Budget 2020 introduced a new personal income tax regime for individual taxpayers. However, the option for this concessional tax regime came with a cost, it required the taxpayer to forego certain specified deductions.The new lower income tax rates offered in the Budget 2020-21 will leave more cash in the hands of those who do not wish to make compulsory investments to save tax.

These deduction are as follows:

(a)

(i) Clause (5) – Leave travel concession;

(ii) Clause (13A) – House rent allowance;

(iii) Clause (14) – Special allowance detailed in Rule 2BB (such as children education allowance, hostel allowance, transport allowance, per diem allowance, uniform allowance, etc.);

(iv) Clause (17) – Allowances to MPs/MLAs;

(v) Clause (32) – Allowance for clubbing of income of minor;

(b) Exemption for SEZ unit under section 10AA;

(c) Standard deduction, deduction for entertainment allowance and employment / professional tax as contained in Section 16;

(d) Interest under section 24 in respect of self-occupied or vacant property (loss under the head IFHP for rented house shall not be allowed to be set off under any other head and would be allowed to be c/f as per extant law);

(e) Additional depreciation under section 32(1)(iia);

(f) Deductions under sections 32AD, 33AB and 33ABA;

(g) Various deductions for donation or expenditure on scientific research contained in in sub-clause (ii) or sub-clause (iia) or sub-clause (iii), of sub-section (1) or sub-section (2AA) of section 35;

(h) Deduction under section 35AD or 35CCC;

(i) Deduction from family pension under clause (iia) of section 57. and Most importantly

(J) All Chapter VI deduction available Under Old scheme (except deduction under sub-section (2) of section 80CCD (employer contribution on account of employee in NPS) and section 80JJAA (for new employment).

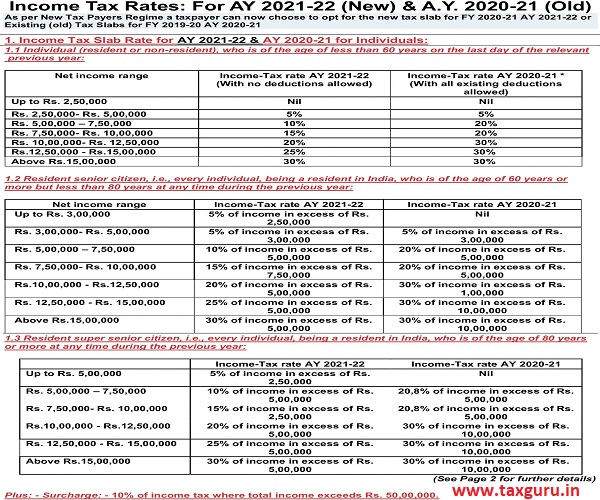

Income tax Rates for AY 2021-22 (New) and A. Y. 2020-21 (old)