“Audere est facere”, is a latin term to mean ‘to dare is to do’ or ‘to have enough courage or confidence to do something’. Crypto has become a parallel currency, allowing transfer of value held in digital wallet, from one person to another, without going through a central authority or bank and to allow the digital asset, as consideration for purchase of goods and services. This maxim, is most relevant to the context we discuss herein, as we understand the implications of GST on supply of such digital assets.

Understanding Digital Assets

1. Digital assets are not defined under GST law and the law is silent is on its meaning, categorisation and taxation. Accordingly, it may be relevant to decipher its meaning under allied law. Section 2(47A) of the Income Tax Bill, 2022, seeking to tax transactions in virtual digital assets, defines it as:

(47A) “virtual digital asset” means

(a) any information or code or number or token (not being Indian currency or foreign currency), generated through cryptographic means or otherwise, by whatever name called, providing a digital representation of value exchanged with or without consideration, with the promise or representation of having inherent value, or functions as a store of value or a unit of account including its use in any financial transaction or investment, but not limited to investment scheme; and can be transferred, stored or traded electronically;

(b) a non-fungible token or any other token of similar nature, by whatever name called;

(c) any other digital asset, as the Central Government may, by notification in the Official Gazette specify:

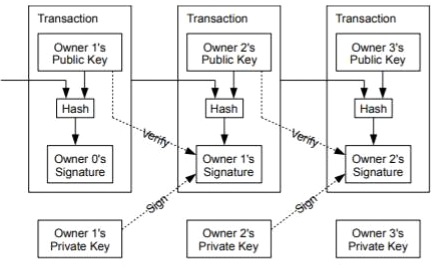

2. More often, digital assets or virtual currencies or crypto currencies, as they are called, use cryptography, to prevent counterfeit or double spend of the currency. They enable secure online payments without the use of third-party intermediaries. “Crypto” uses decentralized network based on blockchain technology, having various encryption algorithms and cryptographic techniques that safeguard transactional entries, such as elliptical curve encryption, public-private key pairs, and hashing functions, depicted below:

3. Blockchain technology is essentially a set of connected blocks or an online ledger. Each block contains a set of transactions that have been independently verified by each member of the network. Every new block generated must be verified by each node before being confirmed, making it almost impossible to forge transaction histories. The contents of the online ledger must be agreed upon by the entire network of an individual node, or computer maintaining a copy of the ledger.

4. Per the above, the uniqueness of blockchain technology is that each owner transfers the digital currency to the next by digitally signing an encryption, say a hash of the previous transaction and the public key of the next owner (transferee) and adding these to the end of the digital currency. In this manner, a payee can verify the signatures, to verify the chain of ownership, preventing double payments or counterfeit.

5. Bitcoin is the most popular and valuable cryptocurrency. An anonymous person by name “Satoshi Nakamoto” invented it and introduced it to the world via a white paper in 2008, with an open source-code. As on November 2021, it is said that there are 18.8 Million bitcoins (of the 21 Million bitcoins stated, as to ever exist), which are in circulation with a total market cap of around $1.2 trillion. In wake of Bitcoin’s success, many other cryptocurrencies, known as “altcoins” have been launched. Some of these are clones of Bitcoin, while others are new currencies that are built from scratch such as Solana, Litecoin, Ethereum, Cardano, and EOS. It is considered that as on November 2021, the aggregate value of all the cryptocurrencies in existence, is estimated to be over $2.1 trillion, with Bitcoin representing approximately 41% of that total value, as is illustrated below:

Source: https://coinmarketcap.com/charts/

6. Cryptocurrencies are either mined (generated) or bought from crypto exchanges such as coinbase, Binance, Coinswitch Kuber, Kraken, Bitfinex, WazirX, etc. Mining crypto currencies involves downloading software that contains a partial or full history of transactions that have occurred in its network. While anyone with a computer and an internet connection, can technically mine cryptocurrency, however, it requires high use of energy, use of complex algorithm and highly resource-intensive and therefore, only large firms dominate the crypto currency mining industry.

