Introduction: –

Has it ever happened with you that after filing TDS return and making payment of TDS to the government, you realized that you have made an error and want to rectify it but are unaware of the procedures to rectify the error. In this article, we will understand what is TDS return, types of error one might commit while filing TDS return and how to rectify those errors.

Let us begin with understanding TDS return: –

TDS stands for tax deducted at source, there are certain specified transaction in which the person initiating the payment needs to deduct tax and then pay the balance amount to the other person. The Tax that has been deducted by the deductor needs to be summarized and paid to the government on or before due date by filing TDS return in various form depending on the nature of deduction.

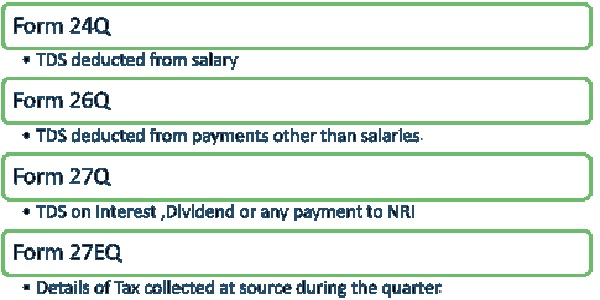

Depending on the nature of transaction there are Different types of TDS return forms they are as follows: –

Types of Errors while filing TDS return:-

It might happen sometimes, due to some or the other reason the details entered in TDS return might be incorrect or entered wrongly, depending on the type of error the person can make the changes in the return and file revised TDS return. To understand which type of correction/changes to be made we first need to understand the mistake that might be committed while filing TDS return and they are as follows: –

Procedure to revise the TDS return:-

1. How to Change the details of the TDS return –

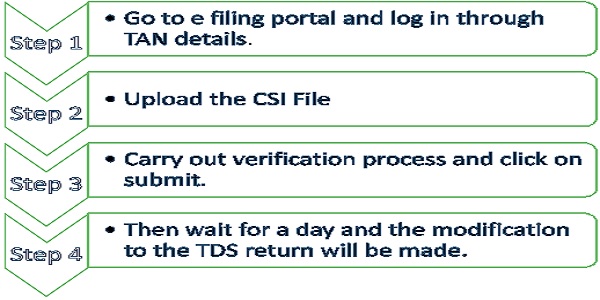

2. How to upload it on portal and check the status?

Conclusion

Conclusion

It is very important to file the TDS return correctly because if there is any mistake in the details of the deductee or employee, then that person will not be able to enjoy the benefit of TDS credit while filing income tax return. The TDS return if furnished with incorrect details need to revised, the revision of such TDS return can be carried out multiple time but the original TDS return can be filed only once. Therefore, filing the TDS return with false or incorrect information is not acceptable instead revise the TDS return multiple time but furnish the correct details in the return.

****

(This article represents the views of the authors only and does not intent to give any kind of legal opinion on any matter)

Authors: Parth Bhikadiya | Associate Consultant| +918355882127|parth.bhikadiya@masd.co.in

Respected Mr Parth Bhikadiya,

Thanks for your extremely beneficial article TDS correction. I would like to put two request:

i) If possible please provide the article in details

ii) If possible Please provide details procedure for monthly TDS payment and qtrly TDS return procedures for beginners.

My mail ID is provided for your convenience:

barenyasanyal14@gmail.com

Regards

Barenya Sanyal

9051667484