♦ Goods Transport Agency (GTA) under GST – A Critical Analysis

– ‘goods transport agency‘ means any person who provides service in relation to transport of goods by road and issue consignment note, by whatever name called;”

– Services by way of transportation of goods (Heading 9965):

- By Road except the services of:

– A Goods Transportation Agency;

– A Courier Agency;

- By Inland Waterways

Thus, transportation of goods by a GTA is not exempt from tax.

Page Contents

- – Applicable Rate for GTA under GST

- Reverse Charge Mechanism on GTA Services –

- – Exemption under GST:

- – Liability to Register under GST by GTA?

- – Place of Supply for GTA under GST

- – AAR in respect of GTA

- – Frequently Asked Questions

- – Case Study

- Difference between ‘Hiring’ and ‘Renting.

- – Whether RCM is applicable on payments made for hiring of transport from unregistered GST traders?

– Applicable Rate for GTA under GST

| 5% without ITC | 12% with ITC |

As per Notification No. 20/2017 – CT (R)

Reverse Charge Mechanism on GTA Services –

Further, the following recipients of services, supplied by a goods transport agency (GTA), are required to pay GST under reverse charge mechanism @ 5.00 % in respect of the said services of transportation of goods by road.

- Any Factory registered under or governed by the Factories Act, 1948 (63 of 1948)

- Any Society registered under the Societies Registration Act, 1860 (21 of 1860) or under any law for the time being in force in any part of India; or

- Any Co-operative Society established by or under any law; or

- Any Person registered under the Central Goods and Services Tax Act or the Integrated Goods and Services Tax Act or the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act; or

- Any Body Corporate established by or under any law; or

- Any Partnership Firm whether registered or not under any law including association of persons; or

- Any Casual Taxable Person

– Exemption under GST:

(A) GTA Services are exempt when such are used for transportation of goods specified under Notification 12/2017 CT(R). Services provided by a goods transport agency, by way of transport in a goods carriage following services are exempt:

- Agricultural Produce, Organic Manure;

- goods, where consideration charged for the transportation of goods on a consignment transported in a single carriage does not exceed one thousand five hundred rupees;

- goods, where consideration charged for transportation of all such goods for a single consignee does not exceed rupees seven hundred and fifty;

- Milk, Salt and Food Grain including Flour, Pulses and Rice;

- Newspaper or Magazines registered with Registrar of Newspapers, Defence or Military Equipment

- Relief Materials for Victims of Natural or Man – Made Disasters, Accidents, Calamities or Mishaps

(B) Provided that nothing contained in this entry under Notification No. 28/2018 CT (R) shall apply to services provided by a goods transport agency, by way of transport of goods in a goods carriage by road, to, –

- Department or establishment of the Central Government or State Government or Union territory; or Local Authority; or

- Governmental Agencies

which has taken registration under the Central Goods and Services Tax Act, 2017 (12 of 2017) only for the purpose of deducting tax under section 51 and not for making a taxable supply of goods or services.”

– Liability to Register under GST by GTA?

– As per Notification No. 5/2017 – CT, A GTA providing transport services to the specified persons who are liable to pay tax on reverse charge, is not required to register under GST. If their turnover crosses the threshold limit, they are not required to register under GST. This is because 100% of their supplies will be reverse charge supplies, so there is no tax liability.

A GTA which is not exclusively providing transport services to the specified persons, who are liable to pay tax on reverse charge, has to register under GST when its aggregate turnover crosses the threshold limit. These are GTAs who provide services to sole proprietors, HUF (Hindu Undivided Family), etc.

– Place of Supply for GTA under GST

| Recipient of GTA Services | Place of Supply |

| Registered Person | Location of Registered Recipient |

| Unregistered Person | Location where goods are given for its transportation |

– AAR in respect of GTA

Case Name: In re Saravana Perumal (GST AAR Karnataka)

Appeal Number: Advance Ruling No. KAR ADRG 98/2019

Date of Judgement/Order: 27/09/2019

Related Assessment Year:

The applicant sought AAR to know whether the hiring services shall be considered as a part of GTA services or to be treated separately. Hence, it is observed that the applicant is providing the following two services:

(a) Goods transportation services as a Goods Transport Agency

(b) Providing services by giving the vehicles on hire basis to another GTA

The services of providing vehicles on hire basis to another GTA is covered under Entry No. 22 of Notification No. 12/2017 – CT (R) dated 28.06.2017 and this entry exempts the services by way of giving on hire: a means of transportation of goods to a goads transport agency.

Conclusion: Therefore, the services provided as a GTA are different from the services provided by way of giving vehicles on hire basis to another GTA & hence are independent of each other so far as tax treatment is concerned. Further, there is no provision in the law barring person being a GTA from renting the vehicle to another GTA.

