobile No, Verifier Email and UDIN Number to be generated. However they are not required to register themselves on the UDIN Portal.

After selecting verify button, following screen will be displayed.

Q.15 In case of FIRM, LLP etc. can a partner generate UDIN for another partner.

Ans. No, UDIN is required to be generated by the partner who is certifying the document.

Q.16 Whether UDIN will be generated for online documents or offline documents only?

Ans. UDIN will be generated for all the professional services referred to in Clause 3 of the ICSI Unique Document Identification Number (UDIN) Guidelines, 2019 and as mentioned in answer to Q. No. 10.

Q.17 What is the registration process in UDIN Portal?

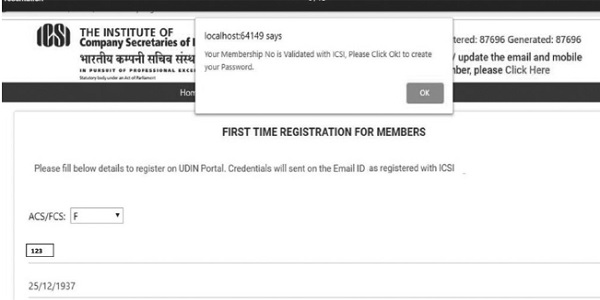

Ans. The practicing company secretary shall go to the designated website https://stimulate.icsi.edu/udin/ Home/MembershipRegistation and create a login id and password by entering the Membership Number, COP No., Phone No, Email Id and PAN.

Please provide details such as Membership Type, Membership Number and Date of Birth

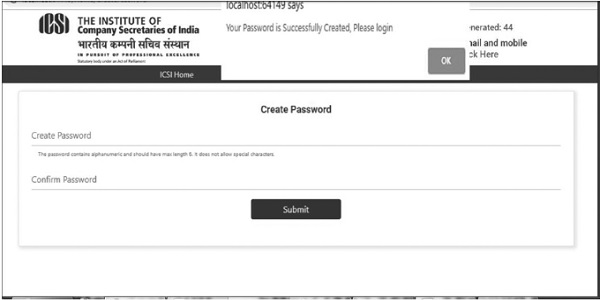

The registration details will be verified through ICSI server and system will request to create password.

Then system will ask member to create password which should be alphanumeric and should have minimum length of 6 Characters and should not create special characters. (e.g. abc1234)

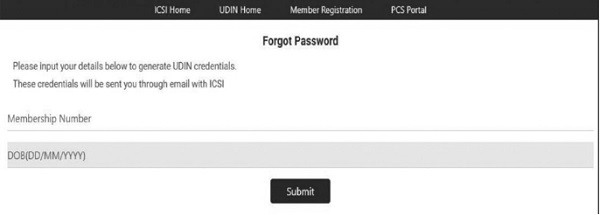

Q.18 How to generate new password if member forgets the Password?

Ans. Member needs to click the Forgot Password link and put his membership number and date of birth, new password will be sent to his / her e-mail id registered with ICSI.

Q.19 How to generate UDIN Number?

Ans. Member should login into the system using UDIN credentials.

- Click on the “Generate UDIN” tab.

- Mention the Company/Firm/Individual details.

- Select the Document Type.

- Mention the FY in “Financial year to which the Report/Certificate pertains” tab.

- Select the document type for which UDIN has to be created.

UDIN will be generated and ready for use.

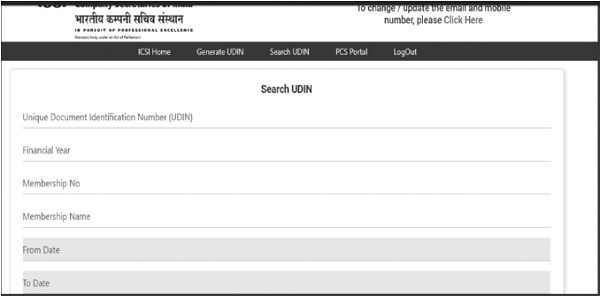

Q.20 How to know the details of all UDINs generated by PCS for a particular Financial Year?

Ans. Only the PCS can view the list of UDIN generated by him through the ‘Search UDIN’ & ‘Download List” option.

List of UDIN generated by the member will be displayed on the screen.

Q.21 How to revoke UDIN?

Ans. Login in to system using your UDIN credentials. Search the particular UDIN using search facility and then click on the ‘Revoke UDIN’ button to revoke.

Q.22 I’m unable to login using the password I use for the ICSI website. What should I do?

Ans. The password for the ICSI login and UDIN login are different as both are independent to each other. Same password would not work and Practicing Company Secretary is required to create a new password for UDIN portal. Create a new user name & password for the UDIN portal at the web link:- https://stimulate.icsi.edu/udin/Home/Membership Registation

Q.23 While registering in UDIN, system is showing an error i.e. “Invalid Membership Number / DOB”. What should I do?

