Relevant Provisions:

Section 35A of the Banking Regulations Act, 1934, where the RBI has the power to issue any direction.

Applicability:

The provisions of these Directions shall apply to all the Private Banks licensed by the RBI to operate in India.

Private Sector Banks:

Means Banks licensed to operate in India under the Banking Regulations Act, 1949, other than-

a. Urban Co-operative Banks,

b. Foreign Banks and

c. Banks licensed under specific Status.

Page Contents

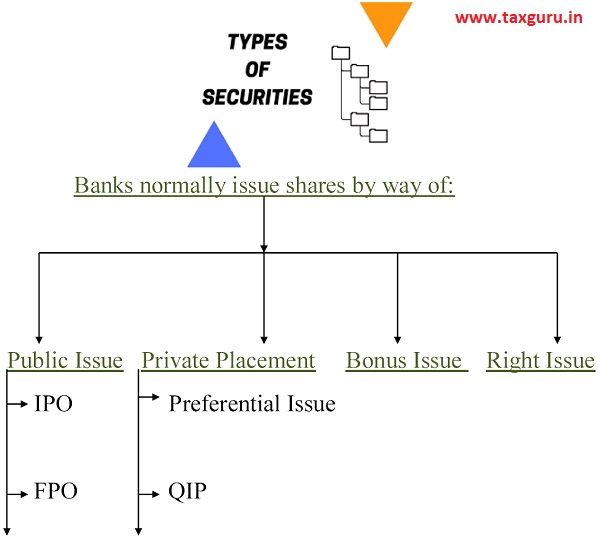

Issue and Pricing of Securities:

A Private Bank both listed and Unlisted, has general permission for issue of shares through all routes mentioned in Section 4 of the FEMA.

Following Conditions shall be complied with u/s 4.

a. The issue of shares shall be in accordance with the provisions of Foreign Exchange Management Act, 1999 and extant Foreign Investment Policy of Government of India for Private Sector Banks.

b. Issue shall be in accordance the extant SEBI guidelines, provisions of Companies Act and rules made thereunder.

c. The issue of shares through any of the routes shall have the approval from Bank’s Board/AGM, as the case may be in compliance with the Companies Act, 2013, SEBI Guidelines.

d. Pricing of shares through any of the routes by listed banks shall be as per the SEBI formula, while for unlisted banks the pricing shall be in accordance with the provisions of the Companies Act, 2013 and Rules made thereunder.

e. Allotment of shares to the investors under any of the route shall be subject to compliance with the extant RBI master directions dated Nov. 19, 2015 on prior approval for acquisition shares or voting rights in private sectors banks which requires investors to obtain specific prior approval of RBI if the proposed acquisition results in aggregating holding of 5% or more of paid-up capital of the Bank.

f. The specific regulatory limits permitted to the shareholders or the promoters/Promoter Group shall not be breached on account of fresh subscription, own entitlement, renouncement of rights or otherwise.

g. On completion of allotment process subject to compliance with the stipulation as para 5(v) above, if applicable, Complete details of the issue shall be reported to the RBI-

1. Date of issue,

2. Details of the types of issue,

3. Issue size

4. Details of pricing number and name of allottees,

5. Post allotment share holding position

Along with a copy of Board/AGM resolution and prospectus/offer document in the format given in the schedule to these Directions.

Format of providing details of securities

| Date of the Issue | Types of the issue | Size of the Issue raised | No. of allot tees for the issue | Pre- Issue | Post Issue | ||||||

| Paid- up Capital | Re serves | Paid- up Capital | Re serve | List of share holder | |||||||

| No. of shares | Face value of each share | Pre mium on each share | Amo unt raised | ||||||||

| Name of the Allottees |

No. of Shares held prior to Allot ment |

% of total paid-up Share prior to Allotment | No. of Shares approved for Allot ment |

% of Shares now allotted to paid up shares |

Aggregate No. of Shares (post issue) | *% of total paid-up Shares (i.e. aggregate percentage shareholding post issue) |

| (A) | (B) | (C) | (D) | (A+C) | (B+D) | |