SEBI Alternative Investment Fund Guidelines– Enhances Transparency & Streamline Disclosure Standards

In the year 1996, Securities and Exchange Board of India (“SEBI”) had introduced and notified Venture Capital Funds Regulations (“VCF Regulations”) attracting a dedicated pool of investment in the form of either a trust or a company including body corporate, especially to encourage and boost the funding for Venture Capital Investments i.e. for budding businesses promising high returns as well as having high risks attached thereto. However, over the years, difficulties were observed to synchronise everything under the VCF Regulations, especially regulation of those funds that dealt with Private Equity (“PE”), Real Estate (“RE”) etc. Hence, the appropriate authorities came up with a solution to fill in this statutory gap, thereby repealing VCF Regulations and instead formulating SEBI (Alternative Investment Funds Regulations) 2012 (“AIF Regulations”) in the year 2012[1].

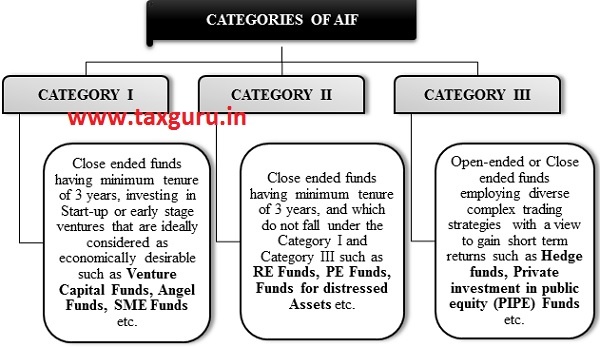

Alternative Investment Fund (“AIF”) is defined and described in detail under Regulation 2(1)(b) of AIF Regulations. It states that AIF is a private investment vehicle, collecting funds from either domestic or foreign investor, for the purpose of making investments as per pre-defined investment policy for the benefits of the investors. It includes investing in all types of funds including PE Funds, RE Funds, Hedge Funds etc. However, AIFs are not governed by Mutual Fund Regulations or Collective Investment Schemes regulations or in fact not presently covered under any other regulations of SEBI regulating activities regarding fund management. At the same time, family trusts, Employee Stock Ownership Plans (“ESOP”) Trusts, employee welfare trusts, gratuity trusts, etc. too won’t be considered as AIFs. AIFs can be classified under following categories –

Recently SEBI vide circular dated 5th February 2020[2] has introduced Disclosure Standards directing all the AIFs to ease and streamline the procedure by the way of ‘Introduction of Performance Benchmarking’ and ‘Standardization of Private Placement Memorandum (“PPM”) for AIFs’.

After receiving and considering public inputs for the same, the Advisory Committee sought to launch following templates and set of actions –

1. Templates for PPM (w.e.f. 1st March 2020):

PPM is a primary offering document which provides valuable information about description of the securities and their attributes such as price, background of key investment team, targeted investors, minimum qualification standards for investors, salient terms and conditions applicable thereof etc. all in a condensed format. The purpose of drafting and issuing industry-specific PPM is to allow the investors to weigh potential risk-reward ratio. It aids the investor to take correct and informed decision in the said matter after contemplating the fact about where and how his funds are going to be deployed.

Since, PPM forms an evident part of this entire process, it has been decided to mandate a two-sectioned template for PPM in such a way that –

- Part A provides for the minimum level of information that is required to be disclosed in a simple format.

- Part B provides for supplementary section to allow disclosures of any other additional information, if required and deemed fit.

Further, it shall be mandatory for the AIFs to carry out annual audit of such compliances either by any internal/external auditor or legal professional and the results of such audit along with necessary findings and corrective steps, shall be communicated to the appropriate authorities. However, it is optional to carry out audit of sections relating to Risk Factors, Legal, Regulatory and Tax Considerations and Track Record of First Time Managers. The above mentioned requirements shall not be applicable to:

- Angel Funds as defined under Chapter III-A of AIF Regulations.

- AIFs or Schemes in which investor pitches in a minimum capital contribution of Rupees Seventy Crores (i.e. USD 10 million or equivalent), as well as those providing for a waiver to the fund from requirement of PPM and annual audit of the same.

