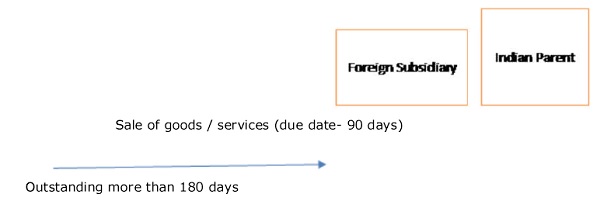

This article mainly covers Accounts Receivable Overdue for more than 180 days in international transaction whether considered as subject to transfer pricing provisions? Here author has analyse this issue with the help of various case laws and related definitions

Page Contents

A. Concept of overdue receivable in International transaction and Notional interest

Transfer Pricing regulation as inserted by way of a clarification in Finance Act, 2012 retrospectively with effect from 1.4.2002 under Sec. 92B of the Income Tax Act, states that the international transaction shall include: –

(c) Capital financing, including any type of long-term or short-term borrowing, lending or guarantee, purchase or sale of marketable securities or any type of advance, payments or deferred payment or receivable or any other debt arising during the course of business.

From the above clarification inserted in the Income Tax Act, it is clear that Receivable is an international transaction. However there still exists ambiguity as to: –

– Whether non-payment for sale of goods or services availed from the Indian Company be termed as “deemed loan”

– If so, whether a “deemed interest” is permissible under the garb of the “international transaction” above.

Also, the notional interest levied on accounts receivable over due from associated enterprises under the premises of a loan facility and the TP adjustment has been litigated across courts in India, retrospectively. Recently, the Supreme Court in Bechtel India Pvt Ltd [TS-591-SC-2017-TP] by setting aside the case at the SLP stage itself has clarified that there is no question of law for TP adjustment to be made for overdue Accounts Receivable.

The issue before court was whether the accounts receivable for the goods sold or services rendered qualify as an international transaction. The courts expressed their disagreement clearly by stating that the outstanding moneys receivables out of a sale transaction cannot be treated as a loan facility advanced to the Associated Enterprise. The court held that it cannot be treated as a standalone transaction as it originates from the sale transaction which has been subjected to transfer pricing bench marking with comparable companies. The court also held that receivable mentioned under Explanation to Sec. 92B does not mean accounts receivable and thus the outstanding balance cannot be treated as an independent transaction for transfer pricing audit.

This implies that the receivable mentioned under clause (c) (capital financing including….) apply to the loan funds only. Hence, the charging of interest is applicable only with the lending or borrowing of funds and not in the case of commercial over-dues which is already subjected to transfer pricing. Also, rate of interest charged on loan granted cannot be used as comparable for charging interest on outstanding trade receivables, even if applicable as per the contract. Also, that the trade receivables has a different business perspective altogether and interest on overdue is only an incidental activity to the main activity of sale or purchase of goods or provision of services.

B. Analysing with definition of transaction and closely linked transactions

Further, as per Rule 10A (d), “Transaction” includes a number of closely linked transactions. Closely linked transactions shall be those transactions which arise out of a continuing transaction or where the determination of the price of a transaction is dependent on the other transaction. For example, if the sale price of a commodity is fixed taking into account the credit period given to the customer factoring the working capital cost attached thereto, then for the purpose of determining the ALP, the closely linked transaction should be aggregated and clubbed together. Here the transactions are influenced by each other and particularly in determining the price and profit involved therein. Hence, the two set of transactions can safely be regarded as closely linked transactions. This also implies that the credit period extended to the AE cannot be treated as a transaction stand-alone without considering the main transaction of sale.

C. Judicial Pronouncements relating to overdue receivable in International transaction and Notional interest

Delhi HC, in Kusum Healthcare (P.) Ltd [TS-412-HC-2017(DEL)-TP] held that if ALP of the main sale transaction computed under TNMM is accepted, no separate adjustment on account of outstanding receivables can be made. In this case, the assessee had demonstrated that the impact of extended credit period on working capital was factored in the pricing / profitability. This makes it amply clear that there is no tax leakage or evasive tactics adopted by the taxpayer while transacting with the AE.

In the recent case of Bechtel India Pvt Ltd [TS-591-SC-2017-TP], the SC set aside the SLP filed by the department challenging Delhi HC for AY 2010-11. The Delhi HC had confirmed ITAT order deleting interest adjustment on AE- receivables and noting that the assessee was a debt free company.

Delhi High Court in CIT vs. EKL Appliances Ltd. [(2012) 345 ITR 241] held that if the receivables is factored in the working capital adjustment and arrived at the arms-length nature for the sale transaction, further adjustment to the interest on delayed payment will distort and re-characterize the transaction bench marked itself.

It is thus understood that TPO should go through the series of transactions for multiple years and see whether there is a substantial gap between the receipts and outstanding receivables to deliberately park the funds for working capital requirements of the Associated Enterprise. Also, a clear understanding of the business model, market dynamics and third party receivables will help in arriving at a conclusion to deem the Accounts receivable as an advance subject to interest charge. However, still the larger argument of closely linked transaction hangs on top.

In Contitech India Pvt Ltd [TS-851-ITAT-2016(DEL)-TP], Tribunal held that the TPO re-characterizing the delay in receipt of receivables as unsecured loans advanced to the Associated Enterprise, charging interest @ 13.25% on the period of delay exceeding 45 days and accordingly proposed interest adjustment of Rs.18.70 lakhs is unwarranted, as the assessee earned higher profitability when compared with third party comparable companies.

In Rusabh Diamonds [TS-145-ITAT-2016(Mum)-TP], Mumbai ITAT held that “as long as sale is benchmarked on TNMM basis… there cannot be any occasion to make a separate adjustment for delay in realization of debts”. Further while considering the question whether the Explanation to Sec 92B inserted by Finance Act, 2012 was indeed retrospective in effect, it observed that, “Quite clearly…just because a provision is stated to be clarificatory, it does not become entitled to be treated as ‘clarificatory’ by the judicial forums as well”. ITAT also opined that even though the amendment was inserted as ‘clarificatory’ in nature, it increases / expands the scope of international transaction u/s 92B and thus “there is no way it could be implemented for the period prior to this law coming on the statute i.e. 28th May 2012” . It also held that since the AY in present case i.e. AY 2009-10 was prior to that date, holds that amended provisions of Sec 92B are inapplicable.

In Msource (India) Pvt Ltd [TS-581-ITAT-2017(Bang)-TP], Tribunal opined that the transaction needs to be looked into from the angle that if the same transaction was carried out between the two independent and unrelated parties whether any interest was being charged on such outstanding amount beyond 180 days. ITAT clarified that “If an identical transaction between non-related party is capable of generating income then the agreement between the related parties cannot be considered as a relevant factor for deciding the issue whether this transaction has generated any income or not.”

D. Conclusion

It can be fairly concluded from the above judicial pronouncements that the receivable mentioned in the Explanation to Sec.92B can be taken up for transfer pricing scrutiny only when it is a standalone activity or a demonstrated approach is adopted by the assessee to use Accounts Receivable to have free working capital funding. A wild argument that had the funds been received in time and deployed would have earned interest income shall hold water only when the original transaction of sale or services provided to the Associated enterprise was benchmarked under CUP method and not subjected to TNMM wherein the net margin earned was exposed with appropriate working capital adjustment to comparable companies. Also, it is to be seen if the government would clarify the position by a circular to put to rest, the notional interest computation by the TPO on Accounts Receivable from Associated Enterprises.

(The opinions expressed in this article are the author’s personal views.)

(Republished with Amendments)