A. FAQs > View notices/orders and File Reply to the Issued Notice

General

Q.1 How can I view my saved/filed application, track it’s status and view associated notices and orders for refund applications filed before or after 26th September 2019?

Ans.

| Refund Application Filed | Form Name | View Saved/ Filed Application | Track Application Status | View Notices/ Orders |

|

Filed before 26th Sep, 2019 |

RFD-01A |

Post login to the GST Portal, navigate to Services > Refunds > My Saved/Filed Applications |

Post login to the GST Portal, navigate to Services > Refunds > Track Application Status |

Notices are manually issued by the Tax Official and are not available on the GST Portal for taxpayers to view. Orders are issued manually by the Tax Official but are not available on the GST Portal for taxpayers to view. |

|

Filed on and after 26th Sep, 2019 |

RFD-01 |

The functionality to issue notices, orders, reply to Show Cause Notice etc. is available online on GST Portal. Orders etc. are issued online by the Tax Official and are available on the GST Portal for taxpayers to view them.

Post login to the GST Portal, navigate to Dashboard > Services > User Services > My Applications. |

Processing Refund Applications

Q.2 What are the steps involved in processing the refund application?

Ans. Listed below are the steps involved in processing of the refund application:

1. Applicant files the refund application on the GST Portal inForm GST RFD-01. Such application will be available at the Dashboard of Tax Official as pending work item.

2. The refund application filed by the applicant has to be processed by the Refund Processing Officer.

3. Refund Processing Officer will scrutinize the application and attachments filed by the applicant.

-

- On the basis of scrutiny of the refund application filed by the applicant, if the refund application is found to be complete in all aspects, Acknowledgement in Form GST RFD-02 will be issued by the Refund Processing Officer, within 15 days from the date of filing of the refund application.

- On the basis of scrutiny of the refund application and attachments filed by the applicant, in case, any deficiencies are noticed in refund application, Deficiency Memo will be issued in Form GST RFD-03 on the refund application by the Refund Processing Officer. In case of issuance of Deficiency Memo in Form GST RFD-03, there would be auto re-credit of refund claimed amount in Electronic Cash/ Credit Ledger, if the ledger has been debited at the time of filing refund application. In this case, the applicant needs to file a fresh refund application for the same period again, if needed, after rectification of the deficiencies mentioned in deficiency memo.

4. Refund Processing Officer can issue online notice for rejection of application for refund or recovery of erroneously granted refundfor seeking any clarification in Form GST RFD-08, if required.

5. Applicantis required tofurnish reply to the notice (issued in Form GST RFD-08) in Form GST RFD-09 online on GST Portal, within 15 days of issuance of notice.

6. Tax Official may issue Provisional Refund Order in Form GST RFD-04 within 7 days from the date of acknowledgement up to 90% of the refund claimed amount, if the applicant is eligible to get provisional refund. Refund Processing Officer can issue Provisional Order in Form GST RFD-04 in following cases:

-

- Refund in case of export of services with payment of tax

- Refund of accumulated ITC on account of export of goods/services under Bond/LUT without payment of integrated tax.

- Supplies made to SEZ Unit/SEZ Developer with payment of Tax

- Supplies made to SEZ Unit /SEZ Developer without payment of Tax

7. Refund Processing Officer will issue Refund Sanction/ Rejection Order inForm GST RFD-06.

Note:

-

- In case of refund applications, in which provisional refund order has been issued in Form GST RFD-04, the final order Form GST RFD-06 will quantify the total sanctioned amount out of the claimed amount and the net balance amount will be sanctioned by issuing Form GST RFD-06, after further verification and examination of the application by the Tax Official.

- In case of complete adjustment of refund towards any demand, Refund Processing Officer may adjust it through Form GST RFD-06.

8. Payment Order needs be issued inForm GST RFD-05after issuance of Form GST RFD-04 or Form GST RFD-06 in case of sanction of refund.

9. The sanctioned refund amount may be withheld by the Refund Processing Officer by issuingForm GST RFD-07 (Part B). In such case, Tax Official will not issue Form GST RFD-05, till the withhold order is in operation.

