Read the monetary policy statement and resolution of the Monetary Policy Committee (MPC) for June 2023. The MPC decided to maintain the policy repo rate at 6.50% and focus on withdrawing accommodation to align inflation with the target while supporting growth. Get insights into the global and domestic economic outlook, inflation projections, and future policy actions. Additionally, learn about the developmental and regulatory policies related to financial markets, regulation, and payment systems announced by the Reserve Bank of India.

Reserve Bank of India

Date : Jun 08, 2023

Governor’s Statement: June 8, 2023

As I make this monetary policy statement, we can derive satisfaction from the fact that the Indian economy and the financial sector stand out as strong and resilient in a world of unprecedented headwinds and swift cross currents. Unlike the previous three tumultuous years, the uncertainty on the horizon appears comparatively less and the path ahead somewhat clearer; but we have to be acutely aware that the geopolitical conflict continues unabated and policy normalisation globally is far from complete. Headline inflation across countries is on a downward trajectory, but is still high and above the targets. Labour markets are tight, and demand is rotating back from goods to services. Hence, central banks across the world remain on high alert and watchful of the evolving conditions, even though many of them have tempered their rate hikes or taken a pause. Financial stability concerns persist in advanced economies, although they appear to have been contained due to resolute actions. Retrenchment in trade, technology and capital flows caused by geopolitical fault lines and economic fragmentation further complicate the situation.

2. In these challenging times, the Reserve Bank of India has continued to focus on preserving price and financial stability, while ensuring adequate flow of financial resources to all productive sectors of the economy. As a result, domestic macroeconomic fundamentals are strengthening – economic activity is exhibiting resilience; inflation has moderated; the current account deficit has narrowed; and foreign exchange reserves are comfortable. Fiscal consolidation is also ongoing. The Indian banking system remains stable and resilient, credit growth is robust and domestic financial markets have evolved in an orderly manner.

Decisions and Deliberations of the Monetary Policy Committee (MPC)

3. The Monetary Policy Committee (MPC) met on 6th, 7th and 8th June 2023. Based on an assessment of the macroeconomic situation and the outlook, the MPC decided unanimously to keep the policy repo rate unchanged at 6.50 per cent. Consequently, the standing deposit facility (SDF) rate remains at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent. The MPC also decided by a majority of 5 out of 6 members to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth.

4. Let me now explain the MPC’s rationale for these decisions on the policy rate and the stance. The MPC recognised that the pace of global economic activity is expected to decelerate in 2023, dragged down by elevated inflation, tight financial conditions and geopolitical tensions. The pace of monetary tightening has slowed in recent months, but uncertainty remains on its future trajectory as inflation continues to rule above targets across the world.

5. In India, consumer price inflation eased during March-April 2023 and moved into the tolerance band, declining from 6.7 per cent in 2022-23. Headline inflation, however, is still above the target as per the latest data and is expected to remain so according to our projections for 2023-24. Therefore, close and continued vigil on the evolving inflation outlook is absolutely necessary, especially as the monsoon outlook and the impact of El Nino remain uncertain. Real GDP growth in 2022-23, on the other hand, turned out to be stronger than anticipated and is holding up well.

6. The policy repo rate has been increased by 250 basis points since May 2022 and is still working its way through the system. Its fuller effects will be seen in the coming months. Against this backdrop, the MPC decided to keep the policy repo rate unchanged at 6.50 per cent. The MPC will continue to remain vigilant on the evolving inflation and growth outlook. It will take further monetary actions promptly and appropriately as required to keep inflation expectations firmly anchored and bring down inflation to the target.

7. With the policy repo rate at 6.50 per cent and full year projected inflation for 2023-24 at just a little above 5 per cent, the real policy rate continues to be positive. The average system liquidity, however, is still in surplus mode and could increase as ₹2,000 banknotes get deposited in the banks. Headline inflation, as noted before, is easing but rules above the target, warranting close monitoring of the evolving price dynamics. Taking all of these factors into account, the MPC decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth.

Assessment of Growth and Inflation

Growth

8. India’s real gross domestic product (GDP) recorded a growth of 7.2 per cent in 2022-23, stronger than the earlier estimate of 7.0 per cent. It has surpassed its pre-pandemic level by 10.1 per cent. Real GDP growth in Q4:2022-23 accelerated to 6.1 per cent (y-o-y) from 4.5 per cent in Q3, aided by fixed investment and higher net exports. On the supply side, real gross value added (GVA) accelerated from 4.7 per cent in Q3 to 6.5 per cent in Q4, driven by rebound in manufacturing activity which moved into expansion territory after two quarters of contraction.

9. Turning to 2023-24, domestic demand conditions remain supportive of growth on the back of improving household consumption and investment activity. Urban demand remains resilient, with indicators such as passenger vehicle sales, domestic air passenger traffic, and credit cards outstanding posting double-digit expansion on a year-on-year basis in April. Rural demand is also on a revival path – motorcycle and three-wheeler sales increased at a robust pace (y-o-y) in April, while tractor sales remained subdued.

10. Growth in steel consumption, cement output, and production and imports of capital goods suggest continued buoyancy in investment activity. On the back of double-digit growth of 15.6 per cent in non-food bank credit, the flow of resources to the commercial sector in 2023-24 (up to May 19, 2023) increased to ₹2.7 lakh crore from ₹1.0 lakh crore during the same period last year. Fixed investment by manufacturing companies expanded in 2022-23, reversing the contraction seen in 2021-22. Our surveys also point towards higher investment intentions of manufacturing companies for 2023-24. The contraction in merchandise imports outpaced that of merchandise exports in April, resulting in a narrowing of the trade deficit. Coupled with the sustained and strong growth in services exports, the drag from net exports on growth is easing.

11. On the supply side, the eight core industries output expanded by 3.5 per cent y-o-y in April 2023 as compared with 3.6 per cent in March 2023. The purchasing managers’ index (PMI) for manufacturing exhibited sustained expansion, rising to 58.7 in May, a 31-month high. Available high frequency indicators suggest that services sector activity has remained on an accelerating trajectory. PMI services maintained strong expansion at 61.2 in May on top of 62.0 in April.

12. Looking ahead, higher rabi crop production, expected normal monsoon, continued buoyancy in services and softening inflation should support household consumption. On the other hand, given the healthy twin balance sheets of banks and corporates, supply chain normalisation and declining uncertainty, conditions are favourable for the capex cycle to gain momentum. Robust government capital expenditure is also expected to nurture investment and manufacturing activity. Consumer and business outlook surveys display continued optimism. The headwinds from weak external demand, volatility in global financial markets, protracted geopolitical tensions and intensity of El Nino impact, however, pose risks to the outlook. Taking all these factors into consideration, real GDP growth for 2023-24 is projected at 6.5 per cent with Q1:2023-24 at 8.0 per cent; Q2 at 6.5 per cent; Q3 at 6.0 per cent; and Q4 at 5.7 per cent, with risks evenly balanced.

Inflation

13. Headline CPI inflation has come down during March-April 2023 to 4.7 per cent in April, the lowest reading since November 2021. Monetary policy tightening and supply side measures contributed to this process. The easing of inflation was observed across food, fuel and core (CPI excluding food and fuel) categories. Food inflation declined to 4.2 per cent in April, while core inflation moderated to 5.1 per cent. A durable disinflation in the core component would be critical for a sustained alignment of the headline inflation with the target.

