The Ministry of Finance announced significant reforms in customs duties aimed at supporting domestic manufacturing, enhancing export competitiveness, and simplifying taxation. Finance Minister Nirmala Sitharman highlighted measures such as exemptions for critical minerals and cancer drugs, reductions in duties on medical equipment and mobile devices, and initiatives to bolster sectors like seafood and leather exports. The reforms also include rationalizing duty structures for precious metals and undertaking a comprehensive review to streamline customs regulations.

Ministry of Finance

REFORMS IN CUSTOMS DUTIES WILL SUPPORT DOMESTIC MANUFACTURING AND PROMOTE EXPORT COMPETITIVENESS; FINANCE MINISTER

25 CRITICAL MINERALS, THREE MORE CANCER DRUGS AMONG ITEMS EXEMPTED FROM CUSTOMS DUTY

RESTRUCTURED CUSTOMS DUTY TO ENHANCE COMPETITIVENESS OF EXPORT OF SEAFOOD AND LEATHER

Posted On: 23 JUL 2024 1:12PM by PIB Delhi

The Budget proposals for Customs Duties intend to support domestic manufacturing, deepen local value addition, promote export competitiveness, and simplify taxation, while keeping the interest of the general public and consumers surmount, said Union Minister of Finance and Corporate Affairs Smt. Nirmala Sitharman in her Budget speech in Parliament today. New Customs Duty rates are proposed for commodities from life saving medicines to rare earth minerals.

In a big relief to cancer patients, three more medicines viz. Trastuzumab Deruxtecan, Osimertinib, and Durvalumab, have been completely exempted from Customs Duties. Further, BCD on x-ray tubes & flat panel detectors for use in medical x-ray machines have also been decreased, so as to synchronise them with domestic capacity addition.

Finance Minister said that last six years have seen a three-fold increase in domestic production of mobile phones and almost a hundred-fold jump in exports of mobile phones. “In the interest of consumers, I now propose to reduce the BCD on mobile phone, mobile PCBA and mobile charger to 15 per cent”, Minister said while presenting the Union Budget 2024-25 in Parliament today.

Finance Minister also announced full exemption of Customs Duties on 25 Critical Minerals and while reducing BCD on two of them. This will benefit sectors like space, defence, telecommunications, high-tech electronics, nuclear energy and renewable energy, where these rare earth minerals are critical. In a further boost to renewable energy sector, Minister announced expansion of the list of exempted capital goods for use in the manufacture of solar cells and panels in the country. “Further, in view of sufficient domestic manufacturing capacity of solar glass and tinned copper interconnect, I propose not to extend the exemption of Customs Duties provided to them”, the Minister said.

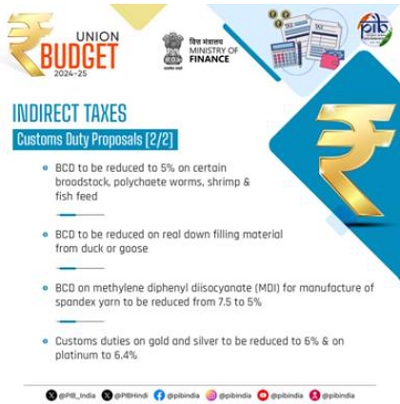

To enhance the competitiveness of seafood exports from the country, Minister proposed reduction of BCD on certain broodstock, polychaete worms, shrimp and fish feed to 5 per cent. Apart from this, various inputs for manufacture of shrimp and fish feed are exempted from Customs Duty to further boost the seafood exports. Similar reduction and exemption in Customs Duty are also announced for various leather raw materials to enhance the competitiveness of exports in the leather and textile sectors. Furthermore, the export duty structure on raw hides, skins and leather is proposed to be simplified and rationalized.

Customs Duties on gold and silver have been reduced from 15% to 6% while that on platinum from 15.4% to 6.4%, to enhance domestic value addition in Gold and Precious metal jewellery in the country. Further, BCD on ferro nickel and blister copper have been removed to reduce the cost of production of Steel and Copper.

The Minister also said that a comprehensive review of the Customs Duty rate structure will be undertaken over the next six months to rationalise and simplify it for ease of trade, removal of duty inversion and reduction of disputes.