1. Introduction

1.1. As you may be aware, Customs authorities are required to ensure compliance with several allied Acts in respect of import/export goods with assistance of other Government Regulatory Agencies. While Customs authorities are primarily responsible for assessing the import or export documents, several other Government regulatory agencies also come into picture as their permission/clearance is required for certain import/export goods such as pharmaceutical drugs, livestock and livestock products, wild life products, food products, plants etc. before such goods could be allowed to be taken out of Customs notified Areas.

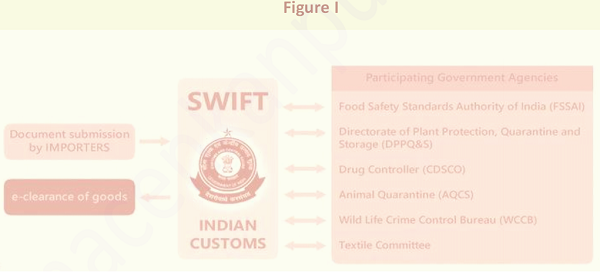

1.2. To ensure transparency and faster clearance of the import/export goods which require permission from other regulatory agencies, a beginning was made for the first time in 2014, when Indian Customs has introduced the concept of single window for the clearance of import and export goods. In simple terms, Single Window essentially means providing a common platform to import or export trade to meet requirements of all regulatory agencies (such as Animal Quarantine, Plant Quarantine, Drug Controller, Textile Committee etc.). The following flow diagram explains the concept of single window in Indian Customs.

1.3. Prior to introduction of Single Window in Customs clearance of import and export goods, the importer /exporters were required to submit the requisite information separately to the Customs Authorities and other relevant regulatory agencies. While information was required to be filed in electronic form with Customs authorities, the information required by other regulatory agencies was to be filed separately in paper forms. Moreover, importer/exporters were required to approach the concerned regulatory agency to obtain NOC/permission. In other words, there was no electronic interface of Customs authorities with other Government agencies. These regulatory authorities took their own time to issue NOC or give requisite permission. Any delay in grant of NOC by these regulatory authorities resulted in delaying the clearance of import/export cargo, causing higher dwell times, increased cost to the importer/exporter, loss of precious time, and increased transaction cost.

1.4. With the launch of Customs SWIFT (Single Window Interface for Facilitating Trade) clearances with effect from 1.3.2016, now importers/exporters are able to file a common electronic ‘Integrated Declaration’ on the ICEGATE portal. The Integrated Declaration compiles the information requirements of Customs, FSSAI, Plant Quarantine, Animal Quarantine, Drug Controller, Wild Life Control Bureau and Textile Committee and it replaces nine separate forms required by these 6 different agencies and Customs.

1.5. Further, with the roll-out of the Single Window, concept of an Integrated Risk Management facility for Partner Govt. Agencies (PGAs) has also been introduced. This will ensure that consignments are not selected by agencies routinely for examination and testing, but based on the principle of risk management.

1.6. Single Window system is a crucial implementation of trade facilitation measure for import/export goods clearance at the country’s points of entry and exit. This would result greater efficiency in the import and export procedures, resulting in saving of money to the importers and exporters by way of reduced trade-related costs and delays.

1.7. To give legal authority for integrated declaration, the necessary changes have been made in the Bill of Entry (Electronic Declaration) Regulations, 2011. These changes has been effected vide notification No. 45/2016-Customs (NT), dated 1.04.2016.

Benefit of Single Window Scheme

1.8. The benefits of Single Window Scheme include ease of doing business, reduced costs, enhanced transparency, reduced duplicity and cost of compliance and optimal utilization of resources.

Essential Requirement of Effective Single Window Scheme

1.9. The necessary and essential ingredients of effective single window concept are as given below:-

(i) Lodging of Customs clearance documents electronically at a single point only with the Custom authority.

(ii) Single Integrated declaration–consisting of data elements/documents as required by Customs authority as well as other regulatory agency(ies);

(iii) Electronic On-line message exchange facility/ online issuance of NOC by all other regulatory agencies.

(iv) Participation in the project by all regulatory agencies dealing with clearance of import/export goods.

(v) Availability of facility at all port/Airport/ICDs/CFSs.

2. Background

2.1. A beginning to introduce single window concept in Customs was made first time in 2014 when Hon’ble Finance Minister in his Budget Speech on 10.07.2014 made the following announcement:-

“It is also proposed to implement an ‘Indian Customs Single Window Project’ to facilitate trade. Under this, importers and exporters would lodge their clearance documents at a single point only. Required permissions, if any, from other regulatory agencies would be obtained online without the trader having to approach these agencies. This would reduce interface with Governmental agencies, dwell time and the cost of doing business. “

2.2. Acting on the announcement made by the Hon’ble Finance Minister in the Parliament, CBEC first time rolled out Customs Single Window project in March, 2015 and issued Circular No.9/2015-Customs, dated 31.03.2015.

2.3. Vide Circular dated 31.03.2015, CBEC announced launching of Single window project with effect from 1.4.2015 at three Customs entry/exit points, namely, JNPT (Nhava Sheva), ICD, Tughlakabad and ICD, Patparganj on pilot basis. Further, this facility was initially limited to only two regulatory agencies, namely, the Food Safety and Standards Authority of India (FSSAI) and the Department of Plant Protection, Quarantine and Storage (DPPQ&S).

2.4. Later vide Circular No.03/2016-Cus, dated 3.2.2016, the facility of single window was extended to the Air cargo complex, Sahar and New Delhi. Further, other regulatory agencies, namely, Animal Quarantine, the Textile Committee, the Drug controller of India and the Wild life authorities were also brought into its ambit.

2.5. Hon’ble Finance Minister in his Budget Speech on 29.02.2016 made the following announcement with regard to Indian Customs Single Window Project:-

“In 2014-15 Budget, I had announced the intent to implement Indian Customs Single Window Project. We have made significant progress in this and it would be implemented at major ports and airports starting from beginning of next financial year.”

