ICAI Concept Paper on Embracing Robotic Process Automation Opportunities and Challenges for Accountancy Profession

EMBRACING ROBOTIC PROCESS AUTOMATION

Page Contents

- Introduction

- Foreword

- Preface

- Era of Automation

- What is Robotic Process Automation (RPA)

- Key Objectives of Implementing RPA

- Triggers for Use of RPA

- Target Areas for RPA

- Critical Success Factors of RPA

- How does RPA Work

- How Does RPA WorkRobotic Tools and Vendor Landscape

- RPA Methodology

- Governance in RPA

- Accounting and Auditing of RPA

- RPA Future – Towards Intelligent Automation

- Case Studies

- Way Forward for Professional Accountancy Organizations (PAO)

- References

Introduction

The Institute of Chartered Accountants of India (ICAI) is a statutory body established by an Act of Parliament, viz. The Chartered Accountants Act, 1949 (Act No.XXXVIII of 1949) for regulating the profession of Chartered Accountancy in the country. ICAI is the one amongst accountancy bodies in the world, with a strong tradition of service to the Indian economy in public interest.

Over a period of time, ICAI has achieved recognition as a premier accounting body not only in the country but also globally, for maintaining highest standards in technical, ethical areas and for sustaining stringent examination and education standards. Since 1949, the Chartered Accountancy profession in India has grown leaps and bounds in terms of:

- Members and student base

- Regulate the profession of Accountancy

- Education and Examination of Chartered Accountancy Course

- Continuing Professional Education of Members

- Conducting Post Qualification Courses

- Formulation of Accounting Standards

- Prescription of Standard Auditing Procedures

- Laying down of Ethical Standards

- Monitoring Quality through Peer Review

- Ensuring Standards of performance of Members

- Exercise Disciplinary Jurisdiction

- Financial Reporting Review

- Input on Policy matters to Government

Digital Accounting and Assurance Board of ICAI

ICAI has constituted “Digital Accounting and Assurance Board” (DAAB) for fostering a cohesive global strategy on aspects related to digital accounting and assurance, through sharing of knowledge and practices amongst the members. DAAB is endeavouring to identify, deliberate and highlight on issues in accounting (including valuation) and assurance (including internal audit) issues in the digital world.

DAAB is focusing on issues in accounting and assurance arising from the high pace of digitisation, including use of artificial intelligence in audit, big data analytics in audit, relevance of sampling, valuation of data as an asset, impairment testing of digital assets, insurance of data – valuation and premium fixation, etc. The Board is taking up initiatives to develop knowledge base through position papers and articles on issues relating to impact of technology on accounting and assurance.

Initiatives to position the profession for opportunities in digital era are –

- Conducting Scalable, Employable and Updated Post Qualification Course on Information System Audit (DISA)

- World Class Training to Members on Forensic Accounting and Fraud Detection (FAFD)

- Imparting Hands on Training through Forensic Labs

- Evolving firms into thriving digital practice by providing leading technology solutions

- Research on Emerging Technologies – Artificial Intelligence, Cloud Computing and Robotics

- Executive Development Program on “Blockchain Technology – Driver of Digital Era”

- Capacity building in digital ecosystem of stakeholders including banks, PSUs

- Mentoring of Technology Driven Startups by Chartered Accountants

- Team of Innovators for helping members navigate digital path

- Digital Competency Maturity Model for upgrading firms in digital landscape

- Research Paper on “Early Signals on Fraud in Banking Sector”

- Incubation Centre for Blockchain Technology

- Webinars on strategies and approach to adopt technology in assurance services

- Research on embedding the understanding and use of technology in accounting and assurance services

Foreword

Organisations world over are challenged by ever changing economic conditions, technological developments, or consumer preferences, thereby forcing organizations to adopt smart automation solutions. Technological revolution in the form of Robotic Process Automation (RPA) is underway, and it offers huge potential to use technology for reassigning resources and improving data quality and process efficiency.

Keeping pace with dynamic digital landscape, Digital Accounting and Assurance Board (DAAB) of the Institute of Chartered Accountants of India (ICAI) has released “Concept Paper on Embracing Robotic Process Automation – Opportunities and Challenges for Accountancy Profession”. This document briefly provides an overview of Robotic Process Automation and focuses on role of chartered accountants in adoption of this evolving technology by organisations.

