Introduction:

Often, we pay GST to the vendor from whom we purchase goods or avail services. It is the consumer who bears the burden of ending up paying GST and it becomes a cost to them. However, in some cases, the burden of paying GST does not lie on the consumer. What are those cases? How is it possible that the burden completely shifts on the goods or service provider?

The GST Act states that certain transaction of Goods and Services are liable to reverse charge. Reverse charge mechanism means that the liability of GST is to be borne by the recipient or provider of the service. The list of goods or services that needs to be charged on Reverse charge mechanism has been notified by the Central Board of Indirect tax and Custom(CBIC) with recommendation of GST Council and the list is an inclusive list. One of the services mentioned in the list is services provided by way of renting of motor vehicle, either by a body corporate or a normal consumer booking a cab through E-Commerce operators such as Ola, Uber, etc. The definition of motor vehicle as per the Act is it must be designed to carry passengers.

In this article we would be understanding about the applicability of reverse charge mechanism including conditions applicable on such services.

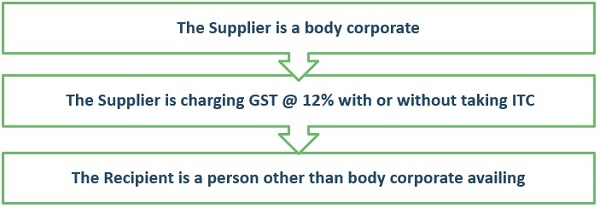

Conditions where RCM is not applicable

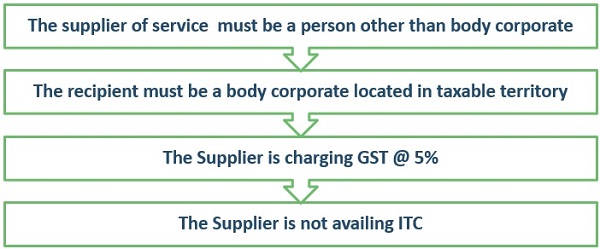

Conditions where RCM is applicable: –

Conclusion: –

By introducing this service in the list of RCM, the supplier has been provided with the option of either charging GST @ 5% or 12%. The supplier on the basis of their convenience can charge GST as both has their pro and cons, if supplier charges GST @ 5% then the supplier cannot claim ITC and also if the recipient of service is a body corporate then the recipient would be liable to pay tax on RCM basis. Whereas if the supplier charges GST @ 12% then the supplier can claim ITC of all purchases including purchase of motor vehicle.

******

(This article represents the views of the authors only and does not intent to give any kind of legal opinion on any matter)

Authors:

Kushal Mehta | Consultant | +919930612247 | kushal.mehta@masd.co.in

Parth Bhikadiya | Associate Consultant| +918355882127|parth.bhikadiya@masd.co.in