Page Contents

Form 10E FAQs

Q.1 What is Form 10E?

Ans. In case of receipt in arrears or advance of any sum in the nature of salary, relief u/s 89 can be claimed. In order to claim such relief, the assessee has to file Form 10E. The Form must be filed before filing the Return of Income.

Q.2 Do I need to download and submit Form 10E?

Ans. No, there is no need to download Form 10E as the submission can be done online after log in to e-Filing portal.

Q.3 When should I file Form 10E?

Ans. Form 10E has to be filed before filing your Income Tax Return.

Q.4 Is Form 10E mandatory to file?

Ans. Yes, it is mandatory to file Form 10E if you want to claim a tax relief on your arrear / advance income.

Q. 5 What will happen if I fail to file Form 10E but claim relief u/s 89 in my ITR?

Ans. If you fail to Form 10E but claim relief u/s 89 in your ITR, your ITR will be processed but the relief claimed u/s 89 will not be allowed.

Q. 6 How do I know that ITD has disallowed the relief claimed by me in my ITR?

Ans. In case the relief claimed by you u/s 89 is disallowed, the same shall be communicated by the ITD through an intimation u/s 143(1) after the processing your ITR is complete.

Form 10E User Manual

1. Overview

The total Income Tax liability is calculated on the total income earned during a particular Financial Year. However, if the income for the particular Financial Year includes an advance or arrear payment in the nature of salary, the Income Tax Act allows relief (u/s 89) for the additional burden of the tax liability. Form 10E needs to be filed to claim such a relief.

Form 10E can be submitted through online mode only.

2. Prerequisites for availing this service

- Registered user on the e-Filing portal with valid user ID and password

3. About the Form

3.1 Purpose

The Income Tax Act u/s 89 provides relief to an assesse for any salary or profit in lieu of salary or family pension received by an assesse in advance or arrears in a Financial Year. This relief is granted as the total income assessed is at a rate higher than that at which it would otherwise have been assessed. Such relief can be claimed by furnishing particulars of your income in Form 10E.

3.2 Who can use it?

All registered users, being an Individual, on the e-Filing portal can furnish particulars of their income in Form 10E for claiming relief as per Section 89 of Income Tax Act, 1961.

4. Form at a Glance

Form 10E has seven parts:

1. Personal Information- PAN and Contact Details

2. Annexure I (Arrears) – Salary / Family Pension received in arrears

3. Annexure I (Advance) – Salary / Family Pension received in advance

4. Annexure II & IIA (Gratuity) – Payment in nature of Gratuity in respect of past services

5. Annexure III (Compensation) – Payment in nature of compensation from the employer or previous employer at or in connection with termination of employment after continuous service of not more than 3 years or where the unexpired portion of term of employment is also not less than 3 years.

6. Annexure IV (Pension) – Payment in commutation of pension

7. Declaration

Based on the nature of amount received, appropriate annexure needs to be selected while filing Form 10E.

4.1 Personal Information

This part contains the required basic contact details to be furnished.

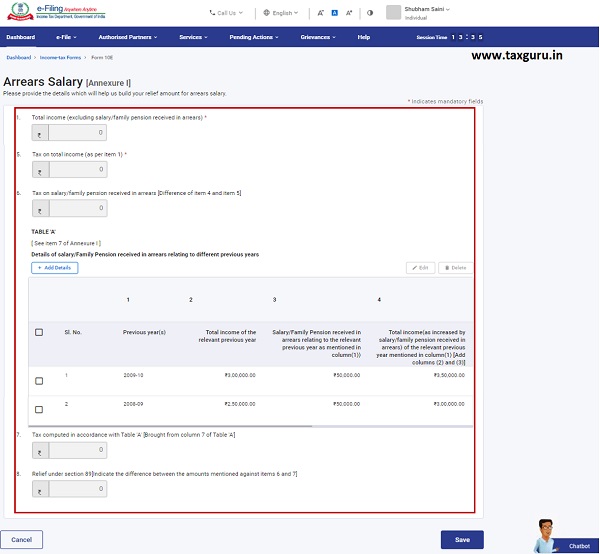

4.2 Annexure I (Arrears)

This part contains general details of salary / Family Pension received in arrears.

4.3 Annexure I (Advance)

This part contains general details of Salary / Family Pension received in advance.

4.4 Annexure II & IIA (Gratuity)

This part contains general details of payment in nature of Gratuity in respect of past services.

4.5 Annexure III (Compensation)

This part contains general details of payment in nature of compensation from the employer or previous employer at or in connection with termination of employment after continuous service of not more than 3 years or where the unexpired portion of term of employment is also not less than 3 years.

4.6 Annexure IV (Pension)

This part contains general details of payment in commutation of pension.

4.7 Declaration

This part contains the declaration required to be provided by the taxpayer.

5. How to Access and Submit

You can fill and submit Form 10E through the following method:

- Online Mode – through e-Filing Portal

Follow the below steps to fill and submit Form 10E through online mode.

5.1. Submitting Form 10E (Online Mode)

Step 1: Log in to the e-Filing portal using your user ID and password.

Step 2: On your Dashboard, click e-File > Income tax forms > File Income Tax Forms.

Step 3: On the File Income Tax Forms page, select Form 10E. Alternatively, enter Form 10E in the search box to file the form.

Step 4: Choose the Assessment Year (A.Y.) and click Continue.

Step 5: On the Instructions page, click Let’s Get Started.

Step 6: Choose the required sections to be filled and click Continue.

Step 7: Once all the details are filled, click Preview.

Step 8: On the Preview page, click Proceed to e-Verify.

Step 9: You will be taken to the e-Verify page.

Note: Refer to the user manual on How to e-Verify to learn more.

After successful e-Verification, a success message is displayed along with a Transaction ID and Acknowledgement Receipt Number. Please keep note of the Transaction ID and Acknowledgement Receipt Number for future reference. An email confirming successful submission of your form is sent to the email ID and mobile number registered with the e-Filing portal.

i have got an arrear for 2022-23 FY in the year 2023-24

Now i want to submit my 10E through online but the AY 2024-25 is not shown in the portal. pl guide me

AY 2022- 23 I filed itr 1 without attaching form 10E. As per 143(1) it is disallowed. Sir, is it permitted to file now? Whether through rectification or revise filing, please advise.

I filed the Form 10E while filing the IT return for AY2021-22. However, I received the Intimation u/s 143(1) indicating the demand and found that Tax relief u/s 89 was not computed. I checked the Form 10E and found that it is still under draft mode and was not submitted properly during filing IT return. What shall I do now?

can you please tell me what did you do with this? I am facing the same issue

if claim of 89(1) relief is disallowed due to non submission of form 10 E what recourse is available to assessee

When A Y 2002-23 FROM 10E IS COME

I filled the Form 10 E.All works completed.When it comes to e verifying, all modes of e verifications are not applicable. ITR V used to sent to Bangalore.

I cannot e verify Form 10 E .What can I do?

Hi George, got any solution to submit 10E?

What is the remedy if I forget to verify Form 10E.

While submitting form 10 e getting an error form data has some errors please fix it.please guide me how to solve

I filed 10E before filing my ITR-I during Assessment Year 2019-20 same was e verified & down loaded ,refund was processed & credited .But in New portal one form filled i.e 10E but same was shown as status not verified.Is there any fault in system or being rectification . Secondly form 10E is not downloaded yet there was internal error in system.Kindly advice.

I have also been facing similar problem. While final submission, it says form has errors. I think there is technical errors in the web sites itself which need to be rectified.