Important matters connected with TCS provision under section 206C(1H) Of Income Tax Act, 1961

1. The provision that has been brought at this time is only in relation to ‘sale of goods’ and services have been kept away from this provision.

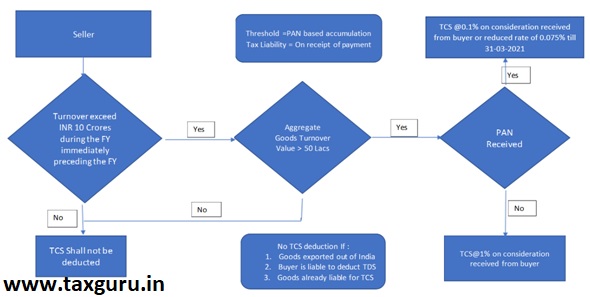

2. This provision will be applicable to seller if the turnover is more than 10 Crores in the previous financial year i.e. the year ended 31 March 2020.

3. The seller will have to collect and deposit TCS on receipts from sale of goods from such buyers from whom the seller received more than Rs. 50 Lakhs as sale consideration during the current financial year.

4. The rate of TCS is 0.1% and due to corona Pandemic 25% discount has been given in this tax rate till 31 March 2021 and its effective rate was 0.075%

5. These provisions are applicable to the “amount” received in connection with the sale and if any advance related to it is received on or after October 1, 2020 then the provisions of TCS will also be applicable.

6. The responsibility for payment of TCS will be on receipt of payment from the buyer and you have to deposit it to the government on the 7th day of the end of the month in which you receive the payment. For example, if you receive payment in October 2020, then you have to pay its TCS by 7 November 2020

Pictorial representation of section 206C(1H) Of Income Tax Act, 1961

Practical illustration

| Turnover during FY 19-20 | Sales till 30.09. 2020 to “M/s ABC” | Sales from 01.10. 2020 to “M/s ABC” | Collection till 30.09. 2020 from M/s ABC | Collection on or after 01.10. 2020 from M/s ABC | TCS u/s 206C(1H) @ 0.075% | Remarks |

| 6 Cr | 11 Cr | 7 Cr | 10 Cr | 8 Cr | Nil | No TCS shall be collected due to there as on that the Turnover of the assessee was less than 10Cr in FY 2019-20 |

| 15Cr | 25 lakhs | 65 lakhs | 20 Lakhs | 60 lakhs | 2250 | TCS applicable on (20+60-50) Rs 30lakhs @0.075% |

| 12 Cr | 65 lakhs | 85 lakhs | 75 lakhs | 40 Lakhs | 3000 | Thre shold limit of Rs 50lakh shas been consumed till 30.09.2020 hence TCS would be applicable on all receipts on or after 01.10.2020 i:e Rs 40lakhs |

| 20 Cr | 85 lakhs | 60 lakhs | Nil | 1.25 Cr | 5625 | TCS applicable on (1.25cr-50lakhs) Rs75lakhs. |