How to Track GST Refund Application Status on GST Portal and PFMS portal

1. The functionality to track the status of refund application has been available on the GST portal. By utilising this functionality, the taxpayers can know the stage at which the refund application is pending with the tax-officer/ taxpayer.

2. A tax officer can issue payment order only after Public Financial Management System (PFMS) has validated the bank account mentioned in the refund application (RFD-01). Similarly, final disbursement of refund amount sanctioned by the tax officer happens only after (PFMS) has validated the bank account mentioned in the payment order (RFD-05). Thus, validation of bank account takes place at two stages. However, the exact detailed status of bank account validation is not available on the GST Portal.

3. The Public Financial Management System (PFMS) of the Controller General of Accounts (CGA) has made available a central portal to track the status of bank account validation and disbursal of refund amount. By visiting the PFMS portal at https://pfms.nic.in/static/NewLayoutCommonContent.aspx?RequestPagename=Static/GSTN_Tracker.aspx the taxpayer can track the status of bank account validation.

4. This advisory is being issued for the benefit of the taxpayers in order to make them aware of the ways in which they can track the status of their refund applications on both the Portals.

Tracking GST Refund Application Status on the GST Portal and PFMS portal

1. Introduction:

1.1 The functionality to track the status of refund application has been available on the GST portal https://www.gst.gov.in. Now, the Public Financial Management System (PFMS) of the Controller General of Accounts (CGA) has also made available a central portal to track the status of bank account validation and disbursal of refund amount. This advisory is being issued for the benefit of the taxpayers in order to make them aware of the ways in which they can track the status of their refund applications.

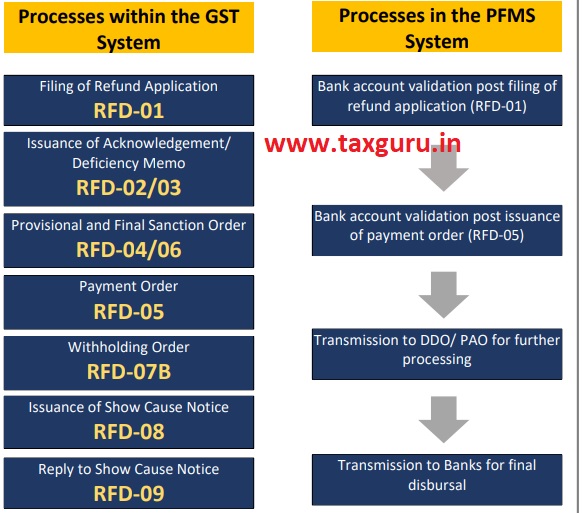

1.2 The refund process under GST consists of two parts:

I. Processing of refund application by the tax officer and

II. Bank account validation by PFMS at two stages:

a) After filing of refund application (RFD-01) by the taxpayer

b) After issuance of payment order (RFD-05) by the tax officer

(Note: For better understanding, please refer to the illustration provided below)

1.3 Stage a) and stage b) in para above are interlinked with the processing of refund application by the tax officer. A tax officer can issue payment order only after PFMS has validated the bank account mentioned in the refund application (RFD-01). Similarly, final disbursement of refund amount sanctioned by the tax officer happens only after PFMS has validated the bank account mentioned in the payment order (RFD-05). Thus, validation of bank account takes place at two stages.

1.4 The taxpayers can track the status of their refund application on:

I. The GST Portal for knowing the exact stage at which the refund application is pending with the officer/ taxpayer

II. The PFMS portal for knowing the status of bank account validation/ disbursal

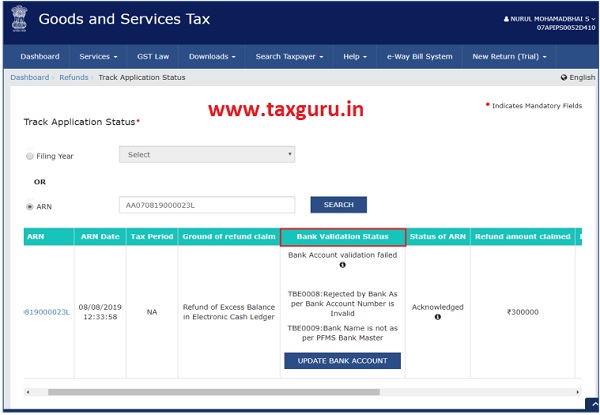

2. Tracking the Status of Refund Application on the GST Portal

2.1 For tracking the status of application on the GST Portal the following steps need to be followed:

(i) To track your submitted refund application, login to the GST Portal and navigate to Services > Refunds > Track Application Status command.

(ii) Track Application Status page is displayed. Select the Filing Year from the drop-down list or enter the ARN & then click the SEARCH button.

(iii) The search results are displayed.

(iii-a) Use the scroll bar and move to the right, to view further details related to the search criteria.

