“Facing issues with ITR filing? Explore FAQs on ITR-2 Capital Gain Schedule for FY 2022-23. Learn how to report securities & mutual funds sale, find total sale value, and compute Short-Term Capital Gain Tax. Get insights on reporting long-term capital gains, dealing with losses, and resolving errors. For expert guidance.”

The deadline to file ITR by an individual for FY 2022-23 is 31st July 2023. Taxpayers are facing issues while filing their Income Tax Returns. The maximum error while validating ITR is due to incomplete/incorrect entries in Schedule CG (Capital Gain) of ITR 2. In this article, an attempt has been made to discuss frequently asked questions and their solution related to the Capital Gain Schedule of ITR 2

Q 1. Annual Information Statement (AIS) is showing the sale of securities & mutual funds. Do these need to be reported in ITR? If yes, which ITR is to be filed and what is the process to report such transactions?

Ans. The sale of securities reflecting in AIS needs to be reported in ITR 2.

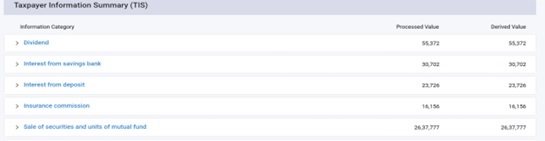

Q2. How to find the total sale value of securities and mutual funds, reflected in AIS

Ans. Log in to the income tax portal: www.incometax.gov.in. Click on AIS (Annual Information Statement)]

Q3. How to check the details of Capital Gain on the Sale of Security?

Ans. All the details of securities sold such as type of security, Long Term / Short Term, Purchase Consideration, Date of sale, Number of Units, etc. will be displayed, once you click on “Sale of securities and units of mutual fund”. However, it is advisable to cross-check these details with the Demat statement.

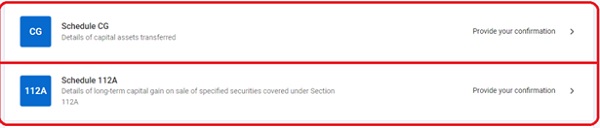

Q4. Where to Report Capital Gain on Sale of Securities in ITR?

Ans. The long-term capital gains from equity-oriented mutual funds need to be reported in ‘Schedule 112A’

Q5. Whether gains or losses arising from such transactions under capital gains shall be reported separately or in aggregate.

Ans. The Income Tax Department has clarified that the scrip-wise details in the return of income are required to be filled up only to report the long-term capital gains for these shares that are eligible for the benefit of grandfathering, i.e., shares acquired on or before 31-01-2018.

Q6. How to compute Short-Term Capital Gain Tax on Securities?

Ans. Short-term capital gains arising from the sale of equity-oriented mutual fund units are taxable at the special rate of 15%. Subtract the purchase value of mutual funds from the sale value.

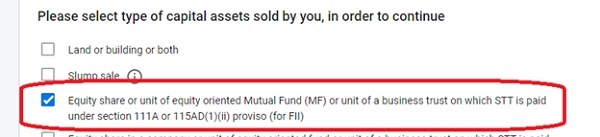

Q7. Where to Report Short-Term Capital Gain Tax in ITR?

Ans. The reporting of short-term capital gains on a unit of equity-oriented Mutual funds on which securities transaction tax (STT) is paid is to be made under section 111A. The details need to be filled in ‘Schedule CG. Select the type of Capital assets sold.

Q8. How to enter quarterly details of Capital gain if there is a loss in some quarters?

Ans. Click on Schedule Capital Gain> Table F (Information about accrual/receipt of Capital Gain). Net Capital Gain after adjusting losses is required to be reported in any of the quarters. In case, there is a net loss of Capital Gain, nothing is to be entered in this table.

Q9. Where to report a capital gain on the sale of a debt-based mutual fund?

Ans Capital Gain on a debt-based mutual fund is to be reported in table ‘Sale of Assets other than all the above-listed items’ in Schedule Capital Gain.

Q10. How to resolve the error: – In Schedule CG, Table F Sl. No. 5 the breakup of all the quarters is not equal to the value from item 3vii of Schedule BFLA”?

Ans: Let us try to understand with the help of an Illustration.

Illustration The transaction details of Mr. Anupam in the year 2022-23 are as indicated below:

| (a) | Long-Term Capital Gain on Sale of Equities | 2,70,000 |

| (b) | Short Term Capital Loss from mutual funds | (35,000) |

| (d) | Income from Interest & Deposits | 3,65,000 |

| (e) | Brought Forward Losses from FY 2021-22 | 1,00,000 |

(a) After entering the details in relevant schedules such as Schedule CG, Income from other Sources, click on confirm the Schedules BFLA, CYLA & CFL. These schedules will report the transactions in the following manner:

(b) Schedule CYLA( Current Year Loss Adjustment)

| Sl. | Income of Current Year | House property losses | Business losses of the current year | Other Sources ( Losses of the current year | The current year remaining after setting off |

| 1 | 2 | 3 | 4 | 5 | |

| (xi) | LTCG @ 10% | 2,35,000 | 0 | 0 | 2,35,000 |

| (xiv) | Net Income from Other Sources | 3,65,000 | 0 | 0 | 3,65,000 |

| Note : Net LTCGof Rs 2,35,000 is after setting off STCL of Rs 35000/- | |||||

(c) Schedule BFLA

| Sl. | Head of Income | Income after setting of current years losses ( as per 5 of schedule CYLA) | Brought forward losses set off | Current Year Income after setting off |

| 1 | 2 | 3 | 5 | |

| (x) | LTCG @ 10& | 2,35,000 | 1,00,000 | 1,35,000 |

(d) Enter the amount in Schedule Capital Gain – Table F, Sl No. 5 –

| Sl | Type of Capital Gain | Upto 15 Jun | 16 Jun- 15 Sep | 16 Sep -15 Dec | 16 Dec – 15 Mar | 16 Mar-31 Mar |

| 5 | LTCG @ 10% | 1,35,000 | ||||

| The amount can be entered in any of the quarters above | ||||||

(e) The amount will be matched and there will not be any error in validation of the return.

Disclaimer: The article is for educational purposes only

The author can be approached at caanitabhadra@gmai.com

I am not been able to claim deductions in CD under Section 54 F against the new House property. It is showing the following error.

Deduction u/s. 54F claimed here (Table D) should match with the total of deduction(s) claimed in the respective asset.

Please advise

Make sure that the amount of deduction claimed is entered in Table D is the sum total of amount claimed in Schedule CG .

Still , if you are facing the issue , feel free to share the details on whats app : 9892815780.

I will certainly help you out.

Shedule CG capital gain has to be filled with quarterly wise gain but the period which is mentioned there is different from the normal one. Normally Q1 is from April 1 to June 30 and Q2 from July 1 to Sep 30 so on, But there it is mentioned that Q1 upto June 15 and Q2 from June 16 to September 15 so on. Which one should I consider becaue based on the period, total tax liability gets changed

Enter the details as per portal. Tax liability will not be effected .

Very helpful!! Thanks for sharing.

In Schedule CG, Table F Sl. No. 5 the breakup of all the quarters is not equal to the value from item 3vii of schedule BFLA

The validation is successful, however at the time of verification the above error is coming and it says to rectify the error you click on hyperlink. I am unable to see the hyperlink as well.

Raised a grievance, asked to send a mail to webmaster…, done the same, still no response since 10 th july and today i tried it all again, still the same error. i tried in Microsoft edge and also in Google chrome browser.

Same problem I faced. No solution . Income Tax dept, Tweet me – “may we request you to write to us with your details (along with PAN & mobile number) at orm@cpc.incometax.gov.in. Our team will look into it.”

Do not click on hyperlink

Log out & log in again.

Make sure that amount indicated in BFLA ( after adjustment of losses) are entered in correct row in Table 5.

Still facing this issue , share the details – caanitabhadra@gmail.com

Thanks for your help. I was able to upload the return.

Do not click on hyperlink.

Log out & log in again.Make sure only Capital Gains ( not losses) are entered in correct row in schedule BFLA and the same amount ( This amount is after setting off losses).

Still you face the same issue- share the details -caanitabhadra@gmail.com

I have one more question pls, being a salaried person and also

there is a business running in a PAN account of around 1 lakh purchase and the sales for the same is 1.25 lakh monthly. GST is filed everu month.

And the tax of 10,000 is deducted from salary.

which form should be selected now to file the returns from salary?

File ITR 3.

You can also opt for ITR 4 ( presumptive taxation) subject to conditions , pros& cons of opting presumptive scheme.

I am getting below error while submitting the ITR2

In Schedule CG, Table F Sl. No. 5 the breakup of all the quarters is not equal to the value from item 3vii of schedule BFLA

Refer Q 10 in the article above.

The error & solution is explained in detail.

Still facing problem- share details thru email- caanitabhadra@gmail.com

Madam, how to report the short term capital loss ? Under CFL tab, the current year is disabled. How to report the current year (assessment year 2023-24) STCL SHORT TERM CAPITAL LOSS in order to offset it in future?

It is not disabled.

Click on Add details , enter the sale consideration,cost of acquisition etc. and save.

It will automatically calculate profit/ loss

As per the information available with the Department and the pre-filled JSON, you have derived income from ‘Rental income from machinery, plants, buildings etc., Thus, please select ITR 2 or 3 as applicable.” (Kindly check your statement available in AIS for details.).

As per the information available with the Department and the pre-filled JSON, you have derived income from ‘Winning from lotteries, crossword puzzles, racehorses etc., Thus, please select ITR 2 or 3 as applicable.” (Kindly check your statement available in AIS for details.)

1. I used to file ITR-1 till last year.

2. i m getting above message now.

3.downloaded AIS and it shows the car purchased and the interest of RS.4300 from bank savings account.

should i user ITR 1 or 2 or 3?