10. Order for re-credit of the amount to Electronic Cash or Credit ledger on rejection of refund claim(Form GST PMT-03) is required to be issued in case if

-

- the ledger has been debited at the time of filing refund application for such amount and

- any amount of refund is marked as inadmissible/rejected by refund processing officer by issue of an Order in Form GST RFD-06.

Q.3 What are the various tabs available to the Applicant on his dashboard after filing the refund application?

Ans. Listed below are the various tabs available to the applicant after filing the refund application

1. Applications: To view filed refund application details

2. Notice/ Acknowledgement: To view acknowledgment and notices issued by the Tax Official and file reply to those notices

3. Replies: To view filed replies

4. Orders: To view orders issued by the Tax Official

5. Audit History:To view the history details or action taken on refund application filed by applicant

Q.4 What are the various statuses while processing refund application?

Ans. Listed below are the various statuses while processing refund application:

1. Acknowledged: When Refund Processing Officer issues Acknowledgement in Form GST RFD-02

2. Deficiency Memo Issued: When Refund Processing Officer issues Deficiency Memo in Form GST RFD-03

3. Pending for Processing: When applicant files refund application and the same is pending for processing by Refund Processing Officer

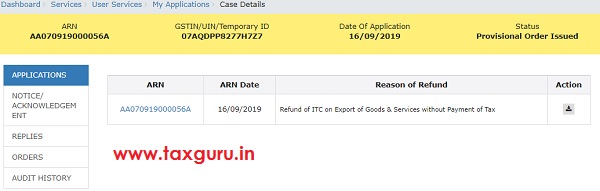

4. Provisional Order Issued: When Refund Processing Officer issues Provisional Order in Form GST RFD-04

5. Pending for Order-Reply Received: When taxpayer replies in Form GST RFD-09 to SCN issued by Tax Official in Form GST RFD-08

6. Pending for Order-Reply not Received: When taxpayer doesn’t reply in Form GST RFD-09 to SCN issued by Tax Official in Form GST RFD-08

7. Refund Applications Withheld: When Refund Processing Officer issues withheld order in Form GST RFD-07 (Part B).

8. Refund Rejected: When Refund Processing Officer issues Form GST RFD-06 and Refund claimed is rejected

9. Refund Sanctioned: When Refund Processing Officer issues Form GST RFD-06 granting Refund of full amount, as claimed by the applicant

10. Refund Sanctioned Partially: When Refund Processing Officer issues Form GST RFD-06 and Refund sanctioned is less than the amount claimed by the applicant

11. Show Cause Notice Issued: When Refund Processing Officer issues Show Cause Notice in Form GST RFD-08 for seeking any clarification to the applicant

Viewing Notices and Orders

Q.5 What is the time frame for an applicant to reply to the notice issued by the Tax Official while processing the refund application submitted by the applicant?

Ans. Applicant need to reply to the notice in Form GST RFD-09, within time period of 15 days or within any other time as fixed by refund processing officer, from the date of service of notice, to give explanations and submit documents regarding the discrepancies as laid in the notice

Q.6 What a Tax Official can do in case an Applicant has not replied to the notice issued by the Tax Official?

Ans. If the applicant doesn’t reply in Form GST RFD-09 to the show cause notice within 15 days or within any other time fixed by the refund processing officer then the status of the refund application will be changed to “Pending for Order-Reply not received” and the Refund Processing Officer can proceed to issue final order.

Q.7 What will happen once an applicant files reply to the notice issued by the Tax Official (notice issued by tax official) while processing the refund application filed by the applicant)?

Ans. Once the Taxpayer files reply, following actions take place on the GST Portal:

- Dashboard of the applicant is updated with the record of the filed reply. He/she can view it from the following navigation: Services > User Services > My Applications > REPLIES.

- Dashboard of the Tax Official is updated with the record of the filed reply.

- Status of the refund application will change to “Pending for Order-Reply Received”.

Q.8 From where can I view the reply filed by me?

Ans. Login to the GST Portal. Navigate to Dashboard > Services > User Services > My Applications > Refunds > Search ARN > Select ARN > Replies option.

Q.9 Does an applicant get any intimation about the notice or order issued to them?

