Punyakoti Venkatesan BSc, BL, MBA, IRS (Retd)

The intimation process under Section 143(1)(a) of the Income Tax Act has evolved significantly since its inception. Initially governed by Section 23(1) of the Indian Income Tax Act, 1922, which allowed the Income-tax Officer to assess returns without additional evidence, the framework changed with the 1961 Act. The introduction of Section 143(1)(a) in 1971 enabled the Income Tax Officer to make prima facie adjustments for incorrect claims. Subsequent amendments, notably in 1987 and 2008, refined these adjustments, including allowing rectification of arithmetical errors and disallowance of incorrect claims. The Finance Act of 2017 further detailed the adjustment criteria, covering areas like loss carry-forwards, disallowed deductions, and income additions from various forms. Recent changes, including the removal of additional tax in 1999 and refinements up to 2021, reflect a move towards centralized processing by the CPC. The CPC now handles adjustments related to employee contributions, trust exemptions, foreign tax credits, concessional tax regimes, and discrepancies in ICDS reports. These adjustments often lead to disputes, as exemplified by varied tribunal rulings on issues like delayed employee contributions and foreign tax credit claims.

Genesis of Intimation under Section 143(1)(a) of Income Tax Act, 1961

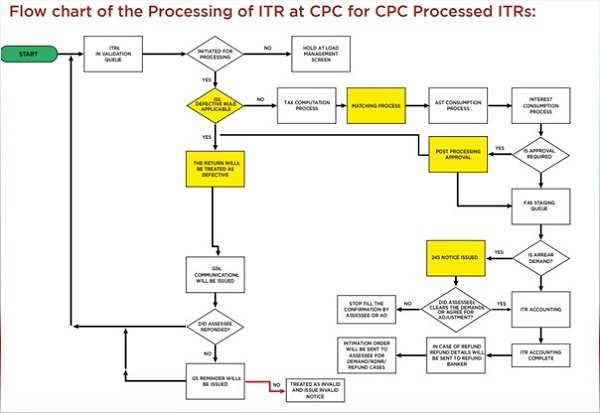

1. When we upload our income tax return on the e-filing portal, the Centralized Processing Centre (CPC) captures and begins processing it through an automated system. The CPC checks for any defects in the return and, if any are found, issues a notice to the taxpayer to correct these issues within 15 days. After this period, the CPC proceeds with processing the return. In most cases, the return is accepted without any further action, and refunds are issued if applicable. However, if there are deficiencies such as incorrect claims, the CPC will make the necessary adjustments and raise a demand after providing necessary opportunity to the tax payers. For sake of reference the flow chart[1] of processing of return of income by CPC is given below:-

2. To understand the evolution of this process of return, let’s look back at the earlier framework. According to Section 23(1) of the Indian Income Tax Act, 1922, if the Income-tax Officer was satisfied that a return filed under Section 22 was correct and complete without requiring the presence of the assessee or any evidence, the total income would be assessed based on the return.

3. Over time, the Income Tax Act of 1961 replaced the earlier Act. With the amendment Act 42 of 1970, Section 143(1)(a) was introduced w.e.f 1.4.1971, allowing the Income Tax Officer to make prima facie adjustments for incorrect claims and to allow claims that were not initially made by the taxpayer in the return.

4. The Direct Tax Laws (Amendment) Act 1987 w.e.f 1.4.1989 introduced significant amendments to Section 143(1)(a), allowing the Assessing Officer to make various adjustments during the summary assessment of income tax returns. If the return indicates any tax or interest due, this amount will be quantified, and an intimation will be issued to the taxpayer, which is considered a demand notice under Section 156 of the Income Tax Act. Similarly, if a refund is due, it will be issued to the taxpayer. The Assessing Officer was also empowered to make the following adjustments under Section 143(1)(a):-

(i) any arithmetical errors in the return, accounts or documents accompanying it shall be rectified;

(ii) any loss carried forward, deduction, allowance or relief, which, on the basis of the information available in such return, accounts or documents, is prima facie admissible but which is not claimed in the return, shall be allowed;

(iii) any loss carried forward, deduction, allowance or relief claimed in the return, which, on the basis of the information available in such return, accounts or documents, is prima facie inadmissible, shall be dis-allowed:

If these adjustments result in an increase in income or a reduction of declared losses, the Assessing Officer could levy an additional tax at a rate of 20% on such adjustments.