I compliment CA. Atul Kumar Gupta, Chairman, DAAB, CA. Manu Agrawal, Vice-Chairman, DAAB, and other members of the Board for this excellent and timely publication. I am sure that this paper will be useful source of information and the members will benefit by understanding this nascent technology and re-skilling their competencies.

CA. Naveen N. D. Gupta

President, ICAI

New Delhi

30th June, 2018

Technological change is occurring at a rapid pace and a host of trends such as, artificial intelligence, machine learning, automation and robotics will accelerate developments even further. Accountancy profession will attain newer heights only when it adapts and embraces these new technologies. The profession has not only to learn from emerging technologies, but also understand its deeper implications; to imbibe/use it in their work as a professional.

In this context, Digital Accounting and Assurance Board of ICAI has issued this “Concept Paper on Embracing Robotic Process Automation – Opportunities and Challenges for Accountancy Profession”. This is an extremely relevant document as it is perceived that all routine, repetitive, rule-based tasks will soon be performed by software BOTS and human resources can be deployed to higher value activities. Our members should proactively understand opportunities provided by Robotic Process Automation and deliver value added services efficiently.

I am sure that the members will find this document useful in adopting this evolving technology.

CA. Prafulla P. Chhajed

Vice-President, ICAI

New Delhi

30th June, 2018

Preface

Advances in new technologies offer an exciting opportunity to re-imagine the future of accountancy profession. Chartered accountants should be key players in driving adoption of these technologies, and in leading the transformation that ensues from technology innovation. Digital Accounting and Assurance board (DAAB) has been proactive in taking up initiatives to upgrade competencies of the members in digital era and evolving firms into thriving digital practice by providing technology driven solutions.

DAAB has released “Concept Paper on Embracing Robotic Process Automation – Opportunities and Challenges for Accountancy Profession” which gives a brief on current adoption of RPA as a technology and its impact on chartered accountancy profession. This document highlights key objectives of RPA, Triggers for Use of RPA, Target Areas for RPA, Critical Success Factors for RPA, Robotic tools and vendor landscape, RPA Future – Towards Intelligent Automation, etc. Case studies also have been included on accounting function, tax function, management reporting and analysis, etc.

At this juncture, we wish to place on record our sincere thanks to CA. Yukti Arora, Convenor of the Group, CA. Nikhil Gupta, and CA. Rahul Gupta for taking time out of their pressing preoccupations and contributing in preparation of draft of this important publication of the Board.

We would like to express our gratitude to CA. Naveen N.D. Gupta, President ICAI and, CA. Prafulla Premsukh Chhajed, Vice President, ICAI for their thought leadership and encouragement to the initiatives of the Board. We also wish to place on record our gratitude for all the Board members, co-opted members and special invitees for providing their invaluable guidance and support to various initiatives of the Board. I also wish to express my sincere appreciation for CA. Jyoti Singh, Secretary, DAAB, for her inputs in finalizing this Concept Paper.

We are sure that the members and other interested readers would find this Concept paper beneficial in exploring use of RPA as a technology for their professional work.

CA. Atul Kumar Gupta

Chairman, DAAB

CA. Manu Agrawal

Vice-Chairman, DAAB

New Delhi

30th June, 2018

Era of Automation

As referred by World Economic Forum, we are at the cusp of “Fourth Industrial Revolution,” and central to which is the development and adoption of automated technologies. Automation enabled by advanced technologies like, machine learning, artificial intelligence, robotic process automation present an enticing solution to many challenges faced by business and organizations.

Asia pacific region is slowly emerging on adoption of RPA currently specifically in off-shore development centers and business process outsourcing (BPO) contracts. North America is currently the largest RPA market, followed by the United Kingdom. As far as industry, leaders in RPA adoption are in Banking and Financial Services Industry, followed by telecom, media, and health care.

Gartner predicts that organizations employing more than 10,000 people will see a significant shift towards RPA by 2020 with slowly evolution to include more types of functionality, such as AI software.

