CA Ahmad Faraz*

About the Article

The Author has aimed to summarise the provisions of Gratuity Fund and accounting thereof as contained in:

- Payment of Gratuity Act, 1972

- Income Tax Act, 1961

- Accounting Standard 15 – Employee Benefits

- Indian Accounting Standard 19 – Employee Benefits

Brief introduction:

Gratuity is a lumpsum amount paid by an employer to its employees at the time of their retirement, superannuation or death. It is a way by which an employer expresses its thankfulness to its employees for remaining in continuous service.

Etymologically, gratuity, a word derived from gratitude, is a reward given voluntarily. However, in India, due to the enactment of Payment of Gratuity Act, 1972 (the Gratuity Act), it has become a statutory liability to be paid by all organisations covered under the Gratuity Act.

The Gratuity Act, inter alia, specifies:

(i) “Employees” eligible for receiving Gratuity [Sec 2(e)].

(ii) the method for computing the gratuity amount [Sec. 4(2)].

(iii) the time when gratuity becomes payable [Sec. 4(1)].

(iv) the maximum amount which can be paid under the Act [Sec 4(3)].

The Gratuity Act further states the manner in which the gratuity liability of an organisation should be provided for. Under section 4A of the Gratuity Act, the following methods have been prescribed:

(i) Obtain a Gratuity Insurance from Life Insurance Corporation of India [Sec. 4A(1)]

(ii) Establish an Approved Gratuity Fund and contribute periodically [Sec. 4A(2)]

Section 4A has only been notified in the State of Andhra Pradesh and remains unnotified for rest of India. It is, therefore, clarified that an organisation may opt for neither purchasing a Gratuity Insurance nor establishing an Approved Gratuity Fund. It may simply create Provision for Gratuity in its books of accounts. However, this does not affect the employer’s liability to pay Gratuity when it becomes payable.

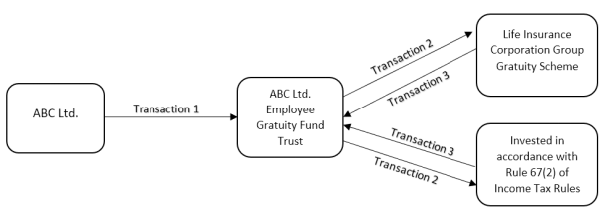

Example: ABC Ltd. is a public limited company incorporated under Companies Act 2013. It is desirous of setting aside funds on a periodic basis to meet gratuity liabilities under Payment of Gratuity Act, 1972. It has following 3 options:

Option 1: Purchase a Gratuity Insurance from LIC.

Option 2: Establish a gratuity fund, get it approved under provisions of Income Tax Act and contribute to it on a periodic basis. This fund invests the contribution in accordance with the conditions laid down in the Income Tax Act, 1961.

Option 3: Neither opt for Gratuity Insurance nor establish Approved Fund. Simply create a Provision for Gratuity in its books of accounts.

Kindly note: It is advised that Actuarial Valuation Report be obtained from an Independent Actuary under all options [para 49 of AS 15]. The Report will calculate the closing value of defined benefit obligation and fair value of planned assets. It also states the amount to be recognised in financial statements as per Accounting Standard 15 or Indian Accounting Standard 19.

For the purpose of this article, only the option of establishing and contributing to Approved Gratuity Fund has been analysed.

Analysis of Option 2: Establish a Gratuity Trust and get approval.

Section 2(5) of the Income Tax Act, 1961 defines an approved gratuity fund as a gratuity fund which has been and continues to be approved by the Principal Chief Commissioner or Chief Commissioner or Principal Commissioner or Commissioner in accordance with the rules contained in Part C of the Fourth Schedule.

Under this option, ABC Ltd. (the Employer) is required to:

1. Establish “ABC Ltd. Employee Gratuity Fund Trust (the Trust)”exclusively for meeting the Gratuity liability of its employees by executing a duly registered Trust Deed. The Trust should be an irrevocable trust.

2. Appoint atleast two Trustees. A Company can be appointed as a Trustee only on approval of Chief Commissioner or Commissioner.

3. Make all employees member/beneficiary of the Trust. Not less than 90% of the employees should be employed in India. A director may be admitted as a member/beneficiary of the Trust only if he is a Whole Time Director or Managing Director and does not hold shares in the Company carrying more than 5% of the total voting power.

4. Make an application to the Income Tax Authority appointed for granting approval. The form for application is specified in Rule 109 of Part C of Fourth Schedule to Income Tax Act, 1961. This application has to be made in the name of the Trust.

