Article explains how to To upload the generated JSON file from the New Return Offline Tool on the GST Portal, Why one need to upload the JSON file into the GST Portal, How to upload the generated JSON file from the New Return Offline Tool, Why do I need to download the JSON file from the GST Portal, How can I download the JSON file from the GST Portal, How Can I download the details of all tables in one go and How can I download the details of specific table.

Also Read-

| S. No | Particulars |

| 1 | All about New GST Returns Dashboard with FAQs |

| 2 | All about Online Upload /Download of Form GST ANX-1 JSON File |

| 3 | Form GST ANX-1: Annexure of Supplies- FAQs/Manual |

| 4 | All about Online Upload and Download of Form GST ANX-2 JSON File |

| 5 | Form GST ANX-2: Annexure of Inward Supplies- FAQs/Manual |

A. FAQs on Online Upload and Download of Form GST ANX-1 JSON File

Online Upload of GST ANX-1 JSON file

Q.1 Why do I need to upload the JSON file into the GST Portal?

Ans. Taxpayers may use the New Return Offline Tool to prepare various details of Form GST ANX 1 to furnish various details regarding outward supplies, imports and inward supplies attracting reverse charge etc. Once Form GST ANX-1 is prepared using offline Tool, a json file can be created and the json file so created is required to be uploaded on the GST Portal.

Q.2 How can I upload the generated JSON file from the New Return Offline Tool?

Ans. To upload the generated JSON file from the New Return Offline Tool, login into the GST Portal and navigate to Returns > New Return (Trial). Select Financial Year, Return Filing Period, Form/Return (as GST ANX-1) and Preparation Mode (as Upload/Download JSON). Choose Upload tab and select the generated JSON file and upload.

Download of GST ANX-1 JSON file

Q.3 Why do I need to download the JSON file from the GST Portal?

Ans. You can download the JSON file from the GST Portal, so that details in Form GST ANX-1 can be opened in the New Return Offline Tool for viewing and editing.

Q.4 How can I download the JSON file from the GST Portal?

Ans. To download the JSON file from the GST Portal, navigate to Returns > New Return (Trial). Select Financial Year, Return Filing Period, Form/Return (as GST ANX-1) and Preparation Mode (as Upload/Download JSON). Choose Download tab and select the date range and click on “Generate JSON File to Download”. To download a specific table, select the table type and Uploaded From and Uploaded Till date range and click on “Generate JSON File to Download”.

Q.5 Can I download the details of all tables in one go?

Ans. Yes, you can download the details of all tables in one go without selecting any table.

Q.6 How can I download the details of specific table?

Ans. You need to select the specific table from the drop-down list to download the specific details.

B. Manual on Online Upload and Download of Form GST ANX-1 JSON File

Taxpayers may use the New Return Offline Tool to prepare various details of Form GST ANX 1 to furnish various details regarding outward supplies, imports and inward supplies attracting reverse charge etc. Once Form GST ANX-1 is prepared using offline Tool, a json file can be created and the json file so created is required to be uploaded on the GST Portal. To upload the generated JSON file from the New Return Offline Tool on the GST Portal following steps as indicated below maybe undertaken.

1. Upload the generated GST ANX-1 JSON file

2. Download the details in Form GST ANX-1

1. Upload the generated GST ANX-1 JSON file

To upload the generated GST ANX-1 JSON file (from the Offline Tool) on the GST Portal:

1. Login to the GST Portal. Navigate to Services> Returns > New Return (Trial).

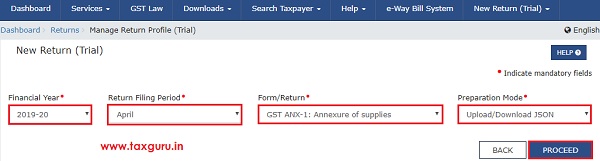

2. Select Financial Year, Return Filing Period, Form/Return(as GST ANX-1: Annexure of Supplies) and Preparation Mode (as Upload/Download JSON) from the drop-down list. Click PROCEED.