Ans. Please make sure that you have prefixed A/F before the Membership number and you have mentioned the date of birth as mentioned in the records of the ICSI. Member needs to update all the details in the membership portal in order to reflect the same in UDIN Portal also. However, in case, the problem persists, one can write an email mentioning the correct details to udin@icsi.edu and request for creation of new login and password.

Q.24 I am in process of issuing certificate which is part of monthly ECB2 return (External Commercial Borrowing) under FEMA. As per list given vide para 3 of the ICSI (UDIN) Guidelines 2019, the above certificate is not appearing in the list. What should I do?

Ans. It is now mandatory under Para 3 of the Guidelines to generate UDIN for ECB2 return (External Commercial Borrowing) under FEMA. As per the Proviso to Para 3 of the Guidelines a PCS may generate the UDIN for any document which are not provided in drop down facility by putting the nature of the certificate by selecting the Other option.

Q.25 I’ve registered on the UDIN portal but didn’t receive the login id and password. Whom do I approach?

Ans. Write an email mentioning the correct details to udin@icsi.edu

Q.26 Whether UDIN is required for Apprenticeship completion certificate as provided by practicing company secretary/ trainer after completing training?

Ans. No, it is not mandatory to generate UDIN under Para 3 of the UDIN Guidelines, 2019.

Q.27 I am a Practising Company Secretary and also Registered Valuer under category Securities or Financial Assets. I have registered as a Valuer with Indian Institute of Valuers (IIV – RVO). If I am issuing valuation report under capacity as a Registered Valuer, do I need to generate UDIN under ICSI?

Ans. The UDIN is not required to be generated in this case. However, as per the first Proviso to Para 3 of the Guidelines a PCS may generate the UDIN for any other document which are not listed and are not mandatory as per these guidelines.

Q.28 I’ve generated an UDIN but did not receive the same through email. What do I do?

Ans. The details of UDIN are shared on the email id registered with the Institute in the Member’s Directory. In case the same is not received on email due to any technical issues, the same can also be tracked from the Register of ‘UDIN generated’ or ‘Download List’, which is available after login.

Q.29 Whom do I approach for generation of UDINs for the certificates to be issued by me?

Ans. The UDIN is to be generated by the members themselves by logging in to the UDIN portal.

Q.30 Do members in employment as Company Secretary also need to generate UDIN for the documents certified by them?

Ans. No, only members holding a valid CoP need to generate UDIN in respect of the documents attested/ certified by them.

Q.31 Can trainees of a firm of PCS generate UDIN?

Ans. No, only members holding a valid CoP need to generate UDIN in respect of the documents attested/ certified by them.

Q.32 How to change the Password?

Ans. Click on the Forgot Password tab and regenerate the new password.

Q.33 What documents are to be uploaded while generating UDIN?

Ans. No documents are to be uploaded while generating UDIN.

Q.34 How can I update my mobile number/email Id in UDIN?

Ans. Member can update his / her mobile number / email Id in the membership portal / membership directory, the same will be automatically updated in the UDIN Portal also.

Q.35 How will the member get notified about verification of UDIN by a third party?

Ans. There is no such provision in the portal as of now.

Q.36 Is UDIN required to be generated for certified true copies of the certificates issued earlier also?

Ans. No, It is not required.

Q.37 Whether UDIN is applicable for manually signed documents only or for digitally signed certificates as well?

Ans. UDIN is mandatory on all documents as mentioned in para 3 of the Guidelines and as mentioned in answer to Q. no. 10.

Q.38 Is UDIN to be generated for original certificates only or for duplicate certificates as well?

Ans. Essentially the certificate remains the same, so the same UDIN would be applicable in case of duplicate copy of the certificate as well.

Q.39 Whether one UDIN can be used for multiple certificates issued to a client in a particular day?

Ans. No, Separate UDIN is to be generated for each certificate.

Q.40 Whether UDIN can be edited? If yes, how?

Ans. No. UDIN cannot be edited. UDIN once generated but not utilized may be surrendered/ cancelled by the PCS within 7 days of such generation or the effective date of UDIN, whichever is later.

However, the Institute to facilitate members time and again launches UDIN Amnesty Scheme, which serves as a onetime opportunity to the members to revoke, modify and generate (if missed earlier) the UDINs.

Q.41 I was unable to cancel/surrender the unutilized UDIN within seven days of generating the same due to technical issues with the UDIN portal / intermittent internet connectivity. What do I do?

Ans. In accordance with Para 5(ix) of the Guidelines, UDIN once generated but not utilized may be surrendered/ cancelled by the PCS within 7 days of such generation or the effective date of UDIN, whichever is later.