14. Going forward, with the recent rabi harvest remaining largely immune to the adverse weather events, the near-term inflation outlook looks more favourable than at the time of the April MPC meeting. The forecast of a normal south-west monsoon by the India Meteorological Department (IMD) augurs well for the kharif crops. Uncertainties, however, remain on the spatial and temporal distribution of monsoon and on the interplay between El Nino and the Indian Ocean Dipole (IOD). Geopolitical tensions; uncertainties around the monsoon and international commodity prices, especially sugar, rice and crude oil; and volatility in global financial markets pose upside risks to inflation. Taking into account these factors and assuming a normal monsoon, CPI inflation is projected at 5.1 per cent for 2023-24, with Q1 at 4.6 per cent, Q2 at 5.2 per cent, Q3 at 5.4 per cent and Q4 at 5.2 per cent. The risks are evenly balanced.

15. As noted in the April statement, the decision to pause was based on the need to assess the cumulative impact of past monetary policy actions while charting out the future course. Subsequent incoming data suggest that while risks to near-term inflation have moderated somewhat, pressure remains during the second half of the year which needs to be watched and addressed at the appropriate time. According to our survey, inflation expectations of households for three months to one year ahead horizon have moderated by 60 to 70 basis points since September 2022. This would indicate that anchoring of expectations is underway and that our monetary policy actions are yielding the desired results. This also provides us the space to keep the policy rate unchanged in this meeting of the MPC. At the same time, given the uncertainties, we need to maintain Arjuna’s eye1 on the evolving inflation scenario. Let me re-emphasise that headline inflation still remains above the target and being within the tolerance band is not enough. Our goal is to achieve the target of 4.0 per cent, going forward. As Mahatma Gandhi had said “The ideal must not be lowered.”2 The continuation of the stance of withdrawal of accommodation should be seen from this perspective.

Liquidity and Financial Market Conditions

16. Surplus liquidity, as reflected in average daily absorptions under the LAF3 at ₹1.7 lakh crore during April-May, was lower than ₹2.9 lakh crore during the full year 2022-23. The shrinkage in surplus liquidity during April-May was, among other things, due to the maturing of TLTROs.4 The seasonal expansion in currency in circulation and build-up of government cash balances during this period also moderated surplus liquidity. Since the third week of May, however, the decline in currency in circulation and pick-up in government spending have expanded the system liquidity. This has got further augmented due to the Reserve Bank’s market operations and the deposit of ₹2,000 banknotes in banks.

17. The prevalence of surplus liquidity amidst higher recourse to the marginal standing facility (MSF) by some banks suggests skewed liquidity distribution within the banking system.5 To address this situation, the Reserve Bank conducted a 14-day variable rate repo (VRR) auction amounting to ₹50,000 crore as part of its main operation on May 19, 2023, similar to two such auctions conducted earlier in February and March 2023. Reflecting swiftness in its liquidity action, the Reserve Bank conducted a 14-day variable rate reverse repo (VRRR) auction of ₹2.0 lakh crore on June 2; 4-day VRRR of ₹1.0 lakh crore on June 5; 3-day VRRR of ₹75,000 crore on June 6; and 2-day VRRR of ₹75,000 crore on June 7, considering the overall build-up of surplus liquidity. The response has been cautious in these auctions. Going forward, the Reserve Bank will remain nimble in its liquidity management, while ensuring that adequate resources are available for the productive requirements of the economy. The Reserve Bank will also ensure the orderly completion of the government’s market borrowing programme.

18. The moderation in system liquidity along with its skewed distribution was reflected in firming up of money market rates even beyond the repo rate on a few occasions before they came down from May 18 to sub-repo rate levels. Long term rates have, however, remained broadly stable. This has led to sharp compression of term spreads in the recent period. The relative stability of long-term yields augurs well for the economy and suggests effective anchoring of market-based long-term inflation expectations.