Forrester predicts that despite rapid growth, to sustain longevity, RPA will have to incorporate Artificial Intelligence to understand process goals and be able to handle more decisions. RPA has potential to reach a market of $2.9 billion by 2021 by moving towards Cognition.

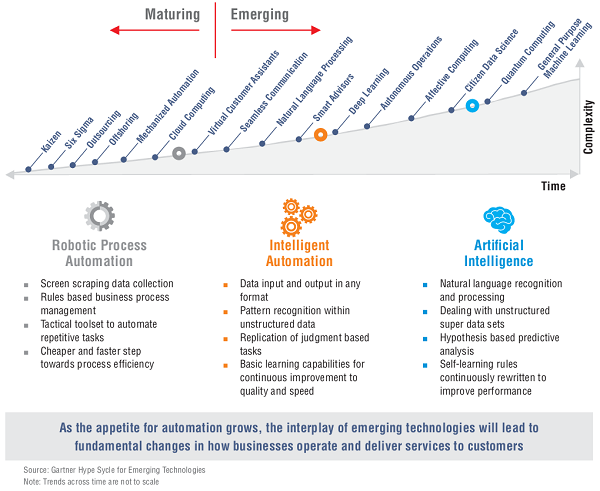

Evolution of Automation

Automation continuum range from enabling strategies that improve parts of business processes to sophisticated technologies with cognitive elements.

What is Robotic Process Automation (RPA)

Robotic Process Automation “RPA” is a software programme, which using recorders and easy programming language imitates human execution of applications, usually for repetitive tasks. Business users control user-friendly configurations and govern it. RPA repeats human interactions with proven technology. It performs common tasks such as queries, cut/paste, merging, button clicks, etc. One of the popular definition of “Robotic Process Automation” is –

“An application of technology that allows employees in a company to configure computer software, or a ‘robot’, to capture and interpret existing applications for processing a transaction, manipulating data, triggering responses and communicating with other digital systems”.

– The Institute for Robotic Process Automation (IRPA)

Robotic Process Automation is not a physical robot sitting at a desk performing tasks. It is a new alternative to improve productivity, unlocking higher Return on Investment than ERP implementations and Software as a Service (SaaS) which requires more investment in terms of time and cost.

It is the first step and necessary foundation in the enterprise digital operation journey, before implementing cognitive, chatbots and artificial intelligence.

Key Objectives of Implementing RPA

Key objectives of implementing Robotic Process Automation are as follows –

- Improve customer experience

- Improve accuracy

- Manage controls

- Higher efficiency

- Reduction of monotonous work

- Cost saving

- Skill upgradation of personnel

Robotic Process Automation (RPA) is the next phase of innovation in the world. It’s significant potential to become a differentiator has become evident. Most of the notable players are either assessing possibilities to benefit from this new solution or even proceeding with the first implementations.

Once IT and security risks are satisfied with the IT architecture, the process is documented in detail and can be carried forward for implementation.

Key sectors where RPA is playing a significant role in bringing in process efficiencies include highly regulated verticals such as, healthcare, banking, financial services and insurance. Other major sectors include telecommunications, utilities, mining, travel and retail.

Functional Areas where RPA implementation is beneficial are as under:

Human Resources

- Payroll Administration

- Benefits Enrolment

- Data of Employees Management

- Management of Claims

- Tracking of Leave Applications

- Routine Query Management

Finance & Accounting

- Accounts Receivable (OTC)

- Procurement/ Sourcing

- Order Management

- Invoice Processing

- Billing Management

- Records to Report (RTR)

Customer Services

- Billing Support

- Query Management

- Compliance Management

- Order Processing

- Sales Management

- Subscription Management

Triggers for Use of RPA

RPA implementation burdens costs and timelines, which are relatively insignificant, compared to Big IT platform updates. It is likely that RPA will quite quickly convert from a Standard Practice to Robotics Process delivering a competitive advantage that are essential for growth and survival.

RPA drives efficiency benefits, along with improvements in quality, scalability, and resiliency in a cost-effective way.

Efficiency and quality

- Human errors are eliminated. It enhances compliances/ auditability and results in higher staff satisfaction.

- Capacity increase by robotics virtual workforce and organisations can refocus on staff for better services.