Union Government’s apprehension to private digital currency

7. There appears to be unanimity of opinion among all the regulators and the governments of various countries that though virtual currencies have not acquired the status of a legal tender, they nevertheless constitute digital representations of value and that they are capable of functioning as (i) a medium of exchange; (ii) a unit of account; (iii) a store of value.

8. On 24-12-2013, a Press Release was issued by RBI cautioning the users, holders and traders of virtual currencies about the potential financial, operational, legal and customer protection and security related risks that they are exposing themselves to. The Press Release noted that the creation, trading or usage of Virtual Currency, as a medium of payment is not authorized by any central bank or monetary authority and hence may pose several risks narrated in the Press Release.

9. On 27-12-2013, newspapers reported the first ever raid in India by the Enforcement Directorate, of 2 Bitcoin trading firms in Ahmedabad, by name, rBitco.in and buysellbitco.in. This was stated to be India’s first raid on a Bitcoin trading firm and the second globally, after Federal Bureau of Investigation of the United States of America conducted a raid in October of the same year

10. The Committee on Payments and Market Infrastructure, which is a body corporate established under the laws of Switzerland and owned by 60 Central Banks of different countries including RBI, in its report issued in Nov’2015 on digital currencies, said although digital currencies typically do have some, but not all the characteristics of a currency, they may also have characteristics of a commodity or other asset. Their legal treatment can vary from jurisdiction to jurisdiction

11. RBI issued another Press Release dated 05-12-2017 reiterating the concerns expressed in earlier press releases. The Government of India, Ministry of Finance also issued a statement on 29-12-2017 cautioning the users, holders and traders of VCs that they are not recognized as legal tender and that the investors should avoid participating in them.

12. While presenting Union Budget 2018, Late Shri Arun Jaitleyji, the then Finance Minister, in his budget speech stated that “The government does not consider cryptocurrencies legal tender or coin and will take all measures to eliminate use of these crypto-assets in financing illegitimate activities or as part of the payment system”.

13. The Central Board of Direct Taxes (CBDT), by an Office Memorandum, dated 05-Mar-2018, submitted to the Department of Economic Affairs, a draft scheme proposing a ban on cryptocurrencies. But the draft scheme advocated a step-by-step approach, as many persons had already invested in cryptocurrencies. The scheme also contained an advice to carry out legislative amendments before banning them.

14. The Inter-Ministerial Committee in its report dated 28-Feb-2019 made certain recommendations which included a complete ban on private cryptocurrencies.

15. On 22-Jul-2019, the Report of the Inter-Ministerial Committee, recommending a ban, along with the draft of the Bill “Banning of Crypto currency and Regulation of Official Digital Currency Bill 2019”, was hosted in the website of the Department of Economic Affairs. The draft of the bill contained a proposal to ban the mining, generation, holding, selling, dealing in, issuing, transferring, disposing of or using crypto currency in the territory of India. At the same time, the bill contemplated (i) the creation of a digital rupee as a legal tender, by the central government in consultation with RBI and (ii) the recognition of any official foreign digital currency, as foreign currency in India

16. In Jan’2022, the Prime Minister of India at virtual Davos summit of the World Economic Forum said “today with change in global order, the challenges we face are also increasing. To fight these challenges, every country and every international organisation needs to take collective and synchronised action. Supply chain disruption, inflation and climate change are such examples. Another example is cryptocurrency. The kind of technology that is linked to it, steps taken by one country will be insufficient to face such challenges. We have to take one view on it.”

17. In Union Budget 2022, the Finance Minister Ms. Nirmala Sitaraman, in her budget speech spoke about Introduction of Central Bank Digital Currency (CBDC) will give a big boost to digital economy. She said that a “Digital currency” will also lead to a more efficient and cheaper currency management system and proposed to introduce Digital Rupee, using blockchain and other technologies, to be issued by the Reserve Bank of India starting 2022-23. The Union Budget 2022 also introduced a scheme of taxation of virtual digital assets.

Classification under GST

18. Taxability of Private digital assets has become a perineal question after introduction of income tax on transaction of virtual digital assets and brings us to analysis the implications under GST.

