What is Merchant Export?

Merchant Export is a popular term used in Foreign Trade, is a method of Trading Export which is equally important to the manufacturer-exporter. The person who is engaged in the merchant export is called as ‘Merchant Exporter‘.

“Merchant Exporter” means a person engaged in trading activity and exporting or intending to export goods. They may not have their own manufacturing unit or processing facility.

Merchant Exporters are instrumental in a boosting of country’s exports especially products from MSME and small manufacturers. Merchant exports generates the foreign exchange for the Country like normal exports and is mainly engaged in export of goods and not services.

Merchant Exporters account for around 35 percent of the total exports, help boost outbound Merchandise Shipments.

Merchant Exporters receives orders from international market and then procure goods from the Indian manufacturers mostly from MSME / labour-intensive sectors such as agriculture, textiles, leather, handicraft and machinery and sell them abroad in their firm’s name.

Merchant Exporters are usually able to negotiate prices with buyers, sellers and shipping lines which are more competitive and better than regular exporters.

Since they procure mostly from MSMEs, thereby help in increasing production of MSME giving a fillip to employment generation as MSMEs are generally in the employment-intensive sectors.

Merchant Exporter can export the goods either directly from the premises of the manufacturer, with or without sealing of the export consignments, or through his premises under claim for rebate or under bond.

Specialization of Merchant Exporters

> Merchant Exporters have generally intimate knowledge of export markets and exportable products.

> They may have extensive contact network all over the specific regions / markets in the world and have access to focused markets.

> They usually have a system of gathering market information and keep a close watch on market trends.

> The nature of their business makes it possible for them to assess the marketability of products and the prospects of their success.

> They often specialize in certain commodities or in certain regions / areas.

> Merchant exporters Buy and Sell on their own account and thus assume the risks involved in exporting.

> Merchant exporters are usually well financed and they usually extend pre-shipment finance to supporting manufacturers.

> They may have technical and commercial expertise who can guide on product development, packing, inspection, regulatory and other related aspects of exports.

> They often have specialized resources and may have their own Shipping, Documentation and Insurance Department and also may maintain their branches at port towns and in important centers abroad.

> In addition, merchant exporters often co-operate with producers in developing countries to adapt products, for instance, by providing product specification giving designs and styling guidance, offering in quality control, and counseling on packaging, labeling and shipping.

> Merchant Exporters have the flexibility to procure goods from many sellers and sell them after negotiating the best prices to foreign buyers. Therefore they generally Accommodate & Encourage New / First Time Suppliers

This method of exportation through Merchant Exporters is useful when the company is small and lacks expertize in exporting and it’s related nitty-gritties, therefore, not in a position to start exports on its own.

Advantages of Exporting through Merchant Exporters

Merchant Exporting is more suitable for a small company which does not possess adequate financial and managerial resources required for making a successful entry in to a foreign market.

The main advantages are:

> The merchant exporter takes care of all botherations involved and assumes all sales and credit risks

> Export merchants usually finance manufacturers against purchase of their goods. Hence their capital is not tied up.

> The firm does not have to spend money on market research or on setting up branches abroad.

> They are frequently arranges overseas buyers and provide sales opportunities

> The manufacturer is free to concentrate on production and not to bother about export marketing and other export formalities.

> Export entry through merchant exporters is the easiest and least costly.

> Selling through such merchant exporters automatically ensures that the goods will reach the important distributors and through them down the distribution system and therefore enable penetration of product and brand image in the overseas markets

Merchant Exports under GST

In GST Regime there is No Exemptions like Excise Duty Exemption against CT-1 / ARE -1 and Exemption of CST against H-Form and VAT in many States in the Pre-GST regime. The manufacturer would be liable to pay CGST + SGST or IGST. The Merchant Exporter is Eligible for taking ITC.

Since Merchant Exporter has to Procure Goods on Payment of GST, it Creates Problem of Working Capital (though ITC is allowed).

Merchant Exporter Procuring from Domestic Supplier at Concessional Rate of GST

In a Major Relief to the Merchant Exporters, Partial Exemption of GST was Provided on Procurement from Domestic Suppliers, w.e.f 23rd October, 2017 vide below Notifications.

Notification No. 40/2017-Central Tax (Rate), 23rd October, 2017

Notification No. 41/2017–Integrated Tax (Rate), 23rd October, 2017

Now Merchant Exporters can Procure from Domestic Suppliers at Concessional Rate of GST @ 0.10% subjective condition that they Export the Goods so Procured within 90 days from the date of issue of Tax Invoice.

