Introduction

I’m sure most of you are only concerned about the conclusion of this topic. So, let me start with the conclusion (ironic) and then deep dive into the research portion. I will garnish this article with a little guidance on filling the ITR form and also provide a flowchart to help you decide whether a tax audit is required or not.

You don’t need to get a Tax audit if you want to carry forward losses of F&O, provided-

1. The Turnover* is below 1 Crore in PY and if cash receipts/cash payments exceed 5% of total receipts/payments

2. The Turnover* is below 10 Crore (for PY 2021-2022) or 5 Crore (for PY 2020-2021) in case cash receipts/cash payments do not exceed 5% of total receipts/payments

3. If you have not chosen 44AD last AY and now choose to opt out

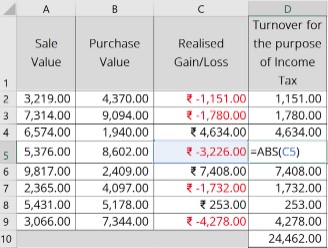

Turnover* here means the sum of realised gains and losses (i.e. don’t consider the minus sign in losses when adding them to profits. See example below!).

Scratching the bare act

Dissecting 44AD

Many people may argue that 44AD is not a choice but a compulsion i.e. a business with turnover less than Rs. 2 Crores has to mandatorily opt for 44AD and declare profits as 8% of Turnover.

It’s true that subsection (1) makes this provision sound mandatory and unjust but it is the virtue of subsection (4) that gives the option to actually declare what you earn and pay taxes accordingly.

Subsection (4) talks about what if an assessee switches from 44AD(1) to declaring lesser income (“…not in accordance with subsection (1)…”). 44AD has to be opted for 5 AY at a stretch. Choosing to depart from 44AD in any of those 5 AY will diminish your right to opt 44AD for the next 5 AY from the AY in which 44AD was not chosen.

This clearly shows we have an option to not choose 44AD.

44AD can be claimed by Individuals, HUFs and resident Partnership firms (LLPs not included).

Bonus Content: Just in case you have profits from F&O and the Turnover* does not exceed Rs. 2 Crores, you can opt for 44AD and pay 6% of Turnover (since more than 95% transactions are electronic). People may say that the broker prepares books and if books are being prepared, 44AD cannot be chosen. This is completely untrue as subsection (6) only bars professionals notified by CBDT in Official Gazette (practically every professional!) and not businesses. Maintaining/not maintaining books doesn’t affect your decision of choosing 44AD. But then again, you will have to opt it for next 4 years as well else you will have to undergo tax audit and there will be no point of the efforts I have put into this article!

Reason for confusion – Section 44AB

Many people often on skimming through the section say that anyone not choosing 44AD has to get a tax audit under clause (e) of section 44AB.

Clause (e) says that if any assessee has switched from 44AD, and if that assessee had income greater than Rs. 2.5 Lakh in any PY, they have to undergo a tax audit. In my opinion, this is a very strict provision.

Also, earlier if an assessee falling under 44AD, wanted to declare lower profits than the deemed profits (6% or 8%), assessee was mandated to maintain books and get a tax audit. But that was long ago. This provision has been omitted and a similar provision for 44ADA has been introduced (w.e.f. 01-04-2017).

Discussing F&Os specifically

With market in bull run and uptick in alternative investment avenues, people are more aware than ever. But on the flip side, new investors are ignorant to the consequences they might face in future – financially and compliance-wise.

There can be chances when the profit made is merely in thousands but their Turnover* crosses crores.

For tax audit to be applicable to F&O business, the Turnover needs to be Rs. 10 Crores (for PY 2021-2022) or Rs. 5 Crore (for PY 2020-2021) since entire transaction is electronic.

If your Turnover in F&O is upto Rs. 2 Crores and realized gain is Rs. 12 Lakh or more, you should definitely opt for 44AD.

In case-

- you have losses; and

- you do not fall under 44AD(4) (refer para 3 of Dissecting 44AD); and

- you do not breach the Turnover* limit of Rs. 1 Crore then no tax audit is applicable to you.

Intuition

Well, a welfare-oriented government would never want a small business to take the burden of extra compliances. Given the fact that they are incurring losses and their operations are small, shelling out money for tax audit would be another dent on their already leaking pockets.

Just to prove me wrong, some might bring up how tedious GST compliances are. These people should know that these are two different taxes (direct and indirect) and they have different purposes. GST compliance should be considered as an expense to run the business and that’s all I’m going to comment about it.

Filling the form

This needs extra care. Let me break it down in pointers-

- Since there are business losses, it will be ITR 3

- Are you liable for audit under section 44AB? – NO

- Are you liable to maintain accounts as per section 44AA? – Yes

This is because you cannot go for no account case as it won’t accept negative figures in gross profit.

- In Profit and Loss – Put Turnover* in “Other operating revenue” under Revenue from Operations and reverse calculate the Purchases to match the realised profit as informed by your broker.

- In case you have open positions at year end, treat them as your stock/inventory.