19. Section 2(52) defines ‘goods’ to “means every kind of movable property other than money and securities but includes actionable claim, growing crops, grass and things attached to or forming part of the land which are agreed to be severed before supply or under a contract of supply”;

20. The Central Goods and Services Tax Act, 2017 defines ‘money’ under Section 2(75) to mean “the Indian legal tender or any foreign currency, cheque, promissory note, bill of exchange, letter of credit, draft, pay order, traveler cheque, money order, postal or electronic remittance or any other instrument recognised by RBI, when used as a consideration to settle an obligation or exchange with Indian legal tender of another denomination but shall not include any currency that is held for its numismatic value.”

21. Perusal of the term ‘Money’ evidences that money means legal tender or foreign currency, recognized by RBI. Digital assets are not money or foreign currency recognized by RBI and hence will not be regarded as ‘Money’.

22. The Central Goods and Services Tax Act, 2017 defines under Section 2(101) as “shall have the same meaning as assigned to it in clause (h) of section 2 of the Securities Contracts (Regulation) Act, 1956”

The term “securities” the Securities Contracts (Regulation) Act, 1956, is defined to include—

(i) shares, scrips, stocks, bonds, debentures, debenture stock or other marketable securities of a like nature in or of any incorporated company or other body corporate;

(ia) derivative;

(ib) units or any other instrument issued by any collective investment scheme to the investors in such schemes;

(ic) security receipt as defined in clause (zg) of section 2 of the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002;

(id) units or any other such instrument issued to the investors under any mutual fund scheme;

(ie) any certificate or instrument (by whatever name called), issued to an investor by any issuer being a special purpose distinct entity which possesses any debt or receivable, including mortgage debt, assigned to such entity, and acknowledging beneficial interest of such investor in such debt or receivable including mortgage debt, as the case may be;

(ii) Government securities;

(iia) such other instruments as may be declared by the Central Government to be securities; and

(iii) rights or interests in securities;”

23. Perusal of the term ‘Securities’ would evidence that digital assets will not fall meaning within the assigned meaning.

24. It may be interesting to analyse the interpretations provided to transactions in Digital Assets, in foreign jurisdictions:

(a) The Sherman Division Eastern District Court of Texas opined in SEC v. Trendon Shavers, [Case No. 4: 13-Cv-416 (August 6, 2013)] that “It is clear that bitcoin can be used as money. It can be used to purchase goods or services and as Shavers stated, used to pay for individual living expenses. The only limitation of bitcoin is that it is limited to those places that accept it as currency. However, it can also be exchanged for conventional currencies such as the US dollar, euro, yen and Yuan. Therefore, bitcoin is a currency or form of money…”

(b) The Singapore International Commercial Court ruled in B2C2 Ltd. v. Quoine Pte Ltd., [(2019) SGHC (I) 3] that virtual currency can be considered as property which is capable of being held on trust.

(c) The Commodity Futures Trading Commission (CFTC) took a view in In re Coinflip, Inc, [CFTC Docket No. 15-29 dated 17-09-2015] that virtual currencies are “commodities”.

(d) The ruling of the European Court of Justice in Skatteverket v. David Hedqvist, [0 Case C-264/14 dated 22-10-2015] was with particular reference to the identity of virtual currencies. ECJ was in this case asked to decide a reference from Supreme Administrative Court, Sweden on whether transactions to exchange a traditional currency for the ‘Bitcoin’ virtual currency or vice versa, which Mr. Hedqvist wished to perform through a company, were subject to value added tax. The Court held that the transactions in issue were entitled to exemption from payment of VAT as they fell under the category of transactions involving ‘currency [and] bank notes and coins used as legal tender’. In this regard, Article 135(1)(e) EU Council VAT Directive 2006/112/EC is applicable to non-traditional currencies i.e., to currencies other than those that are legal tender in one or more countries in so far as those currencies have been accepted by the parties to a transaction as an alternative to legal tender and have no purpose other than to be a means of payment. The court accordingly concluded that virtual currencies would fall under this definition of “non-traditional currencies”.

Thus (i) depending upon the text of the statute involved in the case and (ii) depending upon the context, various courts in different jurisdictions have identified virtual currencies to belong to different categories ranging from property to commodity to non-traditional currency to payment instrument to money to funds.