Productivity boost

- Average handling time is reduced.

- Monitoring is performed around the clock.

- It results in development of new competencies.

Cost saver

- Processing costs may be reduced by up to 80% in most of the cases.

- High Potential ROI, if successfully implemented.

- Short payback in up to one year, provided target area to be automated are judicially identified and implemented.

Scalability and expertise

- Quick implementation of new processes based on proper due diligence.

- Re-usable process elements over a period of time.

- Build expertise with refocus on the relevant areas.

Target Areas for RPA

Following could be the areas for RPA implementation, which when targeted will result in higher and better return on investment –

Processes requiring High Volume Transactions

Candidates for robotic automation need not necessarily be limited to high-value transactional processes. Any process that is labour intensive, high throughput time or high-cost impact errors is a good candidate. For e.g., cash receipts and payments in banking sector, passbook update, etc.

Items Prone to Errors or Re-work

Manual activities in the process today result in a substantial number of errors due to human operator mistakes. For e.g., cash reconciliation in treasury management, inter branch reconciliation, full and final settlement for employees, etc.

High predictability

The process which can be defined as a rule and do not require much of judgement. For e.g., processing of regular payments, stock management, etc.

Limited exception handling

Simpler processes with little exceptions in delivery are excellent candidates for robotic automation in the beginning. When learning, the organisation can expand to processes which are complex or error prone. For e.g., attendance and payroll management, invoice reconciliation under GST regime, account ledgers balance and tax reconciliation, etc.

Significant manual work involved

Processes with little automation support today and large chunks of manual work involved benefit more from Robotics, although the process does not need to be completely ‘straight through processed’. For e.g., MIS reporting, legal and external reporting, maintaining general ledger balance, etc.

Critical Success Factors of RPA

There are five key aspects vital to a successful RPA implementation –

i. Process Prioritization

There should be proper framework for process assessment. The criteria for setting process prioritization may be part of the developed framework. Process owners must be involved in the process assessments for prioritization to secure their early buy-in and build the business case. Processes critical to the business may be identified, it should be completely understood to cover the flow towards recipient processes or interaction among processes (process chain).

ii. Business and IT Accountability

Business process owners must feel accountable for the involvement and commitment of their people to be deployed in both development and implementation stages of the RPA project. In organizing the project, there should be clear definition of business and IT roles across during the process prioritization, deployment, planning and execution. Accordingly, the IT governance protocols must be followed.

iii. Design and Execution

Resources allocated to the RPA project should be dedicated for focused involvement. People intimate to the process being automated should provide the critical participation not just in the functional design, but in the User Acceptance Testing and go-live support as well. Exception handling should be anticipated such that design and testing of such exceptions are comprehensive, and providing no surprises thereafter.

iv. Stakeholder Engagement

Board, Chief Operating Officers, Chief Financial Officers and Chief Information Officers are vital stakeholders. Strategic Business Unit process owners and day-to-day process operators are mainly the directly-impacted stakeholders of an RPA project. It is important that the value and potentials of RPA at all levels are effectively communicated. RPA potentials should be articulated in the context of a broader agenda of benefits and not just confined to benefits where the process resides. Effective change management tools which facilitate adaptation, should be deployed. It results in stakeholder’s commitments for the project and high sense of ownership which safeguards success.

v. Benefits Realization

As RPA implementation proceeds, clear regular updates on benefits being sought and progress against each should be provided. Continuous improvement mechanisms should be well-thought to be in place. These are the ways of gaining continued confidence of all stakeholders.

How does RPA Work

As industrial robots transformed the factory floor, RPA bots can transform support functions and back offices. RPA Bots replicate employee actions like, opening files, inputting data, copy pasting fields in an automated way. To set up an RPA bot, it may not be necessary to know complex programming because solutions available in market are user friendly. RPA can be easily being managed from a central controller to enable interaction with variety of business applications. There are 4 ways to setup RPA bots.

Setting up Instructions

The developer gives detailed instructions to robots to perform and interact with Robot Controller Library.

Robot Controller

It is a core RPA Software which can be used to give jobs to the robots and monitor their activities with respect to performance of their jobs.

