“GST Law Essentials: Streamlining Indirect Taxation for Business Growth – Understand the unified tax structure under GST for efficient compliance.”

GST is an indirect tax reform which attempts to create a common national market. GST has replaced multiple indirect taxes like excise duty, service tax, VAT, CST, luxury tax, entertainment tax, entry tax, etc.

Introduction of GST Law in India

Advantages of GST:

GST has made India a dynamic common market and result in generation of positive externalities. By ensuring uniformity of indirect tax rates across the country, it has substantially improved the efficiency and ease of doing business.

a) Dynamic common market

b) Elimination of cascading effect

c) Efficiency

d) Reduced compliance costs

e) Reduction in tax evasion

f) Improved collection efficiency:

g) Revenue generation

h) Encourages savings and investment:

i) Improved efficiency of logistics

j) Regulation of the unorganized sector

k) Export competitiveness

l) Higher threshold for registration

m) Composition scheme for small businesses

n) Benefits to consumers

Disadvantages of GST:

1. Lack of preparedness

2. Compliance related issues

3. Increased costs due to software purchase

4. Lack of skilled resources and re-skilling existing workforce

5. Multiple rate structure

6. Multiple registrations

7. Effect on discount and reward programs

8. Short term business challenges

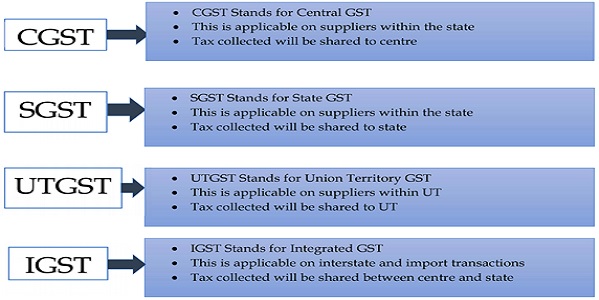

Structure of GST

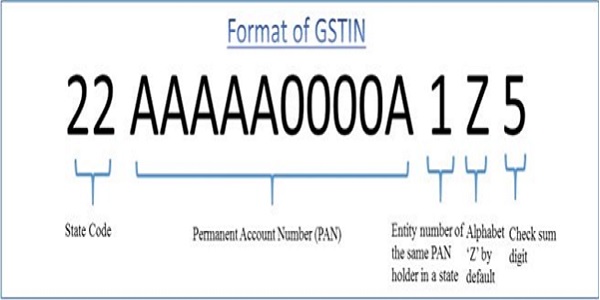

There are four types of indirect taxes under GST: 1. Central Goods and Services Tax (CGST). 2. State Goods and Services Tax (SGST). 3. Union Territory Goods and Services Tax (UTGST). 4. Integrated Goods and Services Tax (IGST)

Order of utilization of credit

There is a specified order in which Input tax credit should be utilized. First, IGST credit should be utilized towards IGST output payment, then towards payment of output CGST and then towards payment of SGST/UTGST.

After entire utilisation of IGST, ITC of CGST should be utilized for the payment of output CGST and output IGST in that order. Thereafter, ITC of SGST /UTGST should be utilized for the payment of output SGST/UTGST and output IGST in that order. ITC of CGST cannot be utilized for the payment of output SGST/UTGST and vice versa. Also, ITC of SGST/UTGST should be utilized for the payment of output IGST, only after ITC of CGST has been utilized fully.

GST Registration

Compulsory Registration

Every supplier of goods and/ or services is required to obtain registration if his aggregate turnover exceeds the threshold limit during the financial year. Please refer the below table:

The special category states under GST includes Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh, Uttarakhand, Jammu & Kashmir.

However, certain category of persons are also required to compulsorily get registered under GST:

Voluntary Registration

The dealers who are not required to register as per the GST Act, does not fall in the above category can apply for voluntary registration on the GST Portal.

Composition Scheme

In GST regime, tax (CGST and SGST/UTGST for intra-State supplies and IGST for inter-State supplies) is payable by every taxable person and in this regard. However, to provide the relief to small businesses, manufacturers, service providers, suppliers of food articles, traders, etc., making intra-State supplies, a simpler method of paying taxes is prescribed, known as composition levy. The objective of composition scheme is to bring simplicity and to reduce the compliance cost for the small taxpayers whose turnover is up to Rs. 75 lakhs ( Rs. 50 lakhs in case of few States).

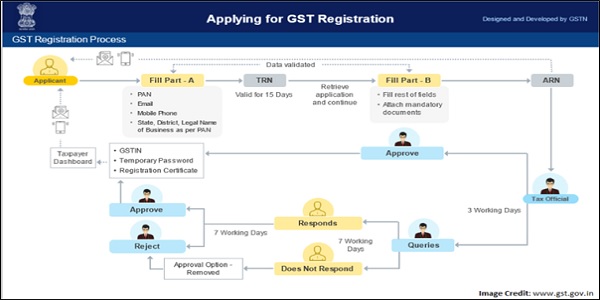

Step-by-Step Procedure of GST Registration for Normal Taxpayers

The GST Registration form comprises 2 parts – A and B:

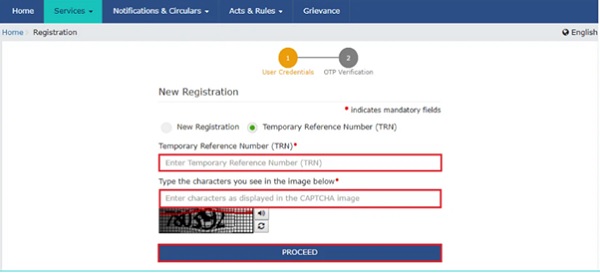

Part A of the GST registration form includes basic information (Refer the image below) of the applicant and helps generate Temporary Reference Number (TRN), which is valid for 15 days. The TRN can be then used to fill out the Part B of the form.