5. Start contributing to the Trust once approval has been granted in writing.

6. In case the approval has been refused, an appeal may be made to CBDT in Form 44.

An approved gratuity fund has been accorded a separate legal entity under the Income Tax Act. This would imply that:

1. The trust must have its own PAN card.

2. The trust must have a separate bank account preferably with a scheduled bank (See rule 101 of Income Tax Rules, 1962).

3. The trust must maintain its own books of accounts (see rule 109(1)(c) of Income Tax Rules, 1962).

Since an approved gratuity fund is a private discretionary trust, it would be assessable as an AOP for Income Tax purpose – Clause (iv) of first proviso to section 164(1).

Taxability of Transaction 1:

- In hands of ABC Ltd. – This is a contribution by an employer to an Approved Gratuity Fund for exclusive benefit of its employees and is an allowable deduction u/s 36(1)(v) of Income Tax Act, 1961.

- In hands of ABC Ltd. Employee Gratuity Fund Trust – The contribution by employer must be received by the trustees on behalf the Trust in a separate bank account. This is a capital receipt in the hands of the Trust and not liable to tax. For the sake of argument, even if it held as revenue in nature, this income will be exempt from tax u/s 10(25)(iv).

Taxability of Transaction 2:

As per Rule 101 of Income Tax Rules, 1962, the trustees have the following options:

(i) Keep the contribution in the bank account opened with Scheduled Bank.

(ii) Invests the contribution on behalf of the Trust in LIC Group Gratuity Scheme

(iii) Invest the contribution in manner specified under Rule 67(2) of Income Tax Rules.

No taxability arises in any of the above-mentioned investments.

Taxability of Transaction 3:

The funds invested with LIC or other securities mentioned in rule 67(2) fetch returns in the form of dividend, interest, appreciation in NAV etc.

This income will again be exempt in the hands of the Trust u/s 10(25)(iv).

Liability to file Income Tax Return by the Trust:

A Gratuity Fund is created with the sole purpose of providing for an employer’s gratuity liability towards its employees. It can have no additional purpose. This is a primary condition which the Commissioner of Income Tax would check before giving approval to the Gratuity Fund [Rule 3(b) of part C of Schedule IV to Income Tax Act, 1961].

In my opinion, an Approved Gratuity Fund would not be liable to file Return of Income. The basis of my opinion is given below:

(a) Section 139(1) reads as under

“Every person,—

(a) being a company or a firm; or

(b) being a person other than a company or a firm, if his total income or the total income of any other person in respect of which he is assessable under this Act during the previous year exceeded the maximum amount which is not chargeable to income-tax,

shall, on or before the due date, furnish a return of his income or the income of such other person during the previous year, in the prescribed form and verified in the prescribed manner and setting forth such other particulars as may be prescribed.”

Since entire income of an Approved Gratuity Fund is exempted from tax u/s 10(25)(iv), total income does not exceed the maximum amount not chargeable to tax. Hence, there is no liability to file a Return of Income.

(b) CBDT Circular No. 18/2017 dated 29th May 2017 is reproduced hereunder:

“CBDT had issued Circulars No. 4/2002 dt. 16 July 2002 and 7/2015 dt. 23 Apr. 2015 prescribing TDS exemption (i.e. no TDS applicable) in respect of payments made to certain tax exempt entities (u/s 10) which are also exempt from ITR filing (u/s 139).

List of such notified entities, which are exempt from TDS, has been reviewed/ revised by the CBDT and name of various entities have been removed/ added based on criteria of tax exemption and ITR filing exemption, as under:

i) Entities that meet both conditions but are not mentioned in the aforesaid Circulars need to be included in the list of TDS exempted entities.

ii) Entities that are mentioned in Circular No. 4/2002 but their exemption from income tax has since been withdrawn need to be removed from the list of TDS exempted entities.

iii) Entities that are mentioned in Circular No. 4/2002 but because of subsequent amendment they are now required to mandatorily file their returns of income u/s 139 need to be removed from the list of TDS exempted entities.

