‘Confusion hi confusion hain…. Solution kuch pata nhi!’

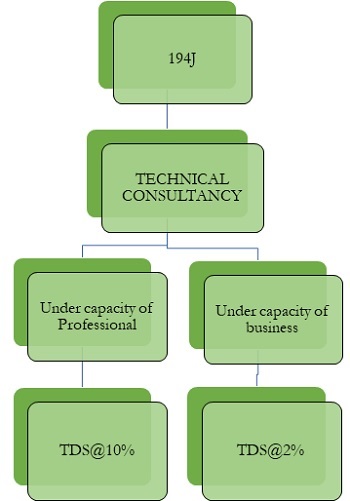

As per section 194J:

(a) TDS on professional services is deducted @10%.

(b) TDS on technical services is deducted @2%.

There is great confusion in the definitions of technical services as well as professional services.

As per clause (a) of explanation to section 194J, professional services” means services rendered by a person in the course of carrying on legal, medical, engineering or architectural profession or the profession of accountancy or technical consultancy or interior decoration or advertising or such other profession as is notified by the Board for the purpose of section 44AA or of this section;

As per clause (b) of explanation to section 194J, fees for technical services” shall have the same meaning as in Explanation 2 to clause (vii) of sub-section (1) of section 9;

As per Explanation 2 to clause (vii) of sub-section (1) of section9“fees for technical services” means any consideration (including any lump sum consideration) for the rendering of any managerial, technical or consultancy services (including the provision of services of technical or other personnel) but does not include consideration for any construction, assembly, mining or like project undertaken by the recipient or consideration which would be income of the recipient chargeable under the head “Salaries”.

The article is all about the confusion in both the definitions. If we read both the definitions, at first glance it seems overlapping because there is mention of technical consultancy in the definition of “professional services” as well as technical consultancy is also mentioned under definition of “fees for technical services”.

These both definitions is creating lot of problems for the assessees, as they are confused whether TDS@2% will be deducted or TDS@10% will be deducted for technical services and there is no clarification available for this confusion till now.

This confusion can result in deduction of TDS at lower rate or higher rate.

TO FINALLY KARNA KYA HAIN??

For this confusion, the principal difference between the technical services and professional services needs to be understood.

The intent that can be behind levying a higher TDS rate in the case of professional services is that there are higher margins in the case of a profession. In profession, one earns with the power of the mind, whereas in business there have to be much more overheads and infrastructure involved. Therefore, lower margins entailing lower TDS rates in case services are provided in the course of business. The percentage of profit in relation to turnover in business is much less than a profession.

So we can differentiate the technical services and professional services with the help of definition of ‘’business’’ and ‘’profession’’ as per Income Tax Act.

As per section 2(13) of the Income Tax Act, “Business” includes any trade, commerce, or manufacture or any adventure or concern in the nature of trade, commerce or manufacture.

The word `business’ is one of wide important and it means activity carried on continuously and systematically by a person by the application of his labour or skill with a view to earning an income. The expression “business” does not necessarily mean trade or manufacture only

As per section 2(36) of the Income Tax Act, “profession” to include vocation,

In general terms, the expression “profession” involves the idea of an occupation requiring purely intellectual skill or manual skill controlled by the intellectual skill of the operator.

So if technical consultancy is provided in the course of the profession, it will be considered in the nature of “professional services”. If technical consultancy is not provided in the course of the profession, then it can be considered that they are provided in the course of business.

Let’s understand this with an example:

Chintu a software engineer providing technical consultancy to ABC Ltd. for which he charged fees of Rs. 35,000 from ABC Ltd.

ABC Ltd. is confused whether the TDS is to be deducted at 2% or 10% as the technical consultancy comes under the definition of both technical services and professional services.

As the Chintu is an individual and he is also a software engineer i.e. he is having certified degree providing technical consultancy in the capacity of the professional, in my opinion TDS@ 10% would be applicable.

Let’s take another example:

Chipmunk Ltd. is providing technical consultancy and employs various fields of professionals for rendering such services, then it cannot be considered as professional services because a company cannot provide these services in the course of a profession and will be eligible for lower rate of TDS i.e.2%.

SYMPTOMS OF A PROFESSIONAL

- Can be an individual or group of individuals having certified degree of profession e.g. doctor, engineer, Chartered Accountant etc.

- Connected with a job that needs a high level of training and/or education.

- Individual who derives their income from his specific knowledge or experience.

- Individual who is engaged in one of the learned professions.

- Individual who works in a specified professional activity.

TO AAIYEIN SHORT SUMMARY SE SAMAJHTE HAIN!!

Technical consultancy provided under the scope of business than it will fall under the definition of “technical services” and TDS@2% will be deducted. If technical consultancy is provided under the capacity of professional, then it will fall under the definition of “professional services” and TDS@10% will be deducted.

About the Author:

Ms. Anushika Garg is a Senior Article Assistant and CA Rakesh Kedia is Partner in Direct Tax Department associated with M/s R Sogani & Associates | Chartered Accountants, situated at C-Scheme, Jaipur, Rajasthan.

Written by – Ms. Anushika Garg under guidance of CA Rakesh Kedia – (E-mail: anushikagarg.155@gmail.com, kedia@soganiprofessionals.com)

DISCLAIMER

The contents of this document are solely for informational purpose. It does not constitute professional advice or a formal recommendation. While due care has been taken in preparing this document, the existence of mistakes and omissions herein is not ruled out. The author does not accept any liabilities for any loss or damage of any kind arising out of any inaccurate or incomplete information in this document nor for any actions taken in reliance thereon. No part of this document should be distributed or copied (except for personal, non-commercial use) without express written permission. Suggestions and criticisms from all readers would be highly appreciated and acknowledged.