We often heard the terminology -Imports and we all know that anything is brought from overseas is treated as imports and parties involved are seller/exporter, freight forwarder/career, buyer/importer and custom authority. For any foreign currency transaction basic documents required are permission i.e. IEC (import export code),PAN (Permanent account number) and GST registration.

Now the question is how goods are brought from overseas and how goods are made available to end users for consumption or for sale. Goods are moved from overseas through three mediums (mentioned above) based on set of documents (as required by regulatory authorities and transport authorities) and term import i.e. INCOTERM.

Before execution of import shipment buyer places purchase order based on acceptance of the same by the supplier and it comprises of: –

1. Purchase order number and date,

2. Title of goods,

3. Price of the product,

4. Quantity,

5. Technical specification,

6. Name and address of the supplier and buyer,

7. Port of loading,

8. Port of discharge,

9. Product code (HSN code),

10. Warehouse address (both for supplier and buyer)

11. Mode of shipment (air/sea),

12. Delivery date,

13. Expected time of dispatch(ETD),

14. Expected time of arrival(ETA),

15. Currency of the product,

16. Remittable currency,

17. INCOTERM,

18. Payment terms,

19. Bill to and Ship to clause,

20. Bank details,

21. Form of transfer (SWIFT, LC, draft etc.) and 22. Authorized signatory of the buyer and supplier.

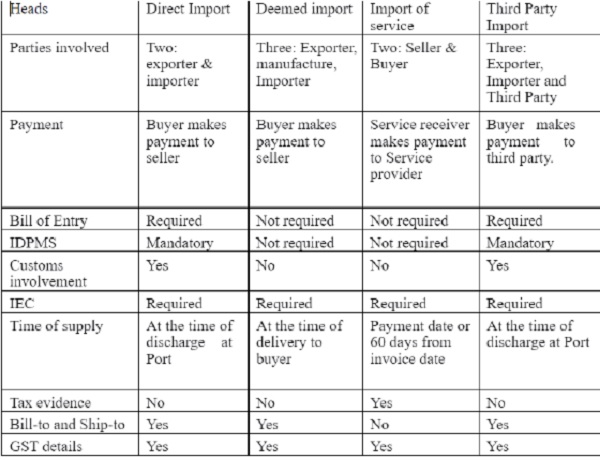

General perception about import is Bill of entry should be made based on which the transaction can be identified as imports. Bill of entry is an evidence of imports but without bill of entry transaction can also be termed as imports e.g. import of service, deemed import.

Another idea among all of us is that payment to seller to be made by the buyer only. No, there is an another option where Govt. of INDIA has introduced to liberalize the imports i.e. Third party imports -where buyer will make payment to third party without being made to seller directly. Obviously this payment arrangement should be disclosed in purchase order and Bill of entry should also mention this clause.

Basic documents required for movement of goods from overseas are purchase order, commercial invoice, packing list, inspection certificate, import manifest, delivery note along with airway bill (air shipment), Bill of lading (sea shipment), Consignment note (rail shipment), GR (Road shipment) and Bill of entry (customs authority).

In case of import of service, no transport documents are required but in place of transport documents we need GST certificate, PAN, tax paid challan, 15CA and 15CB. Similarly, in case of deemed imports in place of transport documents as required for direct import, we need permission letter from Development commissioner, letter seeking approval from Development Commissioner by the manufacturer for manufacturing goods, deliver challans under rule 11, evidence custom duty if goods are delivered from SEZ. All above topics are here discussed as an overview: –

Direct Imports: In case of direct import the buyer buys products directly from supplier of overseas country, without involvement of intermediators. So only two parties are involved: one is exporter/supplier and other one is importer/buyer. Goods are entered in the territory of the country post making of Bill of entry i.e. evidence of import. The time of supply would be the day when this is recorded in customs portal not from the invoice date. Invoice date would be the date when goods are dispatched from supplier’s warehouse and handed over to the freight forwarder. Due date would be counted based on invoice date as agreed.

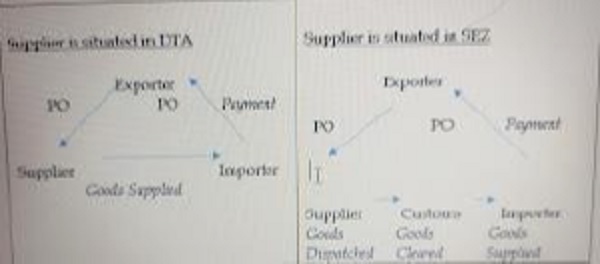

Deemed Imports: All we know that in case of imports goods should touch customs border but there is an exception where customs involvement is not required if goods are supplied from manufacturer functioning in DTA (Domestic Tariff Area) and supplied goods to importer on behalf of exporter.

Why it is required? The main reason for taking delivery of goods from DTA supplier instead of taking delivery directly from seller is saving of cost. For example: One specific book which has strong market in India but the profit margin which the entity is enjoying would have been more if the same is printed by printer in DTA instead of importing.

In case of deemed import the owner of the product is lying with the supplier situated in domestic tariff area(DTA) . If goods are delivered directly from special economic zone (SEZ) evidence of import i.e. Bill of entry is required because SEZ is treated a territory outside the buyer’s country. The time of supply would be the day when final delivery is made. Why final delivery term is used because in some cases it is found that goods are delivered in lots. Final delivery would be the day when last lot is delivered to fulfill the ordered qty. The invoice date would the date when final delivery takes place. Due date would be counted from the date of invoice/final supply.

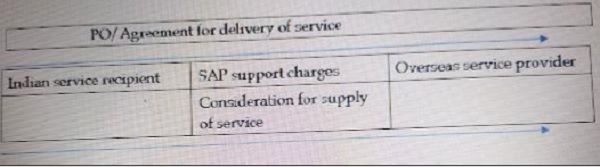

Import of services: Import of services refers to supply of any service where the service provider is located outside the territory of country but the place of supply would be within the territory of service receiver.

Service means anything other than goods, money and securities and supply includes import of services for a consideration. Supply of service is treated as interstate trade.

Unlike direct import and deemed import time of supply shall be either a) payment date or b) day after 60 days of issuance of invoice.

Third-party Imports: In general, we know that in any foreign transaction there are two parties involved, one is seller and another one is buyer and payment is directly flown to seller from buyer but in case of third party goods are delivered to the buyer but settlement of goods supplied would be directly to the third party.

For example, X has imported books from Y, USA, worth CIF value of USD 25,000. Y requested X to remit the amount to Z on behalf of Y. Here consignee would be X and buyer is Z and in AWB/BL consignee would be X and Notify party would be Z. Both supplier and third party must be resident outside the territory of the country of original buyer.

Why third party import: Restriction where a country is facing chronic political and economic issues as well as balance of payment difficulties.

In case of other imports there is no restriction but in case of third party imports maximum USD 100000 is allowed per transaction.

The entire discussion on category of imports is lucidly explained in the following table: