1. ITR-1, also known as or Sahaj Form, is for people with an income up to Rs. 50 lakhs from the following sources: –

(a) Income from Salary/Pension. The salaried individual having income above Rs 50 lakhs should file ITR 2.

(b) Income from One House Property (excluding cases where loss is brought forward from previous years)

(c) Income from Other Sources (excluding winning from Lottery and Income from Race Horses)

2. DUE DATE FOR FILING ITR 1: The due date for ITR 1 is 31st July 2021. The ITR must be filed for income earned from 01st April 2020 to 31 March 2021 latest by 31st July 2021 unless extended by the Government.

2.1 The individual shall file ITR earliest by 1st week of June 2021 as by then, the form 26AS will have all the details of Tax deducted by the employers and the other deductors.

3. NEW ELEMENTS IN ITR 1 FORM: The government has notified the income tax return filing forms for the financial year 2020-21 via a notification dated March 31, 2021. As per the notification, the following are the new elements in the form: –

3.1 TAX DEFERRED ON ESOPS: ITR-1 cannot be used by an individual for whom income tax is deferred on ESOPs.

3.1.1. As per an amendment in Budget 2020, from FY 2020-2021, an employee receiving ESOPs from an eligible start-up need not pay tax in the year of exercising the option.

3.1.2 The TDS on the ‘perquisite’ stands deferred to earlier of the events that are expiry of five years from the year of allotment of ESOPs or date of sale of the ESOPs by the employee or date of termination of employment

3.1.3 Such employees won’t be able to file ITR 1. They will have to file ITR 2.

3.2 TDS DEDUCTED UNDER SEC 194 N: For FY 2020-21, return in ITR 1 cannot be filed by a taxpayer whose tax has been deducted under Section 194N.

3.2.1 TDS is required to be deducted under Section 194N by banks, co-operative banks, or a post office at the rate of 2% or 5% depending on the amount withdrawn in cash from one or more accounts maintained by the recipient.

3.2.2 Such taxpayers may use ITR 2 or 3.

3.3 DISCLOSURE OF DIVIDEND INCOME: ITR-1 asks for the quarterly breakup of dividend income which became taxable in FY 2020-21.

3.3.1 This information is required for claiming relief on payment of advance tax under section 234C on the dividend income.

3.3.2 Earlier, dividend income up to Rs10 lakh was exempt from tax under Section 10(34) and such income was shown under the exempt income section.

3.3.3 Now, the dividend income has to be disclosed under “income from other sources

4. DOCUMENTS WHICH YOU SHOULD KEEP IN HAND BEFORE FILLING OUT YOUR ITR-1

4.1 FORM 16: Issued by all your employers for the given Financial Year

4.2 FORM 26AS: Remember to verify that the TDS mentioned in Form 16 matches the TDS in Part A of your Form 26AS

4.3 BANK INVESTMENT CERTIFICATES: Interest from bank account details – bank passbook or FD certificate

4.4 RECEIPTS: If you have not been able to submit proof of certain exemptions or deductions (such as HRA allowance or Section 80C or 80D deductions) to your employer on time, keep these receipts handy to claim them on your income tax return directly.

5. AADHAAR CARD MANDATORY FOR TAX FILING: The Income Tax Department has made it mandatory for all taxpayers to link the Aadhaar card with PAN on the Income Tax Department website.

6. BANK DETAILS: From the year 2015, the Income Tax Department has given mandated that all taxpayers must report all the bank accounts they possess in the tax return. This includes joint accounts as well.

6.1 While e-filing IT return, the department will not ask for giving all the bank accounts mandatory. But one should know that in case of opening a new bank account filling up KYC and submission of PAN number are mandatory. Since the pan number is linked with the income tax return, the department has knowledge of every bank accounts that you possess.

6.2 It is not mandatory to provide details of accounts that are dormant. So, one can omit giving details of those accounts which have been not in operation for the past 36 months, since those are considered dormant.

7. PRE-VALIDATION OF BANK ACCOUNT: From the Assessment Year 2019-20, it has become mandatory to pre-validate bank accounts to get Electronic Service Credit (ECS) of income tax refund in the account.

