Sponsored

“Explore the dynamics of Family Offices in Singapore, including structures, tax exemptions, recent developments, and significant changes in regulations. Stay informed on the evolving landscape for wealthy individuals and their investments.”

Background

Family offices are organizations that invest the money of wealthy individuals. They don’t require a license to operate however, they need an approval from Monetary Authority of Singapore (MAS) to avail tax exemptions.

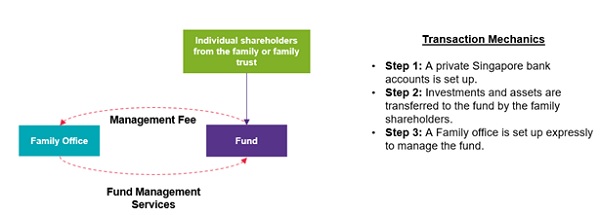

Structure of family office

Family as per MAS

- Individuals who are lineal descendants from a single ancestor.

- Spouses, ex-spouses, adopted children and step-children of these individuals.

Tax exemptions for family offices

- Income derived by company incorporated and resident in Singapore that arises from a fund managed by a fund manager in Singapore.

- Income arising from funds managed by a fund manager in Singapore.

Recent developments

- Section 13R and Section 13X schemes have been replaced with Section 13O and 13U schemes.

- Family offices are facing waits of at least eight months due to recent developments. Demand is soaring high especially amongst Chinese entrepreneurs and their heirs.

- In April 2022, one week grace period was offered before changing its rules regarding assets management, minimum local spending, and number of employees.

Significant changes in the functioning of family offices:

- The fund must have a minimum fund size of S$10 million at the point of application

- That the fund commits to increasing its AUM to S$20 million within a 2-year grace period

- Under Section 13O Scheme, the fund must now be managed or advised directly throughout each year of assessment by a family office in Singapore, where the family office employs at least two Investment Professionals. Such investment professionals are required to be either portfolio managers, research analysts or traders who earn a minimum of S$3,500 per month and must be engaged in a qualifying activity.

- Under Section 13U Scheme, the fund must be managed or advised directly throughout the year by a family office in Singapore, which employs at least three Investment Professionals (with identical qualification requirements as those specified under the S13O Scheme) wherein at least one of the three Investment Professionals must be a non-family member of the beneficial owner.

- There have been significant changes in the limit of business spending under the Section 13O and Section 13U Schemes.

- The funds will need to invest at least 10% of its AUM or S$10,000,000, whichever is lower, in local investments at any one point in time.

The new guidelines are only applicable to funds that are managed or advised directly by a family office which:

- Is an exempt fund management company which manages assets for or on behalf of the family or families

- Is wholly owned or controlled by members of the same family or families.

Sponsored

Kindly Refer to

Privacy Policy &

Complete Terms of Use and Disclaimer.

Can the concept lead to PMLA violations. What are tax issues involved. One can also have accounts in tax havens.

Will FEMA regulations permit.

Does Singapore government share the accounts information with other governments in terms international agreements likeBEPS and FTAs.

Hi Sir, for further discussions we can connect on my linkedin: https://www.linkedin.com/in/caadvsakshijain/