Sponsored

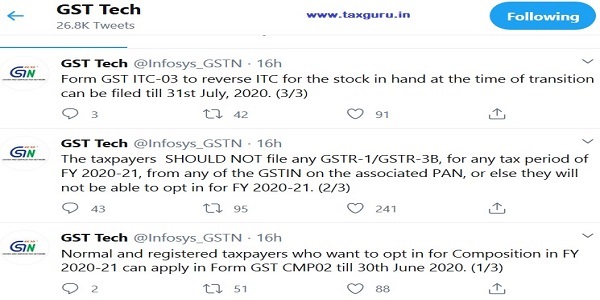

Normal and registered taxpayers who want to opt in for Composition in FY 2020-21 can apply in Form GST CMP02 till 30th June 2020.

The taxpayers SHOULD NOT file any GSTR-1/GSTR-3B, for any tax period of FY 2020-21, from any of the GSTIN on the associated PAN, or else they will not be able to opt in for FY 2020-21.

Form GST ITC-03 to reverse ITC for the stock in hand at the time of transition can be filed till 31st July, 2020.

Source- Tweets from @Infosys_GSTN on 06th April 2020.

Sponsored

Kindly Refer to

Privacy Policy &

Complete Terms of Use and Disclaimer.