Conditions for availing Concessional Rate of GST:

The Supplier to Merchant Exporter Need to be Registered & Goods need to be supplied on a Tax Invoice charging GST @ 0.10%

> Such goods shall be Exported within 90 days from the date of issue of tax invoice

> GSTIN of the supplier and the tax invoice number are to be indicated on shipping bill/bill of export

> Such Merchant exporter shall be registered with an Export Promotion Council or a Commodity Board

> A copy of the order placed at concessional rate shall be provided to the jurisdictional tax officer of the registered supplier

> Such goods shall be directly moved to the port, Inland Container Depot (ICD), Airport or Land custom Station (LCS) or to the registered warehouse from where it shall be moved to the port/ICD/Airport/LCS

> In case the goods are bought from multiple registered suppliers, the goods from each registered supplier shall move to a registered warehouse which shall be further moved to the Port/ ICD/Airport/LCS for export. Also, the merchant exporter shall endorse receipt of goods on the tax invoice and also obtain acknowledgement of receipt of goods in the registered warehouse from the warehouse operator where the endorsed tax invoice and the acknowledgement shall be provided to the registered supplier as well as jurisdictional tax officer.

> After the goods are exported, a copy of shipping bill/bill of export with proof of EGM and export report shall be filed to the registered supplier as well as its jurisdictional tax officer.

The registered supplier shall not be eligible for the above reduced rate if the merchant exporter fails to export the said goods within a period of 90 days from the date of issue of tax invoice.

Clarifications Related to Merchant Export

Circular No. 37/11/2018-GST; Dated the 15th March, 2018

> Merchant Exports Procuring from Domestic Supplier Image 2 Merchant Exports Procuring from Domestic Supplier Image 2Supplies to Merchant Exporters: Notification No. 40/2017 – Central Tax (Rate), dated 23rd October 2017 and Notification No. 41/2017 – Integrated Tax (Rate) dated 23rd October 2017 provide for supplies for exports at a concessional rate of 0.05% and 0.1% respectively, subject to certain conditions specified in the said notifications.

> It is clarified that the benefit of supplies at concessional rate is subject to certain conditions and the said benefit is optional. The option may or may not be availed by the supplier and / or the recipient and the goods may be procured at the normal applicable tax rate.

> It is also clarified that the Merchant Exporter will be eligible to take credit of the tax @ 0.05% / 0.1% paid by him.

> The supplier who supplies goods at the concessional rate is also Eligible for Refund on Account of Inverted Tax Structure as per the provisions of clause (ii) of the first proviso to sub-section (3) of section 54 of the CGST Act.

> It may also be noted that the Merchant Exporter of such goods can export the goods only under LUT / bond and cannot export on payment of integrated tax per Rule 96(10) of the CGST Rules. In this connection, notification No. 3/2018-Central Tax, dated 23.01.2018 may be referred.

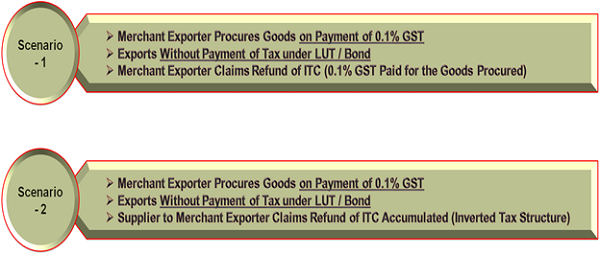

Two Different Scenarios

> In the First Scenario, Concessional Rate of GST availed. The Merchant Exporter after Export under LUT / Bond has to apply for ITC Refund, the procedure of which is tedious and time consuming.

> In the Second Scenario, Concessional Rate of GST availed. The Supplier can apply for Refund of ITC as Inverted Tax Structure. The Procedure is also equally cumbersome and time consuming.

Practical Difficulties

Through Notification No. 40/2017-Central Tax (Rate), 23rd October, 2017 and Notification No. 41/2017–Integrated Tax (Rate), 23rd October, 2017, though Concessional Rate of 0.1% allowed to Merchant Exporters to Procure Goods from Domestic Suppliers, it comes with certain Conditions like

> Such goods shall be Exported within 90 days from the date of issue of tax invoice

> GSTIN of the Supplier and the Tax Invoice Number are to be indicated on Shipping Bill / Bill of Export

> After the goods are exported, a copy of Shipping Bill / Bill of Export with proof of EGM and export report shall be filed to the registered supplier as well as its jurisdictional tax officer.

> The registered supplier shall not be eligible for the above reduced rate if the merchant exporter fails to export the said goods within a period of 90 days from the date of issue of tax invoice.