Accordingly, CBDT has notified revised list of TDS Exempt entities (funds or authorities or Boards or bodies, by whatever name called) which are eligible for unconditional tax exemption u/s 10 as well as ITR filing exemption u/s 139, in view of the fact that income of these entities is anyway exempt under the IT Act, as under:

(i) “local authority”, as referred to in the Explanation to clause (20);

(ii) Regimental Fund or Non-public Fund established by the armed forces of the Union referred to in clause (23AA);

(iii) Fund, by whatever name called, set up by the Life lnsurance Corporation of India on or after 1st August, 1996, or by any other insurer referred to in clause (23AAB);

(iv) Authority (whether known as the Khadi and Village Industries Board or by any other name) referred to in clause (23BB);

(v) Body or authority referred to in clause (23BBA);

(vi) SAARC Fund for Regional Projects set up by Colombo Declaration referred to in clause (23BBC);

(vii) lnsurance Regulatory and Development Authority referred to in clause (23BBE);

(viii) Central Electricity Regulatory Commission referred to in clause (23BBG);

(ix) Prasar Bharati referred to in clause (23BBH);

(x) Prime Minister’s National Relief Fund referred to in sub-clause (i), Prime Minister’s Fund (Promotion of Folk Art) referred to in sub-clause (ii), Prime Minister’s Aid to Students Fund referred to in sub-clause (iii), National Foundation for Communal Harmony referred to in sub-clause (iiia), Swachh Bharat Kosh referred to in sub-clause (iiiaa), Clean Ganga Fund referred to in sub-clause (iiiaaa) of clause (23C);

(xi) Provident fund to which the Provident Funds Act, 1925 (19 of 1925) referred to in sub-clause (i), recognized provident fund referred to in sub-clause (ii), approved superannuation funds referred to in sub-clause (iii), approved gratuity fund referred to in sub-clause (iv) and funds referred to in sub-clause (v) of clause (25);

(xii) Employees’ State Insurance Fund referred to in clause (25A);

(xiii) Agricultural Produce Marketing Committee referred to in clause (26AAB);

(xiv) Corporation, body, institution or association established for promoting interests of members of Scheduled Castes or ScheduIed Tribes or backward classes referred to in clause (26B);

(xv) Corporation established for promoting interests of members of a minority community referred to in clause (26BB);

(xvi) Corporation established for welfare and economic upliftment of ex-servicemen referred to in clause (26BBB);

(xvii) New Pension System Trust referred to in clause (44).

It may be noted that this circular supersedes earlier circulars No. 4/2002 dt. 16 July 2002 and 7/2015 dt. 23 Apr. 2015 issued by the CBDT on the issue, with effect from the date of issue of this Circular.”

It is abundantly clear that an Approved Gratuity Fund enjoys unconditional tax exemption and hence not liable to file Return of Income.

Summary of Important Circulars and Case Laws on Approved Gratuity Fund:

1. Even though the share of the members is indeterminate, section 167B will not be attracted as entire income is exempt from tax u/s 10(25)(iv) – Circular No. 320 [F. No. 131(31)/81-TP(Pt.)], dated 11-1-1982

2. Commissioner has the power to accord approval to Gratuity Fund with retrospective effect from the date from which the Fund satisfied the requirements of rule 3 of Part C of the Fourth Schedule. – Clarification 3 in Circular No. 14 [F. No. 19/4/69-IT(A-II)], dated 23-4-1969.

3. ITO cannot question the validity of approval granted to a Gratuity Fund by the Commissioner. If there is an anomaly in the approval granted, only the Commissioner has the power to take corrective steps. All that the ITO can do is examine the conditions precedent to claiming deduction u/s 36(1)(v) – [1993] 71 Taxman 226 (Calcutta)

4. Where an assessee company has made payment directly to Life Insurance Corporation of Indian towards premium for Group Gratuity Scheme held in the name of Approved Gratuity Fund instead of first contributing to Approved Gratuity Fund and Approved Gratuity Fund making the payment of premium, deduction u/s 36(1)(v) will be allowable – CIT vs. Textool Co. Ltd. [2013] 35 taxmann.com 639 (Supreme Court)

5. Where an assessee had filed application to competent authority for approval of a Gratuity Scheme and had duly complied with conditions laid down for approval, Assessing Officer cannot disallow assessee’s claim for deduction under section 36(1)(v) merely because the application for approval was pending before the Commissioner. The Commissioner should have either rejected or approved the Gratuity Scheme – CIT vs Jaipur Thar Gramin Bank [2017] 81 taxmann.com 126 (Rajasthan)

6. Payment on a date after the creation of Trust but prior to date of approval of Gratuity Fund will be allowed as deduction u/s 36(1)(v). An approval for a fund which is already set up is in the nature of post facto approval and it relates back to the date on which it is set up in accordance with the scheme of the law – Prakash Software Solution (P.) Ltd. v. Income-tax Officer [2018] 89 taxmann.com 130 (Ahmedabad – Trib.)

