Form 67 FAQ

1. Why do I need to submit Form 67?

You will be required to submit Form 67 if you want to claim credit of foreign tax paid in a country or specified territory outside India. You will also be required to submit Form 67 in case of carry backward of loss of the current year resulting in refund of foreign tax for which credit has been claimed in any earlier previous years.

2. What are the modes in which Form 67 can be submitted?

Form 67 can only be submitted online on the e-Filing portal. After logging into the e-Filing portal, select Form 67, prepare and submit the form for CA verification.

3. How can Form 67 be e-verified?

You can e-Verify the form using EVC or DSC. A CA can verify the form using DSC only. You can refer to the How to e-Verify user manual to learn more.

4. Can I add an Authorized Representative to file Form 67 on my behalf?

Yes, you can add an Authorized Representative to file Form 67 on your behalf.

5. What is the time limit to file Form 67?

Form 67 should be filed before the due date of filing of return as specified u/s 139(1).

Form 67 User Manual

1. Overview

As per Rule 128 of the Income Tax Rules, 1962, a resident taxpayer is eligible to claim credit for any foreign tax paid, in a country or specified territory outside India. The credit shall be allowed only if the assessee furnishes the required particulars in Form 67 within the specified timelines.

Form 67 can only be submitted through online mode. This is a post login service which enables the registered users to file Form 67 online through the e-Filing portal.

2. Prerequisites for availing this service

- Registered user on the e-Filing portal with valid user ID and password

- Status of PAN should be Active

3. About the Form

3.1 Purpose

A resident taxpayer who has credit for the amount of any foreign tax paid in a country outside India by way of deduction or otherwise will be required to furnish the statement in Form 67 on or before the due date specified for furnishing the return of income under sub-section (1) of Section 139 to claim credit of such taxes. Form 67 will also be required to be furnished in a case the carry backward of loss of the current year results in refund of foreign tax for which credit has been claimed in any previous years.

3.2 Who can use it?

Any registered user can access this form.

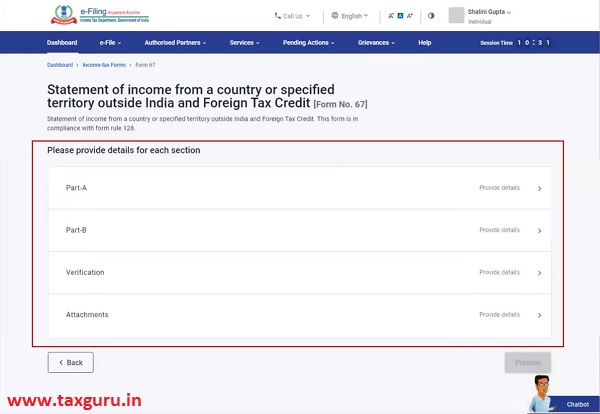

4. Form at a Glance

Form 67 has 4 sections:

1. Part A

2. Part B

3. Verification

4. Attachments

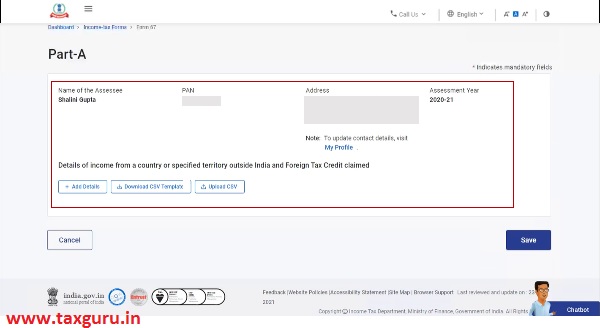

4.1. Part A

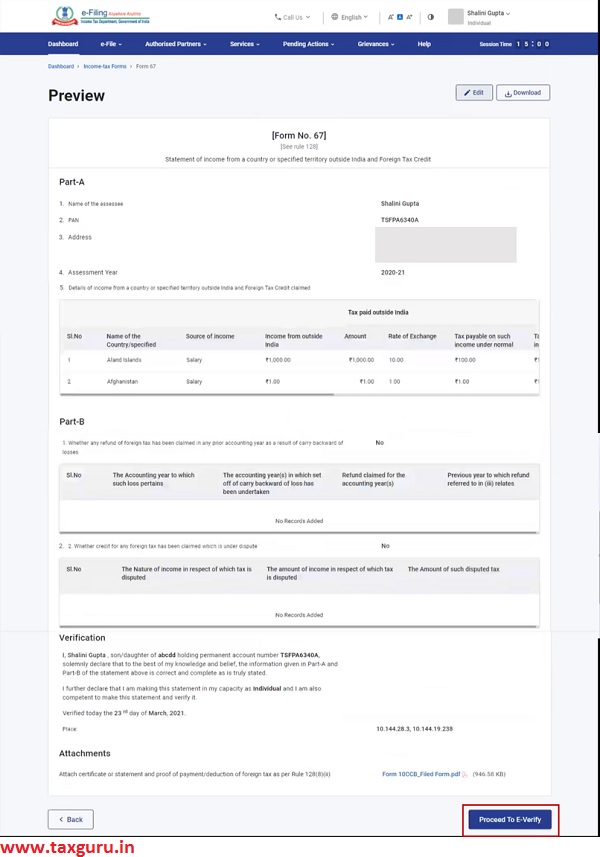

Part A of the form entails basic information such as your Name, PAN or Aadhaar, Address and Assessment Year.

You are also required to the add the receipt details of the income from a country or specified territory outside India and Foreign Tax Credit claimed.

4.2. Part B

Part B of the form is where you will be required to provide details of refund of foreign tax as result of carry backward of losses and disputed foreign tax.

4.3. Verification

The Verification section contains a self-declaration form containing fields as per Rule 128 of the Income Tax Rules, 1962.

4.4. Attachments

The last section of Form 67 is Attachments where you need to attach a copy of the certificate or statement and proof of payment / deduction of foreign tax.

5. How to Access and Submit

- You can fill and submit Form 67 only in online mode through the e-Filing portal.

Follow the below steps to fill and submit Form 67 through online mode.

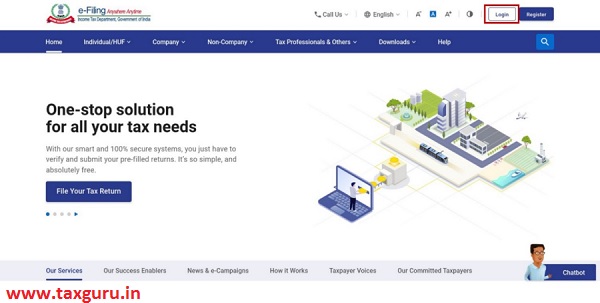

Step 1: Log in to the e-Filing portal using your user ID and password.

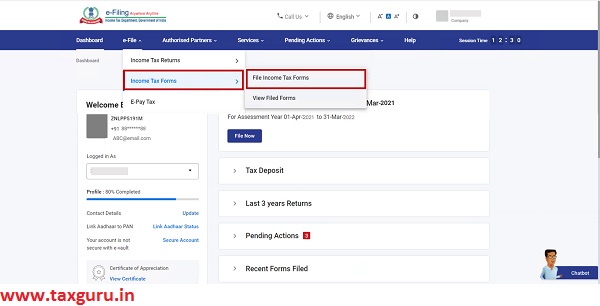

Step 2: On your Dashboard, click e-File > Income Tax Forms > File Income Tax Forms.

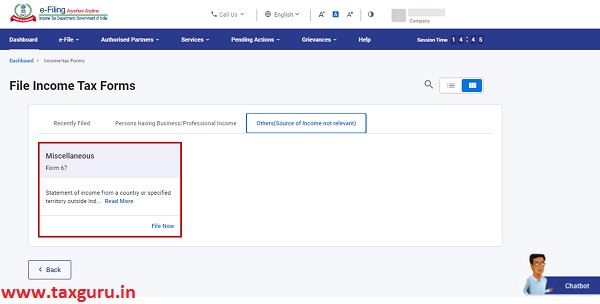

Step 3: On the File Income Tax Forms page, select Form 67. Alternatively, enter Form 67 in the search box to find the form.