3. Regulatory agencies dealing with clearance of Import and Export Goods

3.1. As on date, six regulatory agencies are part of Single window project. These six regulatory agencies and types of Goods dealt by them are given in Table –I below:-

Table I

| Types of goods | Concerned agency |

Applicable Statute/Rules |

| Drugs and Pharmaceutical | Drug Controller |

|

| Live Animals | Animal Quarantine | The Livestock Importation Act, 1898 [ 9 of 1898] |

| Live Plants | Department of Plant Protection, Quarantine & Storage (DPPQ&S) |

|

| Food products | Food Safety Standards Authority of India (FSSAI) |

|

| Wild life items | Wild life Crime Control bureau |

|

| Textiles | Textile Committee |

|

3.2. The above said regulatory agencies are the major agencies dealing with import and export cargo. In addition to above, there are several allied laws and rules, which are also required to be enforced at Border by Customs authorities in coordination with other regulatory agencies. Implementation of these allied laws requires NOC/Permit/licenses/permission etc. by concerned regulatory agency before allowing clearance of such goods. Example of such goods are pesticides/ insecticides, goods subjected to control under Atomic Energy Act, antiques, Hazardous/dangerous Goods, Goods subjected to controls under Explosive Act, 1884 etc.

3.3. A complete list of various such allied laws, concerned regulatory agencies, the goods covered under each of such statute can be seen in the e-book on allied laws.

4. Summary of Circulars/Instructions issued by CBEC on Single Window Project

The Circulars/Instructions issued by CBEC so far on Single Window Project are given in the Table-II below:-

Table-II

Table-II

| Sr. No. | Circular/ Instruction No. and date |

Subject |

| 1. | Circular No.9/2015-Customs, dated 31.03.2015 | Online message exchange between Customs and other regulatory agencies |

| 2. | Circular No.03/201 6-Cus, dated 3.2.2016 | Extending the Indian Customs Single

Window to other locations and other |

| 3. | Instructions F. No. 450/147/ 201 5-CUS-IV, dated 26.02.2016 | Single Window Project-Problems in clearance of Ex-Bond Bills of Entry in online clearance facility-Reg. |

| 4. | Circular No.10/2016-Customs, dated 15.03.2016 | Implementing Integrated Declaration under the Indian Customs Single Window-Reg. |

| 5. | Instruction F.No. 450/147/201 5-Cus-IV, dated 31.03.2016 | Implementation of ‘Integrated Declaration’ – reg. |

| 6. | Circular No. 28/2016- Customs, dated 14.06.2016 |

Single Window Project-Simplification of procedure in SWIFT for clearance of consignments related to drugs & cosmetics |

5. Text of Circulars/Instructions issued by CBEC

I. Circular No. 09/2015-Cus, dated 31.03.2015

Subject: Online message exchange between Customs and other regulatory agencies – reg.

Hon’ble Finance Minister in the Budget, 2014 made an announcement to implement ‘Indian Customs Single Window Project’ to facilitate trade. This project envisages that the importers and exporters would electronically lodge their Customs clearance documents at a single point only with the Customs. The required permission, if any, from other regulatory agencies (such as Animal Quarantine, Plant Quarantine, Drug Controller, Textile Committee etc.) would be obtained online without the importer/exporter having to separately approach these agencies. This would be possible through a common, seamlessly integrated IT systems utilized by all

regulatory agencies and the importers/exporters. The Single Window would thus provide the importers/exporters a single point interface for Customs clearance of import and export goods thereby reducing interface with Governmental agencies, dwell time and cost of doing business.

2. In the direction of establishing the Single Window with all regulatory agencies, the Board has decided to make a beginning by implementing an electronic online message exchange between the Food Safety and Standards Authority of India (FSSAI) and the Department of Plant Protection, Quarantine and Storage (PQIS) with the Customs with effect from 01.04.2015 at JNPT (NhavaSheva), ICD, Tughlakabad and ICD, Patparganj. Under the new online message exchange system for import goods between these two agencies viz. FSSAI and PQIS and the Customs, there will be seamless online exchange in real time of the Customs Bill of Entry (Import declaration) with these agencies and Release Order (RO) from both the agencies will be received by the Customs in electronic message format.

3. The salient feature of the new online message exchange system would be as under:-

(i) Indian Customs EDI (ICES) would transmit “BE message” to the FSSAI and PQIS on completion of assessment of the relevant Bills of Entry (B/Es) by the Customs ICES application after entry-inward of the consignment. The BE message would be provided to FSSAI/PQIS for all B/Es falling under the identified Custom Tariff Heads (CTHs), as per list made available by the respective agencies.

(ii) The Customs officers would be able to access the details of the Bs/E referred by the ICES to FSSAI/PQIS.

(iii) The importers would be able to track the status of the Bs/E on ICEGATE (https ://www.icegate.gov.in).

(iv) The receipt of the Bs/E message shall be acknowledged by the FSSAI/PQIS through a receipt message to the ICES.

(v) On processing of the Bs/E message by the FSSAI/PQIS, these agencies would electronically transmit an RO, concerning each item of the Bs/E. From the Customs side, Out of Charge (OOC) will not be allowed in the system till the RO is received from the agency concerned for all the items. There are 6 types of ROs which may be provided by the FSSAI/PQIS to the ICES, as follows:-

(a) Release – goods can be released by the Customs.

(b) Destruction – goods to be destructed by the Customs.

(c) Deportation – goods to be exported back to the Country of Origin.

(d) No Objection Certificate (NOC)- goods can be released by the Customs.

(e) NCC (Non-compliance Certificate) – non-rectifiable defects observed in the goods.

(f) Product Out of scope – goods are out of scope for FSSAI/PQIS.

In case, the Release Order falls under types(b), (c) and (e) above, the OOC would not be allowed in the ICES. Details of such consignments will be entered by the Customs Assessing Officer in the closure of B/E menu after all processes are complete.

(vi) On receipt of RO online, the Customs ICES shall integrate the data in the

ICES database, which shall be available to the Customs officers concerned.

(vii) The other formalities under the Customs Act, 1962 such as duty payment, goods registration, examination would continue during the time interval between transmissions of Bs/E message from ICES to the receipt of RO message from FSSAI/PQIS. During this period the samples of the goods under consideration may also be taken for testing purposes.