Ans. Applicant will get intimation about all notices and orders issued to him/her through SMS and e-mail on their registered mobile number and email ID.

Q.10 What will happen once a deficiency memo (Form GST RFD-03) is issued to the applicant?

Ans. Once a deficiency memo (Form GST RFD-03) is issued, applicant needs to file a fresh refund application. After successful filing, fresh ARN will be generated. In case of refund of documents declared in statement for a refund application, applicant will be able to use the same documents again in the fresh refund application.

Q.11 On issuance of deficiency memo, the amount debited from the ledger at the time of filing of refund application will be auto re-credited or will be re-credited through Form GST PMT-03?

Ans. In case of issue of Deficiency Memo in GST RFD-03 by Tax Official, there would be auto re-credit of refund claimed amount in Electronic Cash/ Credit Ledger of the applicant, if the ledger has been debited at the time of filing refund application. The documents, for which refund is claimed will again be eligible for refund to use the same documents in fresh refund application.

Q.12 What if the Tax Official is not satisfied with the reply filed by applicant in Form GST RFD-09?

Ans. The applicant need to submit reply in Form GST RFD-09, in respect of the grounds/points mentioned by Tax Official in notice in Form GST RFD-08. The Tax Official will consider the reply filed by the applicant. In case, the applicant does not reply to the notice within the stipulated time or the Tax Official is not satisfied with the reply filed by the applicant, he may proceed further to issue Refund Rejection/ Sanction Order in Form GST RFD-06 for sanctioning/rejecting the amount of refund in whole or part.

Q.13 What type of documents are available in Orders tab?

Ans. In Orders tab, there would be two documents, the order and the annexure containing the details of the refund sanctioned, as attached by the sanctioning authority.

Note:

1. If complete adjustment order or withheld order (Form GST RFD 7B) has been issued by tax official, on refund application, then no payment order would be issued.

2. In other cases of sanctioned refund, the payment order No (Form GST RFD-05) and the annexure for the amount to be transferred to the r bank account given by the applicant would be displayed and can be downloaded, as and when it is issued.

3. In column of PMT-03, the order will be available only in case there is any inadmissible refund amount and the tax officer has issued Form GST PMT-03 order to re-credit the amount in Electronic Cash/Credit Ledger (if the amount was debited in the Electronic Cash/Credit Ledger at the time of filing refund application).

Q.14 Provisional Refund Order in Form GST RFD-04 is available for which refund applications?

Ans. Provisional Refund Order in Form GST RFD-04 is available in case of following refund applications:

- Refund on account of Export of Services with Payment of Tax

- Refund on account of Export of Goods/ Services without Payment of Tax

- Refund on account of Supplies made to SEZ Unit/ SEZ Developer (With Payment of Tax)

- Refund on account of Supplies made to SEZ Unit/ SEZ Developer (Without Payment of Tax)

Q.15 I have received an intimation that Bank Account validation has failed? What do I need to do now

In case of failed Bank Account validation, login to the GST Portal with your ARN. Navigate Services > Refunds > Track Application Status > Enter ARN. Click on UPDATE BANK ACCOUNT button in Bank Validation Status column. Click here to know more about how to update the Bank account.

Viewing Audit History

Q.16 From where can I view the audit history?

Ans. Login to the GST Portal. Navigate to Dashboard > Services > User Services > My Applications > Refunds > Search ARN > Select ARN > Audit History option.

B. Manual > View notices/orders and File Reply to the Issued Notices

How can I view notices/ orders and file reply to the issued notices by the GST Refund Processing Officer?

To view notices/ orders and file reply to the issued notices by the Refund Processing Officer, perform following steps:

A. Searching for your filed refund application in “My Applications” Screen

B. Take action using NOTICE/ACKNOWLEDGEMENT tab of Case Details screen: View Issued Notice and File Reply

C. Take action using ORDERS tab of Case Details screen: View the issued Order

D. Take action using AUDIT HISTORY tab of Case Details screen: View the audit history

A. Searching for your filed refund application in “My Applications” Screen

To search for the filed applications and open the related ARN on the GST Portal, perform following steps:

1. Access the www.gst.gov.in URL. The GST Home page is displayed. Login to the portal with valid credentials. Dashboard page is displayed. Click Dashboard > Services > User Services > My Applications.

