Valuation in customs is a sticky issue, a perennially disputed area. Notwithstanding reduction and rationalization of customs duties over the years, the scope of manipulation of value cannot be ruled out. The transaction value, unless influenced, is the cardinal method of valuation in customs under Section 14 of the Customs Act, 1962. In certain circumstances, specified in first proviso to section 14 (1) ibid, the adjusted transaction value is the customs value. MRP based valuation for CVD purposes has been done away with after introduction of GST w.e.f. 01.07.2017.

In case of import of goods, the importer has to self-assess the merchandise, and he is obligated under rule 11 of the Customs Valuation (Determination of valuation of imported goods) Rules, 2007 to file a declaration disclosing the full and accurate details relating to the value of goods. He is also obligated to furnish any other statement, information or document including an invoice of the manufacturer or producer of the imported goods where the goods are imported from or through a person other than the manufacturer or producer, as considered necessary by the proper officer for determination of the value of imported goods under the rules.

In the companionship of aforesaid existing provisions, the government has recently proposed draft Customs (Assistance in Value Declaration of Identified Imported Goods) Rules, 2022. The draft rules propose a mechanism of identifying and notifying a class of goods to put additional obligations on the importer to justify the truth and accuracy of the declared value of the imported merchandise. A provision for these rules was made vide clause 89 of the Finance Act, 2022 which inserted clause (iv) in the 2nd proviso to Section 14 (1) of the Customs Act, as excerpted below:

SECTION [14. Valuation of goods. — (1) For the purposes of the Customs Tariff Act, 1975 (51 of 1975), or any other law for the time being in force, the value of the imported goods and export goods shall be the transaction value of such goods… subject to such other conditions as may be specified in the rules made in this behalf :

Provided that …

Provided further that the rules made in this behalf may provide for,-

…

(iv) the additional obligations of the importer in respect of any class of imported goods and the checks to be exercised, including the circumstances and manner of exercising thereof, as the Board may specify, where, the Board has reason to believe that the value of such goods may not be declared truthfully or accurately, having regard to the trend of declared value of such goods or any other relevant criteria

As per the explanatory memorandum with the Finance Bill, 2022, this amendment is a measure to address the issue of undervaluation in imports.

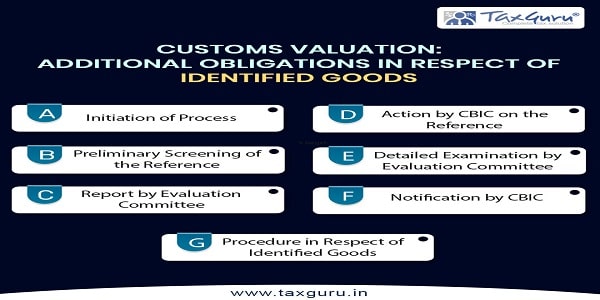

The draft rules specify how the process of identifying the class of goods will be triggered as well as the further processes like the initial screening of the case, the detailed evaluation/ scrutiny of the issue, issuance of notification of the identified class, putting of the alert in the CAS, the additional obligations on the importer, the additional checks, the exceptions, the manner of handling by the proper officer, the consequences of satisfaction/non-satisfaction of the proper about the additional information provided by the importer, the time frame, the limitation etc. Here is a stage-wise linear analysis of the issue.

Page Contents

1. Initiation of Process

As per rule 6 of the draft rules, the process will be set in motion upon

- a written reference made electronically to CBIC by any person having reason to believe that the value of any class of imported goods or subset thereof may not be declared truthfully or accurately.

- a reference made by an officer of Customs, namely a Commissioner or Additional Director General.

- a reference made by person representing any other Government department.

Such reference will be attached with documentary evidence, data and analysis bringing out the basis put forth in support of claim.

2. Action by CBIC on the Reference

The CBIC shall forward this reference electronically for examination to the Screening Committee (Rule 6 (3)). The Screening Committee, having four members, will be consist of three ex-officio members (viz. Director Generals of: Directorate General of Valuation, DRI, and Directorate General of Analytics) and the Convenor of National Assessment Centre (pertaining to the class of goods under consideration) constituted by the Board.

3. Preliminary Screening of the Reference

As per the rule 7, the Screening Committee will make a preliminary examination of the reference by CBIC. It will scrutinize the reference along with material aspects and trend of declared values. If found suitable for detailed examination, the reference (or a part thereof) shall be deemed to have been taken up for detailed examination, else the Screening Committee will record closure of the reference.

