Background :

The United Arab Emirates (UAE), Ministry of Finance has introduced the UAE corporate tax vide Federal Decree Law no. 47 of 2022 on the Taxation of Corporations and Businesses with effect from 1st June 2023 providing the legislature framework for Corporate Tax on Business profit in the UAE.

This decree of law has the 20 chapters & 70 articles.

Since long period UAE has been considered as a tax free regime But for the purpose of line up with the recommendations of implementing Global minimum effective Tax rate under Action No. 2 of the BEPS ( Base Erosion & Profit Shifting) for the neutralising the effects of Hybrid mismatch arrangements, U.A.E. has introduced this decree of law which is known as Corporate Tax.

Taxability :

As per Article no. 2 of this decree of Law, Corporate Tax shall be imposed on taxable income at the rate mentioned below & also payable to the authority under this law:

| Area | Particulars | Rate of Tax |

| Mainland | Below 375000 AED | 0% |

| Above 375000 AED | 9% | |

| Free Zone | Qualifying Income | 0% |

| Non-Qualifying Income | 9% |

Starting of Tax Period:

It is beginning from 1st of June 2023. It will be effective for accounting period starting from 1st June 2023 or after. Those entities whose accounting period beginning after the date of implementation, they have to comply with the provision of this decree of law. But provisions of Article 50 Anti abuse rules will be applied from the date of implementation of corporate tax i.e 1st day of June, 2023.

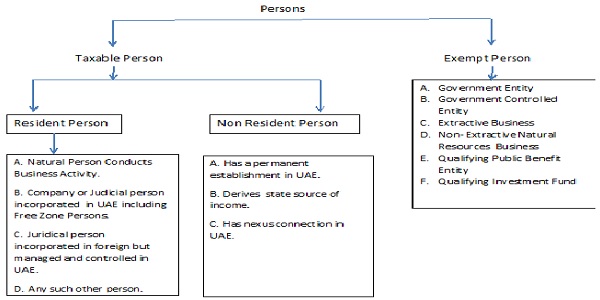

Persons:

Exempt person is the person who would be generally liable to pay tax for the income derived but by virtue of specific provisions contained in this decree of law. These persons are exempted from Corporate Tax after fulfilling the conditions mentioned under the respective Articles.

Exempt person is the person who would be generally liable to pay tax for the income derived but by virtue of specific provisions contained in this decree of law. These persons are exempted from Corporate Tax after fulfilling the conditions mentioned under the respective Articles.

Mode of exemptions:

| Particulars | Exempted |

| Government Entity | Auto exemption |

| Government Controlled Entity | Auto exemption |

| Extractive Business | Auto exemption |

| Non-Extractive Natural Resources Business | Auto exemption |

| Qualifying Public Benefit Entity | On applicaton |

| Qualifying Investment Fund | On applicaton |

Exempted Income :

The following income and related expenditure shall not be taken into account in determining the Taxable Income:

A. Dividends and other profit distributions received from a juridical person that is a resident person.

B. Dividends and other profit distributions received from a participating interest in a foreign juridical person as specified in Article 23 of this Decree-Law.

c. Any other income from a participating interest as specified in Article 23 of this Decree-Law.

D. Income of a Foreign Permanent Establishment that meets the condition of Article 24 of this Decree-law.

E. Income derived by a Non-Resident Person from operating aircraft or ships in international transportation that meets the conditions of Article 25 of this Decree-Law.

Tax Loss

A tax loss can be offset against the taxable income of subsequent tax rate for a indefinite period. There is no restriction for the set off income.

Transfer of Tax Loss:

1. Tax Loss or a portion thereof may be offset against the Taxable Income of another Taxable Person where all of the following conditions are met:

A. Both Taxable Persons are juridical persons.

B. Both Taxable Persons are Resident Persons.

C. Either Taxable Person has a direct or indirect ownership interest of at least 75% in the other, or a third Person has a direct or indirect ownership interest of at least 75% in each of the Taxable Persons.

D. None of the Persons are an Exempt Person.

E. None of the Persons are a Qualifying Free Zone Person.

F. The Financial Year of each of the Taxable Persons ends on the same date.

G. Both Taxable Persons prepare their financial statements using the same accounting standards.

Transfer of tax not allowed

In the following cases tax loss will not be transferred.

A. Where one person is taxable person and another will be exempted person.

B. Where one person is resident juridical person and another person is resident person.

C. Where one person is qualifying free zone and another person is resident juridical person.

D. Where the financial year and on different date.

E. Where both the person prepared the financial statement using the different accounting standard.