Marginal Relief is a significant aspect of the Indian income tax system that provides relief to individuals and companies when their total income crosses certain thresholds. This article will delve into the details of Marginal Relief, how it impacts tax liability for individuals and companies, and provide practical examples to illustrate its application.

Marginal Relief for Individuals:

Marginal Relief for individuals comes into play when their total income exceeds 50 lakhs, and the tax burden on the income above 50 lakhs is more than that income itself. Let’s illustrate this concept with an example:

Mr kapoor, a resident aged 40 years, income in previous year 2022-23 = 5100000

Calculation of Tax.

Step I. Tax on 5100000

| Upto Rs 250,000 | NIL |

| 2,50,000-5,00,000 | 12,500 |

| 5,00,000-10,00,000 | 1,00,000 |

| Balance (41,00,000*30%) | 12,30,000 |

| Tax | 13,42,500 |

| + Surcharge @ 10% of Tax | 1,34,250 |

| Total Tax Payable | 14,76,750 |

Step II. Tax on Rs 50,00,000

| Upto 2,50,000 | NIL |

| 250000-5,00,000 | 12,500 |

| 500000-10,00,000 | 1,00,000 |

| Balance (40,00,000*30%) | 12,00,000 |

| 13,12,500 | – |

| + Surcharge | – |

| 13,12,500 | |

| Tax on 5000000 | 13,12,500 |

| Tax on 5100000 | 14,76,750 |

| Increase in income | 1,00,000 |

| Increase in Tax | 1,64,250 |

For 1,00,000 increase in income, individual has to play 1,64,250 Tax, to make them fair concepts of marginal relief was introduced.

Step III. Tax to be paid = Step II + Extra income

i.e. = income Tax on 5000000 + increased income = 1312500 + 100000 = 1412500

Step IV. Marginal Relief = 1476700 – 1412500 = 64250

Marginal Relief for Companies:

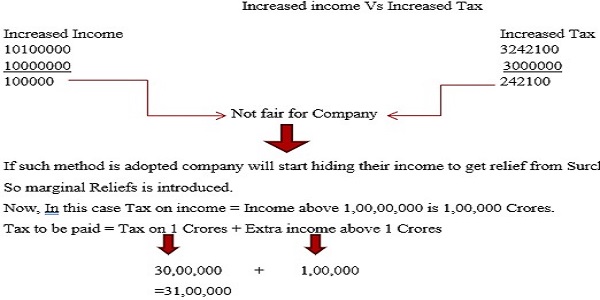

Marginal Relief for companies applies when their total income exceeds 1 Crore but is less than 10 Crores. Here’s an example to understand how it works:

Let’s take an example to understand the same.

MNO Ltd (Domestic Company), Income in previous year 2021-22 = 402 Crores.

Total income = Rs 1,01,00,000

Calculation of Tax

| Step I. 1,01,00,000 | |

| (1,01,00,000*30%) | 30,30,000 |

| + Surcharge @ 7% of Tax | 2,12,100 |

| Total Tax Payable | 32,42,100 |

Assume if Total income is Rs 1,00,00,000

Marginal Relief = Tax on original – Tax to be paid

= 32,42,100 – 31,00,000

= 1,42,100

Total Tax payable = 31,00,000 + 4% Cess

= 32,24,000

Conclusion:

Marginal Relief is a mechanism in Indian income tax that ensures fairness when taxpayers’ incomes cross certain thresholds. It prevents an excessive tax burden on incremental income and provides relief to both individuals and companies. Understanding Marginal Relief is essential for efficient tax planning and compliance with Indian tax laws.

I wanted to know whether marginal relief in tax was available to payers in AY 18-19 or it was introduced at a later date.