The Auditing and Assurance Standards Board of the Institute of Chartered Accountants of India (ICAI) has introduced an important amendment to the “Clarification Regarding Authority Attached to Documents Issued by the Institute.” This amendment aims to provide greater clarity, enhance robustness, and eliminate outdated provisions. Additionally, consequential changes have been made to the “Preface to the Standards on Quality Control, Auditing, Review, Other Assurance, and Related Services.

Auditing and Assurance Standards Board

The Institute of Chartered Accountants of India

19th August, 2023

Amendment to the “Clarification Regarding Authority Attached to Documents Issued by the Institute” and Consequential Amendment to the “Preface to the Standards on Quality Control, Auditing, Review, Other Assurance and Related Services”

I. In 1985, the Council of the Institute of Chartered Accountants of India had issued a Clarification namely “Clarification Regarding Authority Attached to Documents Issued by the Institute” (“The Clarification”). The Clarification was revised in February 2022. The Clarification is in force as on date. The Clarification provides the level of authority of various documents issued by the Institute e.g. Accounting Standards, Auditing Standards, Guidance Notes on Accounting, Guidance Notes on Auditing.

II. The Council of ICAI at its 422nd meeting held on 30th June & 1st July 2023 considered the recommendations of the Auditing and Assurance Standards Board (AASB) of ICAI regarding some changes required to be made in the Clarification to provide more clarity, to make the provisions more robust and to remove the provisions which are not relevant in the present context. The Council also considered the recommendations of AASB regarding some consequential changes required to be made in “Paragraph 11 – Guidance Notes” of the “Preface to the Standards on Quality Control, Auditing, Review, Other Assurance and Related Services” (“The Preface”) in order to align the Preface with the changes made in the Clarification. At the meeting, the Council agreed with these recommendations and decided to issue the amended Clarification and the amended Preface.

III. The amended Clarification is enclosed as Appendix 1. (Please click here to download)

The amended Preface is enclosed as Appendix 2. (Please click here to download)

IV. This Announcement is effective from the date of its hosting on ICAI’s website.

Clarification Regarding Authority Attached to Documents Issued by the Institute1

1. The Institute has, from time to time, issued ‘Guidance Notes’ on a number of With the formation of the Accounting Standards Board and the Auditing and Assurance Standards Board, ‘Accounting Standards’ and ‘Standards on Auditing’ are also being issued.

2. Members have sought guidance regarding the level of authority attached to the various documents issued by the Institute and the degree of compliance required in respect thereof. This note is being issued to provide this guidance.

3. Guidance Notes, though recommendatory in nature, are issued to assist professional accountants in implementing the Engagement Standards and the Standards on Quality Control issued under the authority of the Council. Guidance Notes are also issued to provide guidance on other generic or industry specific audit issues, not necessarily arising out of a Standard. Professional accountants should be aware of and consider Guidance Notes applicable to the engagement. A professional accountant who does not consider and apply the guidance included in a relevant Guidance Note should take reasonable and adequate care in performing the alternate procedures adopted by him to deal with the objectives and basic principles set out in the Guidance Note. In such situations, a professional accountant should also document the rationale in performing the alternate Similarly, while discharging his attest function, a member should examine whether the recommendations in a Guidance Note relating to an accounting matter have been followed or not. If the same have not been followed, the member should consider whether keeping in view the circumstances of the case, a disclosure in his report is necessary in accordance with Engagement Standards.

4. The ‘Accounting Standards’ and ‘Standards on Auditing’ issued by the Accounting Standards Board and the Auditing and Assurance Standards Board, respectively, establish standards which have to be complied with to ensure that financial statements are prepared in accordance with generally accepted accounting standards and that auditors carry out their audits in accordance with the generally accepted auditing practices. They become mandatory on the dates specified either in the respective document or by notification issued by the Council.

Notes:-

1 Published in the December,1985 issue of the ‘The Chartered Accountant’. Revised in February, 2022. The revised (the announcement has been revised primarily from auditing perspective) clarification was considered and approved by the Council of ICAI at its 408th meeting held on 3rd & 4th February, 2022. Further revised in terms of the decision taken by the Council of ICAI at its 422nd meeting held on 30th June & 1st July, 2023.

Introduction

1. This Preface to the Standards on Quality Control, Auditing, Review, Other Assurance and Related Services has been issued to facilitate understanding of the scope and authority of the pronouncements of the AASB issued under the authority of the Council of the Institute of Chartered Accountants of India (the ICAI).