4. As aforementioned, all Bs/E falling under the identified Custom Tariff Heads (CTHs), as per list made available by the FSSAI, would automatically be sent by the ICES to this agency. However, in terms of Board’s Circular No.3/2011 -Cus dated 06.01.2011 import consignments that have been tested on previous five consecutive occasions and found in order may not be referred to FSSAI. Therefore, this Circular will be implemented by the Customs officers by not waiting for the RO from FSSAI in such cases. The ICES provides functionality for this purpose. This measure would be in place till a system based solution is developed. A procedure for informing FSSAI that the RO is not required in such cases is also being examined.

5. Since, the electronically received RO in regard to Bs/E referred to FSSAI/PQIS shall be accepted by the Customs for clearance of the imported foods items/plant materials, the Customs shall not insist that a physical copy of the RO shall be issued by these agencies. Board also desires that the Customs should maintain a close liaison with these two agencies to ensure that responses from these agencies are received in time and there is no delay in clearance of goods except in cases where sampling is required.

6. It is clarified that as some of details required for other regulatory agencies may not be currently captured in the B/E format, in such cases, the importers would continue to furnish these additional details to the respective agency. Further, the mode and manner of payment of fee and other charges of other agencies will continue to be the same as per the existing practice.

7. Chief Commissioners of Customs/Central Excise are requested to sensitize staff working under their jurisdiction to ensure the smooth implementation of the online message exchange system between the Customs and FSSAI/PQIS. It may also be ensured that proactive action is taken to identify Bs/E for which the RO has not been received from FSSAI/PQIS within a reasonable time so that the same could be

got expedited. The Board has separately initiated a dialogue with these agencies to prescribe timelines for issue of ROs.

8. Difficulty faced, if any, may be brought to the notice of the Board at the earliest. Further, a suitable Public Notice may be issued for the information of the Trade with a copy to the local offices of FSSAI and PQIS.

II. CBEC Circular No. 03/2016-Cus, dated 03.02.2016

Subject: Extending the Indian Customs Single Window to other locations and other Participating Government Agencies – reg.

The Central Board of Excise and Customs has taken-up the task of implementing „Indian Customs Single Window Project‟ to facilitate trade. This project envisages that the importers and exporters would electronically lodge their Customs clearance documents at a single point only with the Customs. The required permission, if any, from other regulatory agencies (such as Animal Quarantine, Plant Quarantine, Drug Controller, Textile Committee etc.) would be obtained online without the importer/exporter having to separately approach these agencies. This would be possible through a common, seamlessly integrated IT systems utilized by all regulatory agencies and the importers/exporters. The Single Window would thus provide the importers/exporters a single point interface for Customs clearance of import and export goods thereby reducing interface with Governmental agencies, dwell time and cost of doing business.

Message exchange with FSSAI / DPPQ&S:

The Board issued Circular No. 09/2015 dated 31/03/2015 (vide F.No.450/01/201 1- Dir. (Cus)(Pt.I) to introduce a system of online message exchange between Customs and other regulatory agencies under the „Indian Customs Single Window project’. The online messaging was operational between Customs and the Department of Plant Protection, Quarantine & Storage (DPPQ&S) and Food Safety Standards Authority of India (FSSAI) with effect from 01/04/2015 at JNPT (NhavaSheva), ICD,Tughlakabad and ICD,Patparganj on a pilot basis. The online message exchange is now being further extended to imports at Air Cargo Complex, Sahar and Delhi Air Cargo. Thereafter, it will gradually be extended to all other locations where the systems of FSSAI and DPPQ&S are operational.

No Objection Certificate on ICES for use by Drug Controller / Animal Quarantine / Wild Life Crime Control Bureau:

2. Further the Board has decided to implement a system of online granting of “No Objection Certificate” (NoC) under ICES for the imported goods coming under the purview of the following Agencies namely (i) Drug Controller (ii) Animal Quarantine

(iii) Wild Life Crime Control Bureau. Under this system of granting NOC for imported goods, the offices of these agencies will be connected to the ICES. Upon the online filing and assessment of the Bill of Entry, the system will identify Bills of Entry that contain items requiring NOC from these agencies. The system will then automatically re-direct the Bills of entry to the concerned officers serving with these Agencies for Granting NOC. Initially, as is the case with FSSAI and PQIS, the selection of items to be referred to these agencies will be based on Customs Tariff Head only. Subsequently, criteria will be introduced.

3. To obtain NOC from these agencies, the Customs Broker or Importer would

have to produce hard copies of check-lists, import licenses, and other certificates/documents as required by the Agency, along with a copy of the Bill of Entry. Based on the Bill of Entry Number, the Agency‟s officer will retrieve the Bill of Entry online on ICES, verify the documents and record its decision online. At this stage, the Agency‟s office may

(i) Release – No Objection Certificate

(ii) Out of Scope: Item does not require the Agency‟s NOC

(iii) Reject: Item is not permitted for clearance for home consumption. Ag ency‟s office may make a suitable recommendation in respect of the item such as reexport or destruction. (The Agency will record this remark online.) Customs shall take further necessary action on the Bill of Entry.

(iv) Withhold NOC: NOC has been temporarily withheld for want of further documentation and/or testing after entering suitable remarks in the system by the Agency. These BEs can be retrieved by Agency‟s office for a further decision (Release/Provisional NOC/Out-of-Scope/Rej ect) after the information is received.

(v) Provisional NOC: NOC is granted subject to the production of Letters of Guarantee and carrying out testing of samples as required by the Agency. Customs may release goods after a Bond or Letter of Guarantee is accepted for the Bill of Entry and the requisite samples are drawn. [Provision will be made for the capture of Letter of Guarantee Number or Bond Number to be entered by the Agency.]

4. Out of Charge will be given for the Bill of Entry only after the Agency enters Release/Out of Scope/ or Provisional NOC for all items of the Bill of Entry. Since, the Agency‟s office records the NOC online, Customs shall not insist on the physical copy of the NOC.

5. In case „Reje ction‟, by the Agency, in addition to the remarks entered into by the Agency online on ICES as described in 3(iii) above, the Agency will also advise the basis for rejection so that the concerned Assistant/Deputy Commissioner in the Appraising Group can take further course of action, including adjudication under the provisions of the Customs Act, 1962. Likewise, in case of Provisional NOC, where the samples upon testing fail to meet the qualifying criteria, the Agency‟s officer will advise on the outcome of tests to the concerned Assistant/Deputy Commissioner in the Appraising Group, which will take further action on the Bill of Entry, including adjudication, where necessary.