External Sector

19. In recent months, the trade deficit has narrowed on the back of sharper decline in imports vis-à-vis exports. India is making resolute strides to achieve the US$1 trillion merchandise export target by 2030 by focusing on diversification of markets and products; leveraging free trade agreements; strengthening manufacturing capacity and competitiveness by participating in value chains; and through schemes such as Production Linked Incentive (PLI) across sectors. Service exports and remittances have provided valuable support to India’s external sector viability. During 2022-23, services exports grew faster (27.9 per cent) than merchandise exports (6.9 per cent). The current account deficit (CAD) is expected to have moderated further in Q4:2022-23 and should remain eminently manageable in 2023-24 also.

20. On the financing side, foreign portfolio investment (FPI) flows have seen a significant turnaround in 2023-24 led by equity flows. The net FPI inflows stand at US$ 8.4 billion during the current financial year (up to June 6, 2023) as against net outflows in the preceding two years – US$ 14.1 billion in 2021-22 and US$ 5.9 billion in 2022-23. Net FDI flows to India were US$ 28.0 billion in 2022-23 compared to US$ 38.6 billion in the previous year. Preliminary data for April 2023 suggest that FDI flows have improved. Net inflows under non-resident deposits increased to US$ 8.0 billion during 2022-23 from US$ 3.2 billion in the previous year. The Indian rupee has remained stable since January 2023. Overall, India’s external sector remains resilient as key indicators, such as CAD to GDP, external debt to GDP and international investment position (IIP) to GDP ratios continue to improve. Foreign exchange reserves stood at a comfortable level of US$ 595.1 billion (as on June 2, 2023). Inclusive of net forward assets, foreign exchange reserves are well above US$ 600 billion.

Additional Measures

21. I shall now announce certain additional measures.

Borrowing in Call and Notice Money Markets by Scheduled Commercial Banks

22. The extant regulatory guidelines prescribe prudential limits for outstanding borrowing in Call and Notice Money Markets for Scheduled Commercial Banks (SCBs). With a view to providing greater flexibility for managing their liquidity, it has been decided that SCBs (excluding Small Finance Banks) can set their own limits for borrowing in Call and Notice Money Markets within the prescribed prudential limits for inter-bank liabilities.

Widening of the Scope of the Framework for Resolution of Stressed Assets

23. Compromise settlement is recognised as a resolution mechanism in respect of non-performing assets (NPA) under the Prudential Framework, which is currently applicable to SCBs and select NBFCs. It is proposed to issue comprehensive guidelines on compromise settlements and technical write-offs which will now be applicable to all regulated entities including co-operative banks. Further, it is also proposed to rationalise the extant prudential norms on restructuring of borrower accounts affected by natural calamities.

Default Loss Guarantee Arrangement in Digital Lending

24. The Reserve Bank had issued the regulatory framework for Digital Lending in August/September 2022. With a view to further promoting responsible innovation and prudent risk management, it has been decided to issue guidelines on Default Loss Guarantee arrangements in Digital Lending. This will further facilitate orderly development of the digital lending ecosystem and enhance credit penetration in the economy.

Priority Sector Lending (PSL) Targets for Primary (Urban) Cooperative Banks (UCBs)

25. The Reserve Bank has undertaken several initiatives in recent years to strengthen the UCB sector as well as to deepen financial inclusion. Such initiatives include revision of the priority sector lending targets for UCBs in 2020. While revising the PSL targets, a glide path up to March 2024 was provided for a non-disruptive transition to achieve the revised targets. While a number of UCBs have met the required milestones as of March 2023, a need has arisen to ease the implementation challenges faced by other UCBs. It has, therefore, been decided to extend the timelines for achieving the targets by two more years up to March 2026. Further, UCBs which have met the targets as on March 31, 2023 shall be suitably incentivised.

Rationalisation of Licensing Framework for Authorised Persons (APs) under Foreign Exchange Management Act (FEMA), 1999

26. The licensing framework for Authorised Persons (APs) issued under FEMA was last reviewed in March 2006. Keeping in view the developments, including progressive liberalisation under FEMA, over the last several years and to effectively meet the emerging requirements of the rapidly growing Indian economy, it has been decided to rationalise and simplify the licensing framework for APs. This is expected to improve the efficiency in the delivery of foreign exchange facilities to various segments of users including common persons, tourists and businesses.