2. The ICAI is committed to the goal of enabling the accountancy profession in India to provide services of high quality in the public interest and which are accepted worldwide. To further this goal, the ICAI develops and promulgates technical Standards and other professional literature. The ICAI being one of the founder members of the International Federation of Accountants (IFAC), the Standards developed and promulgated by the AASB under the authority of the Council of the ICAI are in conformity with the corresponding International Standards issued by the International Auditing and Assurance Standards Board (IAASB), established by the IFAC. The “Due Process” of the AASB for formulation of Standards, Guidance Notes and its other pronouncements is given in the Appendix to this Preface.

Standards Issued by AASB Under the Authority of the Council of ICAI

3. The following Standards issued by the Auditing and Assurance Standards Board under the authority of the Council are collectively known as the Engagement Standards:

(a) Standards on Auditing (SAs), to be applied in the audit of historical financial information.

(b) Standards on Review Engagements (SREs), to be applied in the review of historical financial information.

(c) Standards on Assurance Engagements (SAEs), to be applied in assurance engagements, other than audits and reviews of historical financial information.

(d) Standards on Related Services (SRSs), to be applied to engagements involving application of agreed-upon procedures to information, compilation engagements, and other related services engagements, as may be specified by the ICAI.

4. Standards on Quality Control (SQCs), issued by the AASB under the authority of the Council, are to be applied for all services covered by the Engagement Standards as described in paragraph 3 above.

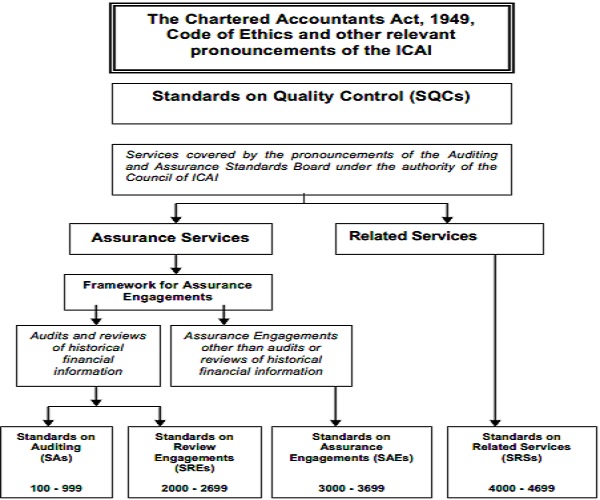

A diagram containing the structure of the Standards issued by the Auditing and Assurance Standards Board under the authority of the Council is given as Annexure to this Preface.

Standards on Auditing

5. The Standards on Auditing (SAs) referred to in paragraph 3(a) above are formulated in the context of an audit of financial statements by an independent auditor. They are to be adapted as necessary in the circumstances when applied to audits of other historical financial information. The authority of SAs is set out in SA 2002.

Standards on Quality Control

6. SQCs are written to apply to firms3 in respect of all their services falling under the Engagement Standards issued by the AASB under the authority of the Council of ICAI. The authority of SQCs is set out in the introduction to the SQCs.

Other Standards

7. The other Engagement Standards identified in paragraph 3(b) to (d) as well as Standards on Quality Control referred to in paragraph 4 ordinarily contain objectives and requirements (requirements are expressed in Standards using “shall”), and related guidance in the form of application and other explanatory material. They may also contain introductory material that provides context relevant to a proper understanding of Standards, and definitions. The entire text of a Standard, therefore, is relevant to an understanding of the objectives stated in a Standard and the proper application of the requirements of a Standard. Appendices, which form part of the application and other explanatory material, are an integral part of a Standard. The purpose and intended use of an appendix are explained in the body of the related Standard or within the title and introduction of the appendix itself. An individual Standard should be read in the context of the objective stated in the Standard as well as this Preface. Any limitation of the applicability of a specific Standard is made clear in the Standard itself.

General Clarifications

8. General Clarifications are issued by the Board under the authority of the Council of the Institute with a view to clarify any issues arising from the Standards. General Clarifications are mandatory in nature.

Professional Judgment

9. The nature of the Standards/General Clarifications requires the professional accountant4 to exercise professional judgment in applying them.