Note: It has been decided to refer the Bill of Entry to the Agencies at the stage of filing and processing of the Bill of Entry by RMS. When this decision is implemented in ICES, the field formations will be notified. Shortly, under the Single Window project, CBEC will implement the ‘Integrated Declaration’ in which the Bill of Entry format will be modified to include all clearance-related data which is presently required in separate application forms by the Drug Controller’s office, Animal Quarantine, Plant Quarantine, Wildlife Crime Control Bureau and FSSAI. Till such time as the ‘Integrated Declaration’ is implemented, separate application forms may continue to be submitted as at present. Further, CBEC will introduce a facility for uploading of digital copies of supporting documents, doing away with the need to submit hardcopy documentation.

6. The Single Window “No Objection Certificate”or NOC module will be introduced on a pilot basis with effect from 05/02/2016 at JNCH, ACC Sahar, Air Cargo Delhi, ICD, Tughlakabad, and ICD, Patparganj for Drug Controllers Office, Wildlife Crime Control Bureau and Animal Quarantine.

Lab Module in ICES for use by CRCL, Textile Committee and other Agencies:-

7. Another feature has been introduced in ICES to bring online the process of referring samples of consignment for testing and analysis. It is referred to as the „Lab Module‟. This feature was launched at a few locations to automate the process of referring samples drawn from consignments to testing facilities of the Central Revenues Control Laboratories (CRCL). Now, this module has been fine tuned in

order to extend it for the testing of consignments by laboratories/referral agencies under the Textile Committee, and to other Agencies to whom Customs may refer samples/documentation for testing and/or NOC.

8. Under the „Lab module‟, Customs officers who are responsible for examination of goods and drawl of samples can generate Test Memos online, record the details of the samples drawn online and print test memos. Customs will duly dispatch the samples drawn from the consignment to the concerned laboratory/ referral agency. Upon the receipt of the samples, the laboratories can access the Test Memo details online, and when tests/analysis is carried out, the laboratory/referral agency shall record the results/ findings online. The results/recommendation can be accessed by Customs instantaneously, and thereafter, Customs can take further necessary action on the consignment without waiting for the physical copy of the test results! recommendation.

9. Under the Single Window project, the Lab Module will be used when a reference has to be made by a Customs Officer online to another Government Agency for NOC! Clearance at the stage of examination, then he may make a reference using the lab module. For example, after going through examination instructions, Compulsory Compliance Requirements (CCRs), documents or goods, if the Officer seeks to forward a sample to another agency such as the Textile Committee for testing of samples, he may draw a sample and forward it to the agency after filling-up details on the Lab Module.

10. To be able to send a sample to a laboratory or to make a reference to an agency using the lab module, the necessary directories have to be updated, wherein the Customs locations and Customs tariff heads may be mapped to the Laboratories! Agencies. DG (Systems) will make the appropriate arrangements in this regard so that these directories are managed by the Local Systems Manager. The required fees for testing etc., and supporting documents required for these Laboratories! referral agencies are not currently provided in the Lab Module. Therefore, importers would continue to furnish the required documents to the respective agencies as before. Further, the mode and manner of payment of testing fee and other charges of these Labs! referral agencies will continue as per the existing practice.

11. The Board desires that the Customs should maintain a close liaison with these laboratories! referral agencies to ensure that their responses are received without delay and action is taken promptly with regard to the clearance of goods.

12. Initially, the Lab Module shall be launched in all Customs locations in Delhi and Mumbai with effect from 05!02!2016. Thereafter, it will be extended to other locations. The concerned laboratories have been mapped in the system with their corresponding Customs locations.

13. The Local System Managers of ICES shall map the roles in ICES to officers from Labs! Referral agencies that are part of Textile Committee and the Wild Life Crime Control Bureau. These roles have been defined as part of the Lab Module, and are outlined in the user manual developed by DG (Systems).

14. Chief Commissioners of Customs!Central Excise are requested to sensitize staff, other Agencies and Customs brokers working under their jurisdiction to ensure the smooth implementation of the Single Window message exchange, NOC Module and the Lab Module. It may also be ensured that proactive action is taken to identify Test Memos for which the Test Report has not been received from these agencies within a reasonable time so that the same could be expedited.

15. Difficulty faced, if any, may be brought to the notice of the Board at the earliest. Further, a suitable Public Notice may be issued for the information of the Trade with a copy to the local offices of the Agencies.

III. CBEC Instructions F.No.450/147/2015-CUS-IV, dated 26.02.2016

Subject: Single Window Project-Problems in clearance of Ex-Bond Bills of Entry in online clearance facility-regarding.

Kind reference is invited to Single Window NOC Module launched at major Customs locations with effect from 5th February, 2016.

2. It has been brought to notice of Board that after implementation of Single Window NOC Module, ex-bond Bills of Entry are getting referred to Participating Government Agencies (PGAs) for No Objection Certificate even though the same goods had received NOC from PGA at the time of warehousing i.e at the into bond Bill of Entry stage.

3. The issue has been examined and it is decided that all regulatory checks shall be applied at the into bond stage for a Bill of Entry for Warehousing. However, in-case of imported goods, of a nature, in respect of which it may not be feasible for PGA to give NOC immediately then such goods may be allowed facility of section 49 of the Customs Act, 1962, till such time the issue of NOC is decided.

4. Difficulty faced in this regard, if any, may be brought to the notice of the Board.

IV. CBEC Circular No.10/2016-Customs, dated 15.03.2016

[Issued from F. No. 450/147/2015-Cus-IV]

Subject: Implementing Integrated Declaration under the Indian Customs Single Window- reg.