Expanding the Scope and Reach of e-RUPI Vouchers

27. At present, purpose-specific e-RUPI digital vouchers are issued by banks. It is now proposed to expand the scope and reach of e-RUPI vouchers by (i) permitting non-bank prepaid payment instruments (PPI) issuers to issue e-RUPI vouchers; (ii) enabling issuance of e-RUPI vouchers on behalf of individuals; and (iii) simplifying the process of issuance, redemption, etc. These measures will make the benefits of e-RUPI digital voucher accessible to a wider set of users and further deepen the penetration of digital payments in the country.

Streamlining the Bharat Bill Payment System (BBPS) Processes and Membership Criteria

28. The Bharat Bill Payment System (BBPS) is operational since August 2017. The scope of BBPS was further expanded in December 2022. To further enhance the efficiency of the BBPS system and to encourage greater participation, it is proposed to streamline the process flow of transactions and membership criteria for operating units.

Internationalising Issuance and Acceptance of RuPay Cards

29. RuPay Debit and Credit cards issued by banks in India are gaining increased acceptance abroad. It has now been decided to permit issuance of RuPay Prepaid Forex cards by banks. This will expand the payment options for Indians travelling abroad. Further, RuPay cards will be enabled for issuance in foreign jurisdictions. These measures will expand the reach and acceptance of RuPay cards globally.

Conclusion

30. We have made good progress in containing inflation, supporting growth and maintaining financial and external sector stability. Despite three years of global turmoil, India’s growth has bounced back and headline CPI inflation is easing. This confluence of factors gives us the confidence that our policies are on the right track. Nevertheless, we need to move towards our primary target of 4 per cent inflation. It is always the last leg of the journey which is the toughest. I wish to emphasise that we will do whatever is necessary to ensure that long-term inflation expectations remain firmly anchored. The best contribution of monetary policy to the economy’s ability to realise its potential is by ensuring price stability. The Reserve Bank will remain watchful and proactive in dealing with emerging risks to price and financial stability. Let me end by recalling the inspiring words of Mahatma Gandhi “… If we are determined, we shall find the way that leads us to our goal.”6

Thank you. Namaskar.

(Yogesh Dayal)

Chief General Manager

Press Release: 2023-2024/366

1 “India: A Story of Resilience” Inaugural Address by Governor, RBI at the Annual FIBAC 2022 Conference Organised Jointly by FICCI and IBA, Mumbai on November 2, 2022 (Paragraph 4).

2 Brewer D. (Edited); Quotes of Mahatma Gandhi, 2020.

3 Including absorptions under the standing deposit facility (SDF) and the variable rate reverse repo (VRRR) window.

4 Targeted long-term repo operations (TLTROs) amounting to about ₹61,000 crore.

5 The daily average MSF borrowing increased to ₹13,654 crore in April-May 2023 from an average of ₹5,716 crore in February-March 2023.

6 Young India, January 15, 1925.

*******

Date : Jun 08, 2023

Monetary Policy Statement, 2023-24 Resolution of the Monetary Policy Committee (MPC) June 6-8, 2023

On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (June 8, 2023) decided to:

- Keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.50 per cent.

The standing deposit facility (SDF) rate remains unchanged at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent.

- The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth.

The main considerations underlying the decision are set out in the statement below.

Assessment

Global Economy

2. In the second quarter of 2023, the global economy is sustaining the momentum gained in the preceding quarter in spite of still elevated though moderating inflation, tighter financial conditions, banking sector stress, and lingering geopolitical conflicts. Sovereign bond yields are trading sideways on expectations of the imminent peaking of the tightening cycle of monetary policy while the US dollar has appreciated. Equity markets have remained range bound since the last MPC meeting. For several emerging market economies (EMEs), weak external demand, elevated debt levels and geoeconomic disintegration amidst tighter external financial conditions pose risks to growth prospects, although capital flows are cautiously returning to them on renewed risk appetite.