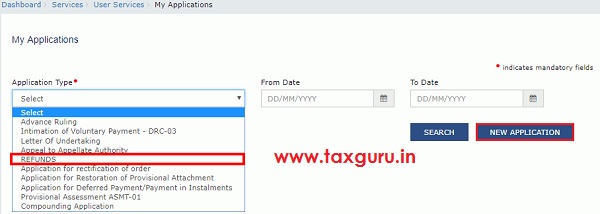

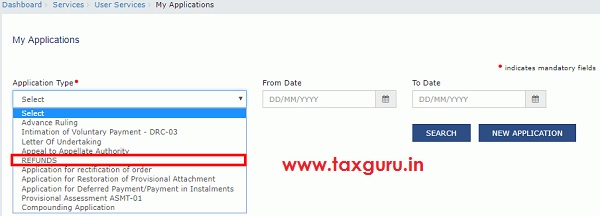

2. My Applications page is displayed. In case, you want to file a new refund application, select “REFUNDS” from the drop-down list and click NEW APPLICATION button.

Note: Click the links below to know more about how to file different types of refund applications.

| S.No. | Refund Type | FAQs Link | User Manual Link |

| 1 | Refund of Excess Balance in Electronic Cash Ledger | FAQs | User Manual |

| 2 | Refund of ITC on Export of Goods & Services without Payment of tax option. | FAQs | User Manual |

| 3 | On account of Supplies to SEZ unit/ SEZ developer (without payment of tax) | FAQs | User Manual |

| 4 | Refund on account of ITC accumulated due to Inverted Tax Structure | FAQs | User Manual |

| 5 | On account of Refund by Recipient of deemed export | FAQs | User Manual |

| 6 | Refund on account of Supplies to SEZ unit/ SEZ Developer (with payment of tax) | FAQs | User Manual |

| 7 | Exports of services with payment of tax | FAQs | User Manual |

| 8 | Tax paid on an intra-State supply which is subsequently held to be inter-State supply and vice versa | FAQs | User Manual |

| 9 | On account of Refund by Supplier of deemed export | FAQs | User Manual |

| 10 | Excess payment of tax | FAQs | User Manual |

| 11 | Any other (specify) | FAQs | User Manual |

| 12 | On account of Assessment/Provisional assessment/Appeal/Any Other Order | FAQs | User Manual |

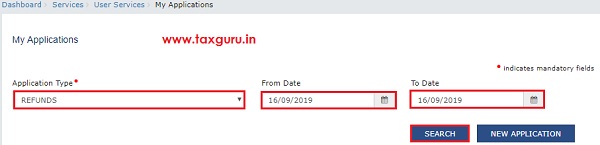

3. In the Application Type field, select “REFUNDS” from the drop-down list.

4. To view the filed refund applications, select the submission period in the From Date field and To Date field. Click SEARCH.

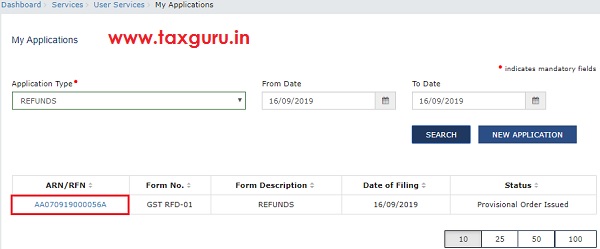

5. Based on your Search criteria, applications are displayed. Click the ARN/RFN hyperlink you want to open. The status of the refund application is displayed in the Status column. The ARN/RFN number is hyper linked and clicking on it would take you to the case details page of that refund application.

Note: In case of failed Bank Account validation, login to the GST Portal with your ARN. Navigate Services > Refunds > Track Application Status > Enter ARN. Click on UPDATE BANK ACCOUNT button in Bank Validation Status column. Click here to know more about how to update the Bank account.