Kind reference is invited to Board‟s Circulars No. 09/2015 dated 31.03.2015 and Circular No. 03/2016 dated 03.02.2016 regarding the Indian Customs Single Window. To re-capitulate, the Central Board of Excise and Customs (CBEC) has taken-up the task of implementing „Indian Customs Single Window Project‟to facilitate trade. This project envisages that the importers and exporters would electronically lodge their Customs clearance documents at a single point only with the Customs. The required permission, if any, from Partner Government Agencies (PGAs) such as Animal Quarantine, Plant Quarantine, Drug Controller, Food Safety and Standards Authority of India, Textile Committee etc. would be obtained online without the importer/exporter having to separately approach these agencies. This would be possible through a common, seamlessly integrated IT systems utilized by all regulatory agencies, logistics service providers and the importers/exporters. The Single Window would thus provide the importers/exporters a single point interface for clearance of import and export goods thereby reducing dwell time and cost of doing business.

Online Clearance from Participating Government Agencies (PGAs)

2. In this backdrop the Board has issued the circulars referred to above, to introduce a system of online clearance between Customs and the Department of Plant Protection, Quarantine and Storage (DPPQ&S), Food Safety Standards Authority of India (FSSAI), Drug Controller (CDSCO), Animal Quarantine (AQCS), Wild Life Crime Control Bureau (WCCB) and Textile Committee. With the introduction of this facility, clearance from these regulatory agencies is flowing online, and the hard-copy of „No Objection Certificates‟(NOCs) is no longer required for clearance of goods. This online clearance under Single Window Project has been rolled out at main ports and airports in Delhi, Mumbai, Kolkata and Chennai so far. It will be gradually extended across the country.

Integrated Declaration under Customs Single Window Project

3. CBEC has since developed the „Integrated Declaration‟, under which all information required for import clearance by the concerned government agencies has been incorporated into the electronic format of the Bill of Entry. The Customs Broker or Importer shall submit the “Integrated Declaration”electronically to a single entry point, i.e. the Customs Gateway (ICEGATE). Separate application forms required by different PGAs like Drug Controller, AQCS, WCCB, PQIS and FSSAI would be dispensed with.

4. The Message Format specifications of the Integrated Declaration, which is to be filed electronically has been published on ICEGATE. The Integrated Declaration captures the particulars of items required by each PGA. The Integrated Declaration will be applicable for consignments to be cleared under the Indian Customs EDI Systems. For the clearance of imported goods in the manual mode, separate documents prescribed by the respective agencies will continue to apply.

5. Since over half of the data required by the PGAs was common with the Bill of Entry, the Integrated Declaration includes a set of standardized and rationalized data, resulting in a 60 percent reduction in the total number of data fields that the trade had to manage in their systems or in hardcopy. Besides, the integrated Declaration replaces 9 separate forms that an importer or his broker was supposed to file with various agencies. These are Customs Bill of Entry, Customs valuation declaration, Application for import of livestock products, Application for import of pet animals/aquatic/other animals, birds and poultry (chicks), Application for quarantine inspection and clearance of imported plants/plant products, ADC Drug sheet for import (Appendix ± II), Additional ADC Sheet for drug category and composition, Application for post shipment examination by the Wildlife Crime Control Bureau, and Application form for NOC from FSSAI for food items imported into India.

Declarations and Undertakings

6. Apart from incorporating the forms mentioned in para 5 above, the Integrated Declaration will also include different types of undertakings, declarations, and letters of guarantee that are presently required to be submitted on company letter heads. The Integrated Declaration has a portion to capture the text of these declarations, undertakings and letters of guarantee etc. in the form of statements. These statements have been standardized and codified, so that while submitting the Integrated Declaration, the importer specify the statement codes, and the printed copies of the Bills of Entry will contain the corresponding standardized texts.

Supporting Documents

7. The Integrated Declaration has a separate section on the particulars of supporting documents to be provided along with the Bill of Entry. The Importer or his Customs Brokers can also provide details of the supporting documents using this section.

8. CBEC is in the process of procuring IT infrastructure to capture digitally signed copies of the supporting documents. Once this facility is implemented, the need to provide hardcopies of supporting documents will be dispensed with.

Risk-based Inspection under Integrated Declaration

9. CBEC has since developed the „Integrated Declaration‟, under which all information required for import clearance by the concerned government agencies has been incorporated into the electronic format of the Bill of Entry. The Customs Broker or Importer shall submit the “Integrated Declaration”electronically to a single entry point, i.e. the Customs Gateway (ICEGATE). Separate application forms required by different PGAs like Drug Controller, AQCS, WCCB, PQIS and FSSAI would be dispensed with.

10. The Risk Management Division has developed a module for introducing a dynamic, risk-based selection of consignments. This module will incorporate criteria developed in consultation with the PGAs. The module will determine whether the bill of entry should be referred to a PGA for NOC, what kind of documentary examination, physical inspection of goods, and testing will be necessary. This module will also implement the rules of delegation of authority from PGAs to Customs for inspection of goods, verification of documents and drawl of samples.

Processing of bill of entry under Integrated Declaration

11. Upon filing of the Integrated Declaration, the bill of entry will automatically be referred to concerned agency, if required, based on risk. The system has been modified to enable simultaneous processing of bill of entry by PGA and Customs.

Implementation Schedule

12. The specifications of bill of entry format for the Integrated Declaration along with the agency-wise guidelines have been uploaded on the ICEGATE website. The Single Window Project (SWP) team has already held number of familiarization

session with the stakeholders, including the service providers who responsible for maintaining the Remote EDI System software on behalf of importers and brokers.

13. The ICEGATE facility will be available for testing of the integrated declaration with effect from 15/3/2016, March, 2016. The Integrated Declaration will go live with effect from 1st April, 2016.

Training/ Familiarization with Integrated Declaration and Single Window Project

14. All stakeholders are requested to carefully go through the Integrated Declaration Form and the process outlined. This is a major initiative of the Department and is expected to significantly simplify and expedite the clearance process. In this regard, the Single Window project team has addressed several gatherings of trade at different forums in order to explain the concept of the Single Window and the Integrated Declaration. To further familiarize the trade about the content of Integrated Declaration, detailed presentations and interactive sessions will be held at all major Custom locations across the country in the third week of March, 2016. The schedules and venues for these training sessions will be notified separately by the respective Commissioner.

