Circular No. 194/06/2023-GST from the Central Board of Indirect Taxes & Customs (CBIC) provides clarification on the Tax Collected at Source (TCS) liability under Section 52 of the CGST Act for cases involving multiple E-commerce Operators (ECOs) in one transaction. This circular addresses the responsibilities of buyer-side ECOs and seller-side ECOs in different scenarios, particularly in the context of the Open Network for Digital Commerce (ONDC).

The circular highlights the distinction between the platform-centric model of e-commerce and the ONDC Network, where multiple ECOs may be involved in a single transaction. It clarifies that the ECO responsible for collecting TCS and ensuring compliance under Section 52 of the CGST Act depends on the specific scenario. If the supplier-side ECO is not the supplier of the goods or services, the supplier-side ECO is liable for compliances and TCS collection. On the other hand, if the supplier-side ECO is also the supplier, the buyer-side ECO is responsible for collecting TCS.

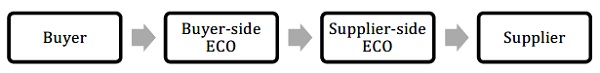

CBIC’s circular aims to provide clarity on TCS liability for transactions involving multiple ECOs. It outlines the responsibilities of buyer-side ECOs and seller-side ECOs in different situations, ensuring compliance with Section 52 of the CGST Act. Trade notices should be issued to disseminate the contents of this circular, and any implementation difficulties should be brought to the attention of the Board.

File No. CBIC-20001/5/2023-GST

Government of India

Ministry of Finance

Department of Revenue

Central Board of Indirect Taxes and Customs

GST Policy Wing

New Delhi

****

Circular No. 194/06/2023-GST | Dated the 17th July, 2023

To,

The Principal Chief Commissioners/Chief Commissioners/Principal Commissioners/Commissioners of Central Tax (All)

The Principal Directors General/ Directors General (All)

Madam/Sir,

Subject: Clarification on TCS liability under Sec 52 of the CGST Act, 2017 in case of multiple E-commerce Operators in one transaction.

Reference has been received seeking clarification regarding TCS liability under section 52 of the Central Goods and Services Tax Act, 2017 (hereinafter referred to as “CGST Act”), in case of multiple E-commerce Operators (ECOs) in one transaction, in the context of Open Network for Digital Commerce (ONDC).

2.1 In the current platform-centric model of e-commerce, the buyer interface and seller interface are operated by the same ECO. This ECO collects the consideration from the buyer, deducts the TCS under Sec 52 of the CGST Act, credits the deducted TCS amount to the GST cash ledger of the seller and passes on the balance of the consideration to the seller after deducting their service charges.

2.2 In the case of the ONDC Network or similar other arrangements, there can be multiple ECOs in a single transaction – one providing an interface to the buyer and the other providing an interface to the seller. In this setup, buyer-side ECO could collect consideration, deduct their commission and pass on the consideration to the seller-side ECO. In this context, clarity has been sought as to which ECO should deduct TCS and make other compliances under section 52 of CGST Act in such situations, as in such models having multiple ECOs in a single transaction, both the Buyer-side ECO and the Seller-side ECO qualify as ECOs as per Section 2(45) of the CGST Act.

3. In order to clarify the issue and to ensure uniformity in the implementation of the provisions of law across the field formations, the Board, in exercise of its powers conferred by section 168 (1) of the CGST Act, hereby clarifies the issues as under:

Issue 1: In a situation where multiple ECOs are involved in a single transaction of supply of goods or services or both through ECO platform and where the supplier-side ECO himself is not the supplier in the said supply, who is liable for compliances under section 52 including collection of TCS?

Clarification: In such a situation where multiple ECOs are involved in a single transaction of supply of goods or services or both through ECO platform and where the supplier-side ECO himself is not the supplier of the said goods or services, the compliances under section 52 of CGST Act, including collection of TCS, is to be done by the supplier-side ECO who finally releases the payment to the supplier for a particular supply made by the said supplier through him.

e.g.: Buyer-side ECO collects payment from the buyer, deducts its fees/commissions and remits the balance to Seller-side ECO. Here, the Seller-side ECO will release the payment to the supplier after deduction of his fees/commissions and therefore will also be required to collect TCS, as applicable and pay the same to the Government in accordance with section 52 of CGST Act and also make other compliances under section 52 of CGST Act.

In this case, the Buyer-side ECO will neither be required to collect TCS nor will be required to make other compliances in accordance with section 52 of CGST Act with respect to this particular supply.

Issue 2: In a situation where multiple ECOs are involved in a single transaction of supply of goods or services or both through ECO platform and the Supplier-side ECO is himself the supplier of the said supply, who is liable for compliances under section 52 including collection of TCS?

Clarification: In such a situation, TCS is to be collected by the Buyer-side ECO while making payment to the supplier for the particular supply being made through it.

e.g. Buyer-side ECO collects payment from the buyer, deducts its fees and remits the balance to the supplier (who is itself an ECO as per the definition in Sec 2(45) of the CGST Act). In this scenario, the Buyer-side ECO will also be required to collect TCS, as applicable, pay the same to the Government in accordance with section 52 of CGST Act and also make other compliances under section 52 of CGST Act.

4. It is requested that suitable trade notices may be issued to publicize the contents of this Circular.

5. Difficulty, if any, in implementation of this Circular may please be brought to the notice of the Board. Hindi version would follow.

(Sanjay Mangal)

Principal Commissioner (GST)