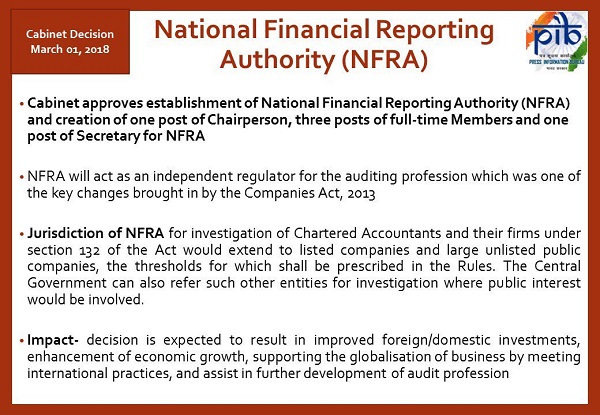

The Union Cabinet chaired by the Prime Minister Shri Narendra Modi has approved the proposal for establishment of National Financial Reporting Authority (NFRA) and creation of one post of Chairperson, three posts of full-time Members and one post of Secretary for NFRA.

The decision aims at establishment of NFRA as an independent regulator for the auditing profession which is one of the key changes brought in by the Companies Act, 2013. The inclusion of the provision in the Act was on the specific recommendations of the Standing Committee on Finance (in its 21st report).

Also Read- NFRA- Stunned ICAI Members

Vishesh Chandiok, National Managing Partner, Grant Thornton India LLP on Cabinet’s approval on setting up of National Financial Reporting Authority said that “Grant Thornton has been a strong supporter of independent regulation in India and Globally. India remains the only major economy where the audit profession is still considered self- regulated. NFRA will help build reinstate trust in the Indian audit profession, which has undoubtedly been tarnished with recent events. I would encourage the profession in India to welcome the NFRA as a golden opportunity to enhance standards, audit quality and above all value of the audit attestation.”

Impact of Establishment of National Financial Reporting Authority:

The decision is expected to result in improved foreign/domestic investments, enhancement of economic growth, supporting the globalisation of business by meeting international practices, and assist in further development of audit profession.

Jurisdiction of National Financial Reporting Authority:

The jurisdiction of NFRA for investigation of Chartered Accountants and their firms under section 132 of the Act would extend to listed companies and large unlisted public companies, the thresholds for which shall be prescribed in the Rules. The Central Government can also refer such other entities for investigation where public interest would be involved.

The inherent regulatory role of ICAI as provided for in the Chartered Accountants Act, 1949 shall continue in respect of its members in general and specifically with respect to audits pertaining to private limited companies, and public unlisted companies below the threshold limit to be notified in the rules.

The Quality Review Board (QRB) will also continue quality audit in respect of private limited companies, public unlisted companies below prescribed threshold and also with respect to audit of those companies that may be delegated to QRB by NFRA. Further, ICAI shall continue to play its advisory role with respect to accounting and auditing standards and policies by making its recommendations to NFRA.

Background:

The need for establishing NFRA has arisen on account of the need felt across various jurisdictions in the world, in the wake of accounting scams, to establish independent regulators, independent from those it regulates, for enforcement of auditing standards and ensuring the quality of audits to strengthen the independence of audit firms, quality of audits and, therefore, enhance investor and public confidence in financial disclosures of companies.

Does the overseeing Auditing Profession will check financial Scams?

If this NFRA jurisdiction is extended to politicians and bureaucrats also who are involved in direct spending of the public money allocated to their constituencies i will appreciate the sincerity of the govt.

What if, desired goals are not achieved. Who would be responsible then. A provision in this regard would be a welcome step.

All professionals including CMA, CS, Doctors, Engineers,Lawyers, IAS officers, Insurance loss assessors and those who are dealing in public money should be inducted

Doctors and Advocate have no role in public distribution money of Govt. Advocate and Doctors cannot fraud any company, financial institute or Government Body or Public institute.

NFRA is a welcome step to safeguard the public money being spent effectively on welfare programmes as it involves Crores of money are being disbursed by Govt every year. A oversight body to supervise that assigned duties are done effectively is needed due to recent lapses. .Suggest that NFRA to include all professionals including CMA, CS, Doctors, Engineers,Lawyers, IAS officers and other institutions who are engaged in Govt /Public funds also to be brought under their umbrella so that entire public expenditure is monitored effectively.

Auditors are being hanged for all Corporate ills,scams and economic offences.NFRA is to be made applicable for all professionalsincluding doctirs,engineers,legal ,secretaries aand IAS cadres who commit and evade any accountavility. CA institute has failed to bring parity of fees for thr commensurate fees for auditors . I t is pathethic It is good we too can it away from all laws of this country easily and also migrate to Fireign places