Monitoring and Feed back

15. To facilitate smooth roll out of Integrated Declaration, feedback and queries may be addressed by email to meena.rajendra@nic.in and Nsm.ices@icegate.gov.in. References in hardcopy may be sent to Commissioner (Single Window), Centre of Excellence, Tower 3&4, NBCC Plaza, PushpVihar, Sector-5, Saket, New Delhi-110077, Fax No. 011-29563902.

V. Instruction F.No.450/147/2015-Cus-IV, dated 31.03.2016

Subject: Implementation of ‘Integrated Declaration’ -reg.

Following the issue of CBEC Circular 10/2016-Cus dated 15.03.2016 regarding implementation of the Single Window “Integrated Declaration” with effect from 1st of April, 2016, the ‘Bill of Entry’ will be replaced by an ‘Integrated Declaration’, which covers all information required for import clearance by the other government agencies. The Customs Broker or Importer shall submit the “Integrated Declaration” electronically to a single entry point, i.e. the Customs Gateway (ICEGATE). Separate application forms (both online and hardcopy) required by different Participating Government Agencies (PGAs) like Drug Controller, AQCS, WCCB, PQIS and FSSAI would be dispensed with.

2. DG (Systems) has issued an advisory vide their letter No. IV(25)/01/2012 dated 18/3/2016, to Commissioners of Customs informing the key points with regard to the changes being introduced to the BE format. Further, Agency-wise Filing Guidelines and Frequently Asked Questions (FAQs) have also been placed on the ICEGATE website. Customs officers, trade associations, Service Centre operators and IT service providers have been sensitized to these changes through training sessions held all over the country. The ICEGATE website now has a separate page to display all instructions and guidelines issued in connection with the Single Window project.

3. The changes introduced to the Bill of Entry include additional requirements on account of Customs as well as Participating Government Agencies (PGAs) under the Single Window project. For the benefit of the officers in the field, a summary has been prepared and is attached as Annex.

4. In case of any difficulty in the implementation of the ‘Integrated Declaration’ a reference may be made to the Single Window project team & DG (Systems).

Annexure

Bill of Entry Level

(i) With effect from April 1, 2016, importers will be required to submit the Authorised Dealer Code of the bank that will be making outward remittance of foreign exchange in connection with the imported goods. This follows the finalization of the specifications for RBIs IDPMS (Import Data Processing & Management System) which is aimed at monitoring the flow of outward remittance.

(ii) A new field is being introduced to report the “UCR” or (Unique Consignment Reference). The UCR is for the identification of consignments in the international supply chain and will facilitate exchange of advance information bilateral agreements / Customs Mutual Assistance Agreements. Presently, this field will not be used and the importers should leave a blank.

(iii) In view of the proposals under the Finance Bill, 2016 proposes amendments to the Customs Act, 1962, to provide for deferred payment of customs duties for importers and exporters to certain class of importers and exporters. To cater to such and other forms/methods of payment of Customs duty, a new field has been added called “payment method code”. At present, the field will carry a mandatory value of T’ for transaction-wise payments.

Invoice Level

(iv) RBI Circular No. 70 November 8, 2013 allows Authorised Dealers to make payments to a third party for import of goods, provided the Bill of Entry mentions the name of the supplier and the narration that the related payment has to be made to the (named) third party. In order to comply with the above

circular and to facilitate the recording of the third party details, a new field has been added into the Bill of Entry. The above RBI circular provides that the third party payment should be made only to FATF (Financial Action Task Force) compliant country. To monitor the same, the Address field is provided to capture Country code to verify compliance to above guidelines.

(v) At present, the EDI Bill of Entry allows four INCOTERMS (CIF, FOB, C&I & C&F). To cater for other types of INCOTERMS, such as ex-works (EXW), a new field “TERMS place” has been added.

(vi) Under Authorised Economic Operator (AEOs) of other countries will be granted facilitated clearance under Mutual Recognition Agreements (MRAs). To allow importers to declare such AEOs in the Bills of Entry, a set of fields have been added.

(vii) A flag has been added with regard to the relationship between buyer and sell. If the importer answers ‘Y’, he has to fill-in the SVB Registration Number. This flag was already present in the forms of the Service Centre. It has now been added to the Bill of Entry Message format.

Item Level Changes

(viii) ‘End use of the item’ is presently a free text field. This has been converted into a dropdown list, because, purpose of import! Intended end-use is a key data field for Participating Government Agencies. It will be used to determine the agency (ies) from whom NOC is required.

(ix) In order to facilitate proper declaration by the importer with regard to accessories of items and their correct treatment under the Accessories (Condition) Rules, 1963, a new field “Accessory Status” has been added to the Bill of Entry at the item level: The importer will declare the Accessory status of an item as follows:

‘0’ indicates that no accessory!spare part!maintenance or repair implements are imported along with the item

„1” Indicates that acce sories/spa re parts/maintenance or repair implements are imported along with the item. These are compulsorily supplied with the item, and are supplied free of cost with the item (Refer to Rule 2 of Accessories (Condition) Rules, 1963).

‘2’ Indicates that accessories!spare parts!maintenance or repair implements are imported along with the item. All such accessories !spare

parts/maintenance or repair implements have been declared as separate items (and classified under the respective CTHs) in the Bill of Entry.

Note: If Accessory Status is ‘1’, please provide a brief description of all accessories supplied as a part of the item in the already existing field “Accessories of Item”.

(x) For receiving a proper declaration in relation to RSP Applicability, the current field is modified so that the importer makes a clear declaration in respect of every item. The importer needs to select Y, N, Q, T or D as follows:

- Importer selects “Y” when item being imported is cov red under the Notification No. 49/2008-CE dated 24.12.2008 as amended (RSP based assessment), and the system will expect details in the RSP table need to be provided.

- Importer selects “N” when item being imported is not covered under the Notification No. 49/2008 – CE dated 24.12.2008 as amended (RSP based assessment), and the system will not expect details in the RSP table need to be provided.

- Importer selects “Q” when item being imported is covered undethe Notification No. 49/2008 – CE dated 24.12.2008 but additional duty of customs is not being paid on RSP basis as the item under import is covered under Rule 3(a) of the Legal Metrology (packaged commodities) Rules, 2011.