> Such Merchant exporter shall be registered with an Export Promotion Council or a Commodity Board

Most of the Merchant Exporters are having apprehensions and hesitations to share with the Supplier a Copy of Shipping Bill where the Details of Overseas Customer along with Price and other Terms are Disclosed. It will open up Customer & Price details which are developed with intense Market Research and Deliberate Efforts over a long period with investment of various resources.

Also Suppliers to Merchant Exporters are hesitant to Supply as in case of failure of Merchant Exporters to Export the Goods so procured within 90 Days, then the Supplier is liable to discharge the differential tax. The Merchant Exporter, is not made responsible, for his failure to export the Taxable Goods but the responsibility is imposed on Supplier.

Export with Payment of IGST not Allowed

According to Notification No. 40/2017-Central Tax (Rate), 23rd October, 2017 and Notification No. 41/2017–Integrated Tax (Rate), 23rd October, 2017, notification No. 3/2018-Central Tax, dated 23.01.2018 and Circular No. 37/11/2018-GST; Dated the 15th March, 2018 the benefit of procuring at Concessional Rate of 0.1% allowed to Merchant Exporters subject to condition that the Merchant Exporter of such goods can Export the goods only under LUT / bond and cannot export on payment of integrated tax per Rule 96(10) of the CGST Rules.

Procedural Difficulties for Claiming Refund

Availing of benefit of supplies at Concessional Rate of 0.1% comes with some Ridder.

Most important one is that the Merchant Exporter cannot export on payment of Integrated Tax (IGST) as per Rule 96(10) of the CGST Rules. They can export the goods only under LUT / bond.

For Claiming ITC Refund the Exporter should follow following procedure :

Circular No. 17/17/2017-GST dated 15.11.2017 and Circular no. 24/24/2017-GST dated 21.12.2017

> File Application in FORM GST RFD-01A on the common portal

> Amount claimed as refund shall get debited from the amount in the Electronic Credit Ledger

> The common portal shall generate a proof of debit (ARN– Acknowledgement Receipt Number)

> Print out of FORM GST RFD-01A mentioning ARN along with all necessary documentary evidences as applicable (as per details in statement 3 or 5 of Annexure to FORM GST RFD-01) and Submit Manually to Jurisdictional proper officer.

> Acknowledgement in FORM GST RFD-02 shall be issued within 15 Days as per Rule 90(2)

> In case of any Deficiencies, intimation is issued in FORM GST RFD-03 and exporter have to re-submit the application a fresh after rectifying the deficiencies : Rule 90(3)

> Provisional Refund of 90% in FORM GST RFD-04 shall be released Within 7 Days : Sec 54(6) & Rule 91(2)

> Payment Advice is made in FORM GST RFD-05 : Rule 91(3)

> Order Sanctioning Balance Refund within 60 Days in FORM GST RFD-06 : Sec 54(7) & Rule 92(1)

Since the above procedure is Cumbersome and Time Consuming because of Semi-Automatic Process (Some part Online Filing & then Manual Submission) most of the Exporters are locked up in bureaucratic entangle to get their legitimate Refunds.

Alternative Scenarios

Since availing of benefit of supplies at Concessional Rate of 0.1% is optional (Circular No. 37/11/2018-GST; Dated the 15th March, 2018) the Merchant Exporter with his own choice may opt for Procurement from Domestic Supplier on Payment of Normal Rate of GST.

This will get him ride off various procedural entangles and conditional obligations specified in Notification No. 40/2017-Central Tax (Rate), 23rd October, 2017 and Notification No. 41/2017–Integrated Tax (Rate), 23rd October, 2017.

Suggestion

We have seen Four Different Scenarios.

> In the First Scenario, Concessional Rate of GST availed. The Merchant Exporter after Export under LUT / Bond has to apply for ITC Refund, the procedure of which is tedious and time consuming.

> In the Second Scenario, Concessional Rate of GST availed. The Supplier can apply for Refund of ITC as Inverted Tax Structure. The Procedure is also equally cumbersome and time consuming.

> In the Third Scenario, Supplies are made on Charging Normal Tax. The Merchant Exporter after Export under LUT / Bond has to apply for ITC Refund, the procedure of which is again as in the scenario one – tedious and time consuming.

> The Fourth Scenario is very much advisable. Here the Merchant Exporter Procures Goods with Payment of Normal applicable GST and then takes ITC. While Exporting he opts with Payment of IGST by utilizing ITC. Once he makes Exports of Goods, the Shipping Bill itself treated as an Application for Refund of Tax Paid and there is no need for separate application.