– Frequently Asked Questions

- Question 1: If GTA hires any means of transport to provide his output service, whether GST is payable on this service?

In case the GTA service supplier hires any means of transport to provide his output service, no GST is payable on such input service.

- Question 2: I own a single truck and I rent it to a major player, who provides GTA service; should I take a registration? Does my monthly rental/lease income attract GST?

Registration is not required since services by way of giving on hire, a means of transportation of goods to a GTA are exempt from tax vide Entry No. 22 of Notification number 12/2017 – CT (R) dated 28th June, 2017.

However, if any intermediary and ancillary service is provided in relation to transportation of goods by road, and charges, if any, for such services are included in the invoice issued by the GTA, such service would form part of the GTA service and would not be treated as a separate supply. In fact, any service provided along with the GTA service that is part of the composite service of GTA shall be taxed along with GTA service and not as separate supplies. However, if such incidental services are provided as separate services and charged separately, whether in the same invoice or separate invoices, they shall be treated as separate supplies.

A GTA providing these services in relation to transportation of goods by road to specified persons who liable to pay tax under RCM can avail the benefit of this exemption (RCM only).

Under Section 7 of the CGST Act, 2017 supply includes all forms of supply of goods such as sale, transfer, barter, exchange, licence, rental, lease or disposal made or agreed to be made for a consideration by a person in the course or furtherance of business. Sale or disposal of old vehicles, old tyres and scrap material for a consideration would therefore attract GST regardless of whether ITC has been availed or not.

– Case Study

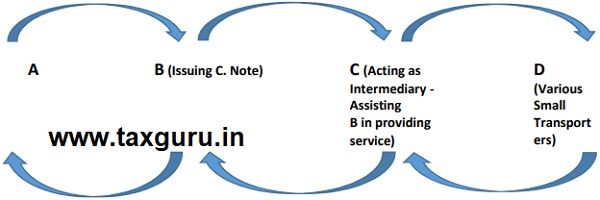

A is the service recipient. A ask B to provide service of transportation of Goods.

B further ask C for transportation of goods at A’s location on behalf of us.

C further ask D for transportation of goods at A’s location. Although, C is having some own vehicles also and rest take assistance from D.

B is GTA, as fulfilling both the applicable conditions.

– Providing services of transportation of

– Issuing Consignment note

Will be liable to pay tax @5% without ITC or 12% with ITC under forward charge as they opt otherwise the service recipient liable to pay tax @5% under reverse charge mechanism as applicable.

D will be exempt from GST by attracting the S.No.18 of Notification No. 12/2017 as services by way of transportation of goods by road except the services of goods transportation agency.

C is the intermediary as he is providing services to B.

– What will be the tax treatment on part of C?

(i) Whether providing services from their own vehicle will be exempt from GST as per No.22(b) of Notification No.12/2017. “Services by way of giving on hire – (b) to a goods transport agency, a means of transportation of goods.” Because C is providing services on hire basis*, as they are providing transportation service on contract basis and charged on the basis of number of tonnes as they transported.

(ii) Providing services from taking assistance from D (Various Small Transporters).

*Interpretation is based on the following considerations

1. What I want to say is that hiring of truck by GTAfrom another person is exempted. According to us, Govt doesn’t want to burden GTA because GTA will be paying taxes on his output services. Hiring charges (without GST) will also form part of transportation charges/cost which will be recovered from the person who bears the freight (may be consignor or consignee). If truck is given to a person other than GTA, it will be considered under the category of “Renting of Motor Vehicles” and tax will be charged accordingly.

Hence, the essence of hiring is that the control and possession of the vehicle is not transferred to the person hiring the vehicle whereas in case of renting, the hirer is provided with the freedom to take the vehicle wherever he desires with the obligation to keep the owner informed of his movements from time to time.

2. There can be two cases of hiring services to GTA:

Case 1) A Ltd. gives on hire to B Ltd., 10 trucks on a fixed hire Charges of Rs. 50,000 per truck per month for the whole financial year.

Case 2) A Ltd. gives on hire to B Ltd., 10 trucks based on “per trip/km” basis for the whole financial year. E.g.: The trips can be multiple trips per truck per day or single trip of more than 1 day per truck.

Difference between ‘Hiring’ and ‘Renting.

As per the Law Lexicon, the Encyclopaedic Law Dictionary, when A person gives motor vehicle to B person, A is providing renting service of motor vehicle (may be car, truck, van, meta door, tipper etc.) and B is hiring that motor vehicle from A.