- Importer selects “T” when item being imported is covered unde the Notification No. 49/2008 – CE dated 24.12.2008 but additional duty of customs is not being paid on RSP basis as the item under import is covered under Rule 3(b) of the Legal Metrology (packaged commodities) Rules, 2011 and importer is an “institutional consumer” as per explanation (i) of Rule 3(b).

- Importer selects “D” when item being imported is covered und r the Notification No. 49/2008 – CE, dated 24.12.2008 but additional duty of customs is not being paid on RSP basis as the item under import is covered under Rule 3(b) of the Legal Metrology (packaged commodities) Rules, 2011 and importer is an “industrial consumer” as per explanation (ii) of Rule 3(b).

(xi) A new flag has been introduced at the item level in view of clarification issued vide Board’s Circular 41/2013, dated 21-0-2013 under which the

importer has the option to avail benefits of concessional Basic Customs Duty and Additional duties of Customs (CVD). Earlier a CVD notification field in the item table was always assumed to be Central Excise Notification. Thus, in order to avail exemption of Additional duty of Customs using Customs Notification, the importer should declare the flag “C” to indicate that the Notification Number declared in position 27 refers to Customs Notification and not a Central Excise one.

(xii) Provision has been made to capture the name and address of the Manufacturer/Producer. Food Safety Authority of India and Drug Controllers are interested in the Manufacturer details, including their names and addresses. Both agencies would be assigning codes to manufactures for the control purposes.

(xiii) Source Country & Transit country are details are required by Participating Government Agencies who are concerned with pest and disease control. Country of manufacturing is important risk indicator for Drug Controllers and Food Safety Authority of India. ‘Country of Origin’, which is a separate mandatory field, will most often be the same as source country and/or country of manufacturing, but that is not necessarily in all cases. Country of Origin is defined essentially in the legal context of a trade agreement and may not always fulfill the strict and specific concerns of the Participating Government Agencies.

(xiv) Four new tables have been added to capture details of items required by the Participating Government Agencies. These tables capture different aspects of the item that are of interest to the PGAs. These include

(a) item identification details,

(b) item category details (based on regulatory categories defined by the PGAs)

(c) Item Characteristics (aspects of an item that are of interest to the PGA)

(d) Item name (based on different taxonomy defined/followed by different PGA)

(e) Item composition, which capture the constituent elements of the item,

(f) Production details used to determine not only the item’s residual shelf-life but also to track and trace production batches/lots even after they are released for home consumption

(g) Item control details to capture the testing, control and processing history of the item prior to import. How an importer needs to provision data for different agencies in the Integrated Declaration has been specified in the

“Agency-wise filing Guidelines”, which can be found on the ICEGATE website.

(xv) In relation to Free Trade Agreement/Treaty, a provision has been made to capture the origin criteria outlined in the respective Customs NT Notification (whether wholly obtained, based on value addition norms or product specific rules, including the specific text of the norms/rules). Separate instructions will be issued when this feature is implemented.

(xvi) There are cases where a consignment has been sold on high seas more than once. A flag has been introduced to capture the transaction hierarchy where there are multiple High Sea Sale transactions involved.

(xvii) Customs (Imported Goods at Concessional Rate of Duty for Manufacture of Excisable Goods) Rules, 2016 requires the importer to mandatorily provide the Central Excise Registration number in the Bill of Entry. Necessary changes have been introduced into the Bill of Entry format to capture Central Excise Registration Number. Similarly, the system has been made ready to capture the GSTIN number by setting the appropriate flag. This will be enabled as and when Goods & Services Tax (GST) is introduced in the country.

(xviii) At the end of the Bill of Entry the declaration statement will appear covering requirements of Customs as well as PGAs. The text of the statement will dynamically include mandatory as well as conditional statements to reflect specific undertakings that an importer is required to make in the context of the Bill of Entry. At present, the text of the statement would only reflect the Customs requirements of in line with the Bill of Entry Regulations 1976, along with statements cover the contents of the Valuation Declaration.

(xix) Details of supporting documents will be captured as part of the Bill of Entry. The table is also to be used in conjunction with the facility to upload electronic versions or copies of the supporting documents. Presently, this table is being used to capture essential data for PGAs.

(xx) Upon preparation and filing of a Bill of Entry a checklist can be printed out containing the additional details that are now being captured as part of the Bill of Entry. Data submitted by the importer which is meant for the PGAs will also be visible to Customs officers in ICES.

VI. CBEC Circular No. 28/2016-Customs, dated 14.06.2016 NEW

[Issued from F.No. 450/147/2015-Cus-IV]

Kind reference is invited to Board’s Circular No. 03/2016 dated 03.02.2016 and Circular No. 10/2016 dated 15.03.2016 regarding the Indian Customs Single Window. Central Board of Excise and Customs (CBEC) has operationalised the ‘Indian Customs Single Window Project’ to facilitate trade from 01st April 2016 at all EDI locations throughout India. As a result the importers and exporters electronically lodge their Customs clearance documents at a single point only with the Customs. The required permission, if any, from Partner Government Agencies (PGAs) such as Animal Quarantine, Plant Quarantine, Drug Controller, Food Safety and Standards Authority of India, Textile Committee etc. is obtained online without the importer/exporter having to separately approach these agencies. This has been made possible through a common, seamlessly integrated IT systems utilized by all regulatory agencies, logistics service providers and the importers/exporters. The Single Window Interface for Trade (SWIFT) thus provides the importers/exporters a single point interface for clearance of import and export goods thereby reducing dwell time and cost of doing business.

2. Since its implementation, reports have been received highlighting problems faced by trade in relation to the import of drugs, cosmetics and medical equipment. The Board has examined these issues and in consultation with the Drug Controller General of India the following decisions have been taken to simplify the procedure for clearance of such goods:

Items that are Chemicals and Not drugs

2.1 Several items falling under different Customs Tariff Heads which have been mapped in SWIFT as requiring clearance from Assistant Drug Controller’s (ADC) office are chemicals and not drugs. These are being routed for ADC’s clearance by virtue of the Customs Tariff Heads under which they are declared, and the ADC’s office routinely declares them as “out of scope”. In this regard, a list of such items have been prepared and published on the ICEGATE website as part of PGA Exemption Category (PEC).