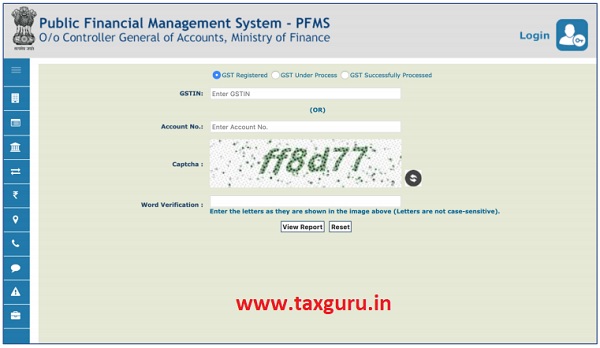

3. Tracking the status of bank account validation on the PFMS Portal

3.1 Once the taxpayer files refund application in form RFD-01, PFMS validates the bank account mentioned in the refund application. Only after successful validation of the bank account, the tax officer can issue payment order in form RFD-05. After issuance of RFD-05 also, PFMS validates the bank account mentioned in the payment order. After successful validation, internal processing for payment takes within place PFMS that includes DDO/ PAO approval, online scroll generation and onward submission to banks for final disbursal.

3.2 For tracking the status of bank account validation on the PFMS Portal the following steps have to be followed:

(i) To track the status of bank account validation go to the link provided below:

https://pfms.nic.in/static/NewLayoutCommonContent.aspx?RequestPagename=Static/GSTN_Tracke

r.aspx

(ii) If you want to check the status of your bank account validation after you have filed RFD-01, select the ‘GST Registered’ button on the screen, enter your GSTIN or Account Number and click on ‘View Report.

(iii) The status of validation appears

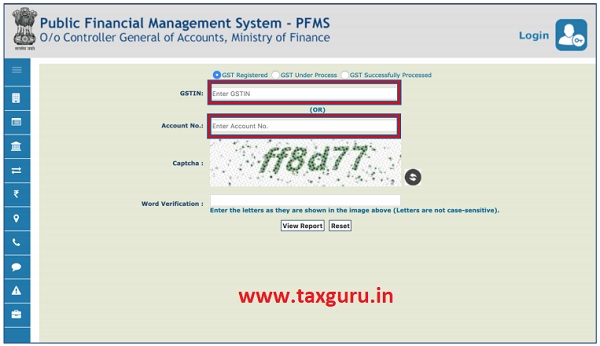

(iv) If you want to check the status of your bank account validation after the tax officer has issued the payment order (RFD-05), select the ‘GST Successfully Processed’ button on the screen and enter your GSTIN or Account Number and click on ‘View Report’.

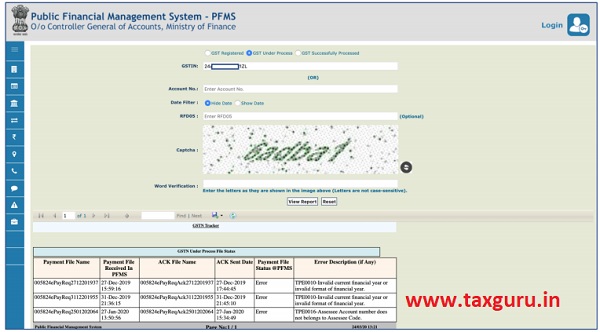

(v) If you don’t find the record under ‘GST Successfully Processed’ it means validation has failed. You can select the ‘GST Under Process’ button on the screen and enter your GSTIN or Account Number and click on ‘View Report’. The error descriptions for validation failure shall appear.

(Note: If the error in bank account validation is on account of a technical error during file exchange, the GST System will correct it and send it to PFMS for revalidation. However, if there is a failure on account of incorrect bank account details, the taxpayer is required to update the bank account in the refund application and tax officer will have to re-issue the payment order RFD 05.)

Bank Account has been validated at first stage by PFMS on 23.02.2023 but not yet received.

showing disbusement sent to pfms ,how many days normally to get credit in our account plz,,,

i have recived rfd-05 but error show on pfms, error is (Refund of the taxpayers has not processed due to the error in other record in file. It would be processed for payment shortly by the PFMS as and when it will be received from the GSTN.) now what i can do…plz help

is the problem resolved? if resolved, how it is resolved? Please let me know on this mail id: sjrmys@gmail.com

Your problem is resolved regarding error on PFMS site for error in record in file while processing GST refund. As we also got same error

Hi, we have mentioned about following error how this error got resolved can you pls help me as I am also getting same error.

i have recived rfd-05 but error show on pfms, error is (Refund of the taxpayers has not processed due to the error in other record in file. It would be processed for payment shortly by the PFMS as and when it will be received from the GSTN.) now what i can do…plz help

my bank accounts showing failed for the some period already we have received our refund in the same account for the another period.

right now again we have updated our account no. on gst portal , for the last 3 days still showing the bank account validation pending at PFMS.

PFMS how much time will taken for the again revalidation account no.

plzz suggest us sir.

Its take 3-4 days but plz chack in your bank account you update your KYC and gst cartifect then its ok

Payment order for GST Refund RFD05 has been issued but still amount has not been disbursed. how to check the status of Payment in PFMS ?

PFMS rejected my gst with payment of igst refund and no error in discription find.

And last refund accepted but this time rejected refund. Please any have next procedure of this or any contact detail of this.

My status is “rfd-05 not issued”. What should i do now? There are no actions advised.

very useful article