Domestic Economy

3. According to the provisional estimates released by the National Statistical Office (NSO) on May 31, 2023, India’s real gross domestic product (GDP) growth accelerated from 4.5 per cent (year-on-year, y-o-y) in Q3:2022-23 to 6.1 per cent in Q4, supported by fixed investment and higher net exports. Real GDP growth for 2022-23 was placed at 7.2 per cent, higher than the second advance estimate of 7.0 per cent.

4. Domestic economic activity remains resilient in Q1:2023-24 as reflected in high frequency indicators. Purchasing managers’ indices (PMI) for manufacturing and services indicated sustained expansion, with the manufacturing PMI at a 31-month high in May and services PMI at a 13-year high in April-May. In the services sector, domestic air passenger traffic, e-way bills, toll collections and diesel consumption exhibited buoyancy in April-May, while railway freight and port traffic registered modest growth.

5. On the demand side, urban spending remains robust as reflected in indicators such as passenger vehicle sales and domestic air passenger traffic which recorded double digit growth in April. Rural demand is gradually improving though unevenly – motorcycle sales expanded in April, while tractor sales contracted partly owing to unseasonal rains. Investment activity is picking up as reflected in the healthy expansion in steel consumption and cement output in April. Merchandise exports and non-oil non-gold imports remained in contraction mode in April while services exports sustained a robust expansion.

6. CPI inflation fell sharply to 4.7 per cent in April 2023 from 6.4 per cent in February on the back of large favourable base effects, with softening observed across all the three major groups. Food group inflation eased, with moderation in cereals, eggs, milk, fruits, meat and fish, spices and prepared meals inflation and deepening of deflation in edible oils. In the fuel group, inflation in LPG and firewood and chips prices fell and kerosene prices slipped into deflation. Core inflation (i.e., CPI inflation excluding food and fuel) dipped, driven down by clothing and footwear, household goods and services, health, transport and communication, personal care and effects and recreation and amusement sub-groups.

7. The average daily absorption under the LAF increased to ₹1.7 lakh crore during April-May from ₹1.4 lakh crore in February-March. Money supply (M3) expanded by 10.1 per cent y-o-y and non-food bank credit by 15.6 per cent as on May 19, 2023. India’s foreign exchange reserves were placed at US$ 595.1 billion as on June 2, 2023.

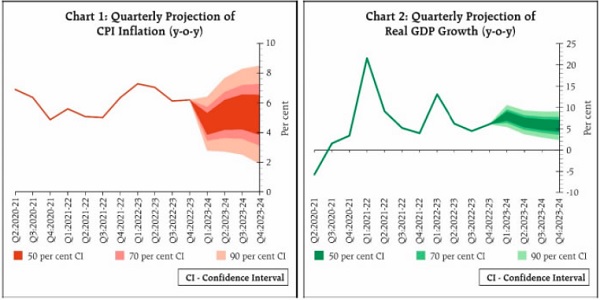

Outlook

8. Going forward, the headline inflation trajectory is likely to be shaped by food price dynamics. Wheat prices could see some correction on robust mandi arrivals and procurement. Milk prices, on the other hand, are likely to remain under pressure due to supply shortfalls and high fodder costs. The forecast of a normal south-west monsoon by the India Meteorological Department (IMD) augurs well for kharif crops; however, the spatial and temporal distribution of the monsoon would need to be closely monitored to assess the prospects for agricultural production. Crude oil prices have eased but the outlook remains uncertain. According to the early results from the Reserve Bank’s surveys, manufacturing, services and infrastructure firms polled expect input costs and output prices to harden. A clearer picture will emerge when the final survey results are available. Taking into account these factors and assuming a normal monsoon, CPI inflation is projected at 5.1 per cent for 2023-24, with Q1 at 4.6 per cent, Q2 at 5.2 per cent, Q3 at 5.4 per cent and Q4 at 5.2 per cent. The risks are evenly balanced (Chart 1).

