Introduction

Concept of ITR-U was introduced in the union budget of 2022.

Many time we made mistakes or we forget to report some income while filing our Income tax returns, which comes to our knowledge later or may be at the time of filing next year income tax return.

So, Section 139(8A) of the Income Tax Act and rule 12AC of Income tax rules gives the taxpayers a chance to update their returns or to file a new return in case no return was filed earlier, for a period upto two years from the end of the relevant assessment year. The purpose for introduction of form ITR-U is to optimise tax compliance by taxpayers without provoking legal action.

ITR-U is applicable from 1st April 2022.

Page Contents

- Eligibility to file ITR-U

- Cases in which updated return can be filed:

- Cases in which updated return cannot be filed:

- Time limit to file ITR-U

- Details required to furnish in form ITR-U

- Verification of updated return

- Payment of Additional Tax

- Computation of Tax Payable in an updated return

- Summary of all above:

- Frequently asked questions

Eligibility to file ITR-U

Any person can furnish updated return irrespective of the fact that whether:

he has furnished/not furnished

– original return

– revised return

– belated return

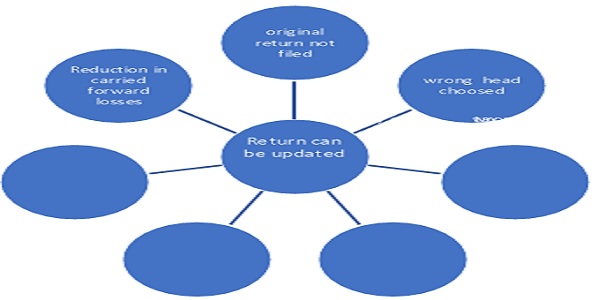

Cases in which updated return can be filed:

- Return not filed previously

- Misreporting of income

- Wrong heads of income chosen

- Paid tax at wrong rate

- To reduce carried forward losses

- To reduce unabsorbed depreciation

- To reduce the tax credit of MAT/AMT u/s 115JB/115JC

- others

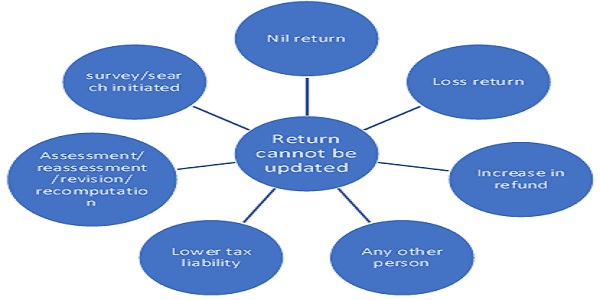

Cases in which updated return cannot be filed:

- If updated return is nil return,

- If updated return is return of loss,

- If filing of updated return results in increase of refund,

- If filing of updated return results in lower tax liability as compared to the originally filed return,

- Where books, documents or assets are seized or called for by the income tax authorities u/s 132A.,

- If survey has been conducted u/s 133A for the said assessment year,

- If search/prosecution proceedings has been initiated for the said assessment year,

- If assessment/reassessment/revision/re-computation is either pending or completed for that relevant year,

- If assessing officer has information against such person under prevention of money laundering act or black money (undisclosed foreign income and asset) and imposition of tax act or benami property transactions act or smugglers and foreign exchange manipulators act and the same has been communicated to the assessee,

- Other notified person.

Crux: No updated return can be filed in case there is no additional tax outgo. (when the tax liability is adjusted with TDS credit/ losses and you do not have any additional tax liability)

Time limit to file ITR-U

The time limit to file updated return is 24 months from the end of the relevant assessment year. So, in the current financial year 2022-2023 updated return for assessment year 2020-2021 and 2021-2022 can be filed.

For eg:-The return for FY 2021-22 can be updated till 31st march 2025.

> Point to be noted that a person can update his return only after the time specified u/s 139(1) for original return, u/s 139(4) for belated return and u/s 139(5) revised return has been lapsed and a return can be updated only once.

Details required to furnish in form ITR-U

ITR-U requires the following additional details from the taxpayers:

Part A – General Information (ITR-U)

This part of ITR-U requires general information from taxpayers related to the filing of an updated return. It includes the following:

- Are you eligible for filing an updated return as per the conditions laid out in first, second and third provisos to section 139(8A)?

- Selecting the ITR form for filing an updated return

- Reasons for updating your income, this includes reasons such as

- returns previously not filed,

- income not reported correctly,

- wrong heads of income chosen, etc.

- Are you filing the updated return during the period upto 12 months from the end of the relevant assessment year or between 12 to 24 months from the end of the relevant assessment year?