Robots

It can be machine or desktop or virtual system where it interacts directly with the Robot Controller and Business Applications.

Business Users

Business users of the organisation review the work of the robots and resolves any exception and escalates, if required, to identify stakeholder for resolution.

In a long run, the bots can be self-learning to go the level of RPA for decision making. RPA is believed to revolutionize and redefine the way we will work and make us more smart and quick in processes, RPA as we see have commenced deployment in most large business and, will continue to grow and will adopt to be cognitive by next five years. Further, it is predicted by many that that is shall develop to machine learning platform probably by year 2025-2026.

Capabilities of RPA

RPA bots can use the operating system applications like a human user. Bots are capable of copying most user actions:

Launching and using various applications including

- Opening emails and attachments

- Logging into applications

- Moving files and folders

Integrating with enterprise tools by

- Connecting to system APIs

- Reading and writing to databases

Augmenting your data by

- Scraping data from the web including social media

Data processing

- Following logical rules such as “if/then” rules

- Making calculations

- Extracting data from documents

- Inputting data to forms

- Extracting and reformatting data into reports or dashboards

- Merging data from multiple source

- Copying and pasting data.

How Does RPA Work Robotic Tools and Vendor Landscape

Robotic Tools and Vendor Landscape

RPA works on user interface level and is able to automate rules-based work without compromising the underlying IT infrastructure and are capable of interacting with a wide range of applications.

There are wide varieties of vendors providing robotic process automation solution in market, important is that an organisation should select vendor carefully based on following factors:

- Clearly laying down the business requirements. e.g., geographic scope, vendor preferences;

- Evaluate characteristics of vendors to best suit the objectives e.g., integration capability, level of developer support;

- Review vendor for specialized solutions showcasing industry and functional expertise;

- Determine appropriate delivery model and pricing structure considering resource availability and support model;

Based on the above major factors, an organisation can choose vendor best suited. Some other important factors which can be considered are:

- Flexibility and costs with licensing model of vendor tool

- Vendor support for training, service desk support and implementation

- Architecture structure of systems, interconnections and dependencies

- Functionality capabilities related to level of support for RPA functions

- Development effort

- Management, auditing and logging capability

- Effort for robot management, scheduling, event triggers and priorities.

RPA Methodology

RPA Methodology can be divided into following four steps:

Step 1 – Plan and Identify

Define scope, stakeholders, and roadmap, key activities including business goals

- Define processes in scope

- Identify key stakeholders

- Begin vendor assessment

- Define deployment roadmap

Key outputs at this stage are –

- Catalogue of RPA target processes

- Defined project team

- Project roadmap

Step 2 – Analyse and Decide

- Evaluate applicability and impact of RPA and define implementation approach

- Analyse, redesign and document target processes and tasks

- Select vendor technology and begin partnering

- Develop business case.

Key outputs at this stage are –

- Vendor selection

- RPA business case

- Deployment approach

Step 3 – Execute and Automate

This stage includes execution of operational improvement and robotics deployment

- Configure, test, and deploy robotics software

- Train staff to leverage the capability

- Define exceptions handling

- Conduct go-live

Key outputs at this stage are –

- Configured robotics software

- Training material

- Command management

Step 4 – Maintain and Sustain

- Determine ongoing support model embedding continuous improvement

- Set up governance structures and Centre of Excellence (COE)

- Perform Key Performance Indicators (KPI) tracking

- Establish approach to continuous improvement

Key outputs at this stage are –

- Set up governance structures and COE

- Perform KPI tracking

- Establish approach to continuous improvement.

Governance in RPA

Governance in RPA

Like any other change process, biggest driver for success of RPA will depend on governance mechanism for same. Important factors include –

- Commitment from Board of Directors;

- Executive leadership involvement to make the change successful;

- Well defined policy and procedure;

- Establishment of Centre of Excellence;

- Roles and responsibility of RPA implementation and sustainability;

- KPI for measurement which should be regularly measured, and necessary corrective action should be taken, wherever required.