Successful submission of Part B of the GST registration form generates an Application Reference Number (ARN). A tax official validates the GST Registration application and once the same is approved, GST Number and GST Registration Certificate are issued.

List of Documents Required for GST Registration

- Certificate of incorporation

- PAN Number

- Photograph of stakeholder/authorized signatory (promoter/partner)

- Company address proofs such as receipt of electricity bill or property tax (preferred not more than 3 months), or a record of legitimate ownership

- Letter of authorisation

- Proofs such as details of the bank account like a bank statement copy and the first page of the passbook and a cancelled cheque.

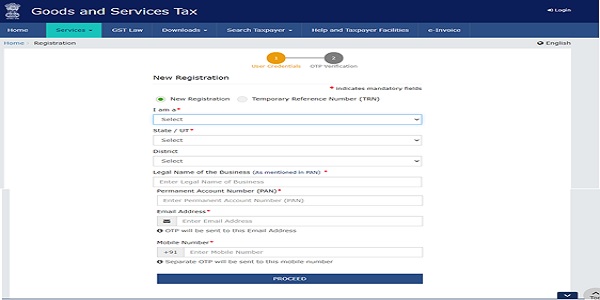

Step 1: Visit the GST Government website: https://www.gst.gov.in/.

Step 2: Click on Services > Registration > New Registration option.

Step 3: The following “New Registration” page is displayed in Part A, fill out the details such as Legal Name, PAN and other details in the form and click on “Proceed”.

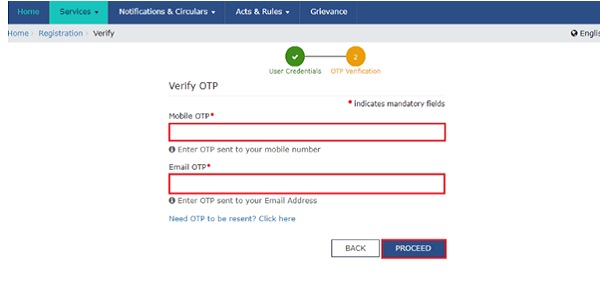

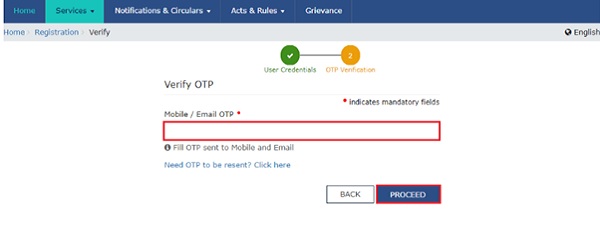

Step 4: On the subsequent OTP Verification page, enter the OTP you received on your mobile number and that on your email address. Please note that the OTP will be valid 10 minutes only.

Step 5: Once the verify the application, Part A of the GST registration form is completed. Subsequently the system automatically generates a Temporary Reference Number (TRN). The TRN acknowledgment information will sent to the e-mail address as well as mobile number. This TRN which is required for completion of registration under GST is valid for only 15 days.

Step 6: To fill out Part B of the form, click on the “My Saved Applications” tab. Enter the TRN generated along with the captcha text as shown on the screen below.

Step 7: Once you click “Proceed”, the following verification page will be displayed. Enter the OTP received on your registered mobile number and e-mail id to proceed further.

Step 8: Subsequently, the My Saved Applications page is displayed. Under the Action column, click on the Edit icon.

Note: The status of the application is ‘Draft’ by default unless the application is submitted. Once the GST application is submitted, the status is changed to ‘Pending for Validation’.

Step 9: On the subsequent screen, the GST registration application form with the following mentioned tabs will be displayed, you need to select each tab and enter the relevant details:

- Business Details

- Promoter/Partners

- Authorized Signatory

- Authorized Representative

- Principal Place of Business

- Goods and Services

- Bank Accounts

- State Specific Information

- Verification

Step 10: After successful verification of your GST application for registration, you will receive an acknowledgement on your registered e-mail address and mobile phone number. An Application Reference Number (ARN) receipt is sent to the registered e-mail address and phone number. You can use the ARN Number to know the status of the GST Application.

Once the application is approved, registered ID and password is emailed to the applicant, you can login and download the GST Registration Certificate.

About the Author

The author is Chhavi Aggarwal Senior Associate in Neeraj Bhagat & Co. Chartered Accountants, a Chartered Accountancy firm helping foreign companies in setting up business in India and complying with various tax laws applicable to foreign companies while establishing their business in India. Neeraj Bhagat & Co. Chartered Accountants, is a well-established Chartered Accountancy firm founded in the year 1997 with its head office at New Delhi.

This article is not updated consequently doesn’t share the information relevant in today’s time. For eg. threshold for composition levy, referring to special category states as to applicability of registration limits without mentioning the non inclusion of H.P., J&K and Assam from Rs.20lakh limits for good. Moreover, Rs.10lakh limits applies only in case of Manipur, Mizoram, Nagaland and Tripura only (not on all special category states) in case of services as well as services.

Solicit your forthcoming article.