Recent Changes on GSTN Portal – Additional Facility for Tax Payers 1. Facility for filing GST PMT – 09 (Transfer of Amount) 2. Facility for filing GSTR 3B Return by Electronic Verification Code i.e. EVC (no need for affixing DSC).

Recently GSTN portal has rolled out certain changes on GSTN portal for taxpayers. Important changes being –

1. Facility for filing GST PMT – 09 for transfer of Cash Balance from One Head to Other Head

2. Facility for filing GSTR 3B Return by EVC (no need for affixing DSC)

Both the changes are explained in the form of below tables and screenshots –

1. Facility for filing GST PMT – 09 (Transfer of Amount)

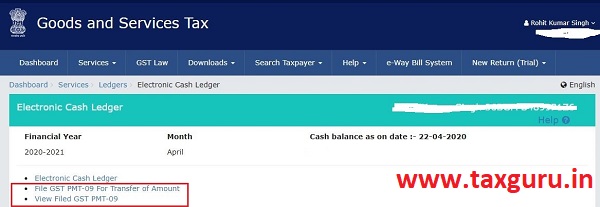

Path for accessing GST PMT – 09 —> Dashboard – Services – Ledger – Electronic Cash Ledger

A transfer can be made from One Major Head to other Major Head (CGST to SGST or any combination) or one Minor Head to Other Minor Head (from Tax to Interest) or from one Major Head to other Minor Head (IGST Tax to CGST Interest). Below is the combination of transfers which can be made –

| Transfer from Head | Transfer to Head | ||

| Major Head | Minor Head | Major Head | Minor Head |

| IGST

CGST SGST Cess |

Tax

Interest Fees Penalty Others |

IGST

CGST SGST Cess |

Tax

Interest Fees Penalty Others |

Note – The transfer can only be made for balance lying in the Electronic Cash Ledger. In case, if the taxpayer wants to withdraw the tax wrongly deposited in the Electronic Cash ledger, a separate refund application has to be filed for the same.

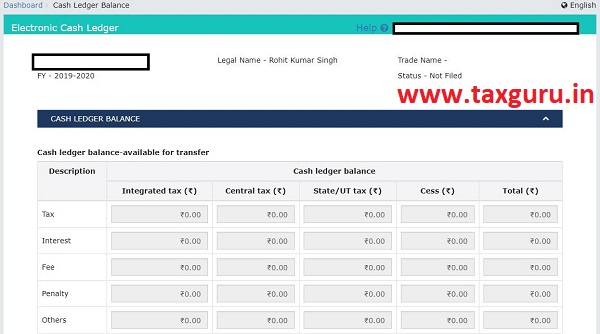

Screen shot explaining the changes being introduced for Filing GST PMT – 09

–

–

Note – The transfer from one head to another head is instant and the balance is immediately reflected. This is a welcome move which saves lot of efforts of claiming refund where the balance was deposited under wrong head.

2. Facility for filing GSTR 3B Return by Electronic Verification Code i.e. EVC (no need for affixing DSC)

The option to file GSTR-3B by EVC instead of DSC is made available on GSTIN portal. Tax payers can submit GSTR-3B without DSC.

It appears that for other returns and documents also system will provide such facility in near future

Note – Facility for filing returns by EVC was only allowed for Individuals and OPC and not for Companies or LLPs or other Entities.

About TaxMarvel: TaxMarvel is a Consulting firm focused on providing GST services to small and medium enterprises. We offer host of GST Services be it registration or compliance or consulting or litigation support. We make GST easy for businesses by bringing in technology and subject matter expertise. You can contact us at: Email: Rohit@taxmarvel.com

Disclaimer: The content of this document is for general information purpose only. TaxMarvel shall not accept any liability for any decision taken based on the advice. You should carefully study the situation before taking any decision.