Accounting and Auditing of RPA

RPA can be used for recording financial transactions which are routine in nature, parking and posting entries, performing reconciliation, getting confirmation, creating master, provision entries, etc. Auditing of Robotic Process Automation requires auditor to –

- Understand the governance process of RPA;

- Reviewing of process of identification of need, areas to be automated, KPI for automation and process of RPA tool implementation;

- Review of system change management control, i.e., how changes were identified, approved, tested, signoff of testing was given, pre and post migration review and approvals;

- Analysing robotic controller to see how instructions are scheduled in RPA tool, and monitoring of the same;

- Reviewing of system blueprint and exception handling process;

- Reviewing process of exception handling log;

- Analyse periodic update and monitoring mechanism implemented by client for monitoring of BOTS.

- Audit access control implemented in RPA, that is who can approve access to RPA administrator, who has access to administer BOT, who have access to manage exception, Re-run or make changes in RPA tool, etc.

- Review of RPA transaction logs.

- Perform testing of edit, validation check, error check, etc., configured in RPA and re-perform few calculation and transaction reviews to ensure that results are consistent.

RPA Future – Towards Intelligent Automation

RPA solutions are gradually moving from Mimics Human Actions, i.e., from usage of rules-based processes which enablefaster processing time, process higher volumes and reduces error to cognitive intelligence, which Mimic Human Judgement. Herein, it is used for judgement-based processes, using machine language learning capability and to interpret human behaviour.

They are moving to augment human cognition and can be used for predictive decision making.

Case Studies

RPA has been used by several large organizations and finance functions. Following are some of the case studies –

1. Accounting Close

In a large organization, typically,financial closure requires rules-based processes, it is conducted across multiple locations often requiring multiple handoffs that involves predominantly manual closure processes, lots of emails and spread sheet-based communications and calculations and the process lacks end-to-end process visibility.

In above case, RPA can be leveraged to automate the process by –

- Automation of loading data into spreadsheets and tracking entity submissions;

- Update close tasks list;

- Period-end account reconciliations including, cash and ledger to spreadsheet;

- Gather and calculate sub-leger and non-financial information.

The above can reduce cycle time for sub-ledger and close activities, automate workflow, centralize operations to gain efficiencies and reduce operating costs with labour cost reduction. It can also improve consistency and quality of financial data.

2. Robotics in Tax Function

All manual, repeatable, and time-consuming processes can be automated using RPA. In fact it is predicted that RPA will be the future of Tax Function. In cases where IT has already implemented Tax Function through technology solutions, then RPA can enhance its direct and indirect tax compliance and reporting.

RPA can execute activities related to the following direct or indirect tax function –

i. Examples of RPA corporate tax return-related tasks:

- Auto reconciliation of inter-company transactions

- Review accounts to ensure consistency with the prior year and note changes

- Analyse account changes and evaluate potential tax impact

- Populate tax returns with financial data

- Automated import of financial tax workbook into tax return forms (using tax return software)

- Complete non-financial tax return line items and information fields

- Execute work-flow processes for tax returns and initiate electronic estimated payments

- Gather and analyse high volumes of state apportionment data (from payroll, fixed assets, and financial systems)

- Auto-calculate and posting of current tax accounting

- Submit tax returns and related payments.

ii. Examples of RPA indirect tax return-related tasks –

- Interact with bolt-on indirect tax solutions and financial systems to complete high volumes of tax returns

- Execute work-flow processes for tax returns and initiate electronic payments

- Gather transactional details and supporting invoices to analyse potential tax impact

- Export Industry-specific data for monitoring, evaluation and analysis

Robotic Process enhancements can help the organisations to –

- Accelerate timing of the tax provision by reducing manual effort by up to 20%-35%

- Efficiently acquire and analyse financial data, creating legal entity accrual adjustments

- Significant impact on accuracy due to increased visibility into accounts

- Reduce the staff time operations used to perform low-value work (data extraction and manipulation).

3. Invoice Reconciliation

In large multinational companies, manual invoice reconciliation creates revenue leakage issues since client invoices and orders are, generally, paper documents (pdfs) and in multiple languages. Reconciliation between paper documents is highly manual / intensive and is prone to error, contracts and invoices were in pdf form and documents range up to 200 pages.

RPA can be used to leverage Natural Language Processing (NLP), thereby it can schedule invoices through natural language processing. Further, it can load and identify functional information from fee schedules of contracts and invoices.

