Future and Options (F&O) Trading is a popular activity amongst taxpayers due to availability of multiple online trading platforms. The Income Tax provisions on F&O trading need to be analysed carefully.

Meaning of F&O Trading

F&O Trading comprises of trading in futures and options. They are classified under Derivatives. Derivatives are securities whose value is derived from the price of an underlying asset. Futures is a contract made on a trading exchange to buy or sell a security at a predetermined price on a predetermined date and specified time in future. Example: Investor who plans to invest in gold can either buy physical gold or can trade in derivative of gold i.e. enter into a futures contract to trade gold at a predetermined future rate.

Options is a contract between buyer and seller which gives the buyer a right to buy or sell the security on a specific date at an agreed upon price. In Futures, the buyer does not have an option to cancel the contract, thus he may earn profit or incur loss. Whereas under Options, the buyer has the right to cancel the contract if he is incurring losses. Since the buyer has this advantage of exercising right, the buyer is required to pay a premium when he enters into the options contract. Thus, if the buyer cancels the options contract he still has to pay the premium amount.

Calculation of Turnover

Turnover of Futures = Absolute Profit

Turnover of Options = Absolute Profit + Premium on Sale of Options

The applicability of tax audit under the Income Tax Act can be determined from the trading turnover. Under F&O Trading, the turnover for futures is equal to sum of positive and negative differences i.e. absolute profit. The turnover for options is equal to absolute profit plus premium on sale of options.

Example

Mr. X buys 2 contracts of Nifty Futures at Rs.1000 on 20th June. The contract expires on 10th July. Price on 10th July is Rs.500. Realised Loss = 2 * 500 = Rs.1000

Mr.X sells 2 contracts of Nifty Futures at Rs.2000 on 10th July. The contract expires on 30th July. Price on 30th July is Rs.1000. Realised Profit = 2 * 1000 = Rs.2000

Turnover = Absolute Profit = 1000 + 2000 = Rs.3,000

Applicability of Tax Audit

Tax Audit u/s 44AD is applicable if:

1. Taxpayer has incurred loss

OR

2. Trading Turnover exceeds Rs.2 Cr

If Tax Audit is applicable, the taxpayer must appoint a Chartered Accountant in practice to:

- Prepare Financial Statements (P&L-B/S)

- Prepare and file Tax Audit Report (Form 3CD)

- Prepare and file Income Tax Return

Imp: If the taxpayer decides not to claim and carry forward the trading loss, he can avoid the hassle of tax audit.

Income Head, ITR Form and Due Date

- Income Head – PGBP (Profits & Gains from Business and Profession)

Income from F&O Trading is classified as Non-Speculative Business Income for preparation of Income Tax Return - ITR Form – ITR-3 (For individuals and HUFs having Income from Profits and Gains of Business or Profession)

- Due Date to file Income Tax Return for FY 18-19 (AY 19-20)

31st July, 2019 – If Tax Audit is not applicable

30th September, 2019 – If Tax Audit is applicable

Calculation of Income Tax

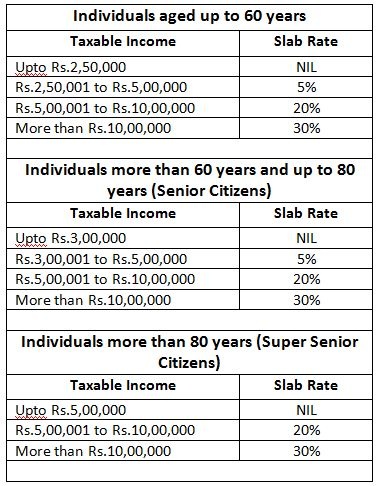

Income Tax is calculated at the prescribed slab rates as per the chart below:

Note: Surcharge is liable on the total income as per the prescribed slab rates. Cess is liable at 4% of (basic tax + surcharge)

Carry Forward of Loss

Loss under F&O Trading can be claimed if Tax Audit u/s 44AD is performed by a professional Chartered Accountant in practice. The loss can be carried forward and set off against future profits to reduce the income tax liability.

Since loss from F&O Trading is a Non-Speculative Loss, it can be carried forward for 8 years. It can be set-off against both Speculative Business Income and Non-Speculative Business Income.

Author is a CA at quicko.com | online tax filing platform

Sir, you mentioned that :- “Imp: If the taxpayer decides not to claim and carry forward the trading loss, he can avoid the hassle of tax audit.”

In this context, can anyone who is having income more than say Rs.500000/- & Loss in F&O Rs.100000. But he doesn’t wish to claim or c/f it. Then can he avoid hassle of tax audit..?

Further to note that, he is not going under presumptive taxation, as already suffered loss.

Sir, you mentioned that, if someone doesn’t wish to claim F&O loss & carry forward it, then there is no hassel of Tax Audit..! Is this true..?

If there are only losses in F&O, which fields are to be filled in ITR 3?

Informative article. but before your first F&O trade you should Always square off your In the Money options positions before expiry.

Informative article. but before your first F&O trade you should Always square off your In the Money options positions before expiry. Otherwise, you will pay a hefty sum as Securities Transaction tax which is unreasonably high.

Hello!

I need to know whether Audit is required in my case where I have a nominal F&O profit (Rs 100 after all the trades) which is less than 6 % of the turnover and the turnover is less than Rs 1 Crore. But my total taxable income (Which includes interest income) is less than Rs 2.5 Lac. So is the audit still needed?

Hi sir/mam, could you please give me example of taxes if i am salaried person of rs 10lakh and do intraday along with frequent delivery trading also and also holds stock for more than a year.

Salary 10 lakh

Intraday profit 60000

Frequent delivery trading 10000

Profit from stock holding more than year 10000

What would be my taxes and in which itr to fill?

What is the use of turnover in tax cal in term for freq. delivery trade and do i neet to get audit done for the same?

Would buying of stocks on daily basis but not selling be consider as frequent delivery trading?

DEAR SIR MY TRADING BUSINESS INCOME IS RS.350000 & MY F&O SHARE LOSS IS RS.816000 I WAS NOT C.F.LOSS & S.OFF THIS YEAR.HOW I WAS 2 BUSINESS INCOME SHOWN IN RETURN PLEASE GUIDE ME-9979186066

Tax audit is not applicable u/s 44AB, even if there is F&O loss(Sec 44AB is amended by FA 2016).

Under which section is tax audit compulsory for catty forward of F&O losses?

Not covered under Sec 44 AB

Nice article, briefly explained. Thank you.

Hello – F&O trading – What would be the revenue and cost of acquisition / purchases when you are preparing the Profit and loss account?

I am salaried person and also income from furture and option . I am filing ITR -3 for AY 2019-20 . Please advise me where should i entry my income form F&O in “Schedule – P&L part-1 (section 64 0r 65)” . I am not considering it presumptive income .and not doing tax auditing .

If the taxpayer incurred only losses while trading in FnO and decides not to claim and carry forward the trading loss, can he choose to fill ITR2 rather than ITR3? Total turnover is approx 20K with losses of 4K.

Thanks.

Is filing of return is must whose income is less than 2.5 lakh in a financial year 2018-19

Sir,

section you have mentioned is to be corrected for tax audit.