4. Detailed Examination by Evaluation Committee

Thereafter, the Evaluation Committee (consisting of junior members from the same organizations as in case of Screening Committee) will comprehensively examine, on preponderance of probabilities, whether or not the value of the relevant class of goods or subset thereof is declared truthfully or accurately. The Evaluation Committee may conduct data analysis and may inter alia take into account trend in international prices, stakeholder consultation, reports of overseas enquiry or verification, cost structure of the products.

5. Report by Evaluation Committee

As per rule 7, the Evaluation Committee shall submit a reasoned and detailed examination report to Screening Committee. If the Evaluation Committee concludes the likelihood that the declared value is not truthful or accurate, the report shall also specify –

- complete description of the class of imported goods with 8-digit HS Code;

- the brands, if any;

- the precautionary unit value which may be used by Customs Automated System to require the fulfilling of additional obligations by the importer;

- the particular Unique Quantity Code;

- the technical or other specifications related to value of the goods necessary to be declared in the bill of entry such as make, model, brand, grade, size, quality, composition (percentage of ingredients) and quantity declared in prescribed Unique Quantity Code.;

- other additional obligations which may include inter alia furnishing manufacturer’s invoice, manufacturer’s test report, expert certification issued in the country of origin, manufacturing process from the manufacturer, costing in relation to manufacture or assembly of goods, purchase order or contract.

- the checks to be exercised with respect to the imported goods, including the circumstances and manner of exercising them;

- the duration, not below 1 year and not exceeding 2 years in the first instance, for which the said additional obligations and the additional checks shall be applied.

6. Notification by CBIC

If the Screening Committee, on the recommendations of the Evaluation Committee, finds the likelihood that the value of the relevant class of goods is not declared truthfully, it will send recommendations to the Board in this regard. The Board shall consider the recommendations made by the Screening Committee, and if it has reasons to believe that the value is not declared truthfully and accurately, it may issue notification under rule 5 specifying the identified goods and prescribing obligations and checks mentioned under rule 10.

7. Procedure in Respect of Identified Goods

Rule 11 is most important rule so far as the procedure to be followed by the importer is concerned. First requirement under the rule is that the importer of the identified goods shall declare the value of goods using the Unique Quantity Code specified in the notification at the time of filing bill of entry. Secondly, where required by the Customs Automated System, the importer of identified goods shall also fulfil the specified additional obligations, and the assessment of goods or the goods themselves shall be subjected to specified checks. The proper officer may, in addition to the specified obligations, ask for further information and documents from the importer to examine the truthfulness and accuracy of the declared value.

On the request of importer, the proper officer may provisionally assess and clear the goods, subject to importer furnishing appropriate security in terms of Section 18 of the Act.

If the proper officer is satisfied, he may accept the declared value for the purpose of these rules. Otherwise, if the proper officer still has reasonable doubt about the truth or accuracy of the value declared in relation to the identified goods, further proceedings shall be in accordance with rule 12 of the Customs Valuation (Determination of Value of Imported Goods) Rules, 2007; which practically means that the value declared by the importer shall be rejected by the proper officer. Further, draft rules also provide exceptions, the timelines, and the scope for mid-term review of the issue. It is not expressly provided in the draft rules as to how the goods will be evaluated once the declared value is rejected. It seems that the process prescribed in the Customs Valuation (Determination of valuation of imported goods) Rules, 2007 will be required to be followed, as this process is line with the Article VII of the GATT.

Prima facie these rules prescribe the manner of identifying the goods where, on a reference, the truth and accuracy of the declared value is found doubtful by a specialized evaluation committee. The mechanism of verifying the correctness of value, rejection of value, and re-determining of value is already there in in existing Valuation Rules, 2007. These draft rules of 2022 provide for a centralized mechanism of identifying and notifying the undervalued goods. These draft rules also provide for putting an alert in Customs Automated System itself, if the declared value is less than a precautionary value. These rules also provide for the subsequent checks including rejection of declared value. From the rule 11 (6) it is apparent that the proper officer, if satisfied, will have the discretion to accept value lower than the precautionary value; nevertheless, the proposed rules will lead to a benchmarking of value of identified class of goods. When the final rules are made applicable, the importers will have to be cautious while declaring the value of the notified goods, as the burden of proof regarding the correctness of value of identified/notified class of goods is cast on the importer in these draft rules.

(Disclaimer: The view expressed are the personal views of the author)

One of the very sensitive issue in Customs has been analyzed by the author in a most plausible way.

The analysis of Sh. Vinay Goel is thought provoking and addresses a very sensitive issue regarding Customs Import valuation. With the changing and evolving Customs procedures, the ease of doing business is also adding momentous responsibility which our entrepreneurs must understand and comply.