5. However, starting April 1, 1999, the additional tax of 20% was removed, and the department was instructed to process returns without making prima facie adjustments.

6. The Finance Act of 2008 brought about a major change by establishing centralized processing of income tax returns, granting the power to make the following adjustments:

(i) any arithmetical error in the return; or

(ii) an incorrect claim, if such incorrect claim is apparent from any information in the return;

7. The Finance Act of 2017 further amended Section 143(1)(a), outlining six specific circumstances under which adjustments could be made by the Assessing Officer:

(i) any arithmetical error in the return; 13[***]

(ii) an incorrect claim, if such incorrect claim is apparent from any information in the return;

14[(iii) disallowance of loss claimed, if return of the previous year for which set off of loss is claimed was furnished beyond the due date specified under sub-section (1) of section 139;

(iv) disallowance of expenditure indicated in the audit report but not taken into account in computing the total income in the return;

(v) disallowance of deduction claimed under sections 10AA, 80-IA, 80-IAB, 80-IB, 80-IC, 80-ID or section 80-IE, if the return is furnished beyond the due date specified under sub-section (1) of section 139; or

(vi) addition of income appearing in Form 26AS or Form 16A or Form 16 which has not been included in computing the total income in the return:

These adjustment provisions are still in effect, with only Clause (v) amended to encompass all Chapter VIA deductions without from 1.4.2021 which is reproduced below:-

(i) any arithmetical error in the return;

(ii) an incorrect claim, if such incorrect claim is apparent from any information in the return;

(iii) disallowance of loss claimed, if return of the previous year for which set off of loss is claimed was furnished beyond the due date specified under sub-section (1) of section 139;

(iv) disallowance of expenditure [or increase in income] indicated in the audit report but not taken into account in computing the total income in the return;

(v) disallowance of deduction claimed under [section 10AA or under any of the provisions of Chapter VI-A under the heading “C.—Deductions in respect of certain incomes”, if] the return is furnished beyond the due date specified under sub-section (1) of section 139; or

(vi) addition of income appearing in Form 26AS or Form 16A or Form 16 which has not been included in computing the total income in the return:

8. It has been observed that the Central Processing Centre (CPC) primarily conducts a majority of its adjustments by utilizing sub-clauses (ii) and (iv) of clause (a) of subsection (1) of Section 143 of the Income Tax Act. Here are some of the key and frequently made adjustments by the CPC:-

| a) Addition of delayed employees contributions to PF/ESI beyond the due dates specified in the respective Acts in accordance with provisions of Section 36(1)(va) of the Income tax Act.

(b) Disallowance of exemptions claimed under Sections 11 and 10(23C) of the Income Tax Act due to the non-filing/delayed filing of audit reports in Form 10B/10BB in the case of trusts. (c) Denial of deductions under Section 80P for not filing the income tax return within the due date specified in Section 139(1). (d) Denial of foreign tax credit due to non-filing or delay in filing Form 67. (e) Rejection of claims for concessional tax regimes under Sections 115BAA/115BAC due to the omission or delay in filing Form 10IC/10IE. (f) ICDS Adjustments – Adjustments are made by the CPC due to discrepancies between the Income Tax Return (ITR) and the Tax Audit Report (TAR). (g) In Commission Agent cases (Katcha Aratia) – Income reflected in Form 26AS is taxed by the CPC, whereas taxpayers argue that the income earned from sales on behalf of farmers should not be taxable as they are only commission agents. Taxpayers assert that only the commission income should be taxed. |