Thanks in advance!

If you have interest from saving bank account & purchase car & no other income such as rent from machinery , winning etc ,you can file ITR 1

Thank u mam for your time!

I am also getting same error “As per the information available with the Department and the pre-filled JSON, you have derived income from ‘Winning from lotteries, crossword puzzles, racehorses etc., Thus, please select ITR 2 or 3 as applicable.” (Kindly check your statement available in AIS for details.)”

There is a transaction of some amount winning from Dream11 in my account. Should I fill ITR2 or 3 in this case. If yes, which one should I fill.

File ITR 2 if you do not have any other income from Business.

Hello Author, very helpful article. However, adding Debt Mutual Fund details in “Sale of Assets other than all the above listed items” still is taxed at 10% for LTCG instead of 20% (verified by visiting Schedule Special Income section in ITR2). Can you please check this and update the article if needed. Thanks.

I am having income from sale of Listed Debentures (Asset type- Long Term). In which schedule of ITR2, it should be entered. I think this should be taxed @10%. But when I enter it in the schedule “Bond and Debenture), tax is deducted @20%

In my view, enter the details in 6th Row in Schedule CG : From sale of listed securities

Dear Ma’am,

I have LTCL from sale of land and building but my share in it is only 25% .While filling details in return online in ITR2 I am not able to show my share because there i am asked to declare full value of consideration etc.,

How should I fill details of my share of LTCL?

Enter 25% of full consideration & cost of acquisition.

Madam

I sold my flat on 24/12/2022, purchased flat on 07/03/2022

Sale deed is not done. Can I take exemption from capital gain

Madam, Your explanation with example helped me to get clarified with regard to Schedule CG. Thank you.

Thank you Sir

Glad that it is helpful for you .

IF OTHER INCOME IS 650000 , LTCG U/S 112A ARE 91000 AND DEDUCTION UNDER VI A IS 165000 THEN WILL TAX LIABILITY ARISE AND IF YES HOW MUCH

Yes, The Tax Liability will be o Rs 11750 +470= 12220.

Tax will be on Rs 4,85,000 (650000-165000= 485000) .

You will not be eligible for Rebate u/s 87A as total income for the purpose include 91000 of Capital Gain also.

THANKS FOR THE HELP

Hello Sir/Madam, I am getting the following error when I am trying to submit my return for AY 2023-24:

In Schedule 112A, Total is not equal to the sum of individual rows

I had uploaded the csv file and then clicked on each entry to check where the error is. I am still not able to find a solution since the Total is automatically calculated. Please assist.

Please make sure that all the schedules i.e., CYLA, CFLA & SI are confirmed and the net amount in Schedule BFLA is entered in Sl. 5 of Table F in Schedule Capital Gain.

If still not happening , share the details at caanitabhadra@gmail.com.

Hello madam, I followed the steps that you mentioned but the error is still persisting.

I am thinking it might be a technical/system error, so have raised a grievance with the IT help-desk. I will keep you updated once I get a resolution from their end. In case I don’t get a reply, will send you the details.

Thank you very much for responding to my comment.

O.K.

Feel free for any further clarification.

Hi Madam, I didn’t get any proper assistance from the IT help-desk, but I was able to resolve this error by reducing the number of rows in schedule 112A (by consolidating some of the transactions). In case someone is facing this same issue, hope this solution will be useful.

Thanks again for the guidance. Will reach out in future for any queries.

Madam, I incurred Capital Losses during AY 2018-19, 19-20 and 20-21. I could only partially set off them during AY 20-21. During AY 21-22, I forgot to set them off though I had Capital gains. Can I now set those losses in the AY 22-23?

There is lot of discrepancies in amounts between AIS,.26AS and pass book entries. When we report data in AIS as not correct ,no reply is coming from the company. We cannot wait indefinitely till reply is received.

Do not wait for AIS to respond. Enter the correct amount as per records available with you.

In case, the previous year losses are reflecting in Schedule BFLA (Brought Forward Loss Adjustments), then only it will be set off against current year gain. There is no other way to set off losses of previous years .

i have purchased foreign exchange for a small amt to remit for educational purpose of my close relative. minor bank charges collected. for me itr 1 is applicable. should i show transaction in itr 1 and where to show.

In my view, small amount of foreign remittance & bank charges thereof need not be reported in ITR .

I invested 20K in crypto through the Coincdx app. I buy and sell many time with day my transaction count is around 3000 for FY. Overall I lost 20 k also. In AIS it showing 1,20,00,000 amount. But no gain also decucted 1% tds on every sell even though less profit of 10 to 20 INR, TDS applied in insted =profit, ex: profit in 200 rs on 20000 but tds decuted on 20200. How to fill ITR with this many tracasaction

Brief description is good.Can I ask any query more

Sure,

Feel free to ask any number of queries.

Brief is good with crisp commentary. Helpful

Thank you sir. Glad that it is helpful.