Authority Attached to Other Standards and General Clarifications

10. It is the duty of the professional accountants to ensure that the Standards/General Clarifications are followed in the engagements undertaken by them5. The need for the professional accountants to depart from a relevant requirement is expected to arise only where the requirement is for a specific procedure to be performed and, in the specific circumstances of the engagement, that procedure would be ineffective. If because of that reason, a professional accountant has not been able to perform an engagement procedure in accordance with any Standard/General Clarification, he is required to document how alternative procedures performed achieve the purpose of the procedure, and, unless otherwise clear, the reasons for the departure. Further, his report should draw attention to such departures. However, a mere disclosure in his report does not absolve a professional accountant from complying with the applicable Standards/General Clarifications 6.

Guidance Notes

11. Guidance Notes, though recommendatory in nature, are issued to assist professional accountants in implementing the Engagement Standards and the Standards on Quality Control issued under the authority of the Council. Guidance Notes are also issued to provide guidance on other generic or industry specific audit issues, not necessarily arising out of a Standard. Professional accountants should be aware of and consider Guidance Notes applicable to the engagement. A professional accountant who does not consider and apply the guidance included in a relevant Guidance Note should take reasonable and adequate care in performing the alternate procedures adopted by him to deal with the objectives and basic principles set out in the Guidance Note. In such situations, a professional accountant should also document the rationale in performing the alternate procedures.

Technical Guides, Practice Manuals, Studies and Other Papers Published by the Auditing and Assurance Standards Board

12. The Auditing and Assurance Standards Board may also publish Technical Guides, Practice Manuals, Studies and other papers. Technical Guides are ordinarily aimed at imparting broad knowledge about a particular aspect or of an industry to the professional accountants. Practice Manuals are aimed at providing additional guidance to professional accountants in performing audit and other related assignments. Studies and other papers are aimed at promoting discussion or debate or creating awareness on issues relating to quality control, auditing, assurance and related service, affecting the profession. Such publications of the Board do not establish any basic principles or essential procedures to be followed in audit, review, other assurance or related services engagements, and accordingly, have no authority of the Council attached to them.

Material Modifications vis-a-vis the Preface to the International Quality Control, Auditing, Review, Other Assurance and Related Services Pronouncements

Addition

This Preface deals, apart from the Standards, with the General Clarifications as the mandatory documents for use by the professional accountants in performing engagements by them, whereas, the Preface issued by the IAASB does not deal with such aspects. Further, the nomenclature of International Auditing Practice Statements (IAPSs) referred in the Preface issued by the IAASB has been changed to Guidance Notes in this

Preface.

Deletion

The Preface issued by the IAASB provides to include, in appropriate cases, additional considerations specific to public sector entities within the body of the Standard. However, since the Standards, General Clarifications and Guidance Notes issued by the ICAI are equally applicable in case of all engagements, irrespective of the form, nature and size of the entity, this Preface does not deal separately with the public sector perspective.

Annexure

Structure of Standards issued by the Auditing and Assurance Standards Board under the Authority of the Council of ICAI

Appendix

Auditing and Assurance Standards Board

and its Due Process

Brief History

1. The Institute of Chartered Accountants of India (ICAI) constituted the Auditing Practices Committee (APC) on 17th September 1982, to review the existing auditing practices in India and to develop Statements on Standard Auditing Practices (now known as “Engagement and Quality Control Standards”) so that these may be issued under the authority of the Council of the Institute. Subsequently, at its 226th meeting held in July 2002, the Council of the Institute approved certain recommendations of the APC to strengthen its role in the growth and development of the accountancy profession in India. The Council, at the said meeting, also approved the renaming of the Auditing Practices Committee as the Auditing and Assurance Standards Board (AASB) as well as renaming of the Statements on Standard Auditing Practices as Auditing and Assurance Standards (AASs) (now known as “Engagement and Quality Control Standards”).

The ICAI is one of the founder members of the International Federation of Accountants (IFAC). It is one of the membership obligations of the Institute to actively propagate the pronouncements of the International Auditing and Assurance Standards Board (IAASB) of the IFAC to contribute towards global harmonisation and acceptance of the Standards issued by the IAASB. Accordingly, while formulating Engagement and Quality Control Standards, the AASB takes into consideration the corresponding Standards, if any, issued by the IAASB. In addition, the AASB also takes into consideration the applicable laws, customs, usages and business environment prevailing in India within the parameters of the July 2006 Policy Paper, A Guide for National Standard Setters that Adopt IAASB’s International Standards but Find it Necessary to Make Limited Modifications, issued by the IAASB.