7.1 Pre-validation of a bank account is also needed, in case of e-verification of ITR through Electronic Verification Code (EVC). This is because a pre-validated bank account may only be made EVC enabled to receive the verification code/one-time password (OTP).

8. UTILITY FOR FILING OF ITR 1: The Income Tax Department has launched a new offline JSON-based utility for the assessment year 2021-22. It has done away with the excel and Java-based utility to improve the tax filing process.

8.1 The new utility is a user-friendly functionality for filing returns and will afford greater ease to the taxpayers. The utility itself provides help in the form of FAQs, guidance notes, circulars, and provisions of the law to enable hassle-free return filing

8.2 Taxpayers shall be able to pay taxes, verify and upload the ITR through the utility itself

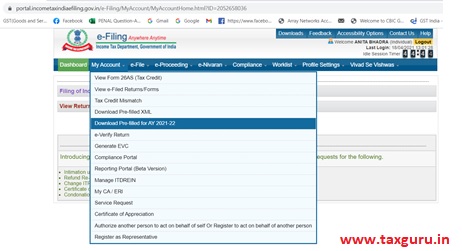

8.3 The tax department has released a step-by-step guide to using the utility. The taxpayer can download the utility and the manual from the e-filing site: –

9. PRE-FILLED DETAILS: The new utility will help taxpayers import prefilled data and edit it before filing the income tax return (ITR). As the tax department will be providing pre-filled data, JSON technology makes the process of extracting data from other sources a lot faster It can handle heavy data in a better way, thus help in avoiding any inconvenience to taxpayers.

9. PRE-FILLED DETAILS: The new utility will help taxpayers import prefilled data and edit it before filing the income tax return (ITR). As the tax department will be providing pre-filled data, JSON technology makes the process of extracting data from other sources a lot faster It can handle heavy data in a better way, thus help in avoiding any inconvenience to taxpayers.

9.1 The taxpayers can download the pre-filled data from the income tax e-filing portal and fill in the rest of the data. The imported prefilled data can be edited to change basic information such as address and all.

10. The taxpayers are advised to wait for filing ITR 1 as the employers and others may not yet file the return for the last quarter of 2020-21. Before filing your ITR 1, please double-check the TDS details mentioned in form 16, form 16A, and Form 26 AS and make sure they match. If there is any discrepancy would have to be sorted out by contacting the TDS deductor.

Disclaimer: The article is for information purposes only.

The author can be approached at caanitabhadra@gmail.com

Is LIC befit recived in FY 2020-21 also taken as income or not

I did not get my refund for Assessment year 2019-20 till today though refund was communicated to me.

Very nice way explaining the procedure to be following for e-filing of the Income-tax Return. Thanks a lot and with Best Wishes, Jagadeesh Bharadwaj

Thanks for your humble comment.

Is there any option to choose NEW REGIME and OLD REGIME in ITR form.

Yes,

Taxpayers other than having business income can select a tax regime at the time of filing a return

I have still not received the refund amount for AY 2020 – 2021… however received the intimation letter in the mnth of Feb 2021

ITDe filing setup does not open. I see a zip file “ITRutility_2021.zip” in “downloads ” folder but no other windows are opening. what is the reason . there are only one PR0 .1.1 not two one for ITR1 and another for ITR4. I am confused.

Right-click on the zip folder and again click on extract here.

Utility 1.1 is for ITR 1 & 4 both

All infomations describe deeply and in a easy way.I appreciate the method of problem solving of Smt.Anita Bhadra.

Thank you sir for your humble comment

Are Post Office Savings Bank Accounts to be shown? They do not have IFSC Codes

Interest income from savings r taxable

IFSC code is not required for the.purpose

Now a Post office in our area in New Delhi has got IFSC code.

My pension is only Rs. 80000/-PA, But main source of income is interst on deposits. It is not possible unless or until interest / Tds deducted shown in 26AS. What is the last date to show interest in 26AS by banks/post office/ financial institutions etc. If after that date. Interest credit shown by banks I shall not be held responsible for less showing interest income.

31st May is the last date for filing returns.( 24Q / 26Q ) by employer/ TDS deductor etc.

Even if bank fails to deduct TDS and it is not reflecting in 26AS , ultimate responsibility is of the individual to pay tax on taxable income