Ministry of Finance

Now the GST Taxpayers can file their GSTR-3B Returns in a Staggered Manner

Posted On: 22 JAN 2020 6:29 PM by PIB Delhi

Considering the difficulties faced by trade and industry in filing of returns, the government has decided to introduce several measures to ease the process. The Finance Ministry today said that now GST taxpayers can file their GSTR-3B returns in a staggered manner.

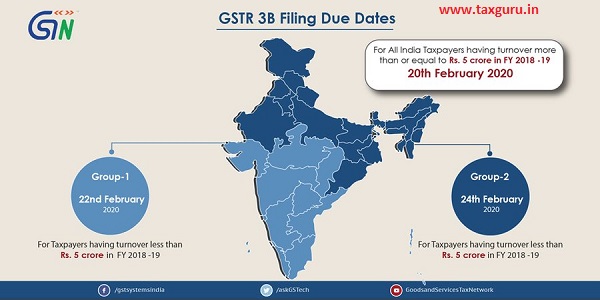

Presently the last date of filing GSTR-3B returns for every taxpayer is 20th of every month. From now on, the last date for filing of GSTR-3B for the taxpayers having annual turnover of Rs 5 crore and above in the previous financial year would be 20th of the month. Thus, around 8 lakh regular taxpayers would have the last date of GSTR-3B filing as 20th of every month without late fees.

The taxpayers having annual turnover below Rs 5 crore in previous financial year will be divided further in two categories. The tax filers from 15 States/ UTs, i.e., Chhattisgarh, Madhya Pradesh, Gujarat, Daman and Diu, Dadra and Nagar Haveli, Maharashtra, Karnataka, Goa, Lakshadweep, Kerala, Tamil Nadu, Puducherry, Andaman and Nicobar Islands, Telangana and Andhra Pradesh will now be having the last date of filing GSTR-3B returns as 22nd of the month without late fees. This category would have around 49 lakh GSTR-3B filers who would now have 22nd of every month as their last date for filing GSTR-3B returns.

For the remaining 46 lakh taxpayers from the 22 States/UTs of Jammu and Kashmir, Laddakh, Himachal Pradesh, Punjab, Chandigarh, Uttarakhand, Haryana, Delhi, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand and Odisha having annual turnover below Rs 5 crore in previous financial year will now be having last date of filing the GSTR-3B as 24th of the month without late fees.

The Finance Ministry said that the necessary notification in this regard would be issued later by the competent authority.

In a statement issues, the Ministry further said that it has also taken a note of difficulties and concerns expressed by the taxpayers regarding filing of GSTR-3B and other returns. The matter has been discussed by the GSTN with Infosys, the Managed Service Provider, which has come out with above solution to de-stress the process as a temporary but immediate measure. For further improving the performance of GSTN filing portal on permanent basis, several technological measures are being worked out with Infosys and will be in place by April 2020..

——————-

Proposed New Due Dates of Form GSTR -3B (Based on State and Turnover Criteria)

| State / UT where Taxpayer is Registered | Turnover | Due Date | |

| Existing | Proposed | ||

| Any State in India including Union Territories | Taxpayers having annual turnover of Rs 5 crore and above in the previous financial Year | 20th of the next month | 20th of the next month without late fees |

| Chhattisgarh, Madhya Pradesh, Gujarat, Daman and Diu, Dadra and Nagar Haveli, Maharashtra, Karnataka, Goa, Lakshadweep, Kerala, Tamil Nadu, Puducherry, Andaman and Nicobar Islands, Telangana and Andhra Pradesh. | Taxpayer having annual turnover below Rs 5 crore in previous financial year | 20th of the next month | 22nd of the next month without late fees |

| Jammu and Kashmir, Laddakh, Himachal Pradesh, Punjab, Chandigarh, Uttarakhand, Haryana, Delhi, Rajasthan, Uttar Pradesh, Bihar, Sikkim, Arunachal Pradesh, Nagaland, Manipur, Mizoram, Tripura, Meghalaya, Assam, West Bengal, Jharkhand and Odisha. | 20th of the next month | 24th of the next month without late fees | |

kindly send me all latest new updates in gst

Good

It’s very helpful to know the daily updates of GST

And please upload how can we take ITC on Capital Goods….