Analysis of some other sections related to Gratuity under the Income Tax Act, 1961:

1. Section 40A(7)

(a) Subject to the provisions of clause (b), no deduction shall be allowed in respect of any provision (whether called as such or by any other name) made by the assessee for the payment of gratuity to his employees on their retirement or on termination of their employment for any reason.

(b) Nothing in clause (a) shall apply in relation to any provision made by the assessee for the purpose of payment of a sum by way of any contribution towards an approved gratuity fund, or for the purpose of payment of any gratuity, that has become payable during the previous year.

Comment: This section will apply to those assessee who opt for option 1 or option 3 i.e. do not have an approved gratuity fund. An assessee will not get deduction for provision made for gratuity unless it is for contribution to Approved Gratuity Fund or unless the Provision is for Gratuity that has become payable to employees during the year. Therefore, if an assessee creates a mere Provision for Gratuity that is not for contribution towards Approved Gratuity Fund or not for Gratuity that has actually become payable, no deduction will be available irrespective of the fact that Provision has been made on the basis of Actuarial Valuation Report – Circular No. 169, dated 23-6-1975

- Section 40(a)(iv)

Notwithstanding anything to the contrary in sections 30 to 38, the following amounts shall not be deducted in computing the income chargeable under the head “Profits and gains of business or profession”,—

(a) in the case of any assessee—

(iv) any payment to a provident or other fund established for the benefit of employees of the assessee, unless the assessee has made effective arrangements to secure that tax shall be deducted at source from any payments made from the fund which are chargeable to tax under the head “Salaries”.

Comment: Contribution to Approved Gratuity Fund allowable as deduction u/s 36(1)(v) would not be allowed if the Employer has not made necessary arrangements for deduction of TDS from the Gratuity payable from the Approved Gratuity Fund.

- Section 40A(9)

No deduction shall be allowed in respect of any sum paid by the assessee as an employer towards the setting up or formation of, or as contribution to, any fund, trust, company, association of persons, body of individuals, society registered under the Societies Registration Act, 1860 (21 of 1860), or other institution for any purpose, except where such sum is so paid, for the purposes and to the extent provided by or under clause (iv) or clause (iva) or clause (v) of sub-section (1) of section 36, or as required by or under any other law for the time being in force.

Comment: Suppose assessee pays –

- Rs. 1,00,000 to a CA who helped in drafting of Gratuity Trust Deed.

- Rs. 50,000 to sub-registrar to register the Trust Deed under The Registration Act, 1908.

- Rs. 50,000 to a LIC consultant who helped in obtaining Group Gratuity Scheme.

Assessee can claim a deduction of Rs. 2,00,000 u/s 37 of Income Tax Act, 1961. However, in case the amount is spent towards setting up of a fund or trust other than an approved gratuity fund, approved provident fund or approved superannuation fund, the amount of Rs. 2,00,000 will be disallowed u/s 40A(9).

- Section 43B(b)

Notwithstanding anything contained in any other provision of this Act, a deduction otherwise allowable under this Act in respect of—

(b) any sum payable by the assessee as an employer by way of contribution to any provident fund or superannuation fund or gratuity fund or any other fund for the welfare of employees;

shall be allowed (irrespective of the previous year in which the liability to pay such sum was incurred by the assessee according to the method of accounting regularly employed by him) only in computing the income referred to in section 28 of that previous year in which such sum is actually paid by him.

Provided that nothing contained in this section shall apply in relation to any sum which is actually paid by the assessee on or before the due date applicable in his case for furnishing the return of income under sub-section (1) of section 139 in respect of the previous year in which the liability to pay such sum was incurred as aforesaid and the evidence of such payment is furnished by the assessee along with such return.

Comment: The assessee must actually make the contribution to Approved Gratuity Fund on of before the due date of furnishing the return in order to claim deduction u/s 36(1)(v) else it will be disallowed u/s 43B.