25. In the landmark judgment of Tata Consultancy Services Vs. State of Andhra Pradesh [271 ITR 401 (SC)] the constitution bench of Supreme Court on the question whether certain software would fall within the meaning of goods under the state sales tax law and it was held by the majority that the term goods used in the Constitution of India is very wide and under the relevant Act it includes all types of movable properties irrespective of tangible or intangible and a transaction sale of computer software is a sale of goods within the meaning of relevant sales tax act. In the concurring opinion, Hon’ble Justice Sinha laid down a three-part test for software to classify as goods i.e. (a) its utility (b) capable of being bought and sold (c) capable of being transmitted, transferred, delivered, stored and possessed.

26. In the instant case, it can be observed that cryptocurrencies are intangible and are made, marketed, and stored on physical servers. They can be bought and sold, transmitted, transferred, delivered, stored, and possessed. Private digital assets like Bitcoin and Ethereum are used for various purposes like a store of value, transfer of value, micropayments, and decentralized applications. These features and the demand for cryptocurrencies for these purposes indicates their utility. Therefore, it can be concluded that based on the text of the law, private digital assets are closest to be regarded as goods and can be classified as such under the GST law.

Taxability under GST

27. The table below summarizes the possible implications under GST, of transactions connected with digital assets:

| Transaction | Taxability | Reasoning |

| Purchase of goods or services in exchange of private digital asset (say Bitcoin) | Regarded as exchange of goods for goods or services | Considering digital assets (bitcoin) to be goods, transfer of bitcoin in exchange of goods or services will be regarded as barter i.e. exchange of goods for goods or services, in return. As digital assets are not classified as such, the general rate of GST ought to be applicable. Alternatively, bitcoins may be regarded as intangible assets and classified as such. |

| Purchase of private digital assets (say bitcoin) on payment of money (Indian Rupee or foreign currency) | Seller of private digital asset will be subject to GST | Considering the digital asset (say bitcoin) to be in the nature of goods, the seller of bitcoin ought to be liable to charge GST for sale of bitcoin, in consideration for payment in money, at general rate of GST |

| Services provided in connection with sale or purchase or exchange of private digital assets | Taxable as Supply of services | Supply of services in connection with purchase, sale or exchange of digital assets for a consideration, charged as service fee, will be subject GST at standard rate, applicable for services. |

| Sale of private non-fungible tokens | Treated as an intangible asset other than software | NFT, which are capable to be sold on digital markets are treated in the same manner as sale of intangible and ought to be taxed as such at the rate applicable for intangibles. |

28. India, is certainly considering to tax transactions in private digital assets. Consequent to growth in such transactions, in the absence of any formal mechanism provided under law, such transactions will be subject to tax at gross value. Ambiguity under law coupled with delayed administration, could cause significant hardship to this industry. While the offenders have their way out, an ignorant assessee may be made to lose all gains from deployment of his already taxed resources.

Way-forward

29. Upon introduction of digital currency by RBI, the industry will be split between private digital assets and digital currency or assets backed by government. India’s digital currency will be regarded as money under GST and will not be taxed as such, while transactions in private digital assets, will be taxed as goods, unless banned or appropriately regulated.

30. It may be imperative for the industry to make a representation to the GST council to allow discharge of GST at nominal rates for the past, with an appropriate amnesty scheme, to ensure that delay in regulation does not impact an ignorant but willing tax payer. Given the number of assessee’s engaged and the volume of such transactions, this may be in the interest of justice, equity and good conscience.

*****

Very well explained

whether TCS provisions Under section 52 of CGST Act applicable on crypto exchanges?

“electronic commerce operator” is defined to mean any person who owns, operates or manages digital or electronic facility or platform for electronic commerce and “electronic commerce” is defined to mean supply of goods or services or both,

including digital products over digital or electronic network.

Crypto exchanges would fall within the meaning of as ecommerce operator u/s. 52 and hence TCS would be applicable. However, if crypto exchanges buy or sell on their behalf, then TCS is not applicable.

Excellent Article. Impressed by the simple language.

Thank you.. appreciate the feedback

Very well explained. It’s high time that government comes out clear with it’s policy with respect to crypto and clear the ambiguity around it. Kudos to the author for explaining the complex subject with simplicity and details.