However, it is very important to make a note of the fact that the terms and conditions provided under the contribution or subscription agreement; shall be akin to those mentioned in the PPM and no clauses shall go beyond the information provided under PPM.

2. Performance benchmarking of AIFs:

In order to assess the performance and compare the progress of AIF industry against other available investment avenues, it is decided to initiate following:

a. Mandatory benchmarking of the performance of AIFs (including Venture Capital Funds) and the AIF industry; and

b. A framework for facilitating the use of data collected by Benchmarking Agencies to provide customized performance reports.

Any association of AIFs (“Association”) representing at least 51% of membership of number of AIFs, may enter into an agreement with one or more Benchmarking Agencies, covering all the specific data required to be reported in order to carry out the Benchmarking process, in such form and format as mutually decided by the parties thereof. Performance benchmarking of AIFs is required to be done semi-annually, based on the data available as on 30th September and 31st March of every year. For the purpose of carrying out benchmarking, AIFs shall provide requisite data on cash flows and valuation of scheme-wise investment to appointed Benchmarking Agencies within 45 days from half-year ending 30th September (may be Audited/Unaudited Data) and within 6 months from the half-year ending 31st March (shall be Audited Data).

In case of given list of probable scenarios, following course of actions shall be adopted by the AIFs in an orderly and timely manner:

| Sr. No. | Particulars | Actions expected to be taken by AIFs |

| 1. | If AIF schemes have completed at least 1 year from date of ‘First Close’; | Then, those AIFs shall report all the mandatory information to Benchmarking Agencies, including but not limited to cash flow data and scheme wise valuation. |

| 2. | If an applicant for registration of AIF claims a track record of performance of funds that are incorporated overseas; | Then, it shall provide the data of the investments of the said funds in Indian companies to the Benchmarking Agencies. |

| 3. | If past performance of AIF is anywhere mentioned in either PPM or any other promotional documents; | Then, copy of actual report of performance v/s. benchmark report provided by Benchmarking Agencies shall be provided. |

| 4. | If performance of AIF/Scheme is compared to any benchmark whilst reporting to any existing investor; | Then, copy of actual report of performance v/s. benchmark report provided by Benchmarking Agencies shall be provided. |

The timeline with regards to following shall be ensured by the Association and Benchmarking Agencies:

- First Industry Benchmark and AIF level performance upto 30th September 2019 v/s. Benchmark Reports shall be available latest by 1st July 2020.

- Further, a progress report to SEBI with regards to the same shall be submitted by Association on monthly basis till the creation of First Industry Benchmark.

Apart from the standard benchmark report, if any AIF seeks additional customized performance reports in a particular manner, then the Benchmarking Agencies shall provide the same subject to the consent of respective AIF and payment of applicable fees as mutually decided, along with compliance of other terms and conditions. ‘Angel Funds’ is the only exception to Benchmarking provisions provided in the said circular.

The list of Annexures attached to the circular are as follows:

- Annexure 1[3] provides for the template for PPM of AIFs raising funds under Category I and Category II.

- Annexure 2[4] provides for the template for PPM of AIFs raising funds under Category III.

- Annexure 3[5] provides for the template for waiver of compliance with SEBI prescribed template of PPM and audit compliance with the terms of PPM.

- Annexure 4[6] provides for the operational guidelines for performance benchmarking.

Thus, with the introduction of the compulsion of publishing PPM Template, SEBI’s this innovative and coherent move is expected to regularize the AIF industry in a more organized and efficient way. In addition, performance benchmarking will enhance transparency among AIF investors thereby enabling the investors to take sound decisions on making investment in any AIF.

[1] https://taxguru.in/sebi/sebi-alternative-investment-funds-regulations-2012.html

[2] https://taxguru.in/sebi/disclosure-standards-alternative-investment-funds-aifs.html

[3] https://www.sebi.gov.in/sebi_data/commondocs/feb-2020/an_1_p.pdf

[4] https://www.sebi.gov.in/sebi_data/commondocs/feb-2020/an_2_p.pdf

[5] https://www.sebi.gov.in/sebi_data/commondocs/feb-2020/ann_3_p.pdf

[6] https://www.sebi.gov.in/sebi_data/commondocs/feb-2020/ann_4_p.pdf