Given that the adjustments mentioned above frequently occur during the processing of income returns, it is proposed to examine these issues in greater detail as follows:

a. Addition on account of Delayed Employees Contributions to Provident Fund (PF) or Employees’ State Insurance (ESI)

Under Section 36(1)(va) of the Income Tax Act, delayed employees contributions made towards the Provident Fund (PF) or Employees’ State Insurance (ESI) beyond the specified due dates are treated differently. The Central Processing Centre (CPC) adjusts these contributions by referring to the details in Form 3CD, particularly Clause No. 20(b), which indicates both the due date and the actual payment date. If the payment date is later than the due date, the CPC treats the delayed contributions as income under Section 2(24)(x) in conjunction with Section 36(1)(va), resulting in the taxpayer losing the deduction for these delayed contributions.

On the other hand, taxpayers argue that the payment details in Form 3CD are only for disclosure and that the Assessing Officer should not make any adjustments based on either sub-clause (ii) or (iv) of Section 143(1) of the Income Tax Act. Additionally, taxpayers argue that the Supreme Court’s recent decision in the case of M/s Check Mate Services P Ltd[2] should not be applied to make adjustments under Section 143(1).

The revenue’s position is that the Supreme Court’s decision is binding and represents the law of the land, which should be applied to adjustments for delayed employee contributions under Section 36(1)(va). Whether such an adjustment can be made under Section 143(1)(a) remains unsettled. Various tribunals have issued conflicting rulings on this issue.

For instance, the Ahmedabad Tax Tribunal has clarified that the Supreme Court’s decision in Check Mate Services P Ltd is applicable to all proceedings, including those under Section 143(1). In contrast, the Jaipur Tax Tribunal in the case of Paris Elysees India Private Limited[3] ruled that adjustments for employee contributions to PF and ESI under Section 36(1)(va) are not permissible under Section 143(1). Conversely, the Mumbai Tax Tribunal in the case of PR Packaging Services[4] determined that disallowing employee contributions to PF while processing returns under Section 143(1) is inconsistent with the provisions of the Income Tax Act, as such disallowance does not fall within the scope of prima facie adjustments.

(b) Disallowance of Exemptions Under Sections 11 and 10(23C) Due to Non-Filing of Audit Reports

Charitable and educational trusts are required to file audit reports in Form 10B or 10BB, respectively, within the deadline specified under Section 139(1) of the Income Tax Act. Failure to file these reports on time results in the Central Processing Centre (CPC) disallowing the exemptions claimed under Sections 11 and 10(23C).

To address this issue, taxpayers can request the concerned jurisdictional Commissioner of Income Tax (Exemption) to condone the delay in filing Form 10B or 10BB, in accordance with Board Circulars issued from time to time as per section 119(2)(b) of the Income Tax Act. The details of Circulars issued by the Board is tabulated below:-

| A.Y | Condonation of delay in filing | Board’s Circular No. | Date |

| 2016-17 | Form No.10BB | Circular No.19/2020 in F.No. 197/135/2020-ITA-I | 03.11.2020 |

| Prior to A.Y 2018-19 | Form No.10B | Circular No. 10/2019 F.No.197/55/2018/ITA | 22.05.2019 |

| 2018-19 | Form No. 10BB | Circular No. 15/2022 in F.No. 197/89/20222-ITA -1 | 19.07.2022 |

| 2018-19 | Form 10B | Circular No. 16/2022 in F. No. 197/89/2022-ITA-1 | 19.07.2022 |

| Circular No,. 2/2020 in F.No. 197/55/2018-ITA I | 03.01.2020 | ||

| 2018-19 and subsequent years | Form No. 10BB | Circular No.15/2022 in F.No. 197/89/2022-ITA-I | 19.07.2022 |

| A.Y. 2018-19 and subsequent years | Form No. 10B | Circular No. 16/2022 in F.No. 197/89/2022-ITA-I | 19.07.2022 |

However, if the matter is appealed to the appellate authorities, no relief is typically granted since the power to condone delays does not lie with these authorities.

