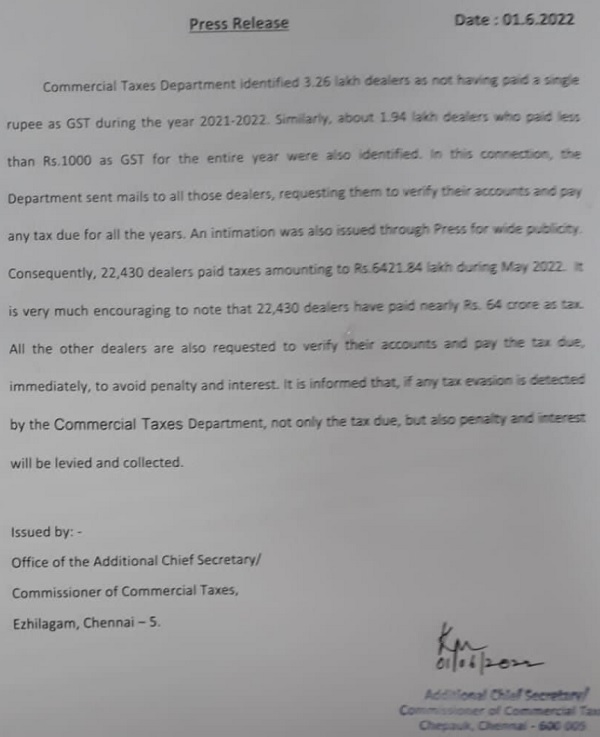

Press Release

Date: 01.06.2022

Commercial Taxes Department identified 3.26 lakh dealers as not having paid a single rupee as GST during the year 2021-2022. Similarly, about 1.94 lakh dealers who paid less than Rs. 1000 as GST for the entire year were also identified. In this connection, the Department sent mails to all those dealers, requesting them to verify their accounts and pay any tax due for all the years. An intimation was also issued through Press for wide publicity.

Consequently, 22,430 dealers paid taxes amounting to Rs. 6421.84 Lakh during May 2022. It is very much encouraging to note that 22,430 dealers have paid nearly Rs. 64 crore as tax.

All the other dealers are also requested to verify their accounts and pay the tax due, immediately, to avoid penalty and interest. It is

informed that, if any tax evasion is detected by the Commercial Taxes Department, not only the tax due, but also penalty and interest will be levied and collected.

Issued by: –

Office of the Additional Chief Secretary/

Commissioner of Commercial Taxes,

Ezhilagam, Chennai – 5.

What are the tamilnadu government officials doing just taking big fat salary without doing any work…

The Same will increase further due to the total failure of entire economic systems