Importers of such goods should identify their items on this PEC list and include them as part of the Integrated Declaration in order to avoid unnecessary references to the ADC. If any more items deserve to be part of the PEC list, importers/ Customs Brokers may bring it to the notice of the respective Commissioners. The Board has already established a Working Group to examine all such items. The PEC will be duly updated after holding consultations in the Working Group and with the approval of the concerned PGAs (DCGI – in case of drugs and cosmetics items).

Dual Use Items & Excipients

2.2 Several items falling under different Customs Tariff Heads which have been mapped in SWIFT as requiring clearance from Assistant Drug Controller’s (ADC) office have dual use (use for medicinal and non-medicinal purposes) and excipients (an inactive substance that can serve as the vehicle or medium for a drug or other active substance). A large number of importers are importing them for purposes other than drugs or medicinal use. Presently, for the clearance of dual use items, the importers have to first seek a permit from Deputy Drug Controller’s office and then to obtain an NOC from ADC office. To simplify the clearance of dual use items, it has been decided in consultation with the DCGI that items that are not pharmaceutical grade or items that do not contain any Active Pharmaceutical Ingredients (API) need not be referred to the ADC for NoC. Therefore, in respect of the category of dual-use items or excipients, in the Integrated Declaration, the items will normally not be referred to the ADC clearance if the importers or their Customs Brokers declare as follows:

(i) While providing the item details, it must be declared that the item is not pharmaceutical

(ii) grade and does not contain any Active Pharmaceutical Ingredient.

(iii) The ‘intended end use! purpose of import’ that is declared as part of item details should not be for human or veterinary medicinal purposes.

Risk-based testing & procedure for drawing of samples

2.3 Samples will be drawn for testing of products based on risk. In this regard, the DCGI has already outlined the criteria for risk-based testing under which intervention for inspection and sampling by ADC officers will be significantly reduced. Further, the procedure for drawing of samples for drugs has been streamlined. Customs officers may carry out the inspection of all drug/cosmetics consignments. They shall forward copies of authenticated labels of consignments for verification by the ADCs office. In cases where the consignments have to be opened for the drawing of product samples, an officer from the ADC’s office shall draw the samples. The ADC’s office reserve the right to inspect any drugs!cosmetics consignment.

2.4 It was reported that in respect of import of drugs & cosmetics items, the ADC’s office draws samples for testing irrespective of whether the same batch to which the item belongs has undergone testing in previous consignments. Considering that this causes unnecessary hardship to the importer, it has been decided that if the product sample from a particular batch has been tested, and based on that sample, the consignment!item has been granted NOC by ADC’s office, then a product sample shall not be drawn again for subsequent consignments!items pertaining to the same batch for the purposes of giving NOC.

Letters of Guarantee and Undertakings

2.5 For different situations of clearance, the DCGI requires the importer to present letters of declarations, undertaking and letters of guarantee in formats prescribed in its Guidance Document. It was decided that wherever the text of these declarations, undertakings, and letters of guarantee are provided as part of the integrated declaration and digitally signed by the declarant, the importer may not produce separate hardcopies of the same declarations undertakings and letters of guarantee. These shall be subsumed as part of the Integrated Declaration.

Mapping ADC’s office to ICES locations

2.6 Drugs, cosmetics, medical devices, non-critical diagnostics, dual use items, feed grade items etc., which require ADC clearance shall be imported only at the ports notified by CDSCO/DCGI. However, if consignments landed from vessel or aircrafts at a notified port are subsequently transshipped to another Customs location, the consignment will be referred for regulatory clearance purposes to the nearest ADC for clearance. For this purpose, when SWIFT was launched, all ICES locations were already mapped in the system to the nearest ADC’s office for routing the consignments for ADC’s clearance. Commissioners of Customs may report to the Board in case there are any problems with the mapping.

3. For implementation of the above decisions, DG (Systems) shall introduce necessary qualifiers in respect of the existing data fields in the Integrated Declaration. In regard to information required by ADC relating to supporting documents, CBEC is carrying out necessary upgrades to its IT infrastructure. Access by ADC’s office to data fields or images of supporting documents and labels etc. will be enabled once the CBEC IT infrastructure is upgraded.

4. Commissioners of Customs may kindly issue public notices to bring to the notice of the Trade the above changes. Importers and Customs Brokers may be advised to correctly declare all information in the Integrated Declaration including product details required by for Single Window and their intended end-use, especially since their declaration will determine how the consignments are handled in respect of regulatory clearances.

5. Any problems faced by field formations pertaining to above may kindly be reported to Single Window Project team, CBEC.

| ADC | Assistant Drug Controller |

| AEO: | Authorized Economic Operator |

| API | Active Pharmaceutical Ingredients |

| AQCS: | Animal Quarantine and Certification Service |

| Bs/E: | Bills of Entry |

| CDSCO: | Central Drugs Standard Control Organization |

| CCRs: | Compulsory Compliance Requirements |

| CTHs: | Customs Tariff Heads |

| CVD: | Countervailing Duty |

| DPPQ&S: | Department of Plant Protection, Quarantine and Storage |

| FATF: | Financial Action Task Force |

| FSSAI: | Food Safety and Standards Authority of India |

| GST: | Goods and Services Tax |

| GSTN: | Goods and Services Tax Network |

| GSTIN: | Goods and Services Tax Identification Number |

| ICEGATE: | Indian Customs Electronic Commerce/Electronic Data Interchange (EC/EDI) Gateway |

| ICES: | Indian Customs EDI System |

| INCOTERMS: | International Commercial Terms |

| MRA: | Mutual Recognition Arrangement/Agreement |

| NCC: | Non Compliance Certificate |

| NOC: | No Objection Certificate |

| OOC: | Out of Charge |

| PEC | PGA Exemption Category |

| PRAs: | Participating Regulating Agencies |

| RO: | Release Order |

| RSP: | Retail Sale Price |

| SWP: | Single Window Project |

| SWIFT: | Single Window Interface for Facilitating Trade |

| UCR: | Unique Consignment Reference |

| WCCB: | Wild Life Crime Control Bureau |

Source-National Academy of Customs Excise and Narcotics Regional Training Institute, Kanpur (India)