Accounting Treatment as per AS 15 and Ind AS 19

Gratuity is a defined benefit plan under AS 15 and Ind AS 19. Treatment under both standards have been explained with the following example:

ABC Ltd. obtains an Actuarial Valuation Report of its Gratuity liability. The report discloses the following information:

| Defined Benefit Obligation (DBO) | |

| Opening value of DBO (as on 01/04/2017) | 5000 |

| Interest cost | 500 |

| Current service cost | 650 |

| Past service cost (non-vested benefits) | – |

| Past service cost (vested benefits) | – |

| Benefits paid | (750) |

| Actuarial (gain)/loss on DBO | 305 |

| Closing value of DBO (as on 31/3/2018) | 5705 |

–

| Fair Value of Planned Assets | |

| Opening value of Planned Asset (as on 01/04/2017) | 6000 |

| Expected return on planned asset | 600 |

| Contribution | 450 |

| Benefits paid | (750) |

| Actuarial gain/(loss) on planned asset | 160 |

| Closing value of Planned Asset (as on 31/3/2018) | 6460 |

Treatment under AS 15:

ABC Ltd. is required to carry 2 ledgers in its books of accounts, namely –

1. Defined Benefit Obligation A/c (opening balance 5000 in this example)

2. Planned Asset A/c (opening balance 6000 in this example)

Entries:

1. At the time of making contribution to Approved Gratuity Trust (It is assumed that the Trust makes an equivalent contribution towards the Gratuity Scheme)

| Planned Assets A/c Dr | 450 |

| To Bank A/c Cr | 450 |

| (Being contribution to Approved Gratuity Trust)This amount is deductible u/s 36(1)(v) | |

2. Finalisation entry at year end:

| Planned Asset A/c dr | 10 | [6460 – 6000 – 450] |

| Profit & Loss A/c dr | 695 | [Balancing figure] |

| To Defined Benefit Obligation | 705 | [5705 – 5000] |

| (Being finalisation entry as per Actuarial Report) | ||

Disclosure:

a. Balance Sheet (refer para 55 of AS 15):

| Present value of defined benefit obligation | 5705 |

| Fair value of planned assets | 6460 |

| Net Asset/(Liability) | 755 |

b. Statement of Profit & Loss (refer para 61 of AS 15):

| Current service cost | 650 |

| Interest cost | 500 |

| Expected return on planned asset | (600) |

| Net actuarial gain/loss recognised in the year | 145 |

| Past service cost – non-vested benefits | – |

| Past service cost – vested benefits | – |

| Expense recognised in Profit & Loss a/c | 695 |

| Expected return on planned asset | 600 |

| Actuarial gain/(loss) on planned asset | 160 |

| Actual return on planned assets | 760 |

Treatment under Ind AS 19:

ABC Ltd. is required to carry 3 ledgers in its books of accounts, namely –

1. Defined Benefit Obligation A/c (opening balance 5000 in this example)

2. Planned Asset A/c (opening balance 6000 in this example)

3. Other Comprehensive Income A/c

Entries:

1. At the time of making contribution to Approved Gratuity Trust (It is assumed that the Trust makes an equivalent contribution towards the Gratuity Scheme)

| Planned Assets A/c Dr | 450 |

| To Bank A/c Cr | 450 |

| (Being contribution to Approved Gratuity Trust)This amount is deductible u/s 36(1)(v) | |

2. Finalisation entry at year end:

| Planned Asset A/c dr | 10 | [6460 – 6000 – 450] |

| Profit & Loss A/c dr | 550 | [Balancing figure] |

| Other Comprehensive Income dr | 145 | [Net actuarial loss: 305-160] |

| To Defined Benefit Obligation | 705 | [5705 – 5000] |

| (Being finalisation entry as per Actuarial Report) | ||

Disclosure:

a. Balance Sheet (refer para 64 of Ind AS 19):

| Present value of defined benefit obligation | 5705 |

| Fair value of planned assets | 6460 |

| Net Asset/(Liability) | 755 |

b. Statement of Profit & Loss (refer para 120 of Ind AS 19):

| Current service cost | 650 |

| Interest cost | 500 |

| Expected return on planned asset | (600) |

| Past service cost – non-vested benefits | – |

| Past service cost – vested benefits | – |

| A: Expense recognised in Profit & Loss a/c | 550 |

| B: Other Comprehensive Income: | |

| Remeasurement loss on net obligations (160-305) | (145) |

*CA Ahmad Faraz Jahangir is an associate member of the Institute of Chartered Accountants of India. He is practicing in Mumbai and specialises in Direct Tax consultation and litigation.

Very good article useful..

In my view merely taking a gratuity policy from LIC will not provide taxation benefits. You need to setup a gratuity trust, get it approved from Principal Commisioner of Income Tax for taxation benefits.

Gratuity Fund is managed by LIC or an approved life insurer as per Rule 101 of Income Tax.