(c) Denial of Deductions Under Section 80P Due to Late Filing of Income Tax Return

To allow the deduction u/s 80P return should be filed within due date and the 80P schedule should be filled correctly and relevant income should be available in the return of income after the adjustment of losses

The Finance Act of 2018 amended Section 80AC of the Income Tax Act to stipulate that no deduction can be claimed unless the taxpayer files the return of income by the due date specified in Section 139(1). Consequently, if there is a delay in filing the income tax return, the Central Processing Centre (CPC) will disallow the deduction during the return processing under section 143(1).

To obtain the deduction despite the delay, the taxpayer must request the competent authorities to condone the delay in filing the return under Section 119(2)(b) of the Income Tax Act, following Board Circular No. 13/2023-Income Tax dated July 26, 2023. This circular applies to assessment years 2018-19 to 2022-23.

(d) Denial of Foreign Tax Credit Due to Non-Filing or Delays in Filing Form 67

When processing income tax returns, the Central Processing Centre (CPC) may reject a claim for Foreign Tax Credit (FTC) if Form 67 is not filed before the return of income. Effective April 1, 2022, the amended Rule 128(9) stipulates that Form 67 must be filed on or before the end of the assessment year relevant to the financial year in which the income was offered or assessed to tax in India, and the return of income must be submitted within the due dates prescribed under Section 139(1) or 139(4). According to these amended provisions, taxpayers can claim FTC if the return of income is filed before the end of the assessment year.

Various appellate authorities have ruled that income tax rules cannot override the provisions of Double Taxation Avoidance Agreements (DTAA), thus making the filing of Form 67 a procedural requirement rather than a mandatory one. Nonetheless, the CPC will deny FTC if the return is not filed by the end of the assessment year for returns related to assessment year 2022-23 and onward. For earlier years, FTC claims will be denied if the return is not filed within the time limits specified under Section 139(1).

In a recent decision by the Madras High Court in the case of Doraiswamy Kumarasamy[5], the court agreed with the taxpayer’s arguments. The court ruled that if Form 67 is filed before the final assessment order is issued, it constitutes sufficient compliance for allowing the FTC claim. The High Court noted that rules are meant to implement the provisions of the Income Tax Act and are directory in nature, and remanded the matter for granting due credit for the FTC claimed.

(e) Rejection of Claims for Concessional Tax Regimes Under Sections 115BAA/115BAC Due to Omission or Delay in Filing Form 10IC/10IE

The Central Processing Centre (CPC) may deny claims for concessional tax regimes under Sections 115BAA and 115BAC if taxpayers fail to file Form 10IC or Form 10IE before submitting their income tax return under Section 139(1).

Section 115BAC, introduced in the 2020 Budget, provides individuals and Hindu Undivided Families (HUFs) the option to pay income tax at lower rates. This new tax regime became effective from the financial year 2020-21 (assessment year 2021-22). Until the financial year 2022-23 (assessment year 2023-24), the old tax regime was the default, and the new regime was optional. Taxpayers opting for the new tax regime were required to file Form 10IE before filing their income tax return. In the recent case of Akshay Devendra Birari vs. DCIT[6], the ITAT Pune, ruled that although Form 10IE was filed on January 10, 2024, after the CPC had processed the return under Section 143(1)(a), the CPC should have considered the form since it was available. The ITAT determined that filing Form 10IE is a directory requirement, not mandatory, and directed the CPC to amend the intimation to reflect the benefit of the new tax regime.

It is important to note that the 2023 Budget amended the tax provisions to make the new tax regime the default starting from the financial year 2023-24 (assessment year 2024-25). Consequently, Form 10IE has been discontinued from this assessment year. Taxpayers wishing to revert to the old tax regime must now file Form 10IEA.