Exemption on ‘hiring basis’ of vehicle meant for transportation of goods is available to GTA only, if truck is supplied to GTA only. It is clearly mentioned at S.No.22 of Notification No. 12/17-CT(R) dated 28.06.2017 as amended. In that situation, the activity of hiring and renting both are covered under the category of ‘Renting of Motor Vehicle’ e.g. we hire cab (Uber Co.) and Uber Co. provides renting service.

In the Case No. 1 and 2 mentioned by us, if B Ltd. is registered under the category of GTA, then the services provided by A Ltd. to B Ltd. is exempted. If B is not registered as GTA then no exemption is available to A Ltd. in both cases. “Emphasis is supplied on hiring to GTA”

The issuance of consignment note is condition/qualification as GTA not for hiring basis. It is mandatory for GTA.

If hiring is not to GTA, explore the renting under RCM for payment of tax under RCM or FCM.

3. AAR Under the Service Tax Regime – Renting vs Hiring Uttarakhand High Court – Landmark Judgement in the case of Commissioner of Customs and Central Excise vs Sachin Malhotra, Raj Kumar Taneja, and M/s Shiva Travels (2014 (10) – TMI 816 – Uttarakhand High Court) wherein the difference b/w renting and hiring has been reported for the purpose levying service tax under the category of “Rent a cab services”.

It is submitted that the Hon’ble High Court has concluded that when the control and possession of the vehicle remains with the owner of the vehicle providing services of transporting of passengers, the said activity is covered by hiring and is not renting of vehicles. The situation of hiring of vehicles may get covered under the category of “Supply of Tangible Goods Service”.

4. In the Case of Commissioner of Service Tax Vs. Vijay Travels [2014 (36) S.T.R. 513 (Guj.)], the Hon’ble High Court of Gujarat, observed as under:

Words and Phrases – Rent – It means the act of payment for the use of something -Renting means a usually fixed periodical return, especially, an agreed sum paid at fixed intervals by a person for any use of the property or car – It is also the amount paid by a hirer to the owner for the use of the property or a car – On facts, Legislature not having made distinction between renting and hiring for levy of Service Tax, Rent-a-Cab Scheme Operator liable therefor – Sections 65(91), 65(105)(o), 68 and 73(1) of Finance Act, 1994

– Sections 74 and 75 of Motor Vehicles Act, 1988 – Section 35G of Central Excise Act, 1944 as applicable to Service Tax vide Section 83 of Finance Act, 1994. [paras 14.2, 14.3]

Therefore, the contentions of the applicant that due to different in the phrases “hire” and “rent”, in their case the impugned would not quality as “rent-a-cab”, have no grounds, as the proposition pronounced in the above cited case law clearly points out that “hiring” and ”renting” are synonyms.

– Whether RCM is applicable on payments made for hiring of transport from unregistered GST traders?

RCM is applicable for GTA and not for transport of goods. Where the vehicle is taken on rent or lease, it will be supply of service under 9966 or 9973 and supply of service will be taxable under RCM under section 9(4).

For example; If a vehicle is arranged by way of rent by the service provider for further renting out. Suppose there are three persons A, B & C. A supplies his vehicle on hire to B and B, in turn, supplies that vehicle to C. Tax paid to A can be availed as ITC by B and B can still charge GST @ 5%/ 18% from C. Thus, we can say that ITC chain is not broken. As per Notification No. 22/19-CT(R) dated 30.09.2019, Service Provider must be paying GST 5%/ 18 (It is natural that that person will be registered and RCM is not applicable to an unregistered person.)

Heading 9966 (Rental services of transport vehicles)

I. Renting of motor cab where the cost of fuel is included in the consideration charged from the service recipient. 5%

II. Rental services of transport vehicles with or without operators, other than (I) above. 18%.

I have One firm in that our buisnees is machine hiring like dozer and laoder to the compny under 18% GST,

so now can i start transportation under RCM in this firm ?

Dear sir,

I have my own truck and I gave it to a company on rent to transport the goods. I have taken the registration under GST. What is the GST treatment in my case please reply

Dear Sir,

I have a query Regarding GTA. There is GTA Service Provider 1 registered under RCM without ITC providing service to Factory(Receipients) hires truck from another GTA service provider 2 who are registered in Forwarded Scheme with ITC @12%. so what will be the GST Treatment in this case whether there will be tax liability on GTA service provider 2.

Sir, A Prop firm is hiring trucks/Motor Vehicle for their Advertising works, they customized the vehicle and fabricated it. The consideration paid to the Transporters is without fuel but included the driver.

The Service providers are registered and issued invoice under RCM, so I would like to know is it fall under RCM if yes ITC available or note?

Regards

Vipin