Penalty provisions under Section 270A of the Income Tax Act, 1961, play a crucial role in ensuring tax compliance. It’s essential for taxpayers to comprehend these provisions to avoid penalties for underreporting or misreporting of income.

Section 270A: Penalty for under reporting misreporting of income

Under section 270A, of the Income Tax Act, 1961 show cause notices can be issued to the Assessee directing him to pay a penalty in addition to tax in case of Under or Misreporting of income. Therefore, it has become important to understand in what cases section 270 A comes into picture.

As per section 270A, an assessing officer (AO), a commissioner (appeals), a principal commissioner, or a commissioner may direct a person to pay a penalty in following cases:

- If he has underreported his income.

or

- If he has misreported his income

Some of the examples of circumstances wherein under reporting of income can occur:

- The income assessed is greater than the income determined in the return;

- The income assessed or reassessed has the effect of reducing the loss or converting such loss into income;

- The income reassessed is greater than the income assessed or reassessed immediately before such reassessment.

Some of the examples of circumstances wherein misreporting of income can occur:

- Misrepresentation or suppression of facts;

- Claim of expenditure not substantiated by any evidence;

- Failure to record any receipt in books of account having a bearing on total income

Amount of penalty:

- In case of underreporting :- 50 % of tax on underreported income

- In case of misreporting:- Penalty can be up to 200% of the tax on unreported income

In order to safeguard oneself against the harsh and overbearing penalty u/s 270A, Income Tax Act introduced Section 270AA w.e.f. A.Y. 2017-18

270 AA: An option to the taxpayers to seek immunity from penalty u/s 270A.

Finance Act, 2016 has inserted section 270AA to provide immunity from imposition of penalty u/s 270A if:

> The tax and the and the interest payable as per the assessment or the reassessment order is paid within the period specified in the notice of demand.

And

> No appeal has been filed against the assessment or the reassessment order.

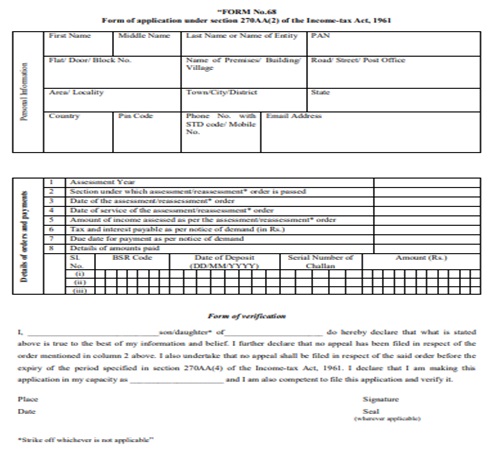

To avail this benefit, an application has to be filed in Form 68 within one month from the end of the month in which assessment order is received by assessee.

Takeaway-

A. Considering the above, in case where any disallowance or additions have been made which falls under the category of under or misreporting of income and the Assessee agrees to the additions /disallowances made: Opt for submission of form 68.

B. Even if a small percentage of demand is disputed (not acceptable by the Assessee), it is advisable to pay tax and interest on the same and opt to file form 68 within due date to seek immunity from penal provisions.

Important note:

These provisions are applicable from assessment year 2017-18 only and not applicable to earlier assessment years.

Conclusion: Understanding the provisions of Section 270A and utilizing the immunity provided by Section 270AA is crucial for taxpayers to avoid hefty penalties. By promptly paying assessed taxes and interest and refraining from appealing against assessment orders, taxpayers can safeguard themselves from penal provisions. It’s imperative for taxpayers to stay compliant with tax regulations and take necessary actions to mitigate risks associated with penalties.

*****

Disclaimer : The information in this article is true and complete to the best of our knowledge. All suggestions/opinion are made without any guarantee on the part of author. The author disclaims any liability in connection with the use of these suggestions/opinions.

Author CA Pardeep Tayal | ptcppt@gmail.com

Co Author:- Ms. Shruti Banga