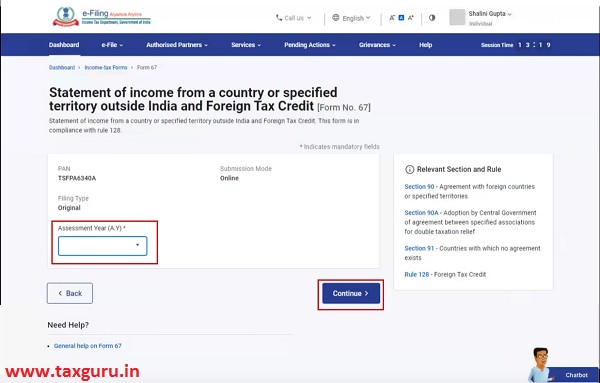

Step 4: On the Form 67 page, select the Assessment Year (A.Y.) and click Continue.

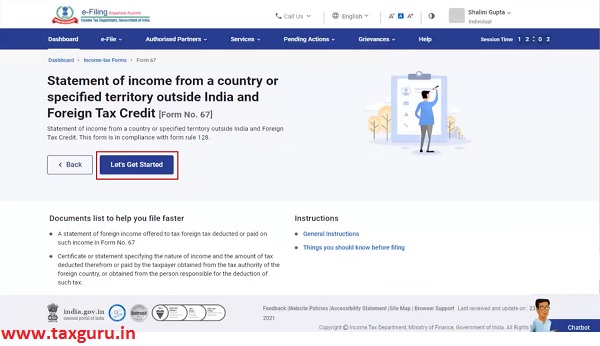

Step 5: On the Instructions page, click Let’s Get Started.

Note: It is mandatory to attach a copy of the certificate or statement and proof of payment / deduction of foreign tax in Attachment section to proceed further.

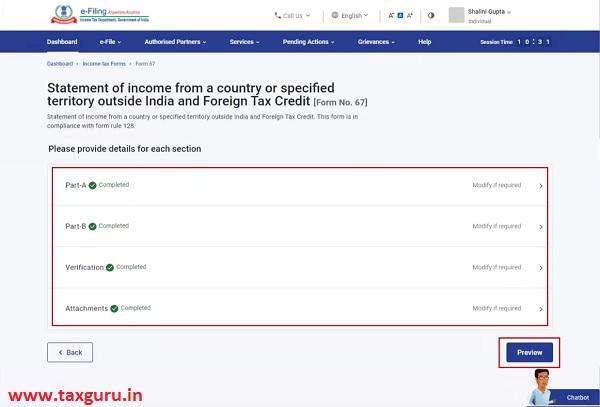

Step 6: On click of Let’s Get Started, Form 67 is displayed. Fill all the required details and click Preview.

Step 7: On the Preview page, verify the details and click Proceed to e-Verify.

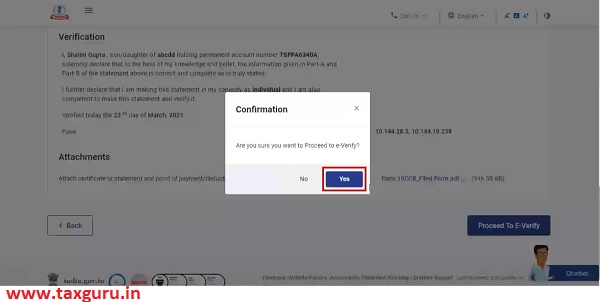

Step 8: Click Yes to submit.

Step 9: On clicking Yes, you will be taken to the e-Verify page.

Note: Refer to How to e-Verify user manual to learn more.

After successful e-Verification, a success message is displayed along with a Transaction ID and Acknowledgement Number. Please keep a note of the Transaction ID and Acknowledgement for future reference. You will also receive a confirmation message on the email ID registered on the e-Filing portal.

yes, it is very much required & need to be filled on line just like tax audit report

I am unable to proceed with e-verify option since nothing comes up after I click on that button. The page stays as it is. Is anyone able to proceed with it?

I have filled up the form and trying to submit, however i am getting an error as “Submission failed!

Response form server:

Please fix the following issues and try to submit again:

Invalid format for Large Count.”

I have tried attaching a zip file ( containing 4 Pdf file) and the size is only 35 Kb, allowed is 50 Mb.

I am also facing the same problem. I tried both PDF and zip format. Did you get a resolution?

I am getting same issue. Any luck??

WHETHER CA CERTIFICATION / ATTESTATION IS REQUIRED ON FORM 67 – NEW PORTAL?