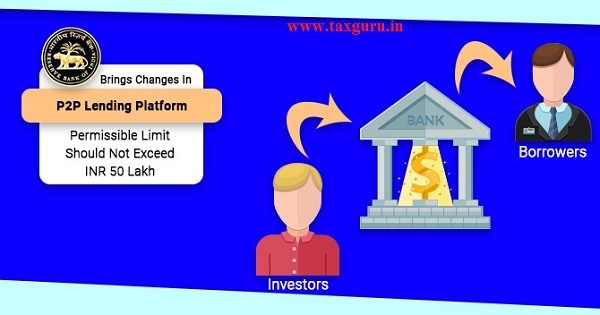

Reserve Bank of India has announced certain changes pertaining to peer- to- peer lending platform. RBI made amendments to the P2P lending platform on 23rd December 2019. The purpose of changes is to make it more consumers friendly and to protect consumer interest. The largest banking body of India consciously made the alteration. As per the latest amendment; the permissible limit for lenders on these platforms should not exceed INR 50 Lakhs at any given point of time.

Any lender who is willing to invest more than Rs10, 00,000 via P2P platform is liable to produce a certificate to P2P platforms from an active Chartered Accountant certifying minimum net-worth of Rs 50, 00,000. Apart from this, all the lenders must submit their declaration to P2P platforms citing that they are aware of all the risks involved with lending transactions and that the P2P platform does not assure the return of principal/payment of interest.

All You Need To Know About Peer-to-Peer Lending Platforms

Peer-to-Peer lending platform is a way to borrow money for short-term requirements. Asking for money via P2P is comparatively easy to traditional personal loans from banks.

P2P lending platform is a medium that connects both borrowers and lenders. It fulfils the requirement of both parties. Often, lenders provide loans to borrowers with the aim to earn attractive returns. Though the amount of risk involved in P2P is higher compare to financial assets that include mutual funds, equity.

P2P lending platform is being regulated by the largest banking body of India, that is, Reserve Bank of India. In October 2017, RBI has passed a mandatory rule for all P2P companies to apply for a license to continue as a P2P platform.

Review of Master Directions – Non-Banking Financial Company -Peer-to-Peer Lending Platform (Reserve Bank) Directions, 2017

RBI said in an official statement, “The lender investing more than INR 10Lakhs across all P2P platforms shall produce a certificate to P2P platforms from a practising chartered accountant certifying minimum net-worth of INR 50 Lakhs.”

Additionally, RBI also made it clear that the investment capacity of these lenders should remain consistent with their net-worth. These regulations are drafted keeping the interest of the consumers in mind.

Currently, the escrow account is used to perform all the transactions on P2P platforms. It works as a secured third-party platform for the transaction. Usually, banks provide these third-party services. In a clarifying statement, RBI said, “Escrow accounts to be operated by bank promoted trustee for transfer of funds need not be mandatorily maintained with the bank which has promoted the trustee.”

Master Directions- Non-Banking Financial Company-Peer to Peer Lending Platform (Reserve Bank) Directions, 2017, has been updated with the recent changes in the norms, RBI notified in a statement.

Title and Beginning of the Directions:

The RBI has provided a name to these directions, these are called, “Non-Banking Financial Company –Peer to Peer Lending Platform (Reserve Bank) Directions, 2017.

The Reserve Bank of India, (hereinafter referred to as “the Bank”) issued a Notification No DNBR. 045/CGM (CDS)-2017 dated August 24, 2017, in terms of sub-clause (iii) of clause (f) of section 45I of the Reserve Bank of India Act, 1934 (hereinafter referred to as “the Act”) and on being just satisfied that it is necessary to do so, in exercise of the powers conferred under section 45IA, 45JA, 45L, and 45M of the Act, and of all the powers enabling it in this behalf, hereby issues these Directions for compliance of the same by every Non-Banking Financial Company that carries on the business of a P2P Lending Platform.

The peer-to-peer lending market in India is nascent. Gradually, it is gaining popularity in the Indian economy and shows the potential for growth and manifold.

India too has popular Peer-to-Peer lending platforms such as LenDenClub, Faircent, RupeeCircle, among others. LenDenClub has managed to raise a whopping amount of 1million dollars in August 2019 in a Pre-Series A funding round. Funds are also raised by Faircent from Gunosy Capital, Das Capital, among others in the same month.