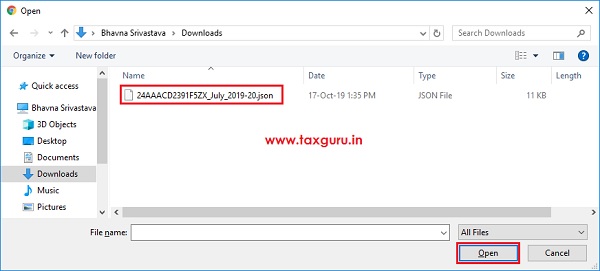

3. Click the Choose Files button available in the Upload Tab.

4. Browse and navigate to the JSON file generated using the New Return Offline Tool, for upload from your computer.

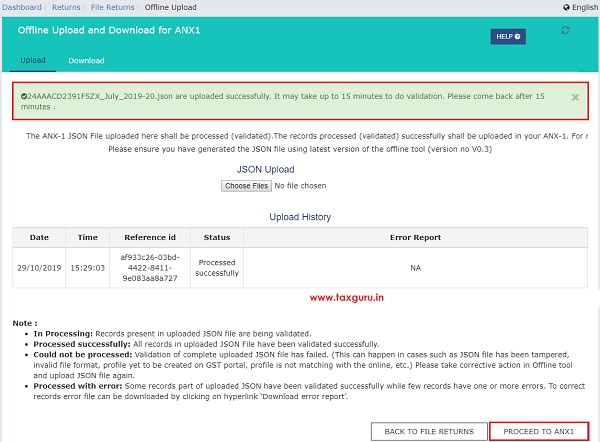

5. A success message in green text box appears confirming the successful upload and asking you to wait for some time, while the GST Portal validates the uploaded data.

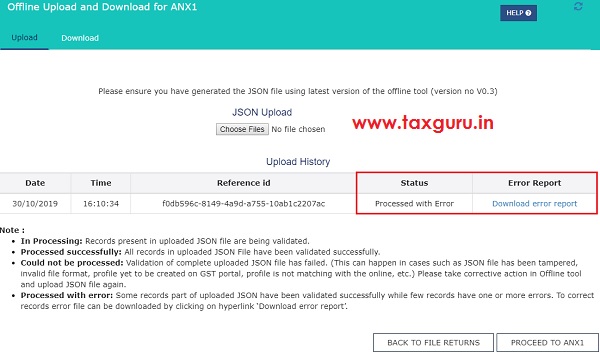

6. In case the JSON file is not processed successfully after upload, the Statuswill show Processed with Error and a link will be provided in the Error Report column to download the error JSON file and import it in the New Return Offline Tool and to make corrections in it. Error report will only contain the records with errors.

7. Next, click the Proceed to ANX1 button and navigate to the GST ANX-1 Dashboard page. From here, you can view the details in Form GST ANX-1.

2. Download the details in Form GST ANX-1

To download the details in Form GST ANX-1 from the GST Portal, so that the same can be opened in the New Return Offline Tool for viewing or editing:

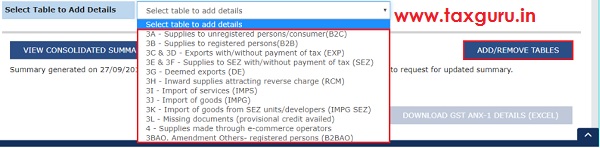

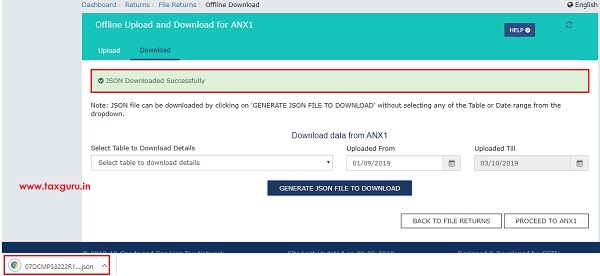

1. Under the Download tab, click the GENERATE JSON FILE TO DOWNLOAD button to download the details of all tables in one go, or else, select the specific table from the drop-down list and Uploaded From and Uploaded Till date range to download the specific details, as uploaded during the selected period.

2. A confirmation message is displayed and JSON file is downloaded. The JSON file is downloaded under the Downloads folder of your computer.

3. You can use the Offline tool to import the downloaded JSON file. For instructions, refer to Offline manual, available at link ->https://tutorial.gst.gov.in/downloads/newgstreturnofflinebeta.pdf

4. Alternatively, you can also click PROCEED TO ANX-1to view details in Form GST ANX-1. From there, you can select the relevant table and view details.