♦ Introduction:

When a Company’s business activities are distributed evenly across various states both on input side and output side, then the company shall be able to utilise the input-tax credit on inward supplies in each such state while offsetting it against tax on outward supplies made from each such state. However, in many cases, a Company’s business activities are unevenly distributed across various states as illustrated in the below example

Example:

ABC Limited has Head office in Maharashtra and has 2 more registrations at Gujarat and Delhi. HO i.e. Maharashtra has availed certain audit services & IT Solution Services. However, such audit services & IT Solution Services shall be used at both the locations i.e., Gujarat & Delhi. The HO has paid GST on such services and has availed ITC for the same. However, it has no outward supplies of its own resulting into accumulation of ITC and thus blocking of working capital of the company. To prevent this loss/underutilisation of credit, the Company should go for cross charge under GST i.e. HO should raise invoice on other units for supply of services and pass on the ITC to other units.

We intend to simplify the concept of cross charge through this article.

♦ What’s the concept of cross charge?

The units of a Company (i.e., units having same PAN) registered under GST Law in more than one state, shall be considered as distinct persons for the purpose of GST. Accordingly, any supply of goods or services or both between distinctpersons, even without consideration, shall be leviable to GST. Accordingly, any support service, including accounting, other administrative services, given by the Corporate Office to branches (or vice versa)shall be construed as supply of services, even though there shall not be any monetary outflow among branches of a business. This acts as a boon for the companies facing problem of accumulation of ITC (as discussed above).

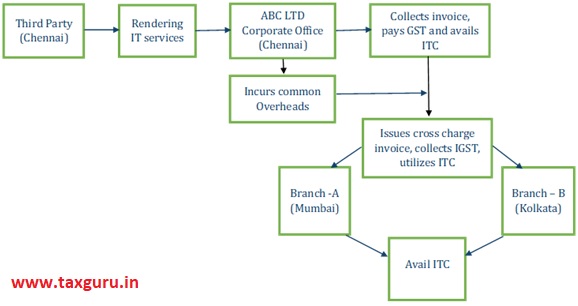

This could be better understood with the help of an example:

♦ Value of supply of services between HO and other locations under cross charge:

The value of the supply of goods or services or both between distinct persons or where the supplier and recipient are related, other than where the supply is made through an agent, shall be computed on the basis of following methods in the sequence as specified:

– Open market value of such supply

– Value of supply of like kind or quality

– 110% of cost of acquisition of such goods or cost of provision of such services or

– Any other reasonable means

Provided that where the recipient is eligible for full input tax credit, the value declared in the invoice shall be deemed to be open market value of the goods or services.

♦ Calculation of Cross charge

The basis for cross charging of common expenses to different units would be very subjective and depends upon the industry practice. However, a standard approach could be taking taxable turnover made by concerned units. Some other basis of cross charge could be the number of employees, space, plant capacity utilization, etc.

♦ Comparison between ISD and Cross charge

- In ISD only ITC on input services which are attributable to other distinct entities are distributable: No element of service, but mere distribution. In a cross-charge mechanism, expenses incurred by a distinct person for the purpose of carrying out activities the outcome of which benefits other distinct persons is required to be cross charged as there is an element of service.

- Separate registration is required for ISD. However, no separate registration is required for cross charge.

- ISD registration is taken only for those locations which does not provide any services but are only billed to for the common/ specific services. However, in case the said location makes any supply of goods and services, cross charge shall be required.

♦ Conclusion:

The Input Tax Credit on common expenses like audit charges, consultancy, etc. may be either distributed via ISD or transferred via cross charge. However, for supplies made between distinct taxable persons, cross charge is the only option. Cross Charge Mechanism is meant to simplify the credit taking process for entities and to strengthen the seamless flow of credit under GST.

It offers flexibility and is also the only mechanism that can be employed for the distribution of credits related to goods and capital goods.

Authors:

Shreyans Dedhia | Partner|Email:shreyans.dedhia@masd.co.in

Anuj Pai | Associate Consultant|Email:anuj.pai@masd.co.in

Sutishna Dhanuki | Associate Consultant|Email: sutishna.dhanuki@masd.co.in

nice article