9. The higher rabi crop production in 2022-23, the expected normal monsoon, and the sustained buoyancy in services should support private consumption and overall economic activity in the current year. The government’s thrust on capital expenditure, moderation in commodity prices and robust credit growth are expected to nurture investment activity. Weak external demand, geoeconomic fragmentation, and protracted geopolitical tensions, however, pose risks to the outlook. Taking all these factors into consideration, real GDP growth for 2023-24 is projected at 6.5 per cent with Q1 at 8.0 per cent, Q2 at 6.5 per cent, Q3 at 6.0 per cent, and Q4 at 5.7 per cent, with risks evenly balanced (Chart 2).

10. The MPC took note of the moderation in CPI headline inflation in March-April into the tolerance band, in line with projections, reflecting the combined impact of monetary tightening and supply augmenting measures. Headline inflation is projected to decline in 2023-24 from its level in 2022-23 but would still be above the target, warranting continuous vigil. The progress of the south west monsoon is critical in this regard. Domestic economic activity is holding up well. Consumer confidence is improving and businesses remain optimistic about the future. The cumulative rate hike of 250 basis points undertaken by the MPC is transmitting through the economy and its fuller impact should keep inflationary pressures contained in the coming months. Monetary policy would need to be carefully calibrated for alignment of inflation with the target. Against this backdrop, the MPC decided to keep the policy repo rate unchanged at 6.50 per cent. The MPC resolved to continue keeping a close vigil on the evolving inflation and growth outlook. It will take further monetary actions promptly and appropriately as required to keep inflation expectations firmly anchored and to bring down inflation to the target. The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth.

11. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted to keep the policy repo rate unchanged at 6.50 per cent.

12. Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth. Prof. Jayanth R. Varma expressed reservations on this part of the resolution.

13. The minutes of the MPC’s meeting will be published on June 22, 2023.

14. The next meeting of the MPC is scheduled during August 8-10, 2023.

(Yogesh Dayal)

Chief General Manager

Press Release: 2023-2024/364

*******

Date : Jun 08, 2023

Statement on Developmental and Regulatory Policies

This Statement sets out various developmental and regulatory policy measures relating to (i) Financial Markets; (ii) Regulation; and (iii) Payment Systems.

I. Financial Markets

1. Borrowing in Call and Notice Money Markets by Scheduled Commercial Banks

The extant guidelines on the Call, Notice and Term Money Markets prescribe prudential limits for outstanding borrowing in Call and Notice Money Markets for Scheduled Commercial Banks. With a view to providing greater flexibility for managing the money market borrowings, it has been decided that Scheduled Commercial Banks (excluding Small Finance Banks) can set their own limits for borrowing in Call and Notice Money Markets within the prudential limits for inter-bank liabilities prescribed by the Reserve Bank of India. Necessary directions are being issued today.

II. Regulation

2. Widening of the Scope of Prudential Framework for Stressed Assets

The Prudential Framework for Resolution of Stressed Assets dated June 7, 2019 provides a broad principle-based framework. With a view to provide further impetus to the same, as well as to harmonise the instructions across all regulated entities, it is proposed to (i) issue a comprehensive regulatory framework governing compromise settlements and technical write-offs covering all regulated entities; and (ii) rationalise the extant prudential norms for implementation of resolution plans in respect of exposures affected by natural calamities, drawing upon the lessons from the resolution frameworks introduced during the Covid19 pandemic. Detailed guidelines on the above will be issued separately.