However, the Institute to facilitate members time and again launches UDIN Amnesty Scheme, which serves as a onetime opportunity to the members to revoke, modify and generate (if missed earlier) the UDINs.

Q.42 Whether UDIN once surrendered / cancelled be generated again in old signature date?

Ans. No, UDIN once surrendered / cancelled can’t be generated again.

Q.43 Is there any limit on the maximum number of UDINs that may be generated by a PCS?

Ans. There is no restriction on the number of UDINs to be generated. However, the Council of the Institute has prescribed ceiling for certain Reports and Returns that are available at the link

https://www.icsi.edu/media/webmodules/

GuidelinesforIssuingComplianceCertificate.pdf

The PCS should ensure the compliance of the same.

Q.44 If I have surrendered CoP for some time and reentered into practice, do I need to re-register on the UDIN portal?

Ans. Registration on UDIN Portal is basically connected to ACS / FCS number. Accordingly, no registration is required if any member re-entered into practice with the new COP number, after the applicability of UDIN Guidelines, 2019. (i.e. effective date- 1st October, 2019)

Q.45 I registered on the UDIN portal with my ACS number, do I need to register again after becoming FCS?

Ans. No, there’s no need to register with the FCS number is he / she already registered with the ACS number.

Q.46 Whether UDIN is to be generated in case of intimation to previous incumbent before accepting any professional assignment?

Ans. No, it is not required to be generated in case of intimation to previous incumbent before accepting any professional assignment.

Q.47 Is UDIN required to be generated in case of a Peer Review Report issued by a Practicing Company Secretary (PCS)?

Ans. No, the same is not mandatorily required to be generated, however, PCS may generate the UDIN for any other document which are not mandatory as per the ICSI (UDIN) Guidelines, 2019.

Q.48 Is UDIN required to be generated in case of a Quality Review Report issued by a Practicing Company Secretary (PCS)?

Ans. No, the same is not mandatorily required to be generated, however, PCS may generate the UDIN for any other document which are not mandatory as per the ICSI (UDIN) Guidelines, 2019.

Q.49 What are the consequences of not generating UDIN for the documents mentioned in Clause 3 of the UDIN Guidelines?

Ans. Any non-compliance with these Guidelines shall render the PCS liable for action under the Company Secretaries Act, 1980 read with First Schedule and Second Schedule to the Company Secretaries Act, 1980.

Q.50 Where can I find a copy of the latest amended UDIN Guidelines?

Ans. Visit the web link: https://stimulate.icsi.edu/udin/PDF/ UdinGuidelines.pdf

Q.51 What is the meaning of “effective date” as given in the Guidelines?

Ans. Effective date is the date as mentioned by the user in the column “Date of signing’, at the time of generation of UDIN.

Q.52 Until when the UDIN generated for e-form MGT-7 be cancelled /surrendered by PCS?

Ans. According to second proviso to Para 3 of the Guidelines, UDIN generated for e-Form MGT-7 shall remain valid for further period of seven days from the effective date of UDIN and the same can be digitally signed by the PCS during those seven days.

In accordance with Para 5(ix) of the Guidelines UDIN once generated but not utilized may be surrendered/ cancelled by the PCS within 7 days of such generation or the effective date of UDIN, whichever is later.

Illustration 1- UDIN is generated on 1st March, 2021 for MGT-7, effective date of this UDIN is 1st March 2021. This MGT-7 can be signed on any day upto 7th March, 2021 (both days inclusive).

Illustration 2- UDIN generated on 1st Aug, 2021 for MGT-7, let’s say to be signed on 1st Aug, 2021. In case of un-utilized UDIN, the same may be surrendered/ cancelled by the PCS till 7th August, 2021.

Illustration 3- UDIN generated on 1st Aug, 2021 for MGT-7, let’s say to be signed on 7th Aug, 2021. In case of un-utilized UDIN, the same may be surrendered/ cancelled by the PCS till 13th August, 2021.

Illustration 4- UDIN generated on 1st Aug, 2021 for MGT-7, with an intention to sign on 6th August, 2021. UDIN so generated was placed on the form and sent to the Company for signatures of the Directors, but due to variable reasons the signed form is reverted, say on 8th Aug, 2021. In such a case, further period of seven (7) days from effective date is allowed, hence, the UDIN so generated shall be valid for additional seven days i.e. till 13th Aug, 2021. In case of un-utilized UDIN, the same may be surrendered/ cancelled by the PCS till 12th August, 2021.

Q.53 How the UDIN will be generated for e-Form MGT-7 in case of One Person Company/ Small Company?