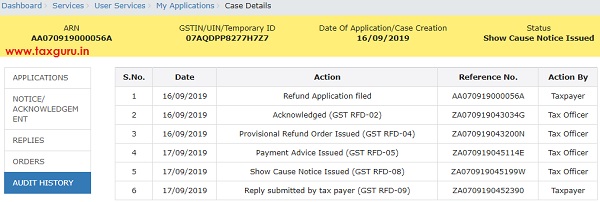

6. Case Details page is displayed. From this page, you can click on the tabs provided at the left-hand side of the page to view and download their related details.

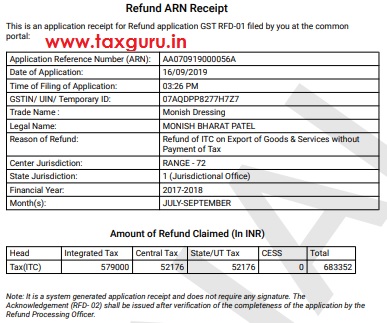

7. To view your filed refund application details, on the Case Details page of that particular application, select the APPLICATIONS tab, if it is not selected by default. This tab provides you an option to view the filed refund application, along with its supporting documents in PDF mode. In the “ARN” column, click the “ARN” link to download the ARN receipt.

7a. The ARN receipt is downloaded in PDF format.

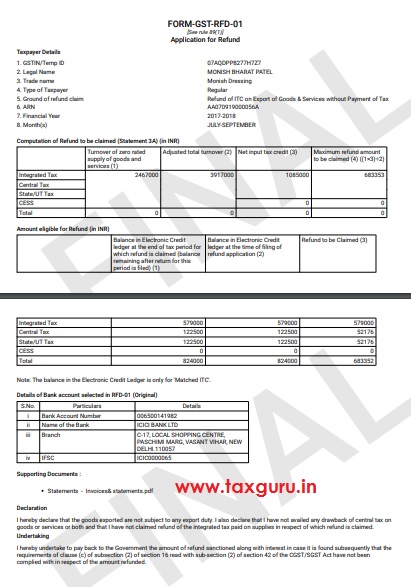

7b. In the “Action” column, click the “Download“ link to download the filed refund application. The filed refund application is downloaded in PDF format.

B. View Issued Notices and File Reply

To view notices issued by the Tax Official and to reply to those notices, perform following steps:

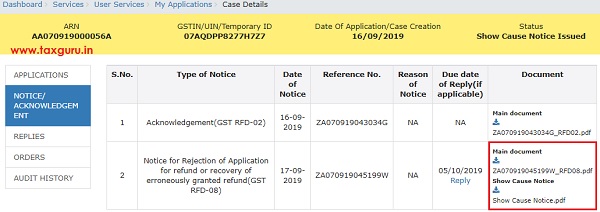

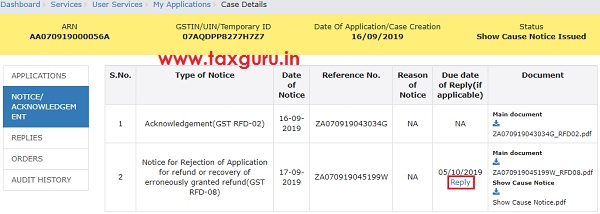

1. On the Case Details page of that particular application, select the NOTICE/ACKNOWLEDGEMENT tab, if it is not selected by default. This tab displays all the notices issued by the Tax Official to you. In the “Document” column, click the document link to download the notice issued by the Tax Official on your system.

2. To reply to notices issued by the Tax Official, on the Case Details page of that particular application, select the NOTICE/ACKNOWLEDGEMENT tab, if it is not selected by default. This tab displays all the notices issued by the Tax Official to you. In the “Document” column, click the document name(s) to download them into your system and view them.

3. To file reply to the issued notice, click the REPLY button. A hyperlinked “Reply” button would be visible in the column of “Due date of Reply”.