Under Section 115BAA, domestic companies have the option to pay tax at a concessional rate of 22% (plus applicable surcharge and cess) provided they forgo specified deductions and incentives. Companies could opt for this rate from the assessment year 2020-21 by filing Form 10IC within the prescribed time limit. For assessment year 2020-21, the CBDT issued a circular No. (F.No. 173/32/2022-ITA-1 dated March 17, 2022) allowing for the condonation of delays in filing Form 10IC under the following conditions:

i) The income tax return for the assessment year 2020-21 was filed by the due date specified under Section 139(1).

ii) The company opted for taxation under Section 115BAA in “Part A-GEN” of Form ITR-6.

iii) Form 10IC was filed electronically by June 30, 2022, or within three months from the end of the month in which this circular was issued, whichever is later.

Taxpayers can seek condonation for the assessment year 2020-21 based on this circular from the concerned Assessing Officer with rectification application or appellate authorities. Similarly, the CBDT has issued a Circular No. 19/2023 for A.Y. 2021-22 on 23.10.2023 in F.No.173/32/2022-ITA-1 for condonation of delay in filing Form 10IC.

(f) ICDS Adjustments: The CPC makes adjustments due to discrepancies between the Income Tax Return (ITR) and the Tax Audit Report (TAR) under Section 143(1).

These adjustments are based on details captured in Clause 13(e) of Form 3CD. In some cases, taxpayers have claimed ICDS (Income Computation and Disclosure Standards) adjustments in Schedule BP of the income return, but these adjustments are not reflected in Schedule ICDS. Taxpayers must ensure that amounts in Schedule BP are adjusted according to ICDS standards and that these adjustments are properly recorded in Schedule ICDS. Failure to do so may lead to incorrect reflection of profit decreases or loss increases resulting from ICDS application. Adjustments in this area often arise from errors in completing Schedules BP and ICDS. Taxpayers can appeal to the first appellate authority or the assessing officer with the necessary documentation, and relief is often granted after reconciliation.

(g) Commission Agent Cases (Katcha Aratia): Income shown in Form 26AS is taxed by the CPC, but taxpayers argue that income earned from sales on behalf of farmers should not be taxable, as they are merely commission agents. They contend that only the commission income should be taxed. When processing ITR under Section 143(1), if the gross receipts reported in the ITR do not match the TDS claim, the TDS credit is restricted according to Rule 37BA read with Section 199 of the Act. Taxpayers must provide the necessary information in the ITR to address this discrepancy and make the appropriate adjustments. For cases of shortfall in TDS credit, taxpayers can approach the assessing officer with rectification applicaiton or first appellate authorities with the relevant reconciliation and documents. Many first appellate authorities grant relief to taxpayers in such cases. In the recent case of Kanjula Rajagopal Reddy Firm vs. ITO[7], the ITAT Visakhapatnam, ruled that a Katcha Aratia’s turnover should include only the gross commission and not the sales made on behalf of their principals. The ITAT confirmed that since the assessee is a licensed commission agent under the Agricultural Market Committee Yard, Guntur, the CBDT Circular applies, and the entire amount of TDS deducted should be credited to the assessee. The orders of the Revenue Authorities were set aside, and the assessing officer was directed to grant full TDS credit.

[1] Hand Book for Tax Consultants/Tax Payers, November 2020 – CPC, Income Tax Department.

[2] 2022 SCC On Line SC 1423

[3] ITA No.357/JPR/2022 dated 20.02.2023

[4] ITA No. 2376/MUM/2022 dated 07.12.2022

[5] Duraisamy Kumarasamy Vs PCIT in W.P No. 5824 of 2022 dated 6.10.2023

[6] ITA No. 782/PUN/2024 dated 05.05.2024

[7] ITA No. 59/VIZ/2024 dated 27.03.2024