Please note that premium received on shorting options (whether call or put) shall be included in Turnover*.

Please note, this is when you want to carry forward losses from F&O and you fall in the criteria as mentioned in Para 5 of “Discussing F&Os specifically” above.

It is also advised to take professional help as this becomes very complex once you start putting figures in Profit and Loss Account / Trading Account.

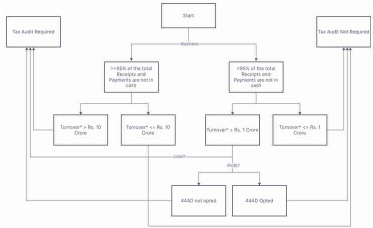

How to decide Tax Audit?

Hope this simple flowchart helps the cause! (valid for AY 2022-2023, PY 2021-2022)

I am salaried professional with annual CTC of 11 Lakhs..

My FnO turnover is 40 Lakhs and loss is 7 Lakhs.

I want to carry forward my losses.

Do i need to get tax audit done? Please reply

Sir,

I have Turnover from business of Consultancy of Rs. 20,00,000 and Turnover from F&O business 30,00,000 with loss from F&O 30,000. Can I choose 44AD for my Consultancy business income and prepare my books of Accounts for only F&O business without getting my self Audited.

I am a salaried person. My fno turnover is 650000 and loss is 50k.Do i need audit? While filing itr 3 at the end i am seeing validation successful no errors found but below i am receiving warning Category of defect B/D. Error description is “You have claimed income less than 8% of gross turnover and audit information is not filled up”. Please help me to rectify this error.

Sir i am a salaried person above exempt limit of 2.5 L

I traded in F&O and loss of aprox 3L and turnover 70L

In intraday loss of 7000

In Short term delivery based equity profit pf 5000.

Not opted for presumptive income in previous year

Its my first year on stock market

Last year i simply filed ITR 1

So my question is

Is it compulsory to opt for presumptive income??

Is there requirement of audit even if i opt out section 44AD presumptive income

Please reply sir

I HAVE AN F&O GAIN LAST YEAR UNDER PROVISION OF 44AD SHOWN LAST YEAR.

THIS CURRENT YEAR I HAVE AN F&O LOSSES AND I DOESNT WANT CARRY FORWARD OF LOSSES AND DOESN’T WANT TO REPORT THE LOSS IN MY IT RETURN AND FURTHER THIS YEAR I HAVE OTHER SOURCE GAIN OF RS.3 LAKH.

CAN I IGNORE REPORTING OF F&O LOSSES ????

In additon I have capitals gains from shares for FY 2021-22 STCG= +25,543(Pr year loss -86017), LTCG =+2,59,704/- (Pr loss -5,312/-)

My share intraday turn over is 3.5 lakhs and I made as loss of -25000/-. Whether i am liable for tax audit ? If not under which section I must enetr Sectn 44AB or 44AD. I am a retired private firm employee and i am getting yearly pension 45,000/- and has dividend income for FY 2021-22 4,27,000/-.

Further Can I skip intraday gains under business income and show under short term capital gains this Fy 2021-22 tax filing ? (Note: I have shown intraday gains under business income for FY2020-21 tax filing last year)

Fno and intraday turnover below 1 CR , incurred loss in the same . Further other income and salary above 5 lacs.

While filing the return there is an error. That you have claimed income less than 8%. Kindly fill audit information.

Please guide, thanks

That’s because your total income exceed 2.5 lakhs. Sec 44AB says no requirement of tax audit if turnover under limit and 44AD says if profit is below required % but does not exceeds 2.5 lakhs, then no need of audit. Otherwise, audit required.

This is my opinion. Thus, you need to declare income of F&O as per % basis because your other income exceeds 2.5 lakhs if not wish to audit.

in previous year I have filed income u/s 44AE and this year also income u/s 44AE but apart from that I have F&O T/O of Rs 5 crore and loss of 2.5 lakhs. What should I do? Please help

If I do not want to carry forward losses and turnover is more than 10 crores, do I still need to get audit done?

Total turnover of speculative(intrday equity) and non-speculative ( F$O) are 2.5 crore and Loss of 3.5 Lakh. In this scenario, can I carry forward losses without tax audit for fy 2021-2022 ? Note: my salary Income 5L per anum.

One important point that the article should have highlighted was that once you get a tax audit, you will always have to get a tax audit even if you are not meeting turnover limits.

Only exception of this case would be when you opt for 44AD.

This is an interpretation from the law but in parlance, is not followed. Reckoners and guides on tax audit suggest that turnover is to be seen only for the previous year in question and not any previous year.

Whether liable to get audit if there is income from House property and interest of Rs. 10 lakhs and loss from intraday and FnO of Rs. 200000/-?

No audit required if-

Turnover from f&o and speculative is less than Rs. 10 crores (since 100% transaction is electronic) for return that will be filed in next FY.

If you are filing return for income earned in 2020-2021, replace 10 crores with 5 crores.

Also check the applicability of 44AD(4) in your case and you are good to go!