- Are you filing an updated return to reduce carried forward loss, unabsorbed dep., or tax credit?

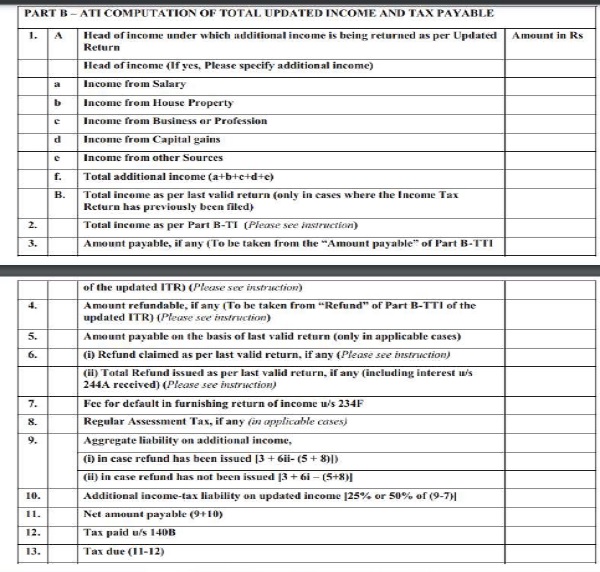

Part B – ATI Computation Of Total Updated Income and Tax Payable (ITR-U)

This part of ITR-U includes heads of income under which additional income is reported. The taxpayer is required to mention only the amount of additional income. Total income as reported in Part B of the ITR form shall also be reported here to compute the additional tax payable by the assessee on the updated return. Given table depicts the PART B of Form ITR-U:

Verification of updated return

| CASES | METHOD |

| Any person who is required to get audited u/s 44AB (TAX Audit Assessee) | Digital Signature Certificate (DSC) |

| In other cases | Electronic Verification Code (EVC)or voluntarily with DSC |

Payment of Additional Tax

Any person filling an updated return is required to pay an additional tax of 25% or 50% on the tax amount, depending on when you file the ITR-U

| ITR-U Filed | Additional tax |

| Within 12 months from the end of the relevant assessment year | 25% of additional tax +interest |

| Within 24 months from the end of the relevant assessment year | 50% of additional tax +interest |

Computation of Tax Payable in an updated return

| Particulars | Amount | |

| Total Tax on Income | XXXX | |

| Less | Advance Tax Paid | (XXXX) |

| Less | TDS (Tax Deducted at Source) | (XXXX) |

| Less | TCS (Tax Collected at Source) | (XXXX) |

| Less | Self Assessment Tax | (XXXX) |

| Less | Relief u/s 89/90/90A/91 | (XXXX) |

| Less | Tax Credit u/s 115JAA/115JD | (XXXX) |

| Basic Tax Payable | XXXX | |

| Add | Interest u/s 234A, 234B, 234C | XXXX |

| Tax Payable | XXXX | |

| Add | Additional Tax (25% or 50%) | XXXX |

| Total Tax Payable | XXXX |

Note : Late Fee under Section 234F must be paid if ITR under Section 139(1) is not filed earlier.

Summary of all above:

| Additional tax u/s 140B , Late fees & Last date to file updated return | |||||

| Financial years | Additional tax u/s 140B | Late fees based on total income | Last date to update return |

||

| 25% | 50% | upto Rs 5 lakh | Above Rs 5 lakh | ||

| F.Y 2021-22 (A.Y 2022- 23) | From

01/01/2023 to 31/03/2024 |

From

01/04/2024 to 31/03/2025 |

Rs.1000 | Rs.5000 | 31-03- 2025 |

| F.Y 2020-21 (A.Y 2021-22) | From 01/04/2022 to 31/03/2023 | From 01/04/2023 to 31/03/2024 | Rs.1000 | Rs.5000 | 31-03-2024 |

Frequently asked questions

Que. How many times ITR-U can be filed?

Ans. For any financial year a return can be updated only once.

Que. Can ITR-U BE filed if there is no tax liability payable?

Ans. No, if there is no additional tax outgo, ITR-U cannot be filed.

Que. Can ITR-U be filed if total income is less than Rs. 5lakh?

Ans. Yes, ITR-U can be filed but, that person has to pay late filing fees.

Que. If deadline for revised return or belated return is not passed then in that case can I file ITR-U?

Ans. No, in this case ITR-U cannot be filed. ITR-U can be filed only when time for revised return and belated return has been passed/ lapsed.

If you need any help in filing ITR U you can whatsup at 90249154.88

while filing ITR U if there is Rs 20 payable after adjusting Late fees u/s 234 F of Rs 5000 with tax credit then ITR U can be filed without actual paid of Rs 5000?