However following Conditions shall be fulfilled :

Carrier of Conveyance Files EGM

Applicant Furnished Invoice Details in Table 6A of GSTR -1

Applicant Furnished GSTR- 3B

This procedure is very simple, automatic and faster to get Refunds in case of Export of Goods

PPT can be viewed @:

https://www.youtube.com/watch?v=Q3gG-esdrV0

Disclaimer : The views, Expressions and opinions; thoughts and assumptions; analysis and conclusions expressed in this article are those of the authors and do not necessarily reflect any legal standing.

Author : SN Panigrahi, GST Consultant, Practitioner, Corporate Trainer & Author

Can be reached @ snpanigrahi1963@gmail.com

Sir, you have mentioned that the 4th scenario is advisable. My query is if a merchant exporter (from another city) is exporting a heavy product and he wants to transfer the product directly from the manufacturers factory (located in another city) to the port, can I do it under the 4th scenario ie payment of regular GST but the goods will be transferred from the manufacturers location to the port? Do I still need to share my export invoice with the supplier if I choose scenario 4. Please do shed light on this. Thank you!

Sir, you have mentioned that the 4th scenario is advisable. My query is if a merchant exporter (from another city) is exporting a heavy product and he wants to transfer the product directly from the manufacturers factory (located in another city) to the port, can I do it under the 4th scenario ie payment of regular GST but the goods will be transferred from the manufacturers location to the port? Please do shed light on this. Thank you!

What if registered supplier has not submitted the purchase order to jurisdiction officer or within how many days it should be submitted.

Please suggest.

I am a merchant exporter. I have purchased goods at 0.1% gst rate. I exported the goods under LUT but I have not shown GST details and Invoice number of supplier on the shipping bill. So, what will happen in this case?

I am Manufacturer and supply the material to the merchant exporter for export under GST conssional rate 0.1%. but the merchant exporter has fails to export within valid period of 90 days. so in this case what liabilities are comes to me. please explain, if any amendment in the 90 days period so please provide the notification.

thanks in advance.

in case if merchant exporter buy the goods under 0.10 gst and file shipping bill at IGST, already shipped then what to do

merchant exporter if buy goods Rs.100 then how many cost add additional for export time.

Can a merchant exporter claim refund of accumulated cess from Export done to SEZ

Sir, as a Merchant exporter procured Metarial from Manufacturer and paid GST as per rules. And now exporting with LUT. So we can claim benefit. My doubt is… is it mandate to mention IEC number of manufacturer in Shipping Bill for customs clearance purpose? Because our manufacturer saying we will not get 0.1% gst benefit so we will not give our IEC number. So pls advise how to proceed further.

Dear Sir,

When manufacturer exports through Merchant Exporter and the exporter pays to manufacturer in Indian Rupees, in that case the revenue of manufacturer shall be considered under export or domestic?

Regards,

Sujit

If merchant exporter fails to export goods within 90 days as per notification no. 40/2017 then supplier can take goods back from exporter by sales return .. if yes then what will be the procedure for the same??

Very well explained.Great effort.

Can a Manufacturer Exporter procure @ 0.10% GST

Thank you so much sir. It is well explained article on merchant exports. Thank you once again.

Thank you soo much for this article.

Really satisfied with the stuff.

Dear sir,

one of our Merchant Exporter failed to furnish our GST no & invoice no in shipping bill, material exported, but compliance is due, pl advice, what to do and how to do also (Recipient).

sir,

I am Manufacturer and suppy the material to merchant exporter for export under GST conssional rate 0.1% Is this normal supply or deemed export. for the purpose of filling GSTR 1. kindly clarify

sir,

I am Manufacturer and suppy the material to merchant exporter for export under GST conssional rate 0.1% Is this normal supply or deemed export. for the purpose of filling GSTR 1. kindly clarify

1) As a regular exporter whether we are able to do the Merchant Trade ?

2) If I procure material from Egypt and sell it to Italy as Merchant Trader ?

For merchant export we are getting payment 180 days ,but we have to make the foreign payment 90 days ..

It is allowed or not

EPC contractor buys from supplier goods . Goods taken out by paying 0.1% GST.

Supplier paid in Usd.

Export benefits to whose account ?

I am a merchant exporter for filament yearns. I have got GST Number. Now I want to export masala & food products. I want to know whether I want to obtain new GST number for Masala & Food products

sir its very nice article , its very use full. thanks for easy explanation with example.

Dear Sir, If a Merchant Exporter want to stuff container with RFID Seal from Registered Suppliers premises then, 1) who has to obtain Stuffing Permission / self sealing permission 2) we will supply RFID seals? Pl. guide in details regarding MERCHANT EXPORT stuffing from Registered Suppliers Premises.