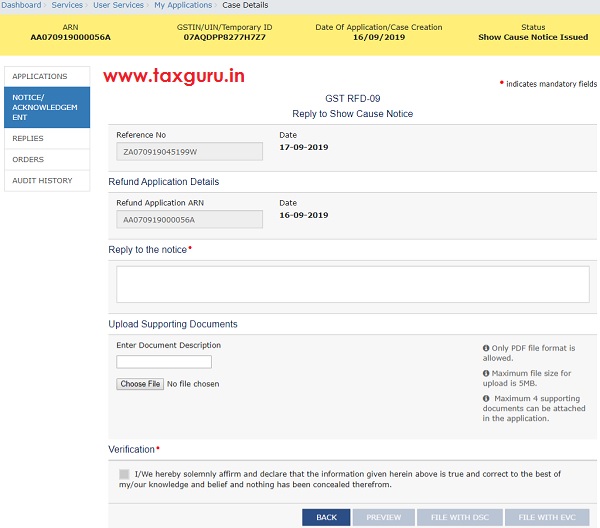

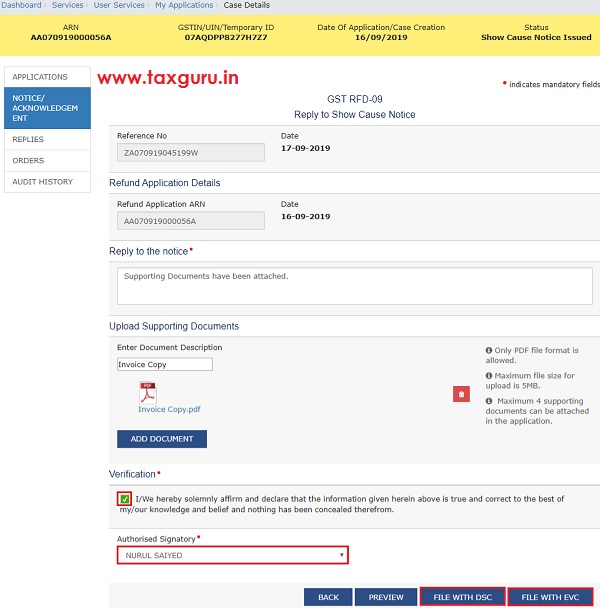

4. The REPLY page is displayed. The Reference No, Refund Application Details fields are auto-populated.

5. In the Reply to the Notice field, enter your reply.

6. If required, in the Upload Supporting Documents section, you can also upload supporting documents. Enter the Document Description of the document to be uploaded.

7. Click the Choose File button.

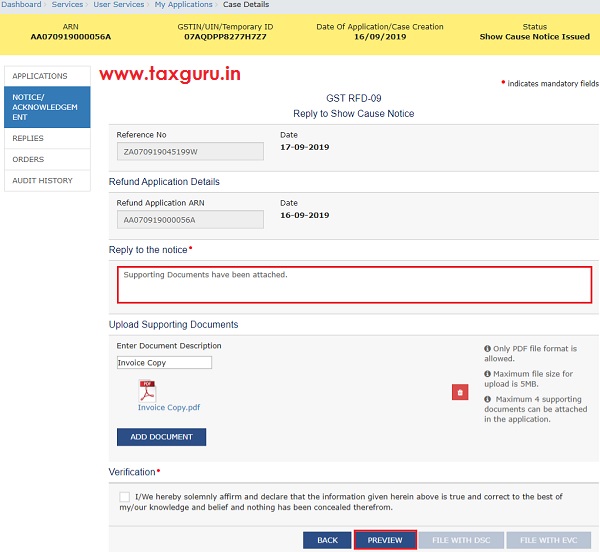

8. The ADD DOCUMENT button gets displayed. Click it to upload the document(s) from your system.

Note: You can delete the uploaded document by clicking the DELETE button and upload again.

9. Click the PREVIEW button to preview the reply to be filed to the Tax Official.

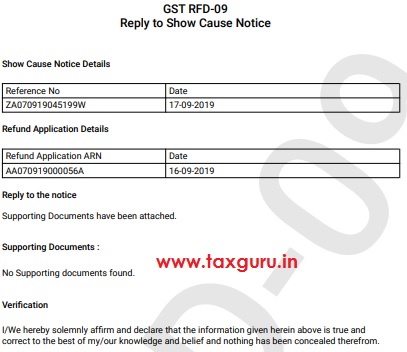

10. Preview of captured reply in the Form GST RFD-09 is displayed in the PDF format.

11. Select the Verification checkbox. Select the Authorized Signatory from the drop-down list. Click FILE WITH DSC or FILE WITH EVC button.