Ans. In case of One Person Company / Small Company, Form MGT-7A needs to be file instead of e-Form MGT-7 and it’s not mandatory to generate the UDIN for MGT-7A, as no certification from PCS is required on Form 7A.

Q.54 Is any person other than Company Secretary in Practice allowed to register at UDIN portal?

Ans. No, only Company Secretaries who are in full-time Practice and hold Certificate of Practice (CoP) can register on UDIN portal to generate UDIN.

Q.55 Is it advisable to change the password after first login?

Ans. The password generated by the system is encrypted to ensure the appropriate safety. However, interested members may change the password at any time through “Change Password” button.

Q.56 Whether fresh registration is required for every financial year?

Ans. There is no need for fresh registration under UDIN Portal for every financial year.

Q.57 A member has signed 24 e-form MGT-7s during the FY 2020-21 for which he hasn’t generated any UDIN, what is the procedure to generate at a later date?

Ans. There is no procedure to generate UDIN for back date.

UDIN shall be generated at the time of signing of Certificate/Report/Form/Other documents or seven days in advance to the date of such signing as above.

There is no possibility to generate the back dated certificate as system will only allow you to select the current date or any prospective date within next 7 days.

However, the Institute to facilitate members time and again launches UDIN Amnesty Scheme, which serves as a onetime opportunity to the members to revoke, modify and generate (if missed earlier) the UDINs.

Q.58 UDIN generated on 1st Aug, 2021 for Secretarial Audit Report (Report), let’s say date of signing is 7th Aug, 2021. Within how much time can the UDIN so generated be cancelled/ surrendered?

Ans. In accordance with Para 5(ix) of the Guidelines, the UDIN once generated but not utilized may be surrendered/ cancelled by the PCS within 7 days of such generation or the effective date of UDIN, whichever is later.

Hence the UDIN in present case can be surrendered/ cancelled by the PCS till 13th August, 2021.

Q.59 Is UDIN required to be mentioned on every page of the Document or it can be mentioned at the last?

Ans. UDIN is to be mentioned after every signature and COP number of the Member.

Q.60 What are the services for which Peer Reviewed Firms/PCS can generate the UDINs?

Ans. The following are the services for which Peer Reviewed Firms/PCS can generate UDINs:

> Due Diligence Report under Regulation 10 (3) of the SEBI (Delisting of Equity Shares) Regulations, 2021.

> Certificate relating to shares held by inactive shareholders under Regulation 21(a) (iii) of the SEBI (Delisting of Equity Shares) Regulations, 2021.

Conduct of Internal Audit of Operations of the Depository Participants registered with National Securities Depository Limited (NSDL) and Central Depository Services Limited (CDSL) under the Bye Laws issued by NSDL and CDSL.

> Diligence reporting for Banks in case of multiple banking/consortium lending arrangements in terms of the circular issued by RBI

However, the Council of the Institute has prescribed the following services where Peer Reviewed Firm/ PCS can provide these services subject to ceiling and market capitalization as per details given as under:

|

Services |

Ceiling specifically for Peer Reviewed Units |

Applicability | Effective Date (w.e.f) |

| Secretarial Audit Report / Annual Secretarial Compliance Report (ASCR) under SEBI (LODR) Regulations, 2015 |

10 + 5 (additional) Secretarial Audits per partner/ PCS in each financial year5 + 5 (additional) ASCR per partner/ PCS in each financial year |

Top 100 companies as per market capitalization as on 31st March, 2020Top 500 companies as per market capitalization as on 31st March, 2021All Listed CompaniesAll Companies |

April 1, 2020

April 1, 2021 April 1, 2022 April 1, 2023 |

| Certification of Annual Return in terms of Section 92 (2) of the Companies Act, 2013 | For not more than 80 companies for each of the financial year |

||

| Compliance Certificate under Schedule V, Clause E of SEBI (LODR) Regulations, 2015 | – | ||

| Half yearly Share Capital Reconciliation Certificate under Regulation 40 (9) of SEBI (LODR) Regulation, 2015 | – | ||

| Quarterly Share Capital Reconciliation Certificate under Regulation 76 of SEBI (Depository Participants) Regulation, 2018 |

– |

> For further details w.r.t the ceiling for certain Reports and Returns, click on the link given below:

https://www.icsi.edu/media/webmodules/ GuidelinesforIssuingComplianceCertificate.pdf

> For further details w.r.t. the Peer Review Services, click on the link given below:

https://www.icsi.edu/media/webmodules/ PRB/Mandatory_Peer_Review.jpg

Q.61 Should existing digital signature be revised or changed due to registration on the UDIN Portal?

Ans. UDIN has no connection with the digital signature. Hence, no changes will be required in digital signature.

Q.62 Specify the validity of UDIN generated?

Ans. UDIN has no expiry unless it is revoked.