3. Default Loss Guarantee Arrangement in Digital Lending

While issuing the Press Release dated August 10, 2022 on Implementation of the Recommendations of the Working group on Digital Lending, it was stated that the recommendation pertaining to First Loss Default Guarantee (FLDG) is under examination with the Reserve Bank. Based on extensive consultations with various stakeholders, and in tune with our objective of maintaining a balance between innovation and prudent risk management, it has been decided to put in place a regulatory framework for permitting Default Loss Guarantee arrangements in Digital Lending. Detailed guidelines on the matter will be issued separately.

4. Priority Sector Lending (PSL) Targets for Primary (Urban) Cooperative Banks (UCBs)

The PSL targets for UCBs were revised in 2020. In order to ensure a non-disruptive transition, a glide path was provided till March 31, 2024 to achieve the revised targets. With a view to ease the implementation challenges faced by the UCBs, it has been decided to extend the phase-in time for achievement of the said targets by two years, i.e. upto March 31, 2026. Further, suitable incentives shall be provided to UCBs that have met the prescribed targets as on March 31, 2023. Detailed circular on the matter will be issued separately.

5. Rationalisation of Licensing framework for Authorised Persons (Aps) under Foreign Exchange Management Act (FEMA), 1999

The Licensing framework for Authorised Persons (APs) issued under FEMA, 1999 was last reviewed in March 2006. Keeping in view the progressive liberalisation under FEMA, increasing integration of the Indian economy with the global economy, digitisation of payment systems, evolving institutional structure, etc. over the last two decades, it has been decided to rationalise and simplify the licensing framework for APs to effectively meet the emerging requirements of the rapidly growing Indian economy. The objective is to achieve operational efficiency in the delivery of foreign exchange facilities to common persons, tourists and businesses, while maintaining appropriate safeguards. A draft of the revised authorisation framework would be issued for public feedback.

III. Payments Systems

6. Expanding the Scope and Reach of e-RUPI vouchers

The e-RUPI, a digital voucher launched in August 2021, rides on the Unified Payments Interface (UPI) system of National Payments Corporation of India (NPCI). At present, purpose-specific vouchers are issued by banks on behalf of Central and State Governments and to a limited extent on behalf of corporates. Keeping in view the benefits for users and beneficiaries alike, it is proposed to expand the scope and reach of e-RUPI vouchers by (a) permitting non-bank Prepaid Payment Instrument (PPI) issuers to issue e-RUPI vouchers and (b) enabling issuance of e-RUPI vouchers on behalf of individuals. Other aspects like reloading of vouchers, authentication process, issuance limits, etc., will also be modified to facilitate use of e-RUPI vouchers. Separate instructions will be issued shortly.

7. Streamlining Bharat Bill Payment System processes and membership criteria

Bharat Bill Payment System (BBPS) is an ‘anytime anywhere’ bill payments platform which is operational since August 2017. Currently, BBPS has onboarded over 20,500 billers and processes over 9.8 crore transactions every month. The scope of BBPS was further expanded in December 2022 to include all categories of payments and collections, both recurring and non-recurring in nature, as well as facilitating in-bound cross-border bill payments. To enhance efficiency of the system and also to encourage greater participation, the process flow of transactions and membership criteria for onboarding operating units in BBPS will be streamlined. Revised guidelines will be issued shortly.

8. Internationalising Issuance and Acceptance of RuPay Cards

RuPay Debit and Credit cards issued by banks in India have gained international acceptance through bilateral arrangements with international partners and co-badging arrangements with international card schemes. In order to expand payment options for Indians travelling abroad, it has been decided to allow issuance of RuPay Prepaid Forex cards by banks in India for use at ATMs, PoS machines and online merchants overseas. Further, RuPay Debit, Credit, and Prepaid Cards will be enabled for issuance in foreign jurisdictions, which can be used internationally, including in India. These measures will expand the reach and acceptance of RuPay cards globally. Necessary instructions will be issued separately.

(Yogesh Dayal)

Chief General Manager

Press Release: 2023-2024/365