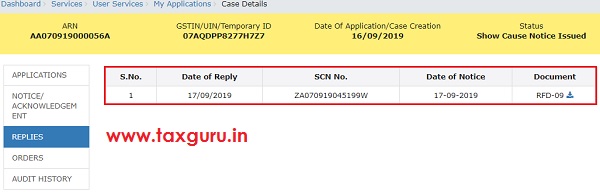

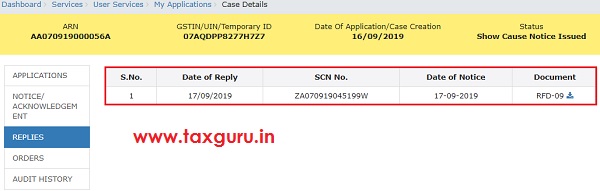

12. The updated REPLIES tab is displayed, with the record of the filed reply in a table. Click the documents in the Document section of the table to download them. Status of the application is changed to “Pending for Order-Reply Received”.

13. Once the Taxpayer files reply, following actions take place on the GST Portal:

- Dashboard of the Taxpayer is updated with the record of the filed reply. He/she can view it from the following navigation: Services > User Services > My Applications > REPLIES.

- Dashboard of the Tax Official is updated with the record of the filed reply.

14. To view the filed replies to the Tax Official, on the Case Details page of that particular application, select the REPLIES tab. This tab will display the replies that you have filed on the issued Notices. In the “Document” column, click the document name(s) to download them into your system and view them.

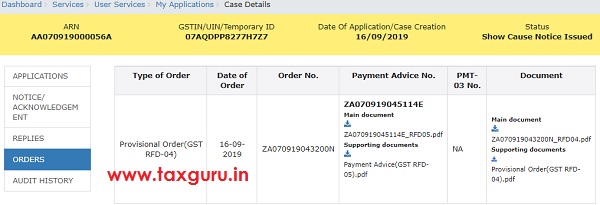

C. View the issued Order

To view and download the order issued against your refund application, perform following steps:

1. On the Case Details page of that particular application, select the ORDERS tab. This tab displays all the orders issued by the Tax Official to you.

2. In the Payment Advice No., PMT-03 No. and Document column, click the document name(s) to download them into your system and view them.

Note:

1. If amount is adjusted completely through refund sanction order (GST RFD-06) or withheld order (Form GST RFD 7B) has been issued by tax official, on your refund application, then no payment advice would be issued.

2. In other cases of sanctioned refund, the payment order No (GST RFD-05) and the downloadable annexure for the amount to be transferred to the taxpayer’s bank account would be displayed, as and when it is issued.

3. In column of PMT-03, the order will be available only in case there is any inadmissible refund amount and the tax officer has issued GST PMT-03 order to re-credit the amount in Electronic Cash/Credit Ledger (if the amount was debited in the Electronic Cash/Credit Ledger at the time of filing refund application).

D. View the audit history

To view history details related to the refund application filed by the taxpayer, perform following steps:

1. On the Case Detail page of that particular taxpayer, select the AUDIT HISTORY tab. This tab displays all actions on the refund application filed by the taxpayer.

(Republished with amendments)

****

Disclaimer: The contents of this article are for information purposes only and does not constitute an advice or a legal opinion and are personal views of the author. It is based upon relevant law and/or facts available at that point of time and prepared with due accuracy & reliability. Readers are requested to check and refer relevant provisions of statute, latest judicial pronouncements, circulars, clarifications etc before acting on the basis of the above write up. The possibility of other views on the subject matter cannot be ruled out. By the use of the said information, you agree that Author / TaxGuru is not responsible or liable in any manner for the authenticity, accuracy, completeness, errors or any kind of omissions in this piece of information for any action taken thereof. This is not any kind of advertisement or solicitation of work by a professional.

The procedure to be followed relating to refund claim in very easy way is nicely explained in step by step manner which a layman can understand and work in the web portal. Lots of thanks

Thanks for sharing tutorial on REFUND and which help me to reply show cause notice

Most crucial tutorial.

Thanks for sharing such tutorial on REFUND