Objectives and Functions of the Auditing and Assurance Standards Board

3. The following are the objectives and functions of the Auditing and Assurance Standards Board:

(i) To review the existing and emerging auditing practices worldwide and identify areas in which Standards on Quality Control and Engagement Standards need to be developed.

(ii) To formulate Engagement Standards and Standards on Quality Control so that these may be issued under the authority of the Council of the Institute.

(iii) To review the existing Standards to assess their relevance in the changed conditions and to undertake their revision, if necessary.

(iv) To develop Guidance Notes on issues arising out of any Standard, auditing issues pertaining to any specific industry or on generic issues, so that those may be issued under the authority of the Council of the Institute.

(v) To review the existing Guidance Notes to assess their relevance in the changed circumstances and to undertake their revision, if necessary.

(vi) To formulate General Clarifications, where necessary, on issues arising from Standards.

(vii) To formulate and issue Technical Guides, Practice Manuals, Studies and other papers under its own authority for guidance of professional accountants in the cases felt appropriate by the Board.

(viii) To proactively participate with the national and international bodies engaged in the standard-setting process, such as, sending comments on various consultative papers such as Exposure Drafts, Discussion Papers etc., issued by the International Auditing and Assurance Standards Board and various other international bodies.

Composition

4. The composition of the AASB is fairly broad-based and attempts to ensure participation of all interest groups in the standard-setting process. Apart from amongst the elected members of the Council of the ICAI the following are also represented on AASB:

(i) Eminent members of the profession, whether in industry or in practice, as co-opted members on the Board.

(ii) One special invitee from each three regulatory bodies, viz., the Securities and Exchange Board of India, the Reserve Bank of India and the Insurance Regulatory and Development Authority of India.

(iii) One special invitee from the Indian Institute(s) of Management, or from any other prominent academic and/or research organisation, as considered appropriate.

(iv) One special invitee from a prominent Industry association.

(v) One special invitee representing public interest, e.g., not for profit organization, etc.

The special invitees mentioned at (ii) through (v) above are decided in consultation with the President of the Institute. Further, special invitees do not constitute the members of the Board, as referred to in this document.

Term of the Members

5. The term of the Chairman of the Board is three years. Where such period of three years exceeds the term of the Council of ICAI during which the Chairman has been appointed, the term of the Chairman is restricted to the abovementioned term of the Council. The Council of the ICAI may fill any vacancy in the Office of the Chairman and the Chairman so appointed holds office for the unexpired term of the Council. The term of other members of the Board and the special invitees is one year. However, in case the period of one year exceeds the term of the Council during which the members have been appointed, the term of the members is restricted to the abovementioned term of the Council.

Attendance at the Meetings

6. Each AASB meeting requires the attendance of at least one third of the members of the Board in person or by simultaneous telecommunication link (such as teleconferencing, videoconferencing, etc.).

7. In case any member of the AASB absents himself from three consecutive meetings of the Board, without seeking leave of absence the AASB would bring such fact to the attention of the Council.

AASB Working Procedure

Standards and General Clarifications

Project Identification, Prioritization and Approval

8. Project proposals to develop new, or revise existing Standards or General Clarifications are identified based on international and national developments, input from members of the Council of the ICAI, AASB members, members of other committees of the ICAI and/or recommendations received from other interested parties, such as regulators or professional accountants.

9. The AASB determines the priorities of various projects on hand for commencement.

10. In the preparation of Standards and General Clarifications, AASB is assisted by Study Groups/Task Forces constituted to consider specific projects. The AASB appoints one of the professional accountants as a convenor of the Study Group/Task Force. The convenor, in consultation with the Chairman, AASB, nominates other members of the Study Group/Task Force, ordinarily five to seven in number. For operating convenience and economy, a study group is usually based in the area where the convenor is located. In situations considered necessary, the Board may also consider having an outside expert on such Study Groups/Task Forces and such an expert need not necessarily be a professional accountant. The Study Group/Task Force is responsible for preparing the basic draft of the Standard/ General Clarification. In addition, a separate group of experts may be formed to advice the Study Group /Task Force.

11. The AASB may also conduct projects jointly with regulators and/or others. In such cases, the joint Study Group/Task Force is ordinarily chaired by the convenor appointed with mutual consent.

