Sponsored

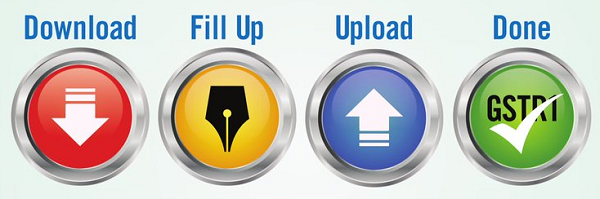

Easy Steps to Create GSTR1 with Offline Tool and Excel Worksheet

Available on GST portal www.gst.gov.in free of cost.

GST Portal provides simple-to-use Offline Utility for uploading invoice data and other records for creating GSTR-1.

Download and Install the Offline tool on your computer.

Enter/Import all invoice data in downloaded Excel template.

Keep adding invoice data to the Excel worksheet.

Import data from the Excel to generate file using Offline tool.

Upload created file on GST Portal for preparing GSTR-1.

| Key Benefits: | System Requirements: |

|

1. Operating system Windows 7 & above

2. Best viewed in:

3. Microsoft Excel 2007 & above Please Note:

|

For assistance please contact us at Email: helpdesk@gst.gov.in, or call at Helpdesk on: 0120-4888999

Sponsored

Kindly Refer to

Privacy Policy &

Complete Terms of Use and Disclaimer.