Simultaneously, it normalizes data from multiple input formats and develops rules to extract functional information. This way it can translate requirements into an automated, executable business process workflow and execute analysis

4. Management Reporting and Analytics

RPA can also be used to –

- Streamline data preparation and sourcing for management reporting;

- Deploy cognitive automation to improve the analytics;

- Leverage use of Natural Language Generation (NLG) to produce narratives;

- Articulate insights from the automation output.

By performing the above processes, the organization could perform better management reporting as it assists in preparing data from GL and data warehouse for management reports, helps in loading data into excel reports and/ or standard reporting suites for better analysis on decision making. This results in generating reports with analysis.

The above enables more informed corrective actions and reduces efforts, which would result in more meaningful and contextualized analysis.

For instance, RPA can process the following MIS Reports:

- Cash Flow Projection

- Credit Report

- Budget Vs Actual

- Profitability Statement

- Management Estimates

It can extract the information from the ERP for actual performance and compare it with the spreadsheet projections available with the management. This would provide analysis for insight to decision making.

5. Time and Expense Process Streamlining

Time and Expense Process issues include situations where client spends a significant amount of manual effort and hours reviewing expense reports and supporting receipts for validity and accuracy. Existing process was prone to errors and in some cases expenses without receipts were being approved due to volumes. Expenditure policy was

loosely followed, and expense reports was challenged on a limit basis, due to the workload of reviews and light staffing levels.

We can leverage RPA to automate data extraction, data validation, and summary report output with a step-by-step audit trail. In this case, RPA application was used to automate

- Process of reading expense reports and receipts,

- Validation of key fields

- Providing a summarized report.

OCR technology was also leveraged in conjunction with RPA to read receipts and provide a structured format for comparison. The program stores all inputs and reports in a central location enabling audit trail.

This improved efficiency and accuracy as well as audit compliance by identifying non-compliance on a daily basis, and also saves reimbursement for non-policy expenses.

Way Forward for Professional Accountancy Organizations (PAO)

Robotic Process Automation “RPA” is emerging technology and service area for professional accountancy organisation “PAO”. With the increase in implementation of BOT and focus of organisation on automation, the auditor will be required to audit financial and controls generated from BOT. PAO need to enhance the skillset of the professional accountants for this emerging technology.

RPA can provide an opportunity to professional accountants to automate their process and deliver client services in an efficient, error-free and faster way. PAO can deploy RPA for tax filing, GST compliance and reconciliation, reminder mailers, MIS reporting, even they can deliver managed services for a client using this technology.

Robotic Process Automation (RPA) is not replacing accountants but evolving their role and augmenting their effectiveness through automation. It is a progressive, positive, and necessary shift that is creating the digital workspace for accounting and finance professionals to focus on the greatest value they can provide to their organisation.

Automation tools may lead to a reduction in headcount. But robo-accountants are not actual accountants. Despite the enormous power and promise of digital solutions, there will always be a need for the human connection. They’re simply machines making routine work easier and more efficient.

ICAEW’s document “The Future of the Profession” states that new ways of doing business, shaped by technology and shifting regulatory environments, mean accountants in business and practice are facing tough challenges and exciting opportunities. Further, it mentions skills required of accountants in the future are tech-savvy thinkers, strong communicators, flexible thinkers, strategic thinkers & good networkers.

Professional accountants will also be required to operate and manage BOT for efficient delivery of accounting, taxation and finance work. Besides, rendering services on automation, ERP implementation and analytics, professional accountants may enhance their service offering to RPA. To conclude, RPA has huge potential and PAOs have to provide required training to upskill accountants; which will bring the new changed efficient way of delivering value-added services efficiently.

References

- Robotic Process Automation – Driving the Next Wave of Cost Rationalisation ( Minefields, September 2017)

- Global Challenge Insight Report – “The Future of Jobs – Employment, Skills and Workforce Strategy for the Fourth Industrial Revolution” (World Economic Forum, January 2016)

- Gartner Hype Cycle for Emerging Technologies.

- The Future of the Profession (ICAEW, 2017).

Source- https://resource.cdn.icai.org/51008daab230718-1110.pdf