Consultation and Debate

12. The Study Group/Task Force develops the preliminary draft of the Standard / General Clarification based on appropriate research and consultation, which may include, depending on the circumstances, consultation with the other professionals, regulators and other interested parties, as well as reviewing professional pronouncements issued by IFAC member bodies and other professional bodies. The draft submitted by the study group, along with issue papers/background papers, is sent to the Chairman, AASB for approval.

13. The draft Standard/General Clarification, along with other agenda papers, as approved by the Chairman, AASB is sent to the AASB members. The agenda papers, including background papers and draft Standard /General Clarification prepared by the Study Group/Task Force for review and debate are made available to the members of and special invitees to the AASB at the meeting at which such draft Standard/General Clarification is planned to be considered.

14. The AASB considers the preliminary draft of the Standard /General Clarification prepared by the Study Group/Task Force. The AASB may refer the draft to the Study Group/Task Force to examine the issues arising out of the deliberations of the AASB and accordingly modify the draft Standard/General Clarification.

15. In case the revision to the Standard/General Clarification is made by the Study Group/ Task Force in terms of the requirements of paragraph 14 above, the procedure laid down in paragraphs 12 to 14 above is followed for the revised draft of the Standard/General Clarification.

16. The draft of the proposed Standard/General Clarification, as modified in the light of the deliberations of the Board and approved by the Chairman, AASB, is circulated to the Council members of the ICAI for their comments before being issued as an Exposure Draft. Normally, a period of ten days is given for receiving comments on the Draft Exposure Draft. If required, outreach meeting is organized by AASB to ascertain views of various stakeholders (those charged with governance e.g. audit committees, specified bodies listed in paragraph 18 below) on proposed Standard. AASB finalises the Exposure Draft of the proposed Standard on the basis of the comments so received, if any and the views received from stakeholders, if applicable. Ordinarily, an Exposure Draft of a General Clarification is not issued.

Public Exposure

17. The Exposure Draft of the proposed Standard is issued, by way of publication in the monthly Journal of the Institute and/or hosted on the website of the ICAI wherefrom it is downloadable free of charge, for comments by the professional accountants and the public. Each Exposure Draft is, ordinarily, accompanied by an explanatory memorandum that highlights the objectives and significant proposals contained in the draft. The explanatory memorandum may also direct the respondents to those aspects of the Exposure Draft on which specific feedback is sought.

18. The Exposure Draft is sent to the members of the Council of the ICAI, the Institute’s past Presidents, Regional Councils and their branches. Copies of the Exposure Draft are also sent to the following bodies:

i. The Ministry of Corporate Affairs, Government of India (A copy of Exposure Draft is sent to the National Financial Reporting Authority, with intimation to the Ministry of Corporate Affairs)

ii. The Comptroller and Auditor General of India

iii. The Reserve Bank of India

iv. The Insurance Regulatory and Development Authority of India

v. The Central Board of Direct Taxes

vi. The Central Board of Indirect Taxes and Customs

vii. The Securities and Exchange Board of India

viii. The Central Registrar of Co-operative Societies

ix. The Institute of Cost Accountants of India

x. The Institute of Company Secretaries of India

xi. The Indian Banks Association

xii. Industry organizations such as Federation of Indian Chambers of Commerce and Industry, Associated Chambers of Commerce and Industry of India, Confederation of Indian Industry

xiii. Indian Institute(s) of Management

xiv. The Telecom Regulatory Authority of India

xv. The Standing Conference on Public Enterprises

xvi. Recognised stock exchanges in India

xvii. Any other body considered relevant by the AASB keeping in view the nature and requirement of Standard.

19. To allow adequate time for due consideration and comment from all interested parties, exposure period is

ordinarily 45 (forty five) days or such other period, but not less than 45 days in any case, as may be decided by the AASB. Further, the exposure period would be reckoned from the date of hosting of the Exposure Draft on the website of the Institute.

Responses to Exposure Drafts and Consideration of Respondents’ Comments

20. An acknowledgement is sent to every respondent to an Exposure Draft. Except where the respondent has specifically indicated otherwise, the respondents’ comments are considered a matter of public records. Comments which are received upto ten days prior to the date of the AASB meeting at which such comments are proposed to be considered, are hosted on the website of the AASB and kept there till the date of the AASB meeting at which the Exposure Draft and comments thereon are considered. The members of the AASB as well as the Council of the Institute are notified when the comments are hosted on the website of the AASB. Copies of the Exposure Draft and comment letters are also made available to the AASB members at the AASB meeting at which the Exposure Draft is scheduled for discussion.