Gratuity Product is approved by Insurance Regulatory and Development Authority.

I want apply for new pan card for Trust how

sir,

I was working In ABC Company 10 year Company Register in LIC Group Gratuity Trust i have left company lost 6 month my gratuity settlement not done till date trust was claim My gratuity amount from LIC But Company Not paid to us

PLEASE SUGGEST

Hi, in the Employee’s point of view: irrespective of Option 1,2,3 taken by the company .. if the employer gives gratuity voluntarily & then, Still Employee claims exemption in the income tax (calculated based on the 15 days salary pa?

We are a private limited MNC . we have established a Trust with LIC for Gratuity contribution . There is a propper Agreement which states as follows.

For employees who had put on service for more less than 15 years , Gratuity will be calculated on the basis of 15 Days for every completed years of service ( 15/22 * basic salary ) . we follow 22 instead of 26 days as mentioned in Gratuity act or gratuity act

For employees who have completed over 15 Years of service, They are entitled full months Basic salary for every completed y ears of service .( basic salary * NO : of years of completed years of service )

What is income tax applicability as I shall be retiring in near future after completing 25 Years of service . I shall be entitled for 25 Times of my Basic salary ( average)

( roughly around 16 Lakhs)

At present the IT provision have the ceiling of 20 lakhs

Shall I Be fully exempted or liable to pay in excess of 15 days of every completed year of service ( approximately 8 Lakhs)

Thanking you

We are maintaining Gratuity trust, whether its mandatory to maintain Profit and Loss reports….

companies is paying premium to LIC for gratuity liability covering whether on part payment to LiC is covering for full liability of gratuity

The assessee company is contributing to Gratuity trust created for its employees. But the accounts of the trust are not got audited. Whether AO can disallow the contribution since the trust accounts are not got audited.

Hi. Can directors be the trustees of the gratuity fund? Also, are there any Central Rules made in pursuance of Section 4A of the Gratuity Act?

MY UNIVERSITY IS INTERESTED IN PAYING GRATUITY TO ITS EMPLOYEES. WHETHER WE CAN SHOW 4.81% OF SALARY AS PART OF CTC TOWARDS GRATUITY?

IF YES , THEN HOW WE CAN SHOW THE SAME IN BOOKS OF ACCOUNTS? KINDLY CLARIFY AT THE EARLIEST ABOUT THE TREATMENT.

please, what formality noc from income tax

There were three companies i.e. Company A, Company B and Company C. Each company also had their respective gratuity fund trust i.e. Trust A, Trust B and Trust C. The trusts are approved by the Commissioner of Income Tax and claim exemption under section 10(25)(iv) of Income Tax Act.

Company B and Company C are now merged into Company A.

Queries

1. If the gratuity funds are to be merged, whether the merger necessarily needs to be in line with the merger of the Companies i.e. Trust B and Trust C get merged in to Trust A (‘Scenario 1’)? Is it possible to merger Trust A and Trust B into Trust C (‘Scenario 2’)?

2. If Scenario 2 is not possible, whether the same is as per any applicable law?

3. If Scenario 2 is possible, any practical issues that may arise? What is the procedure to be followed for such merger?

Whether Return of Income is to be filed, if the Trust/Fund has been started in 2017 with INDIAFIRST; PAN has been taken; but no Income Tax Approval has been given till date, (Application submitted with the Income Tax Department but pending)

I worked in Railways for 8 years and later joined RBI. Railways did not pay gratuity stating that 10 years is the eligible service. RBI rules allow near about 20 years 20 lakhs, and for the remaining years of service 15 days salary for every one year of service. I have completed 30 years. My present employer is not including the past service of 8 years. Earlier there was a provision of inclusion of any govt service past service with the present service. I want my 8 years service to be included. Please clarify.

If you want any details of gratuity and (Approved & Register Gratuity Trust) contact me at 9716647377 or rajeshkumar9716@gmail.com

Do we need to register the Trust deed with the relevant Registrar?

Dear AFJ

The article very informative.

Thank You

Filing of Income tax return is mandatory for Gratuity trust. Please refer Section 139(4C)(ca).

Respected sir,

I want to know how to close my gratuity fund approved with income tax authorities. What is format for application under rule 108 of income tax rules for taking approval of commissioner .

My client wants to surrender LIC gratuity scheme and LIC wants the income tax certificate approving the closure of trust approval . Please guide

Thanks

CA Anoop Tantia