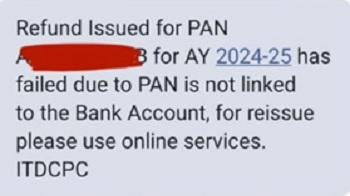

Few days ago I received a message from one of my client regarding failed refund, so I checked upon this issue, Recently, I have noted that the Income Tax Department has started issuing notices to assesses regarding “refund failure” and giving the reason that “Your PAN is not linked with your Bank Account.”

This new issue created by the income tax department has triggered extreme frustration among the taxpayers, most of the assessees have claimed that they have been using the same bank accounts for years without facing any prior issues.

Same case happened with my own relative, she was using her husband’s account for refund and was successfully getting refund till last year, but this year notice made her curious. Hence these sudden notices which are issued by department from this year itself, have caused confusion and anxiety among taxpayers, also affected taxpayers who are struggling to resolve the situation have chosen the department’s grievance redressal system to address the issue.

PAN Not Linked with Bank Account: issue

The problem arose when several taxpayers who were expecting refunds, instead received the notices from the Income tax Department stating that their refunds had failed because their Permanent Account Number was not linked with their bank accounts. This is despite many taxpayers stating that they have already linked their PAN with their bank accounts years ago, and in some cases, the accounts in question have been in use for a long period without any problems in previous assessment years or getting refunds in previous years by the department.

There are increasing number of taxpayers who are receiving such type of notices, even though their PAN is linked to their bank accounts properly and are functioning. Taxpayers are moving to their social media platforms like LinkedIn and twitter to address such issue on a regular basis hence this issue is not been isolated any more. As I pointed out earlier in this article, The taxpayers have reported their grievances as per grievance redressal mechanism of the department, but many claim that their complaints are closed without any satisfactory resolutions, leaving them in a difficult position.

What is the impact on refunds above INR 10k?

One of the key observation is that refunds of amounts that are above INR 10,000/- appear to be the primary target of the department for these notices, maybe they have used Artificial intelligence to target these individuals as in case PAN is not linked to their account, their refund amount might be misused by some other individual.

On the other hand, some taxpayers suspect that this could be a deliberate attempt to delay the processing of larger refunds, which is leading to further frustration amongst the taxpayers as they shared their experiences on social media, with some noting that even though both their PAN and Aadhaar are correctly linked, and have given their own bank accounts with linked PAN number, still their refunds are being blocked without any clear explanation.

The issue might be due to a systemic failure at the department’s end to recognize accounts that are linked or not, resulting in an automatic generation of refund failure notices. This is despite the fact that PAN-Aadhaar linking has become a mandatory step for the processing of refunds.

Potential loss of interest and Systemic Delays

The implications of these delays are causing the inconvenience to taxpayers by blocking their funds and that too without interest. Hence, many of the taxpayers have raised the concerns about this potential financial losses faced by them due to accrued interest on these delayed refunds and on the other hand most of the taxpayers are questioning to the department, whether these delays are the result of inefficiencies in the system or a more deliberate practice by the department to withhold refunds.

A central concern of the taxpayers is whether they will be compensated for the interest loss on these delayed refunds. Under Section 244A of the Income Tax Act, taxpayers are entitled to interest on delayed refunds. However, with refunds being blocked due to the PAN-Bank Account linking issue, it remains unclear how the department will handle interest compensation in cases where the delay is not the fault of the taxpayers

Resolution and Next Steps

The Income Tax Department has urged taxpayers to ensure that their PAN and Aadhaar details are properly linked and that their bank account information is accurate and up to date. The linking of PAN with bank accounts has become a critical step in the processing of refunds, and taxpayers are encouraged to verify their linking status on the official Income tax e-filing portal.

Taxpayers experiencing similar issues are advised to check their PAN-Aadhaar and PAN-Bank Account Link status which is the first step in resolving the issue to ensuring that your PAN and Aadhaar are linked properly, and that the PAN is also linked with your bank account.

They are also advised to use the income tax department’s grievance redressal mechanism, in case of delay or withheld of refund, it is suggested to the taxpayer to file a grievance on the official e-filing portal. However, he must be aware that many grievances have been closed without resolution, so persistence may be required in that case.

What are the broader implications and need for clarity?

As on 31st July 2024 the current tax season for individual filers have been closed, the volume of unresolved refund issues is expected to increase unless the Income Tax Department addresses the problem with adequate transparency. Taxpayers are looking for clear communication and timely resolutions by the department. The department must take proactive steps to ensure that legitimate refunds are processed without unnecessary delays and that taxpayers are not left grappling with systemic failures.

Conclusion

The issue of refund failures due to “PAN not linked with Bank Account” is becoming a significant concern for Indian taxpayers. While the department has cited the linking of PAN with bank accounts as a mandatory requirement for refunds, the surge in complaints suggests that the system itself may be flawed. Taxpayers are rightfully frustrated by the lack of clear explanations and the inefficiencies in the grievance redressal system. The Income Tax Department must act swiftly to address these issues to restore trust and ensure that refunds are processed fairly and in a timely manner.