21. The comments and suggestions received within the exposure period are read and considered by the AASB. The AASB’s deliberations on the significant issues raised in the comments letters received together with the AASB’s decision thereon are recorded in the minutes of the relevant AASB meeting and also hosted on the website of the AASB. The AASB may decide to discuss with the respondents their comment letters or explain to them the reasons for not having accepted their proposals. The nature and outcome of such discussions are reported and recorded in the minutes of the relevant AASB meeting.

22. Such part of the AASB meetings whereat the Exposure Draft of proposed Standard and the comments thereon are to be discussed is open for public. The members of the public, at their own expenditure, can attend the said part of the meeting(s) as observers. Such observers, however, do not have the right to participate in the discussions at the meeting. The notification as to the date of the said AASB meeting is hosted on the website of the Institute at least 30 days in advance and the members of the public desirous of attending the said meeting(s) are required to send their request for the same to the Board at least 15 days prior to the date of the concerned AASB meeting. The seats for the members of the public at such meetings are limited to such numbers as may be decided by the AASB and allotted on a first come first serve basis. The AASB may also hold a meeting with the representatives of the specified bodies, as may be identified by the Board on a case to case basis, to ascertain their views on the draft of the proposed Standard.

23. After taking into consideration the comments received, the draft of the proposed Standard is finalized by the AASB and submitted to the Council of the ICAI for its consideration and approval. The draft of the General Clarification, as finalised by the AASB, is submitted to the Council of ICAI for its consideration and approval.

24. The Council of the ICAI considers the final draft of the proposed Standard /General Clarification, and if found necessary, modifies the same in consultation with AASB. The concerned Standard/ General Clarification is then issued under the authority of the Council of the ICAI except as mentioned below.

In the case of Standards on Auditing referred to under Section 143(10) of the Companies Act, 2013 (i.e. Standards on Auditing in the 200 series to the 700 series) which are applicable for statutory audit of historical financial statements of companies prepared under Section 129 of the Companies Act, 2013, these Standards are recommended by the ICAI to the Ministry of Corporate Affairs (MCA) for notification under the Companies Act, 2013. In terms of Section 143(10) of the Companies Act, 2013, the Central Government may prescribe the standards of auditing or any addendum thereto, as recommended by the Institute of Chartered Accountants of India, constituted under section 3 of the Chartered Accountants Act, 1949, in consultation with and after examination of the recommendations made by the National Financial Reporting Authority.

Re-exposure

25. The AASB on a direction from the Council of the ICAI or on its own, in cases considered appropriate, may re-expose a proposed Standard. The need for re-exposure may arise on account of factors such as significant issues coming to the notice of the Board subsequently, including, significant changes in the laws or regulations having an impact on the requirements of the Standard or revision of the corresponding International Standard by IAASB. In cases where a re-exposure of a Standard is required, the procedures as listed in paragraphs 12 to 24 are followed.

Procedure for Issuing the Guidance Notes

26. The AASB identifies the issues on which Guidance Notes need to be formulated and the priority in regard to selection thereof.

27. In the preparation of the Guidance Note, the AASB is assisted by Study Groups/Task Forces constituted

to consider specific projects. The AASB appoints one of the professional accountants as a convenor of the Study Group / Task Force. The Convenor nominates other members of the Study Group/Task Force and in the formation of Study Groups / Task Forces, provision is made for participation of a cross-section of members of the ICAI. In situations considered necessary, the Board may also consider having an outside expert on such Study Groups/Task Forces and such “expert” need not necessarily be a professional accountant. The Study Group/Task Force will be responsible for preparing the basic draft of the Guidance Note.

28. The Study Group/Task Force develops the preliminary draft of the Guidance Note based on appropriate research and consultation, which may include, depending on the circumstances, consulting with the other professionals, regulators and other interested parties, as well as reviewing professional pronouncements issued by IFAC member bodies and other parties and submits the preliminary draft Guidance Note to the AASB. The draft Guidance Note, along with the background papers, if any, is sent to the Chairman, AASB for approval.

29. The AASB considers the preliminary draft prepared by the Study Group/Task Force and may refer the same to the Study Group/Task Force to examine the issues arising out of the deliberations of the AASB and accordingly modify the draft Guidance Note. The modified Draft Guidance Note is once again considered by the Board. The AASB finalises the Exposure Draft of the proposed Guidance Note.

30. The Exposure Draft of the proposed Guidance Note is issued, by way of hosting on the website of the ICAI wherefrom it is downloadable free of charge, for comments by the professional accountants and the public. To allow adequate time for due consideration and comment from all interested parties, exposure period is at least 30 (thirty) days.7 Further, the exposure period would be reckoned from the date of hosting of the Exposure Draft on the website of the ICAI. In exceptional cases, when it is not possible to issue an exposure draft owing to paucity of time, since a Guidance Note is to be issued urgently, the draft Guidance Note may be placed for the consideration of the Council with the approval of the President-in-office. The comments and suggestions received within the exposure period are read and considered by the AASB. After taking into consideration the comments received, the draft of the proposed Guidance Note is finalized by the AASB and submitted to the Council of the ICAI for its consideration and approval.

31. The Council of the Institute considers the final draft of the proposed Guidance Note and, if necessary, suggests modifications thereto in consultation with the AASB. The Guidance Note is then issued under the authority of the Council of the ICAI.

Limited or Substantive Revision to the Standard or Guidance Note

32. Subsequent to issuance of a Standard or Guidance Note, the introduction of any new legal or professional requirement or any other national or international development in the field of auditing, may require a substantive revision to that Standard or Guidance Note. In that case, the Council of the ICAI makes substantive revision to such Standard /Guidance Note. The procedure followed for substantive revision is the same as that followed for formulation of a new Standard or the Guidance Note, as the case may be, as detailed above.

33. Similarly, subsequent to issuance of a Standard or Guidance Note, some aspect(s) may require revision which are not substantive in nature. For this purpose, the Council of the ICAI may make limited revision to a Standard /Guidance Note. In case of the Standards on Auditing (SAs), any revision to a Standard is treated as limited only if that revision is restricted to the application guidance of that Standard. The procedure followed for the limited revision is, in principle, the same as that followed for formulation of a Standard or Guidance Note, as the case may be. However, the AASB may decide to cut short some time limits, e.g. period of public exposure in case of a limited revision to a Standard, as detailed above, for the process.

Technical Guides, Practice Manuals, Studies and Other Papers Published by the Auditing and Assurance Standards Board

34. For issuance of a Technical Guides/Studies, etc., the procedure adopted by the AASB is ordinarily the same as in case of a Guidance Note except that the draft Technical Guide/ Practice Manual/ Study is not exposed for public comments nor such part of the AASB meeting at which the proposed Technical Guide, Practice Manual, etc., is considered, open for public. Also, since the Technical Guides, Practice Manuals, Studies, etc., are not issued under the authority of the Council, these are not required to be placed for consideration and final approval of the Council, and are issued by the AASB under its own authority.

Voting

35. The affirmative votes of a majority of the members of the Board, in person or by simultaneous telecommunication link, are required to approve the final draft of a Standard for submission to the Council.

36. Each member of the AASB has the right to one vote. In case of tie of votes, Chairman, AASB will have a casting vote.

Notes:-

1 Issued in July, 2007.

2 SA 200, “Overall Objectives of the Independent Auditor and the Conduct of an Audit in Accordance with Standards on Auditing”.

3 The term “firm” refers to a sole practitioner/proprietor, partnership, including limited liability partnership or any such entity of professional accountants, as may be permitted by law.

4 The term “professional accountant” refers to a member of the Institute of Chartered Accountants of India.

5 Members’ attention is invited to Clause 5 of Part I of the Second Schedule to the Chartered Accountants Act, 1949, according to which a chartered accountant in practice shall be deemed to be guilty of professional misconduct, if he fails to disclose a material fact known to him which is not disclosed in a financial statement, but disclosure of which is necessary in making such financial statement where he is concerned with that financial statement in a professional capacity. Further Clause 7 of Part I of the Second Schedule to the Chartered Accountants Act, 1949 states that a chartered accountant in practice shall be deemed to be guilty of professional misconduct, if he does not exercise due diligence, or is grossly negligent in the conduct of his professional duties.

6 Attention of the members is also drawn to Clause 9 of Part I of the Second Schedule to the Chartered Accountants Act, 1949, whereby, a member is deemed to be guilty of professional misconduct if he fails to invite attention to any material departure from the generally accepted procedures of audit applicable to the circumstances.

7 Please refer the “Guidelines for Standardisation of Guidance Notes issued under the authority of the Council” dated July 22, 2016, issued by the Council of ICAI.